The Alta Settlement Statement for Taxes is a document prepared during the settlement or closing process of a real estate transaction. It serves as an itemized list of all the financial transactions related to the property sale, ensuring transparency and accuracy when it comes to taxes and other financial obligations. This statement is especially crucial for tax purposes as it provides detailed information that can be used during tax filings. Keywords: Alta settlement statement, taxes, real estate transaction, closing process, financial transactions, itemized list, transparency, accuracy, tax purposes, tax filings. Different types of Alta Settlement Statements for Taxes: 1. Buyer's Alta Settlement Statement for Taxes: This type of settlement statement is prepared for the buyer and outlines their expenses related to the property acquisition, including purchase price, loan fees, prepaid interest, and any other costs associated with the sale. 2. Seller's Alta Settlement Statement for Taxes: This statement is prepared for the seller and provides a comprehensive breakdown of the funds they will receive from the property sale. It includes details about the purchase price, real estate commissions, outstanding loan balance, taxes, and any charges or credits applicable to the seller. 3. Refinance Alta Settlement Statement for Taxes: When refinancing a property, a refinancing settlement statement is generated. This document details the financial transactions involved in the refinancing process, such as loan origination fees, prepaid interest, appraisal charges, and other expenses that may affect taxes. 4. Rental Property Alta Settlement Statement for Taxes: If the property being sold or refinanced is a rental property, a specific settlement statement is prepared. This statement includes income received from rental payments, expenses associated with property management, maintenance, repairs, and other tax-deductible items related to the rental property. 5. Investment Property Alta Settlement Statement for Taxes: When dealing with an investment property, a specialized settlement statement is created. It provides a comprehensive breakdown of financial transactions, including acquisition costs, sale proceeds, capital gains taxes, property management fees, and any other relevant details for tax purposes. It is essential to consult with a tax professional or the Internal Revenue Service (IRS) to ensure accurate reporting and compliance with tax laws based on the specific type of Alta Settlement Statement for Taxes.

Alta Settlement Statement For Taxes

Description

How to fill out North Carolina Closing Statement?

