North Carolina Affidavit Of Capital Improvement

Description

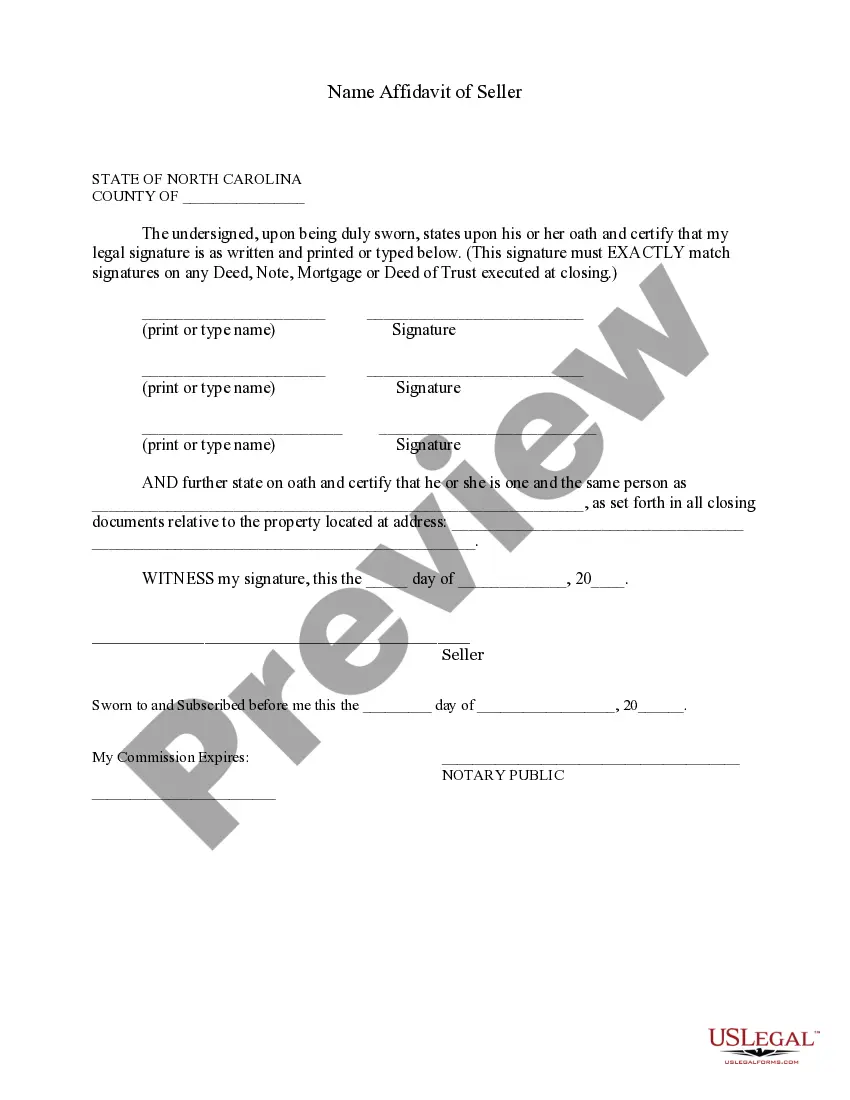

How to fill out North Carolina Name Affidavit Of Seller?

Whether you handle documentation regularly or occasionally need to send a legal paper, it is essential to acquire a reliable resource where all the templates are relevant and current.

The initial step with a North Carolina Affidavit Of Capital Improvement is to verify if it is indeed the latest version, as this affects its submittability.

If you wish to make your search for the most recent document samples more straightforward, look for them on US Legal Forms.

Forget about the confusion associated with handling legal documents. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents featuring nearly every example of paperwork you might seek.

- Look for the templates you need, assess their relevance instantly, and learn more about their application.

- With US Legal Forms, you have entry to over 85,000 form templates across a broad range of fields.

- Obtain the North Carolina Affidavit Of Capital Improvement samples in just a few clicks and save them anytime in your account.

- A US Legal Forms account enables you to access all the samples you need, providing ease and less hassle.

- Simply click Log In in the site header and access the My documents section where all the forms you need are readily available, allowing you to avoid wasting time on either finding the ideal template or verifying its authenticity.

- To acquire a form without an account, follow these steps.

Form popularity

FAQ

Form E-589CI, Affidavit of Capital Improvement, is generally required to substantiate that a contract, or a portion of work to be performed to fulfill a contract, is to be taxed for sales and use tax purposes as a real property contract with respect to a capital improvement to real property.

Generally, the purchase price of tangible personal property or digital property that becomes part of or is applied to a purchaser's property as part of a capital improvement or used to provide an exempt repair, maintenance, or installation service is generally subject to sales and use tax.

Capital improvement means: An addition or alteration to real property that is new construction, reconstruction or remodeling of a building, structure or fixture on land that becomes part of the real property or is permanently installed or applied to the real property so that the removal would cause material damage to

Capital improvement means: An addition or alteration to real property that is new construction, reconstruction or remodeling of a building, structure or fixture on land that becomes part of the real property or is permanently installed or applied to the real property so that the removal would cause material damage to

A capital improvement is a permanent structural alteration or repair to a property that improves it substantially, thereby increasing its overall value. That may come with updating the property to suit new needs or extending its life. However, basic maintenance and repair are not considered capital improvements.