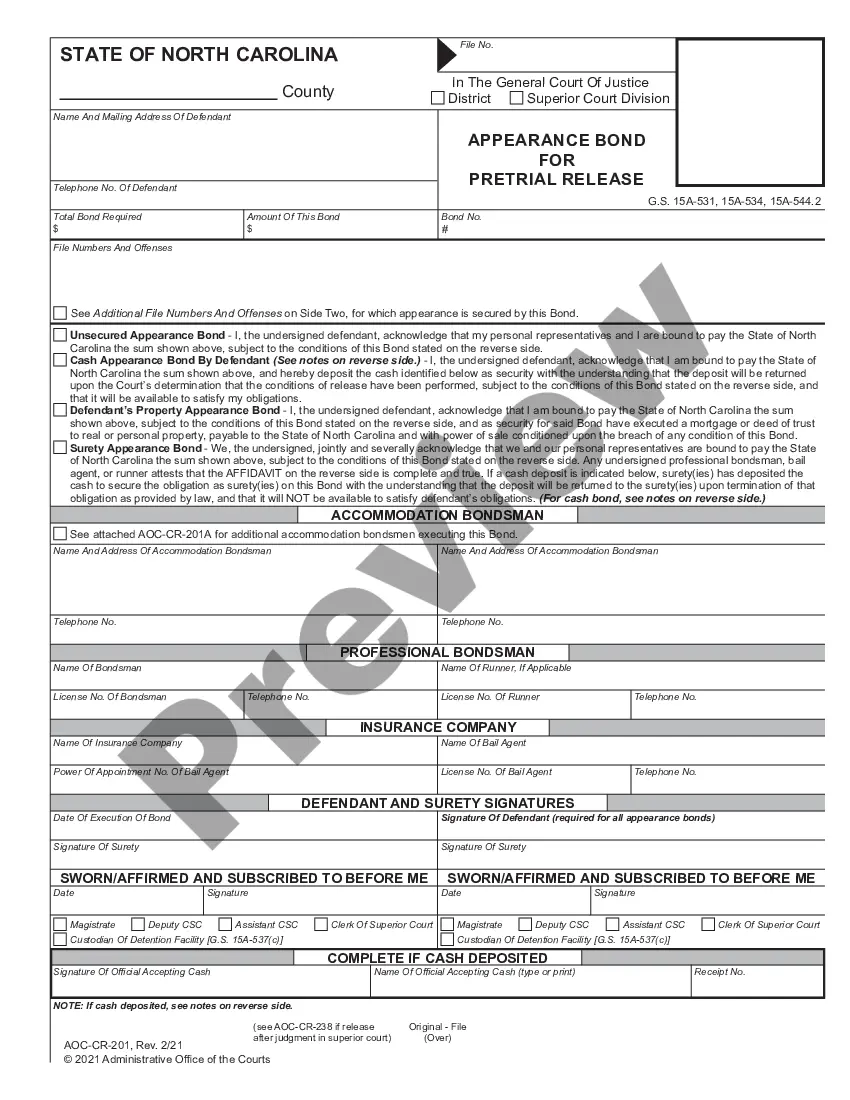

Appearance Bond for Release After Judgement in Superior Court: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Appearance After Court For Credit Card Debt

Description

How to fill out North Carolina Appearance Bond For Release After Judgment In Superior Court?

When you must present Appearance After Court For Credit Card Debt per your region's legal statutes and regulations, there could be various selections available.

You need not verify each form to ensure it meets all legal specifications if you are subscribed to US Legal Forms.

It is a reliable service that can assist you in obtaining a reusable and current template on any subject.

Acquiring expertly crafted formal documents becomes simple with US Legal Forms. Additionally, Premium users may also benefit from advanced integrated tools for online PDF editing and signing. Experience it today!

- US Legal Forms is the most extensive online database with an archive of over 85,000 ready-to-use documents for both business and personal legal matters.

- All templates are confirmed to comply with the laws and regulations of each state.

- Therefore, when downloading Appearance After Court For Credit Card Debt from our platform, you can trust that you have a legitimate and current document.

- Acquiring the necessary template from our platform is quite simple.

- If you already possess an account, just Log In to the system, ensure your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile to retrieve Appearance After Court For Credit Card Debt whenever needed.

- If this is your first time using our library, kindly follow the instructions below.

- Browse the suggested page and ensure it fits your needs.

Form popularity

FAQ

To get your credit card debt cleared, you might want to consider filing for bankruptcy or working with a credit counselor. Bankruptcy can clear unsecured debts like credit cards, whereas credit counseling can provide personalized strategies for managing and paying off your debts. It's vital to explore all available options and understand the consequences. Post your appearance after court for credit card debt, utilize resources like the US Legal Forms platform to find assistance in navigating these pathways.

You can have your credit card debt forgiven through programs such as relief contracts or, in some cases, through bankruptcy. Typically, this involves demonstrating financial hardship to negotiate with the credit card issuer. Engage with a debt relief specialist to explore your options. Following your appearance after court for credit card debt, you may find pathways to forgiveness that align with your financial situation.

To legally get rid of credit card debt, consider debt settlement or consolidation options. Debt settlement involves negotiating with creditors to reduce the total amount owed, while consolidation combines multiple debts into a single payment plan. Both methods can help you manage payments more effectively. After your court appearance for credit card debt, these options may provide a viable path to financial relief.

You can legally discharge your credit card debt through bankruptcy, specifically Chapter 7 or Chapter 13 filings. In Chapter 7 bankruptcy, unsecured debts like credit card balances may be eliminated, giving you a fresh start. It is essential to understand the implications and seek guidance from a legal professional before making this decision. After the court appearance for credit card debt, ensure you follow all legal steps to achieve the discharge.

Credit card companies often settle for 30% to 50% of the outstanding balance, which can vary based on your financial situation and the age of the debt. While negotiating, keep in mind the importance of your appearance after court for credit card debt, which may influence their willingness to settle. Always be prepared with a reasonable offer to facilitate discussions.

To create a good debt settlement letter, ensure it is concise and direct. Start with your intent to settle the debt, followed by your proposed payment amount and justification. Including your upcoming appearance after court for credit card debt may enhance your credibility, showing that you are taking steps to address your obligations.