Dissolution Dissolve Company Formation

Description

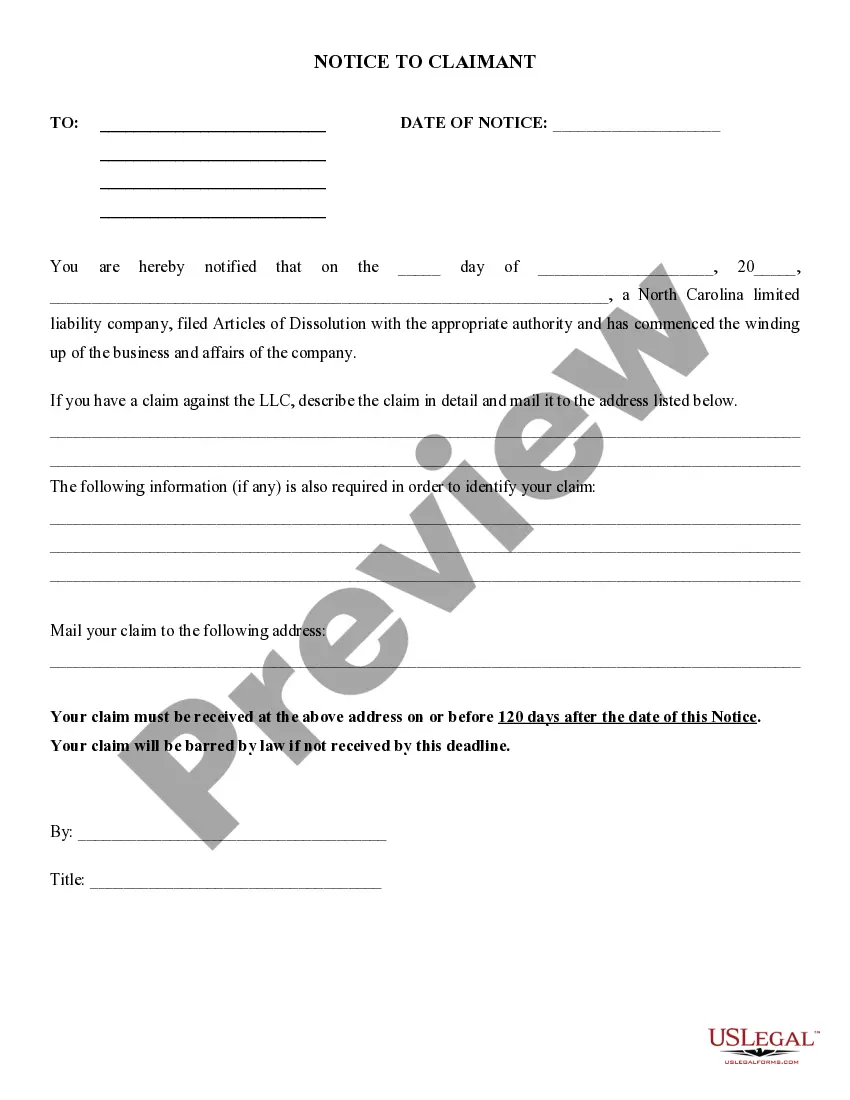

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

It’s clear that you cannot become a legal specialist instantly, nor can you understand how to swiftly compose Dissolution Dissolve Company Formation without possessing a unique set of abilities.

Assembling legal documents is a labor-intensive task necessitating a certain level of education and expertise.

So why not entrust the development of the Dissolution Dissolve Company Formation to the experts.

You can regain access to your documents from the My documents tab at any time.

If you are an existing customer, you can simply Log In, and locate and download the template from the same tab. Regardless of the purpose of your documents—be it financial, legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Locate the document you require using the search bar at the top of the site.

- Preview it (if this option is available) and examine the accompanying description to determine if Dissolution Dissolve Company Formation is what you are looking for.

- Restart your search if you need another template.

- Create a free account and select a subscription plan to purchase the template.

- Click Buy now. After the payment is finalized, you can download the Dissolution Dissolve Company Formation, fill it out, print it, and dispatch or send it via mail to the appropriate parties or organizations.

