Dissolved Dissolve Company With Assets

Description

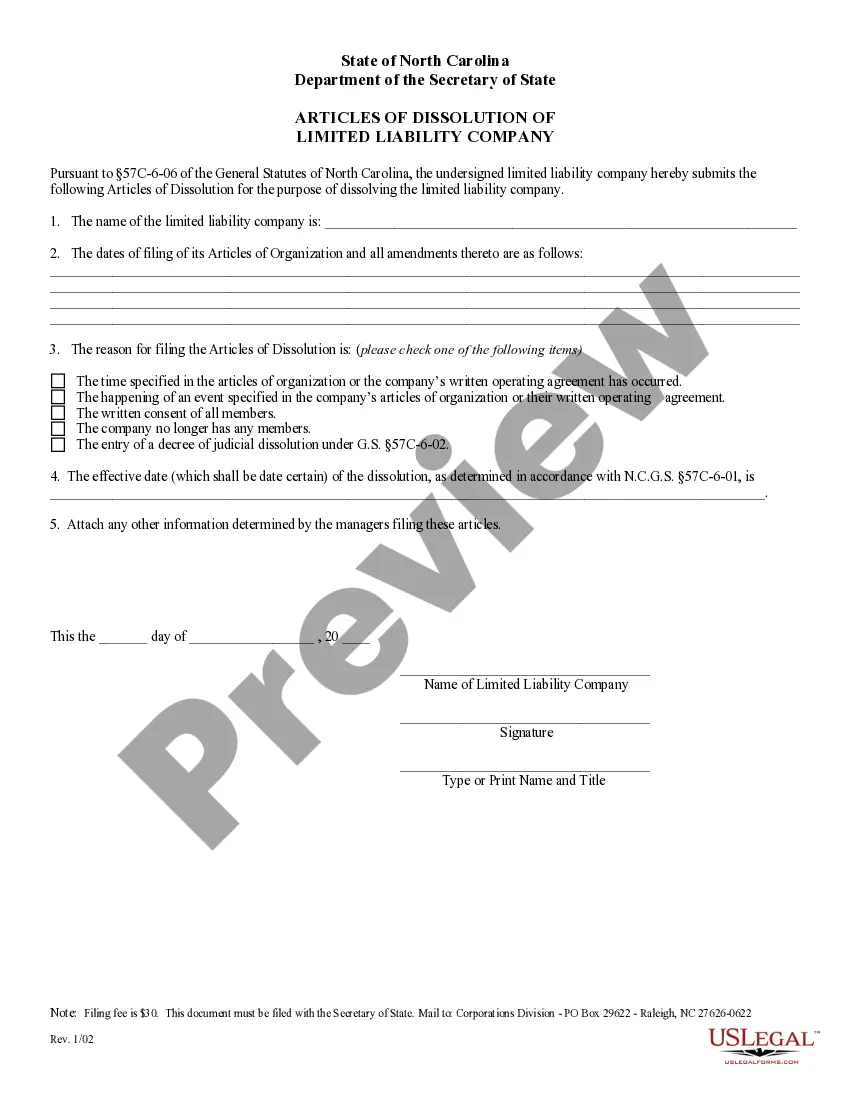

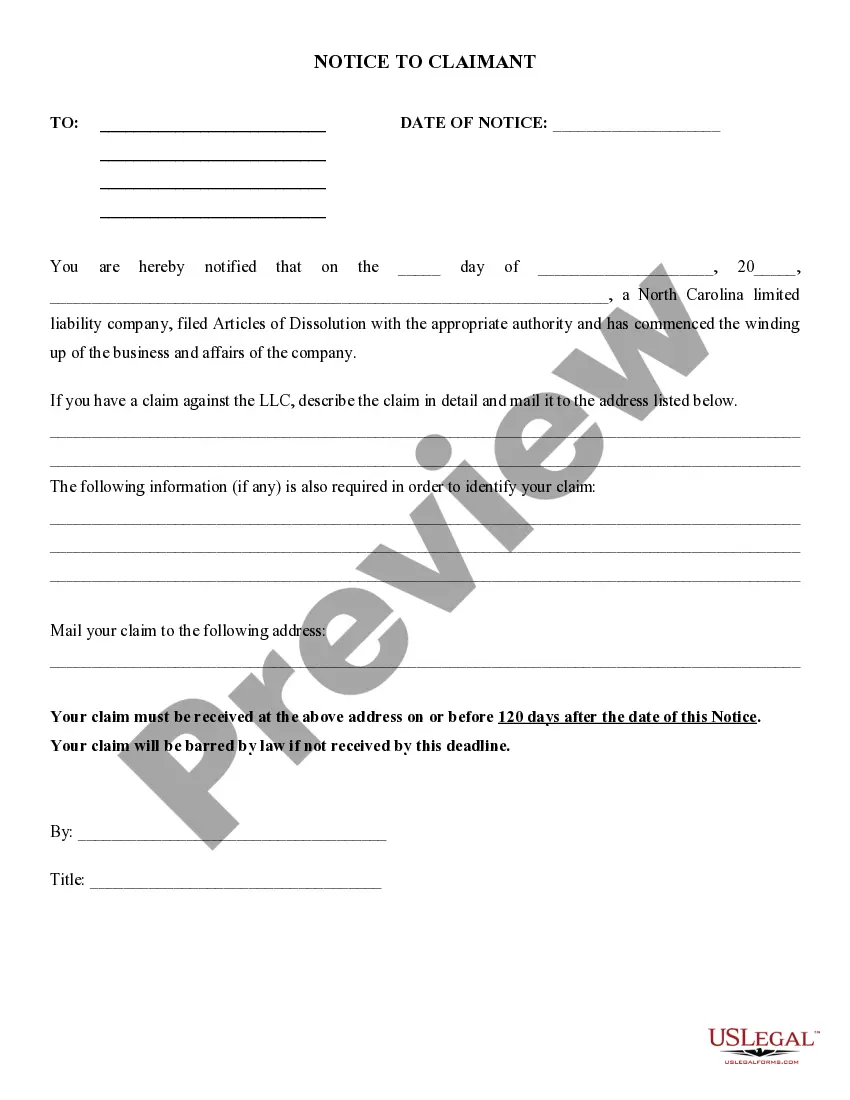

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

Managing legal documents can be overwhelming, even for the most skilled professionals.

When you seek a Dissolved Company With Assets and miss the opportunity to dedicate time to find the accurate and current version, the processes can be challenging.

US Legal Forms is a prominent provider in online legal forms, offering over 85,000 state-specific legal forms available to you at any time.

With US Legal Forms, you can.

Leverage the US Legal Forms web library, supported by 25 years of experience and reliability. Transform your daily document management into a simple and user-friendly process today.

- Access legal and business forms specific to your state or county.

- US Legal Forms caters to all your requirements, from personal to business paperwork, all in one location.

- If you have an account, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check your My documents tab to view the forms you have previously downloaded and to organize your files as desired.

- If this is your first time using US Legal Forms, sign up for an account to gain unlimited access to all library advantages.

- Use advanced tools to handle and oversee your Dissolved Company With Assets.

- Access a library of articles, guides, and resources related to your circumstances and requirements.

- Save time and energy searching for the documents you need, and utilize US Legal Forms’ sophisticated search and Review feature to find the Dissolved Company With Assets and obtain it.

Form popularity

FAQ

When a corporation is dissolved, its assets must be handled carefully. Typically, the assets are liquidated and distributed among creditors and shareholders, following legal guidelines. If your corporation has assets, you will need to ensure proper distribution in accordance with state laws. Using a platform like US Legal Forms can help you navigate the complexities of dissolving your company with assets smoothly.

Closing a limited company involves specific actions regarding its assets. You must first clear any liabilities to prevent complications down the line. Following this, you can distribute the remaining assets to shareholders as per the company’s articles of association. For assistance in navigating the complexities of a dissolved company with assets, US Legal Forms offers valuable resources to help you through each step.

