Dissolving Dissolve Company With Debts

Description

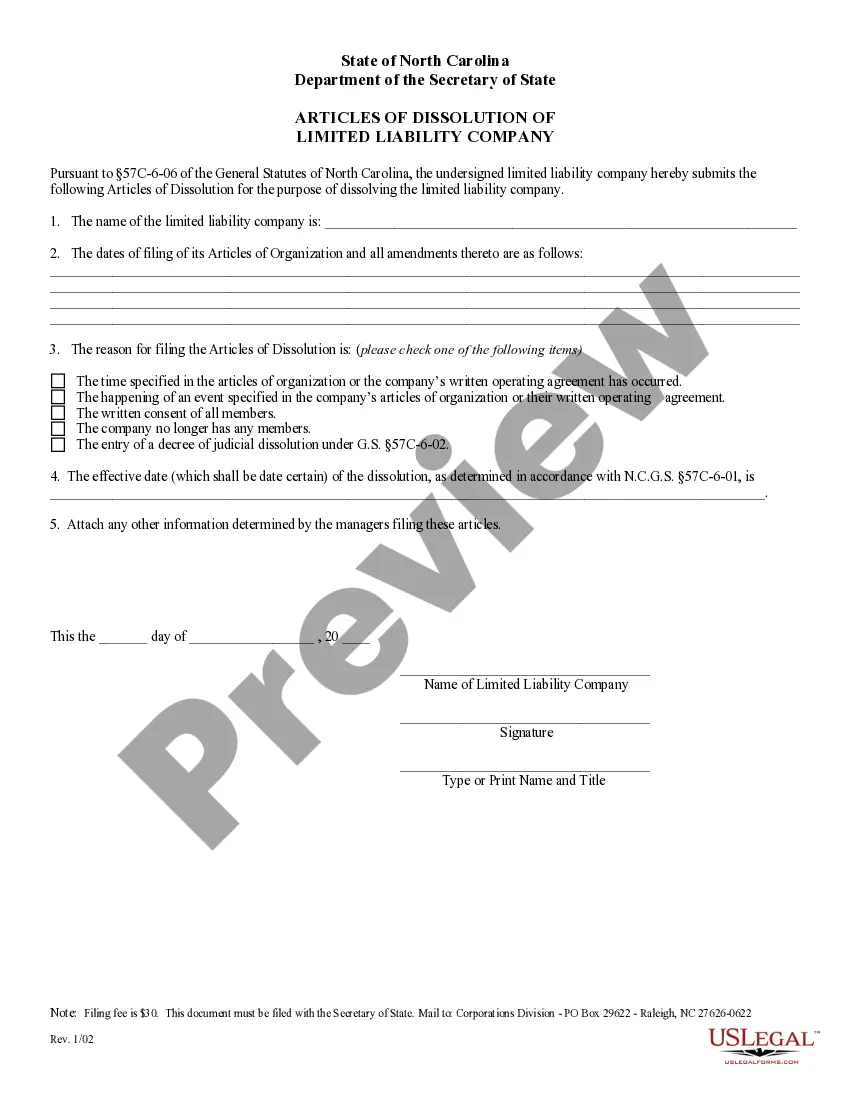

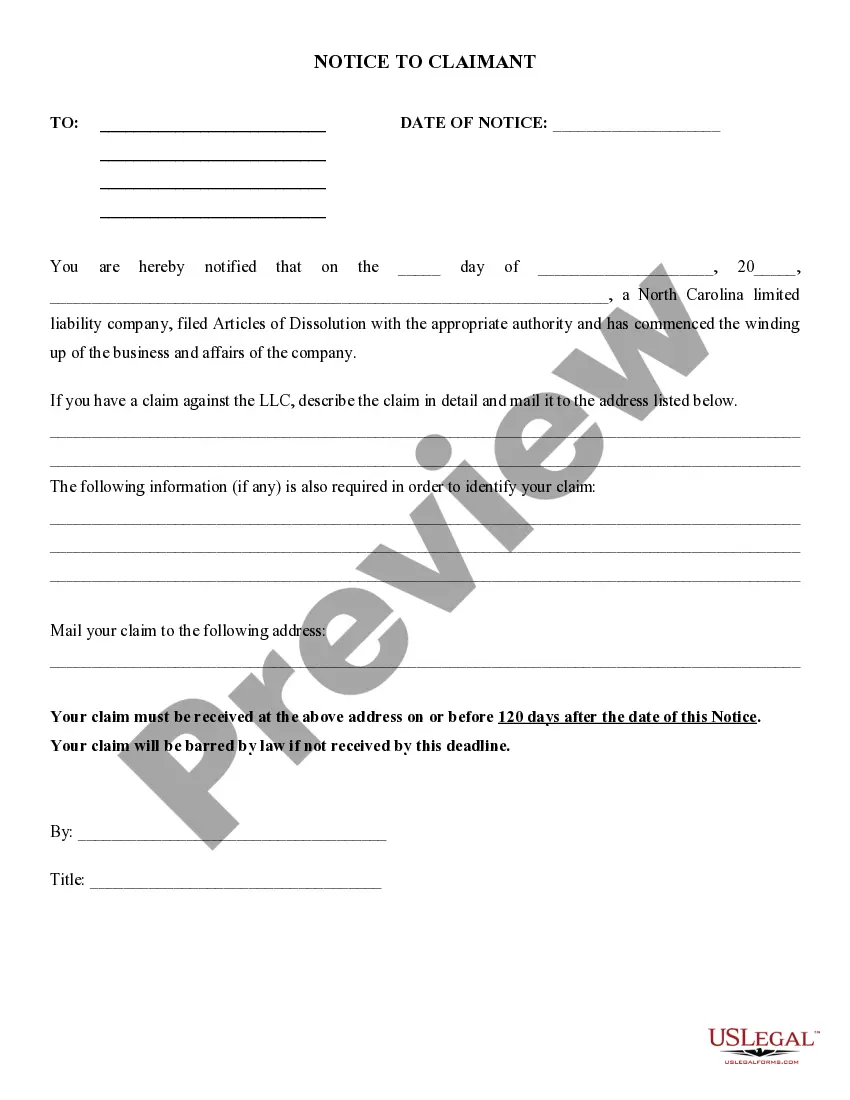

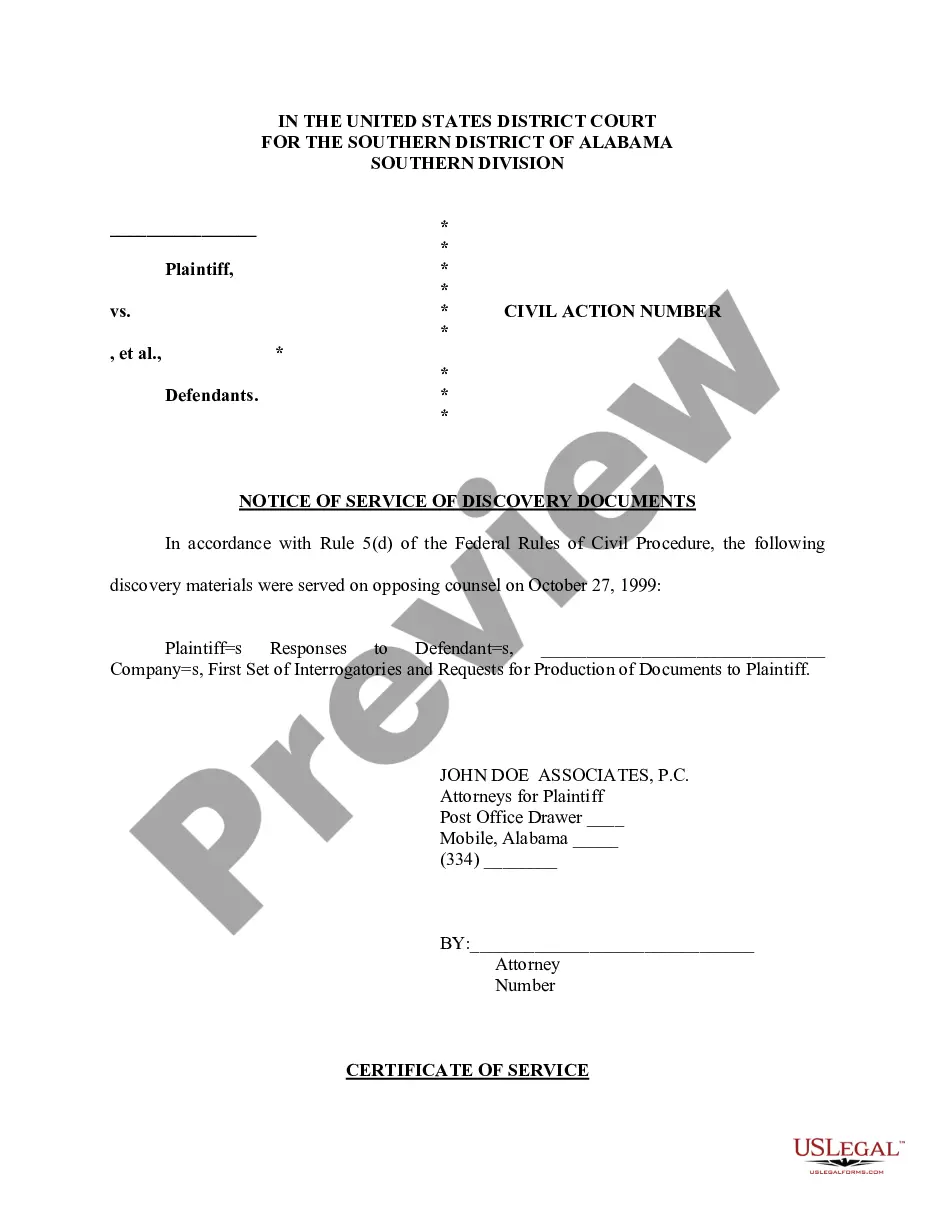

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

It’s well known that you cannot instantly become a legal professional, nor can you comprehend how to swiftly organize Dissolving Dissolve Company With Debts without possessing a specialized education.

Drafting legal documents is a lengthy process that demands specific training and abilities. So why not entrust the preparation of the Dissolving Dissolve Company With Debts to the experts.

With US Legal Forms, one of the largest legal template repositories, you can access a wide range of materials from court filings to templates for internal business communication. We understand how important it is to comply with federal and state regulations.

Click Buy now. After the payment process is completed, you can download the Dissolving Dissolve Company With Debts, complete it, print it, and distribute it to the relevant individuals or organizations.

You can access your forms anytime via the My documents tab. If you're a current client, simply Log In to find and download the template from that same tab.

- Visit our website and find the form you need in just a few minutes.

- Search for the form using the search bar located at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine if Dissolving Dissolve Company With Debts is what you are looking for.

- If you require another template, start your search again.