Form popularity

FAQ

Yes, if you are dissolving an S Corporation, you must file Form 966 with the IRS. This form notifies the IRS about the corporation's dissolution and must be submitted within 30 days of the dissolution. Additionally, ensure you follow your state’s requirements for the dissolution process. US Legal Forms can assist you in preparing Form 966 and other necessary documents for a smooth dissolve company formation.

To officially dissolve a business, you must follow state-specific procedures. Begin by holding a meeting with your partners or board to agree on the dissolution. Next, file the appropriate paperwork with your state’s business division. Using platforms like US Legal Forms can simplify this process, ensuring you complete the required documents for your dissolution and dissolve company formation efficiently.

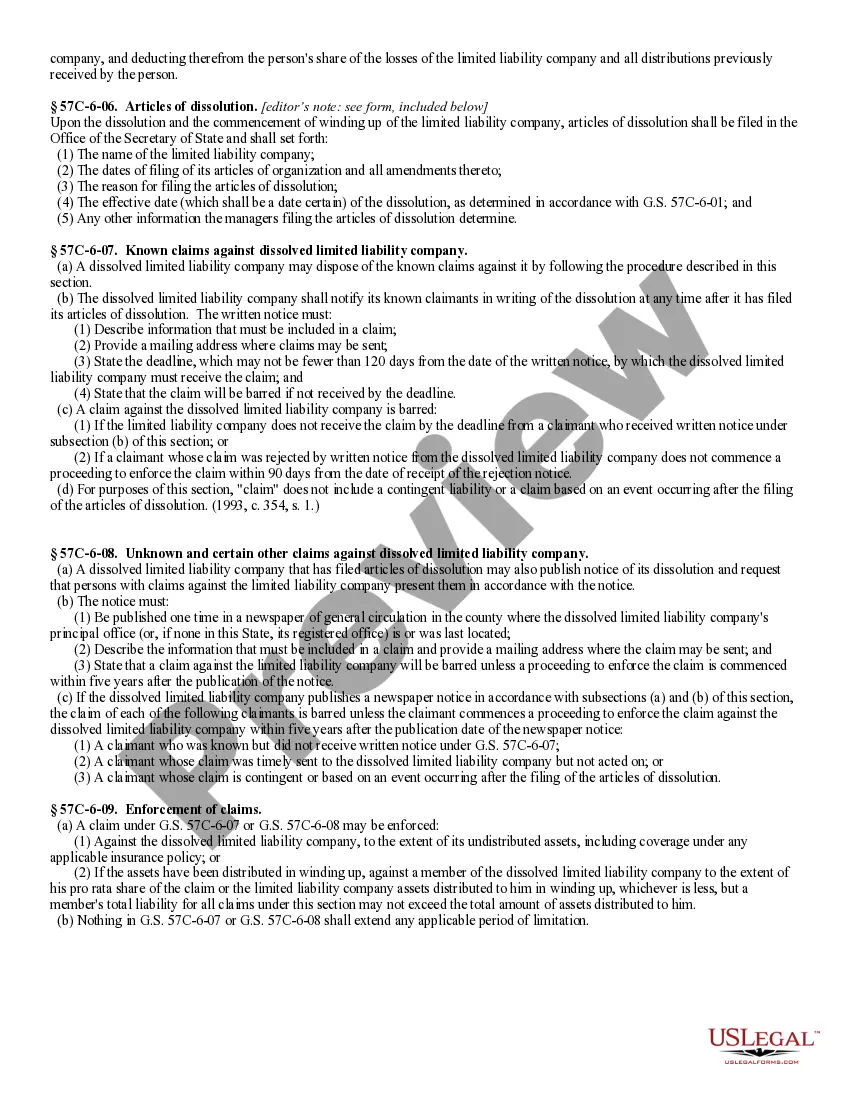

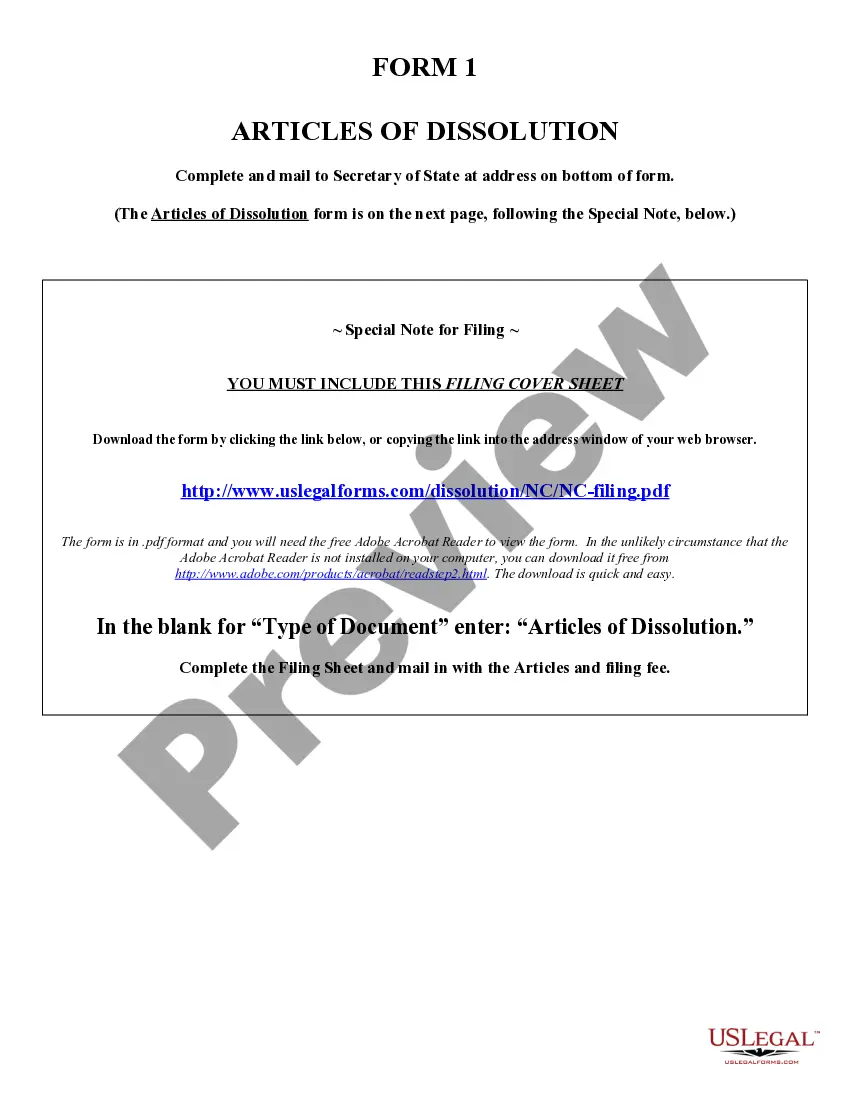

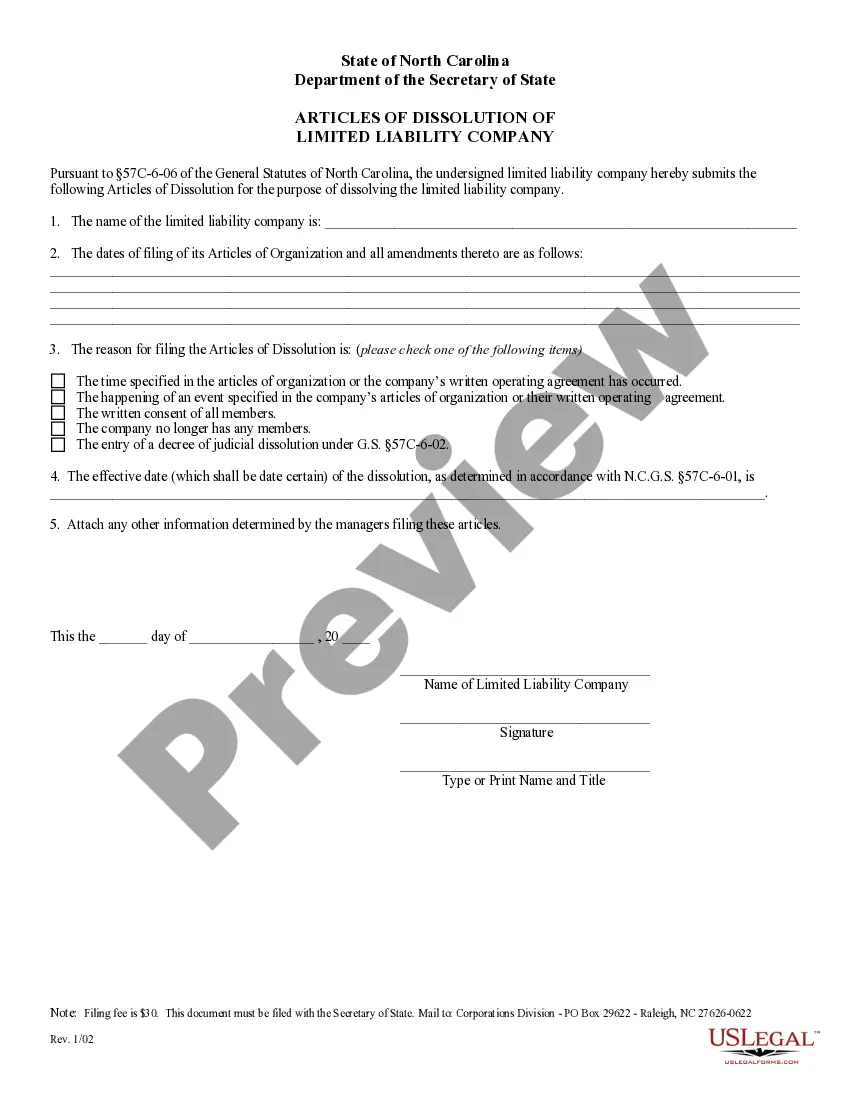

Filing a dissolution for an LLC involves submitting articles of dissolution to your state's Secretary of State. You will also need to settle any debts and distribute remaining assets among members. After filing, ensure you notify the IRS and close all business accounts. US Legal Forms offers the resources and templates you need for a seamless dissolution dissolve company formation experience.

