North Dakota Transfer On Death Deed Form For Property

Description

How to fill out North Dakota Transfer On Death Deed Or TOD - Beneficiary Deed From An Individual To Three (3) Individuals?

It’s obvious that you can’t become a law professional overnight, nor can you grasp how to quickly prepare North Dakota Transfer On Death Deed Form For Property without having a specialized background. Creating legal forms is a long process requiring a particular education and skills. So why not leave the preparation of the North Dakota Transfer On Death Deed Form For Property to the pros?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court papers to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s start off with our platform and get the document you need in mere minutes:

- Discover the document you need with the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to determine whether North Dakota Transfer On Death Deed Form For Property is what you’re looking for.

- Begin your search again if you need any other template.

- Set up a free account and select a subscription option to buy the form.

- Choose Buy now. As soon as the payment is complete, you can get the North Dakota Transfer On Death Deed Form For Property, fill it out, print it, and send or mail it to the designated people or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

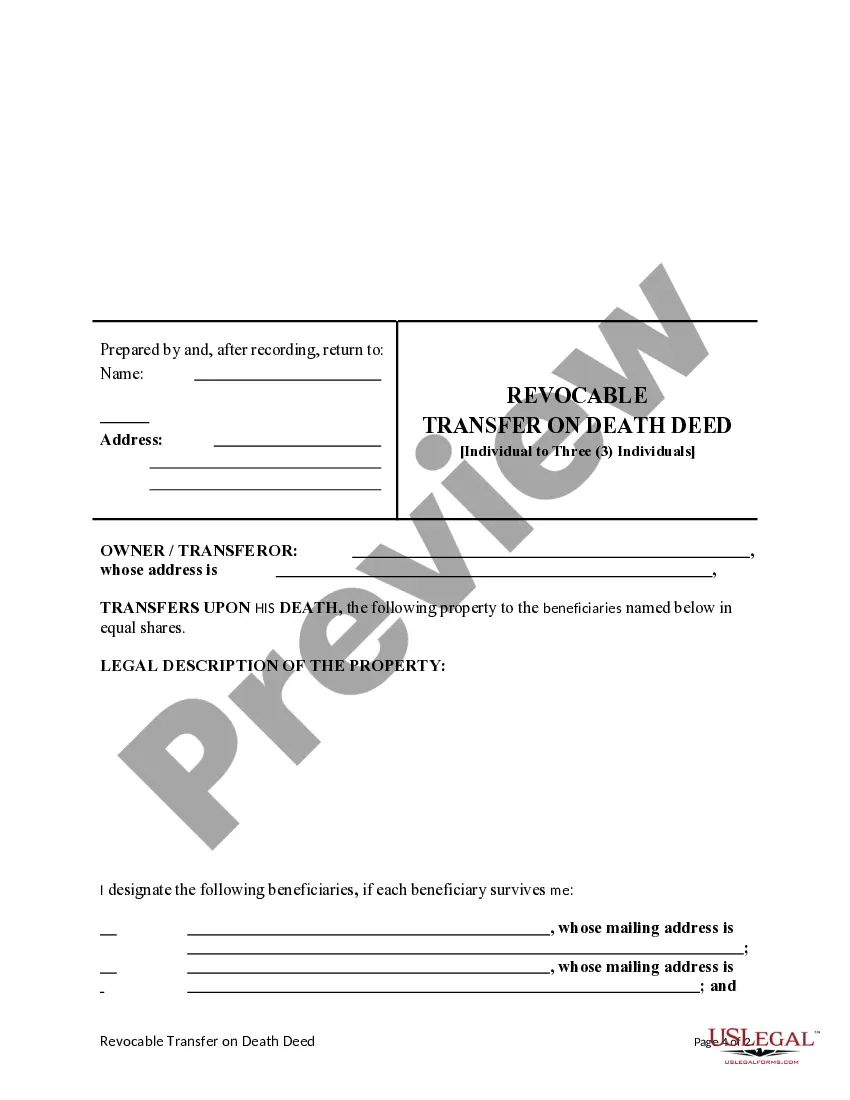

Real Estate and TOD in North Dakota In North Dakota, real estate can be transferred via a TOD deed, otherwise known as a beneficiary deed.

Cent. Code § 30.1-32.1-02. An individual may transfer property to one or more beneficiaries effective at the transferor's death by a transfer on death deed.

A transfer on death deed is valid if the deed is recorded in a county in which at least a part of the real property described in the deed is located and is recorded before the death of the grantor owner upon whose death the conveyance or transfer is effective.

A North Dakota property owner may transfer or retitle real estate during the owner's life using a signed, written deed. A North Dakota deed must satisfy the legal requirements described below to be eligible for recording and to legally transfer title to the new owner.

To get title to the property after your death, the beneficiary must record the following documents in the county where the property is located: (1) an affidavit of identity and survivorship, (2) a certified death certificate, and (3) a clearance certificate (showing that the county will not seek reimbursement for ...