Will Vs Transfer On Death Deed

Description

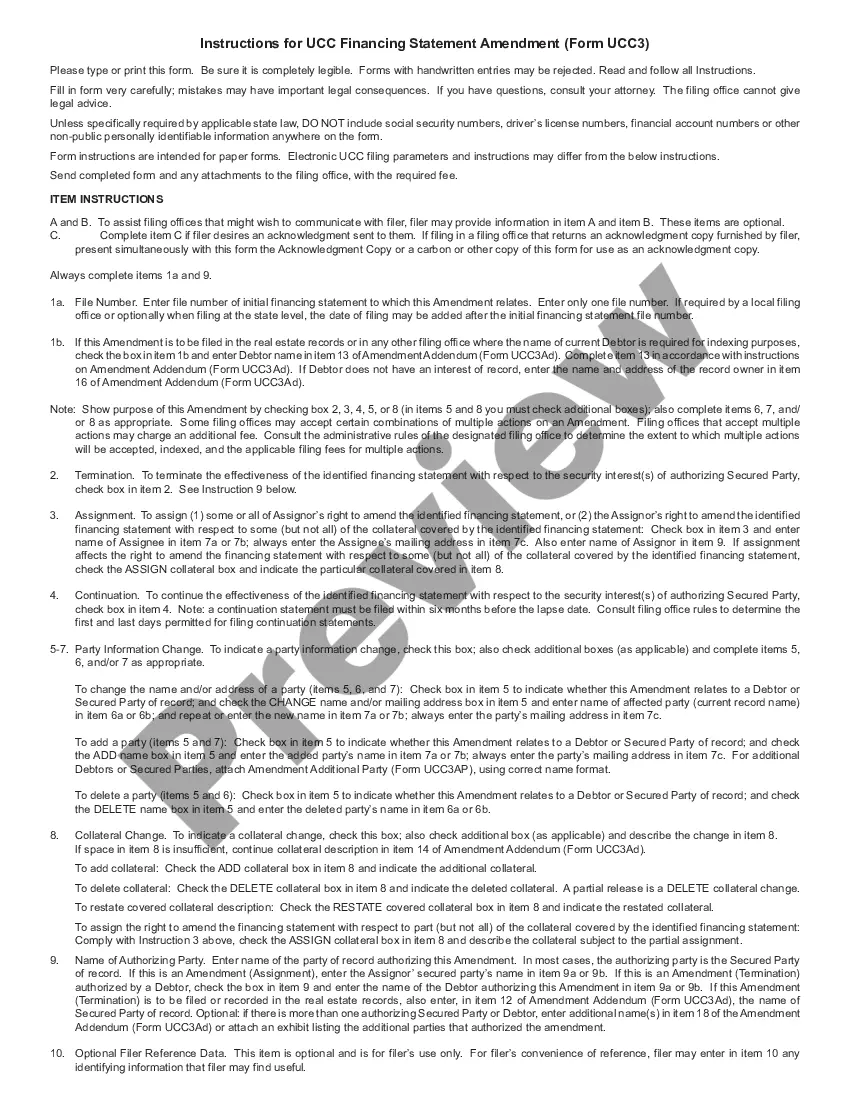

How to fill out North Dakota Transfer On Death Deed Or TOD - Beneficiary Deed From An Individual To Three (3) Individuals?

The Will Vs Transfer On Death Deed you see on this page is a reusable legal template drafted by professional lawyers in accordance with federal and local laws. For more than 25 years, US Legal Forms has provided people, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the quickest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Will Vs Transfer On Death Deed will take you just a few simple steps:

- Look for the document you need and check it. Look through the file you searched and preview it or check the form description to ensure it fits your needs. If it does not, make use of the search option to get the correct one. Click Buy Now when you have located the template you need.

- Sign up and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Choose the format you want for your Will Vs Transfer On Death Deed (PDF, DOCX, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

A beneficiary who receives real estate through a transfer on death deed becomes personally liable for the debts of the dead property owner without proper counsel from an estate planning professional or a title company. The beneficiary becomes liable to potential financial obligations as a result.

TOD Accounts Supersede a Will A TOD account skips the probate process and takes precedence over a will. If you will all of your money and property to your children, but have a TOD account naming your brother the beneficiary, he will receive what's in the account and your children will get everything else.

Cons To Using Beneficiary Deed Estate taxes. Property transferred may be taxed. No asset protection. The beneficiary receives the property without protection from creditors, divorces, and lawsuits. Medicaid eligibility. ... No automatic transfer. ... Incapacity not addressed. ... Problems with beneficiaries.

A Will provides instructions for all of the assets included in your estate, whereas a beneficiary designation is for a specific asset.

A will is more comprehensive than a TOD deed. It tells the authorities how to distribute your cash, investments and other types of belongings. This document can also provide instructions regarding the care of minors and pets. A transfer-on-death deed doesn't enable you to express all of your final wishes.