To notify the IRS of your corporation's dissolution, you must file your final tax return and mark it as 'final.' You should also report the dissolution on Form 1120, including any necessary documentation. This step ensures that the IRS is aware of your company’s status and helps prevent future tax complications. Utilizing US Legal Forms can assist you in preparing the necessary forms for this dissolution dissolve company formation requirement.

When you decide to dissolve your business, the paperwork typically includes a certificate of dissolution and any required state-specific forms. You may also need to settle outstanding debts and notify stakeholders. It's essential to follow your state's regulations to ensure a smooth dissolution process. Using a platform like US Legal Forms can streamline this dissolution dissolve company formation process, providing you with the right forms and guidance.

Once a company is dissolved, it no longer exists as a legal entity and cannot conduct business or enter into contracts. Dissolution may also trigger a number of certain legal obligations, such as the distribution of remaining assets to creditors or shareholders. It also might involve the filing of final tax returns.

What are the differences between liquidation and dissolution? Dissolving a company through the process of dissolution often takes place when a company is solvent, but is no longer trading. Liquidation however, occurs due to a company having financial difficulties and therefore being unable to keep up with their debts.

6 Steps to Dissolve a Corporation #1 ? Seek Approval from the Board of Directors and Shareholders. First, hold a meeting with the board of directors. ... #2 ? File Articles of Dissolution. ... #3 ? Finalize Taxes. ... #4 ? Notify Creditors. ... #5 ? Liquidate and Distribute Assets. ... #6 ? Wrap Up Operations.

Although the content will vary, certain elements should be included in every letter of dissolution. These include: The name of the recipient and the name of the person sending the letter. The purpose of the letter, including the relationship to be terminated and the date of termination, stated in the first paragraph.

6 Steps to Dissolve a Corporation #1 ? Seek Approval from the Board of Directors and Shareholders. First, hold a meeting with the board of directors. ... #2 ? File Articles of Dissolution. ... #3 ? Finalize Taxes. ... #4 ? Notify Creditors. ... #5 ? Liquidate and Distribute Assets. ... #6 ? Wrap Up Operations.