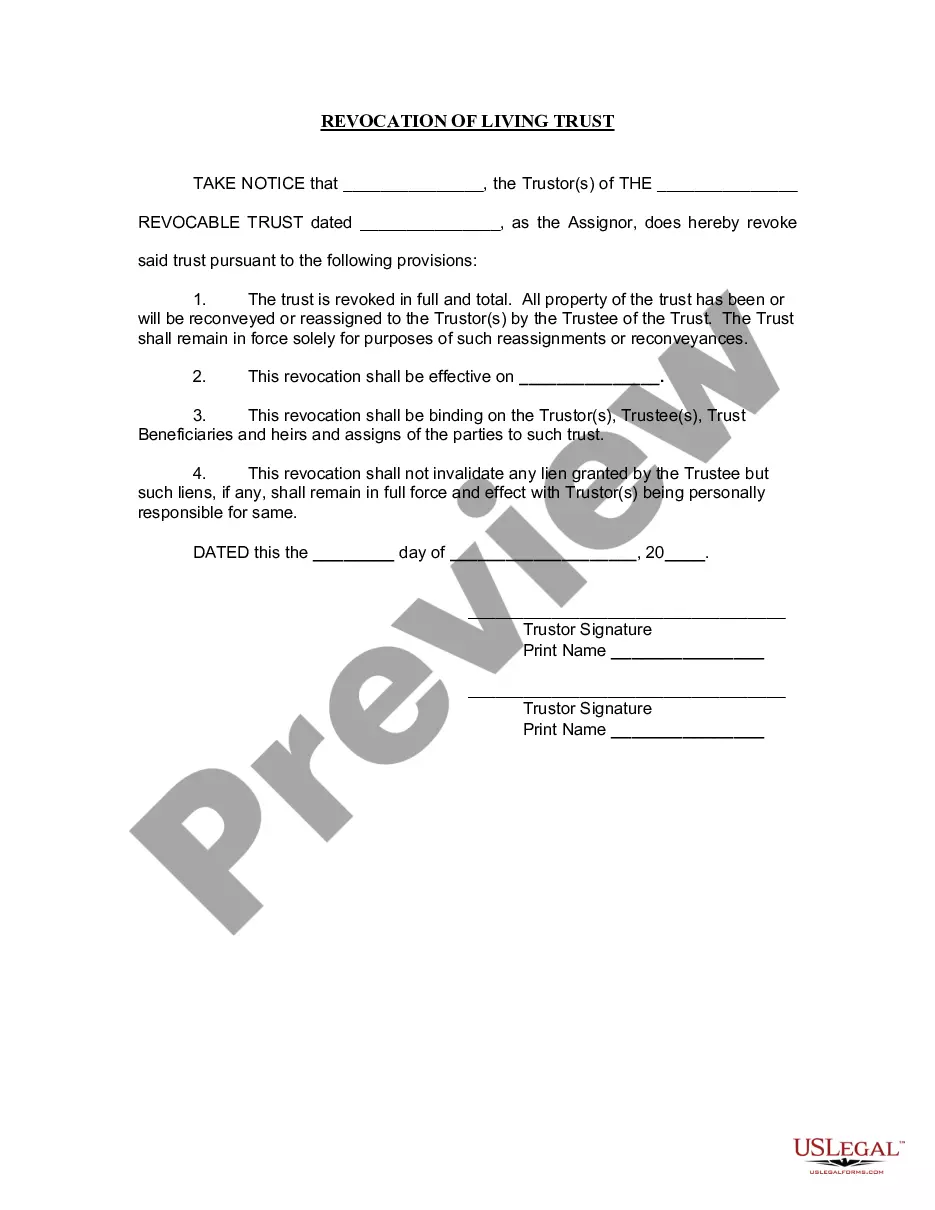

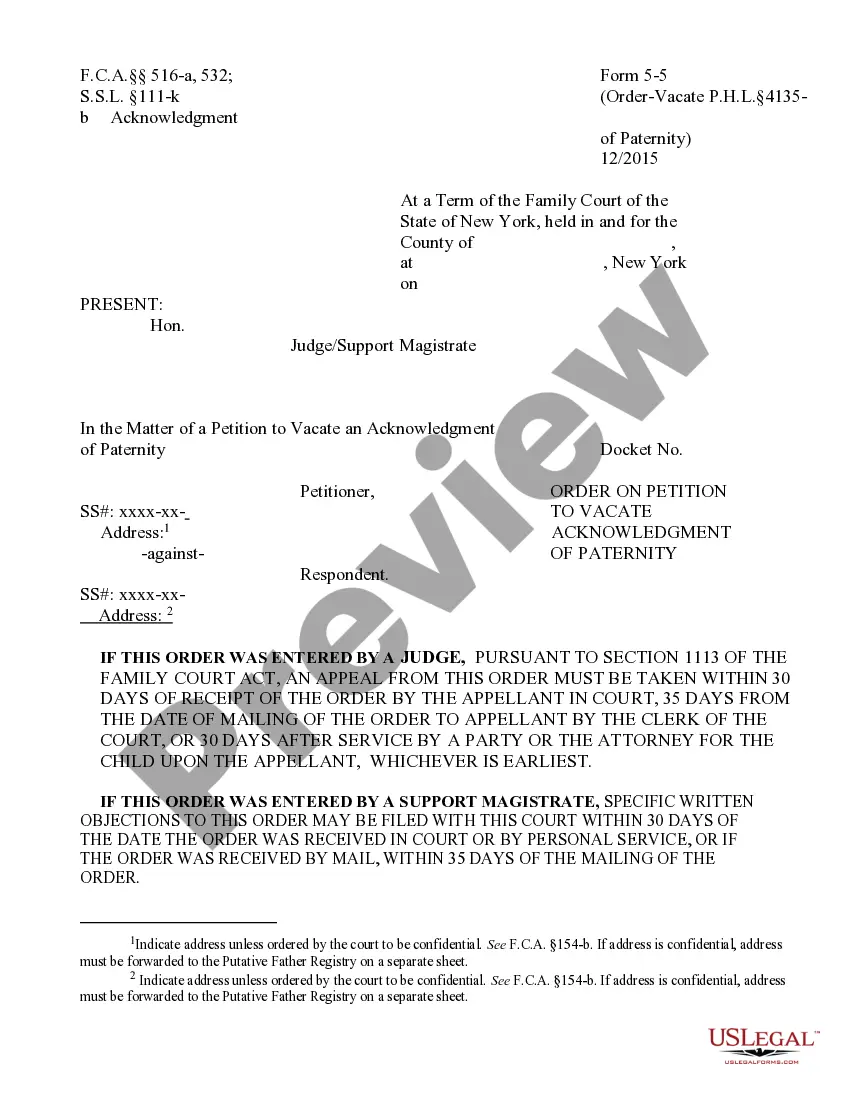

Whether for business purposes or for individual matters, everyone has to handle legal situations at some point in their life. Completing legal documents demands careful attention, starting with selecting the correct form template. For instance, if you select a wrong edition of the Alta Settlement Statement For Taxes, it will be declined when you submit it. It is therefore essential to have a dependable source of legal papers like US Legal Forms.

If you need to obtain a Alta Settlement Statement For Taxes template, stick to these simple steps:

- Find the template you need by using the search field or catalog navigation.

- Examine the form’s description to make sure it matches your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the wrong form, go back to the search function to find the Alta Settlement Statement For Taxes sample you need.

- Download the template when it matches your needs.

- If you have a US Legal Forms profile, simply click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Pick the appropriate pricing option.

- Complete the profile registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Pick the file format you want and download the Alta Settlement Statement For Taxes.

- When it is downloaded, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time seeking for the appropriate template across the web. Take advantage of the library’s straightforward navigation to get the proper template for any occasion.

Form popularity

FAQ

The ALTA statement is an itemized list of all the cost components that the seller and the buyer are supposed to pay during the home closing process to multiple parties. The statement segregates these cost components into 8-9 sections. Each cost component could either be debited or credited to the concerned party.

ALTA has developed standardized ALTA Settlement Statements for title insurance and settlement companies to use to itemize all the fees and charges that both the homebuyer and seller must pay during the settlement process of a housing transaction.

If a Settlement Statement is used, the totals must match the Closing Disclosure.? The nice part about the closing disclosures is that is is only intended for real estate buyers so it only contains information that buyers would want to know. Whereas the ALTA statement contains both buyer and seller credits and charges.

ALTA Settlement Statement Cash ? This is the version used for cash transactions for property purchases. Settlement Statement ? This is the version used specifically for the buyers in the real estate purchase and contains only information pertinent to the buyer's side of the transaction.

ALTA is the American Land Title Association and the ALTA Settlement Statement is a standardized form that itemizes the debits and credits for the buyer and seller in a real estate transaction.