Payment Rent Property With Bad Credit

Description

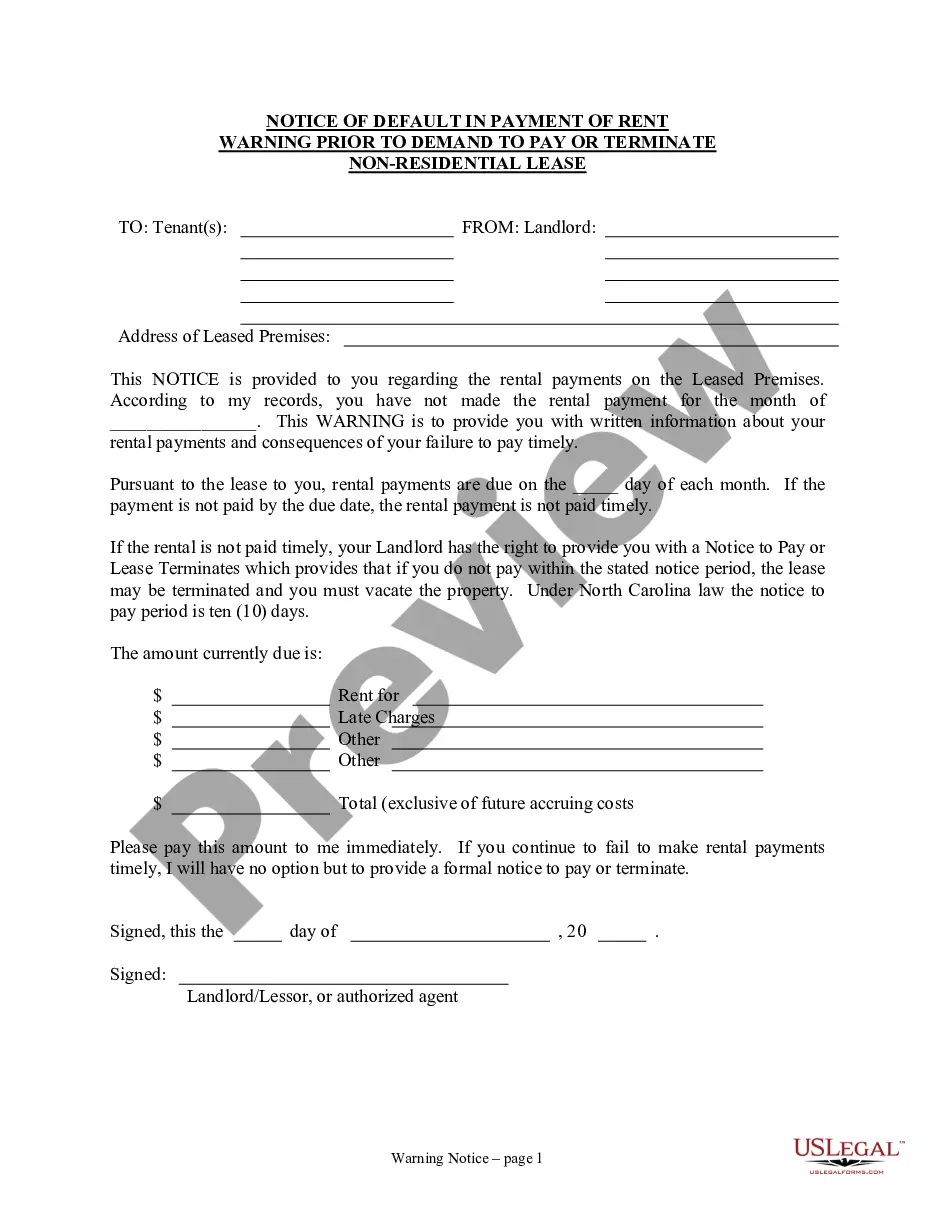

How to fill out North Carolina Notice Of Default In Payment Of Rent As Warning Prior To Demand To Pay Or Terminate For Nonresidential Or Commercial Property?

Using legal templates that comply with federal and state laws is a matter of necessity, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the correctly drafted Payment Rent Property With Bad Credit sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by lawyers for any professional and personal case. They are simple to browse with all files collected by state and purpose of use. Our experts keep up with legislative changes, so you can always be confident your form is up to date and compliant when getting a Payment Rent Property With Bad Credit from our website.

