North Carolina Affidavit Of Heirship

Description

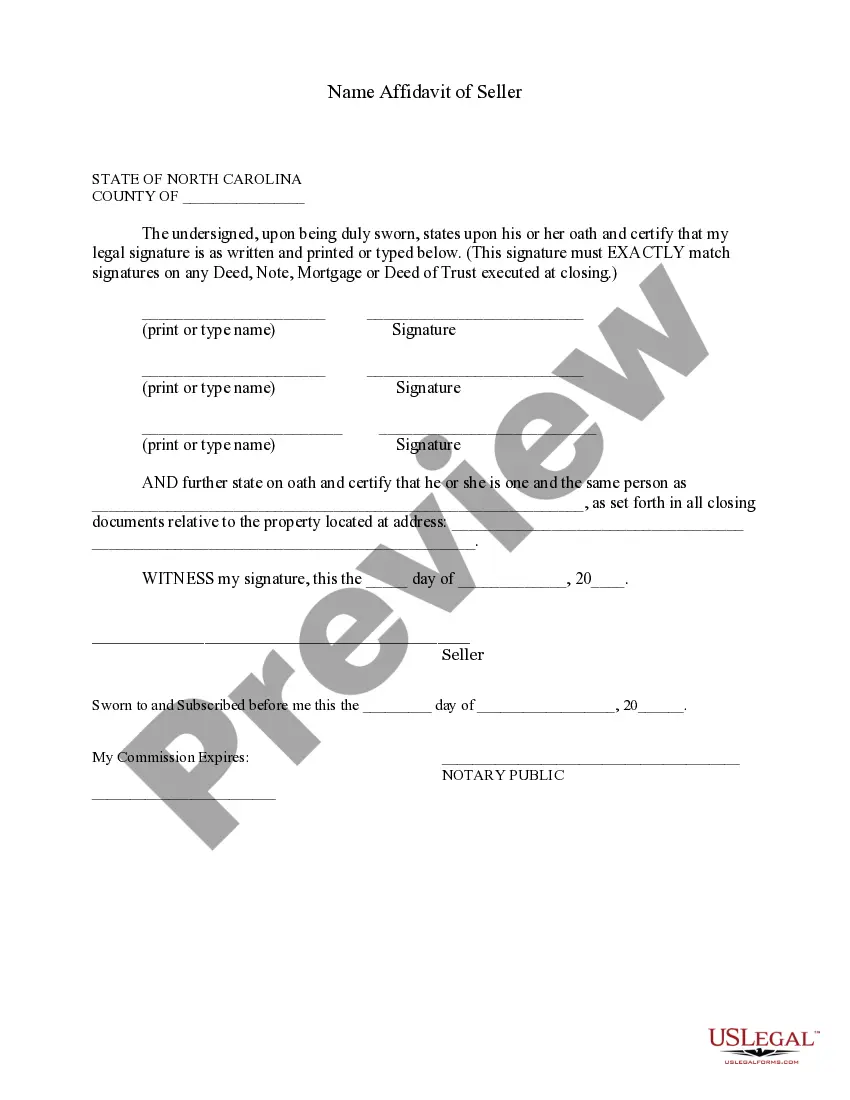

How to fill out North Carolina Name Affidavit Of Seller?

There's no longer a reason to squander hours searching for legal documents to meet your local state's requirements.

US Legal Forms has compiled all of them in one location and simplified their availability.

Our platform provides over 85k templates for various business and individual legal situations categorized by state and area of use.

Utilize the search bar above to find another template if the current one does not meet your needs. Click Buy Now next to the template name once you discover the right one. Choose the most suitable subscription plan and register for an account or Log In. Process payment for your subscription via card or PayPal to proceed. Choose the file format for your North Carolina Affidavit Of Heirship and download it to your device. Print out your form to complete it manually or upload the sample if you prefer to do it in an online editor. Preparing legal documents under federal and state laws and regulations is quick and simple with our platform. Experience US Legal Forms today to keep your documentation organized!

- All forms are properly drafted and verified for validity, ensuring you receive a current North Carolina Affidavit Of Heirship.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all saved documents at any time via the My documents tab in your profile.

- If you've never interacted with our platform before, the process will require a few additional steps.

- Here's how new users can find the North Carolina Affidavit Of Heirship in our catalog.

- Carefully read the page content to confirm it contains the sample you need.

- To assist with this, make use of the form description and preview options if available.

Form popularity

FAQ

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

You should expect it to take a minimum of six months to a year to settle an estate because of the legal notice requirements and time that creditors have to submit claims against the estate. Creditors have 90 days from the first publication date of the notice of probate.

Step 1 Wait Thirty (30) Days. Before filing this affidavit with the court, affiants must wait until a minimum of thirty (30) days have passed since the death of the decedent.Step 2 No Personal Representative.Step 3 Complete Documentation.Step 4 File with the Superior Court.

ChecklistThe name and address of the deceased party (called the "Decedent")The name and address of the party providing sworn testimony in this affidavit (called the "Affiant")The date and location of the Decedent's death.Whether or not the Decedent left a will and, if so, the name and address of the Executor.More items...

Spouses in North Carolina Inheritance LawIf you have no living parents or descendants, your spouse will inherit all of your intestate property. If you die with parents but no descendants, your spouse will inherit half of intestate real estate and the first $100,000 of personal property.