Nc Dissolve Llc With Debt

Description

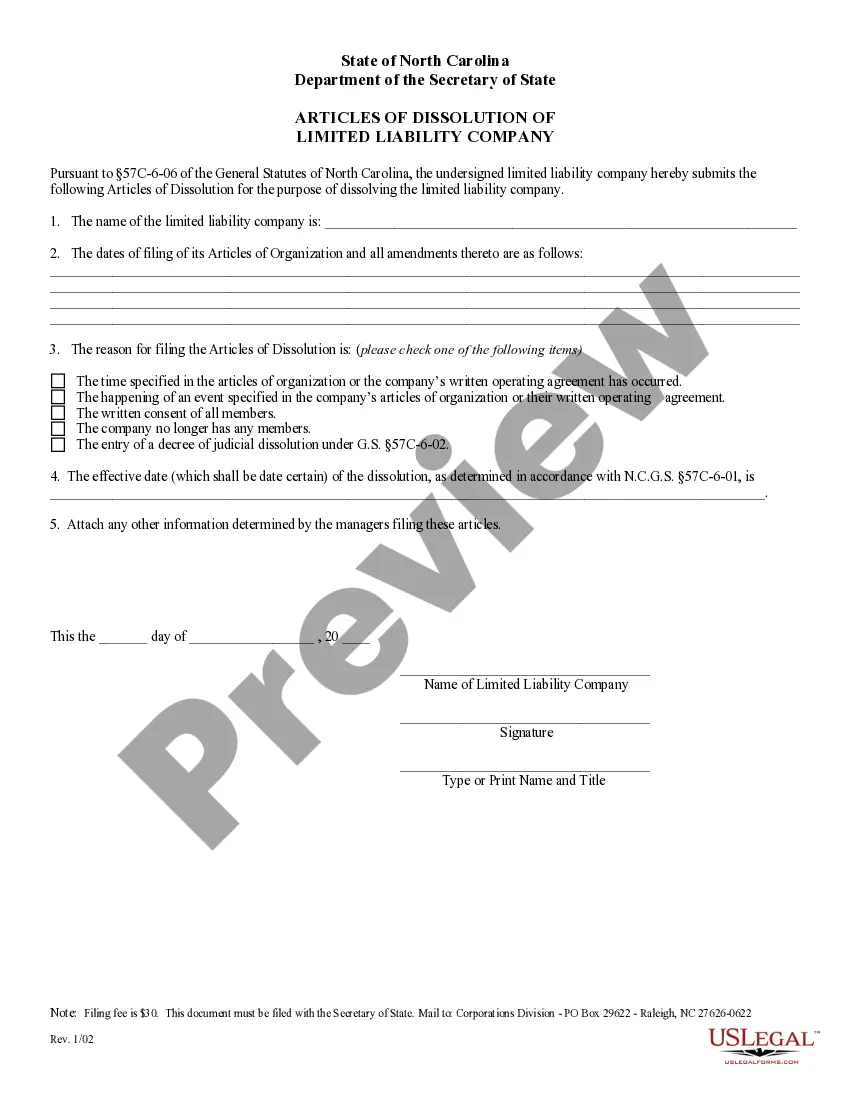

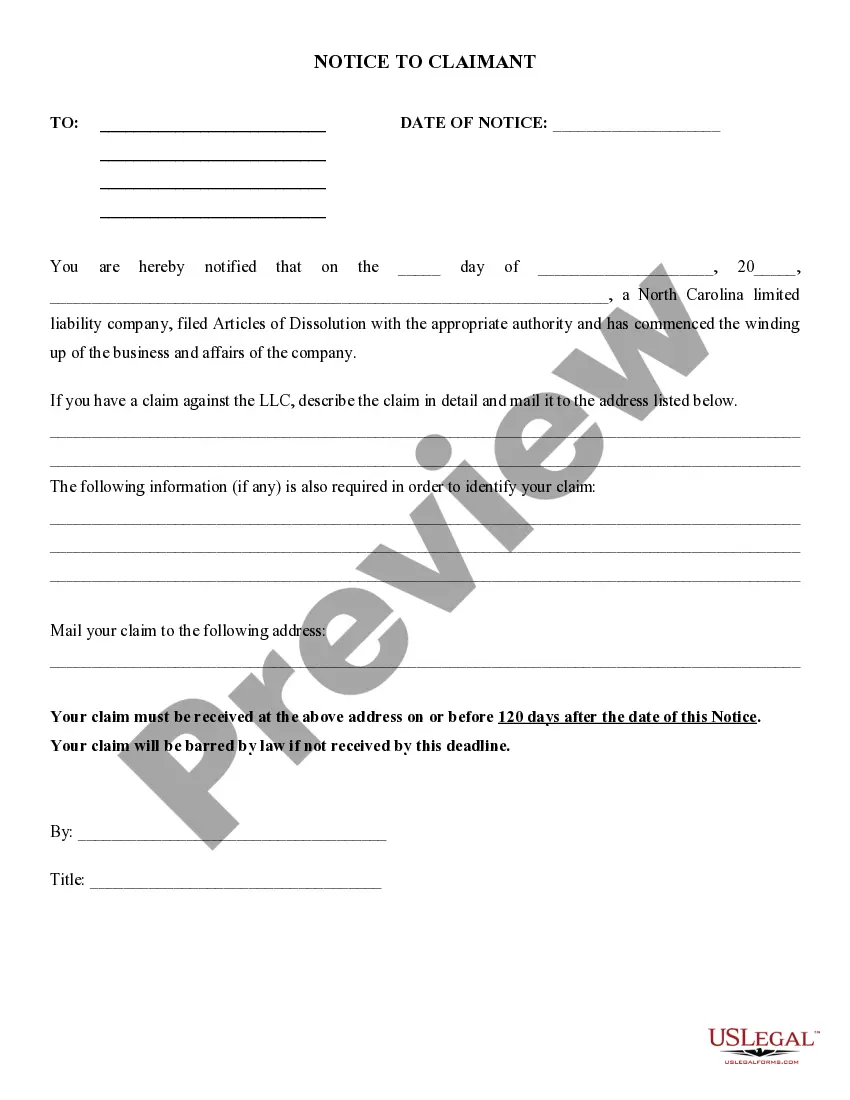

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

Whether for commercial objectives or personal matters, everyone must handle legal issues at some time in their life.

Filling out legal documents demands meticulous consideration, beginning with selecting the appropriate form template.

With a vast US Legal Forms catalog available, you do not need to waste time searching for the right template across the internet. Utilize the library’s straightforward navigation to find the correct template for any circumstance.

- For example, if you select an incorrect version of a Nc Dissolve Llc With Debt, it will be turned down once you submit it.

- Thus, it is essential to obtain a reliable source of legal documents like US Legal Forms.

- If you need to acquire a Nc Dissolve Llc With Debt template, follow these straightforward steps.

- Retrieve the template you require using the search bar or catalog navigation.

- Review the form’s details to confirm it aligns with your situation, state, and area.

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search feature to find the Nc Dissolve Llc With Debt sample you need.

- Download the template if it fits your needs.

- If you have a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you prefer and download the Nc Dissolve Llc With Debt.

- Once it is saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

?[T]he corporation remains liable to the extent of its undistributed assets, including any available insurance. (Claims exceeding the corporation's undistributed assets may be enforced against the shareholders to the extent they receive liquidation distributions; see ¶08 ff.)? Cal. Prac. Guide Corps.

Steps to Dissolve an LLC Follow the Operating Agreement (or the law) to wind-down the LLC (i.e. distribute assets and pay off liabilities). Negotiate, finalize and execute a Dissolution Agreement with your partners. Properly notify the IRS (within 30 days) using Form 966.

The decision to dissolve a corporation does not automatically invalidate its outstanding debts. Remember, a dissolution is not a bankruptcy, so your corporation will still need to deal with its creditors, vendors, unpaid employees, and anyone else who is owed money or property.

You must pay all of your debts before you can distribute company assets to the members when closing an LLC. The members are personally liable to the creditors of the company, so you must be sure the creditors are paid before taking the remaining assets.

How Can You Dissolve a Company With Debt? Take on no further business. Repay any loans taken by the directors. Pay back all debts. Keep the company bank account open until all the debts clear. Deal with any company vehicles by contacting the leasing or selling companies. Run the final payroll and make a return.