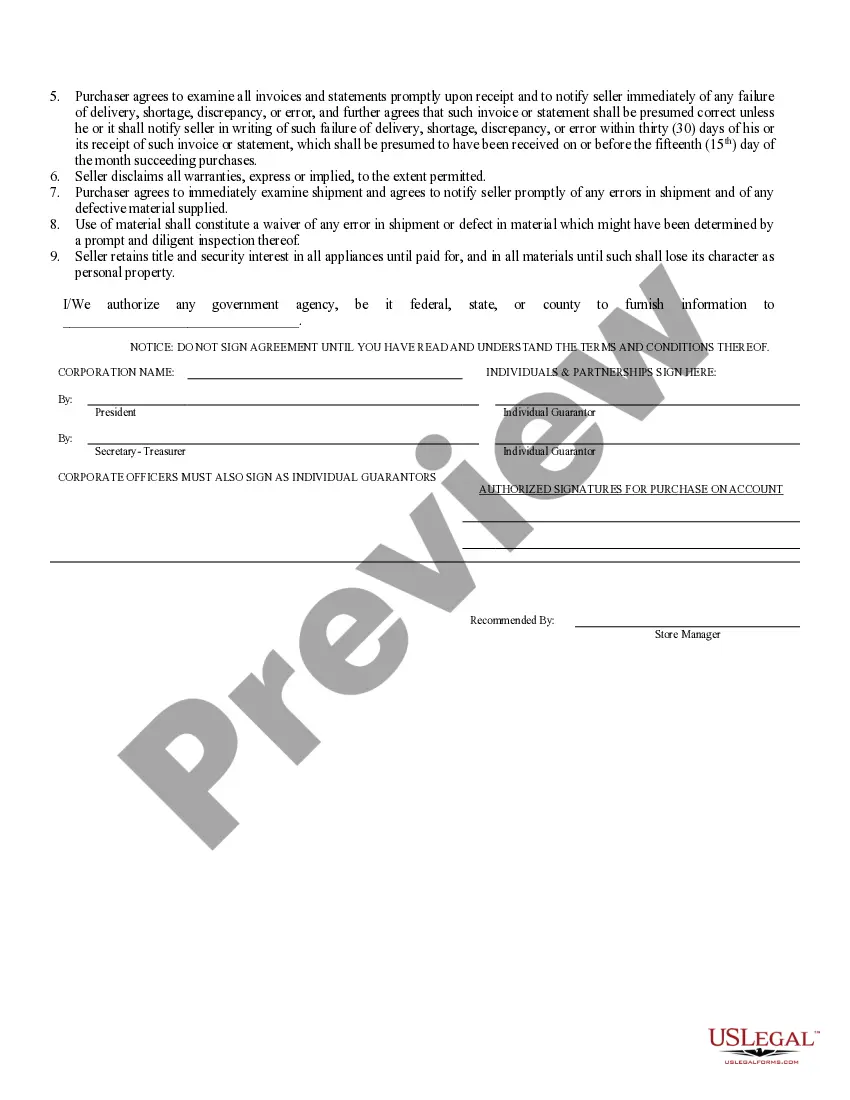

Credit Application Form For Company

Description

How to fill out North Carolina Business Credit Application?

Regardless of whether you often handle documents or only need to file a legal document from time to time, it is crucial to possess a helpful resource where all samples are pertinent and current.

The initial step to take with a Credit Application Form For Company is to verify that it is indeed the latest version, as this determines if it can be submitted.

If you wish to streamline your search for the most recent document samples, seek them on US Legal Forms.

1. Utilize the search menu to locate the form you require. 2. Review the preview and description of the Credit Application Form For Company to make sure it is the exact one you need. 3. After double-checking the form, click Buy Now. 4. Select a subscription plan that suits you. 5. Create an account or Log In to your current one. 6. Use your credit card information or PayPal account to complete the transaction. 7. Choose the file format for download and confirm your selection. 8. Eliminate any confusion when handling legal documents. All your templates will be orderly and verified with an account at US Legal Forms.

- US Legal Forms is a repository of legal forms that encompasses nearly every document template you could require.

- Look for the templates you need, immediately evaluate their relevance, and learn more about how to use them.

- With US Legal Forms, you gain access to over 85,000 document templates across a broad range of areas.

- Locate the Credit Application Form For Company samples in just a few clicks and store them in your profile anytime.

- A US Legal Forms profile will enable you to access all the necessary samples with greater ease and reduced hassle.

- You simply need to click Log In in the header of the website and visit the My documents section, where all the forms you need are at your disposal, eliminating the need to spend time searching for the best template or confirming its relevance.

- To acquire a form without an account, follow these instructions.

Form popularity

FAQ

The primary purpose of a credit application form is to assess a business's eligibility for credit. This form helps lenders evaluate risk and determine the appropriate credit limit. By utilizing a reliable credit application form for company requests, businesses can increase their chances of receiving favorable credit terms, thus facilitating better financial planning.

A commercial credit application is a specific type of credit application focused on business needs. It includes detailed information about the applicant's financial standing and business operations. Providing a meticulously completed credit application form for company endeavors can yield better financing terms and swift access to necessary credit.

A credit application form is a document that businesses complete to request credit from a lender. This form collects essential information regarding the company’s financial status, operational details, and credit history. Using a well-structured credit application form for company purposes can significantly improve the approval process and enhance lender confidence.

A commercial letter of credit is issued to facilitate trade transactions. It serves as a guarantee from a bank that payment will be made to a seller upon presentation of specific documents. This assurance enables businesses to engage in international trade with confidence. Therefore, incorporating a credit application form for company purposes streamlines the acceptance of such letters.

To fill out an application form for company purposes, make sure to include relevant details such as your business name, address, and the nature of your operations. Accurately provide financial information and any required references for better approval chances. Using a well-designed credit application form for company accounts can simplify this process and keep your information organized.

Filling out a letter of credit application form involves collecting essential information about your business, including its legal name, ownership structure, and financial details. Be clear and precise, providing accurate data to ensure your application is processed smoothly. Utilizing a credit application form for company transactions can streamline your request and enhance your chances of approval.

Yes, you can use your EIN to build business credit. This number serves as your business's unique identifier and separates your company credit from your personal credit. To effectively utilize your EIN, submit a credit application form for company accounts and ensure timely payments to vendors, which will positively impact your credit history.

A credit application from a vendor is a document your business completes to request credit terms for purchasing goods or services. This application typically collects information about your company's financial health, ownership, and trade references. Using a credit application form for company purchases helps establish a trustworthy financial relationship between you and the vendor.

To create a business credit file, start by establishing your company as a separate entity from your personal finances. Obtain a federal Employer Identification Number (EIN) and register with credit reporting agencies. Utilize a credit application form for company accounts to begin building your credit profile, as punctual payments to vendors will positively influence your score.

To create a credit application form, start by detailing the information you need, such as business structure, ownership details, and financial assets. Then, consider using a service like US Legal Forms to find ready-to-use templates that ensure your application meets legal guidelines. Customizing these templates allows you to better address your company's unique credit requirements.