When a business closes, its assets need to be handled according to legal requirements. First, you should settle any outstanding debts to protect yourself from future claims. After addressing these obligations, the business assets can be distributed or liquidated. To simplify this process, consider using US Legal Forms to ensure you manage the dissolution of your company with assets properly.

When an LLC is dissolved, its assets must be properly handled. The process typically involves settling any outstanding debts and obligations. After that, the remaining assets can be distributed among the members according to the operating agreement. It's important to manage this process carefully to ensure compliance with state laws concerning a dissolved company with assets.

Yes, you can dissolve a company with assets. However, it's important to follow the legal procedures to ensure that all obligations are met before dissolution. When you dissolve a company with assets, you must address any outstanding debts, distribute remaining assets to shareholders, and file the necessary paperwork. Utilizing a platform like US Legal Forms can simplify this process and ensure compliance with all legal requirements.

When a company is dissolved, its assets must be handled properly. Typically, the dissolved company with assets must liquidate or distribute its remaining resources to creditors and shareholders. If there are any debts, those should be settled first before any distribution. Using a platform like US Legal Forms can help guide you through the necessary steps and ensure compliance with legal requirements.

When a company is wound up this means it is officially closed down, its assets and liabilities are dealt with, and the business removed from the register held at Companies House. As part of this process, all assets the company has will be liquidated.

When a company is dissolved (or closes), the assets must be liquidated (i.e., sold). The process often involves an auction of the company's non-cash assets, liquidation sale over time or an complete sale to a buyer.

The distribution to shareholders must be made as soon as reasonably consistent with the beneficial liquidation of the corporation's assets, and may be made either in money or in property or securities and either in installments or as a whole.

Shutting down all company bank accounts. Paying outstanding debts, or confirming the company can do this. Following staff redundancy rules and paying final staff wages. Completing a final tax return through HMRC (you must state that this is the last one).