Harbor Freight Credit Application Withdrawal

Description

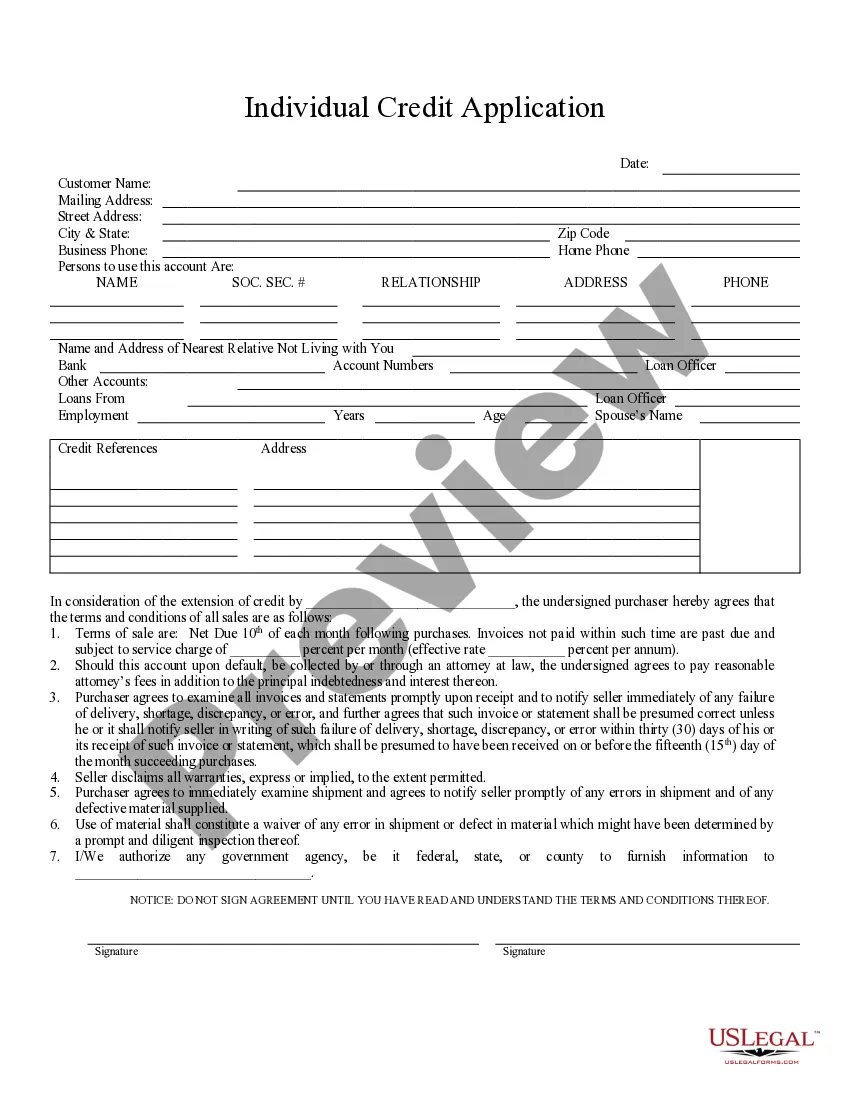

How to fill out North Carolina Individual Credit Application?

Navigating through the red tape of standard documents and templates can be challenging, particularly if one does not engage in that work professionally.

Even locating the appropriate template to submit a Harbor Freight Credit Application Withdrawal will be labor-intensive, as it must be accurate and precise to the very last digit.

However, you will need to invest considerably less time searching for a suitable template if it originates from a dependable source.

Obtain the correct form in a few simple steps: Enter the title of the document in the search field. Choose the appropriate Harbor Freight Credit Application Withdrawal from the list of results. Review the description of the example or open its preview. If the template meets your requirements, click Buy Now. Then proceed to select your subscription plan. Provide your email and create a secure password to register an account at US Legal Forms. Choose a credit card or PayPal payment method. Finally, save the template document on your device in your preferred format.

- US Legal Forms is a platform that streamlines the process of locating the correct forms online.

- US Legal Forms is a single destination you need to find the most recent examples of documents, review their usage, and download these examples to complete them.

- This is a collection containing over 85K forms that are applicable across various employment sectors.

- When looking for a Harbor Freight Credit Application Withdrawal, you will not have to doubt its authenticity as all the forms are validated.

- Having an account at US Legal Forms will ensure you have all the essential examples within your reach.

- Store them in your history or add them to the My documents catalog.

- You can retrieve your saved forms from any device by clicking Log In at the library site.

- If you do not yet have an account, you can always search again for the template you require.

Form popularity

FAQ

Having a credit score of 580 can make it challenging to get approved for a Harbor Freight Credit Card, as most approvals require a higher score. However, don’t lose hope; some programs cater to those with lower scores. If your application is declined, you might experience a Harbor Freight credit application withdrawal, but consider seeking guidance on improving your credit situation.

Getting approved for a Harbor Freight Credit Card is achievable for many individuals, especially with a decent credit score. However, each application is assessed on multiple criteria, including income and existing debts. If you face challenges, such as a Harbor Freight credit application withdrawal, it might be beneficial to improve your credit profile before reapplying.

Credit card applications are not always instantly approved due to a variety of factors, such as the completeness of your information or the need for further verification. Sometimes, additional documentation may be required to support your application. If you experience a Harbor Freight credit application withdrawal, consider checking your credit history or contacting customer service for clarity.

To get approved for a Harbor Freight Credit Card, most applicants should aim for a credit score of at least 640. Having a good credit history and manageable debt levels can improve your chances. If your application is not approved, reviewing your credit report could help you understand the reasons behind a Harbor Freight credit application withdrawal.

Harbor Freight typically requires a credit score of around 660 or higher for their credit card application process. However, this can vary based on other factors in your financial profile. If your score is lower, you might consider alternative options. In some cases, you may experience a Harbor Freight credit application withdrawal if your score does not meet their minimum.

Cancelling a credit card application can have minor effects on your credit score. While the impact may be minimal if you do it within a short timeframe, it's still a consideration for future applications. If you're contemplating a Harbor Freight credit application withdrawal, keep this in mind as you make your decision.

The approval process for a Harbor Freight Credit Card can be easier than anticipated for many applicants. Factors like your credit score and history play a significant role in the decision. If you have concerns about approval, knowing how to navigate the Harbor Freight credit application withdrawal process can be beneficial.

If you're looking for easy approvals, consider options like store credit cards or secured cards. These types tend to have more lenient approval requirements. However, if you're facing challenges, understanding the potential impact of a Harbor Freight credit application withdrawal may help you in exploring alternative options.

Filling out the credit authorization form through Harbor Freight is a straightforward process. You'll need to provide personal information such as your name, address, and social security number. Ensure accuracy to avoid issues, especially if you decide to withdraw your Harbor Freight credit application later.

When you apply for credit through Harbor Freight, they often pull your credit report from one of the major credit bureaus. This can include Equifax, Experian, or TransUnion, depending on various factors. If you’re contemplating a Harbor Freight credit application withdrawal, be aware of how this might influence your credit report.