- Create a free account and select a subscription plan to acquire the template.

Form popularity

FAQ

Yes, you can dissolve a company with debt, but the process requires careful consideration. When dissolving a company with debts, you need to address those obligations before finalizing the dissolution. It is essential to inform creditors and potentially negotiate payments or settlements. Utilizing services like US Legal Forms can simplify this process, ensuring you comply with all necessary legal requirements.

You can dissolve a corporation that has debt, but it's crucial to understand your legal obligations. The process typically involves settling debts or reaching agreements with creditors to avoid personal liability. Filing the correct documents is essential, and platforms like US Legal Forms can provide the necessary resources to assist you in dissolving a corporation with debt smoothly.

Yes, you can dissolve a company even if it has debts. However, the process may require careful planning and negotiation with creditors. It is important to notify them of your decision and settle any outstanding obligations, if possible. Using US Legal Forms can help you navigate the legal requirements for dissolving a company with debts efficiently.

Dissolving a company with debts involves several key steps. First, you need to assess all outstanding obligations and communicate with your creditors about your intent to dissolve. Next, file the necessary paperwork with your state to officially begin the dissolution process. Utilizing platforms like US Legal Forms can simplify this process by providing the required forms and guidance tailored for dissolving a company with debts.

Can I Dissolve a Business With Debt? When a business has outstanding debts that it cannot pay, the company may be liquidated or close under administrative dissolution by the state. With liquidation, the company sells its assets to pay off debts before it closes.

Ontario Dissolution Learning Centre The Articles of Dissolution cost $272.40 in total. The fee is made up of $149.00 for our fee of preparing the form filing and gaining approval from you to proceed. There is a $39.99 fee for the submission filing and $25.00 government fee.

Hire a professional auctioneer and hold a public auction. Pay a business broker a fee to sell off your assets. File bankruptcy, in which case the bankruptcy trustee will sell your assets and pay off your creditors with the proceeds. Assign your assets and debts to a company that specializes in liquidating businesses.

Corporations that are able to pay off their debts and want to close down need to follow these important steps: Take on no further business. Repay any loans taken by the directors. Pay back all debts. Keep the company bank account open until all the debts clear.

Dissolved corporations could have their assets seized and liquidated to pay off debts, and companies or individuals that dissolve their corporations in an attempt to avoid taxes could be subject to fines, penalties, interest payments and even jail time.