Obtaining a Payment Rent Property With Bad Credit is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the steps below:

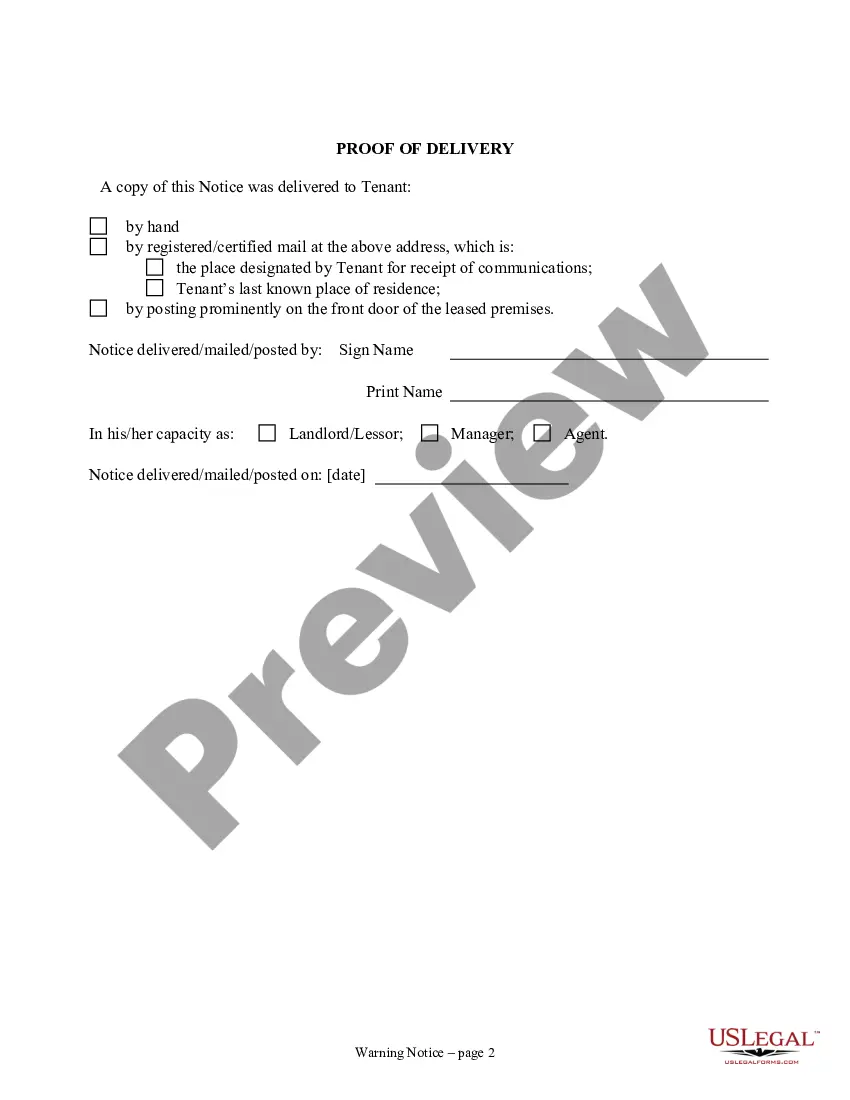

- Examine the template utilizing the Preview option or via the text outline to make certain it meets your requirements.

- Look for a different sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the right form and select a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Payment Rent Property With Bad Credit and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and fill out previously obtained forms, open the My Forms tab in your profile. Benefit from the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

5 Potential Tenant Red Flags Bad Credit. As a landlord, one of your first obligations is in finding a tenant who will be able to pay your rent rates on time every month without any prodding. ... Criminal History. ... Eviction History. ... Scattered Employment History. ... Dishonesty.

Explain Your Situation- Be extremely honest with your landlord or property manager about your credit history. Explain why your credit score may be low, whether you're dealing with medical bills, divorce, or other financial situations, and your landlord may be more lenient.

Prove your financially stable You should aim for a minimum credit score of at least 620 before you apply for a rental home. If you don't meet the credit criteria, a high income and proof of finances can show the landlord you're stable and can afford the rent.

Some renter warning signs are as obvious. Frequent evictions, a history of relevant crimes, and lack of income might stick out like an over-sized elephant wearing a red flag for a hat. However, not every potential threat is so easy to see.

Where to Get a Tenant's Credit Report. The most common ways of getting a tenant's credit report are directly through one of the three major credit reporting bureaus (Equifax, Experian, and TransUnion) or through a property management software platform like Avail.