30 Day Notice To Quit Form California

Description

How to fill out North Carolina Letter From Tenant To Landlord For 30 Day Notice To Landlord That Tenant Will Vacate Premises On Or Prior To Expiration Of Lease?

Creating legal documents from the ground up can often be daunting.

Certain situations may require countless hours of research and considerable expenses.

If you’re seeking a more straightforward and economical method of generating a 30 Day Notice To Quit Form California or any other documentation without unnecessary hurdles, US Legal Forms is always accessible to you.

Our online collection of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can effortlessly obtain state- and county-compliant forms meticulously prepared for you by our legal experts.

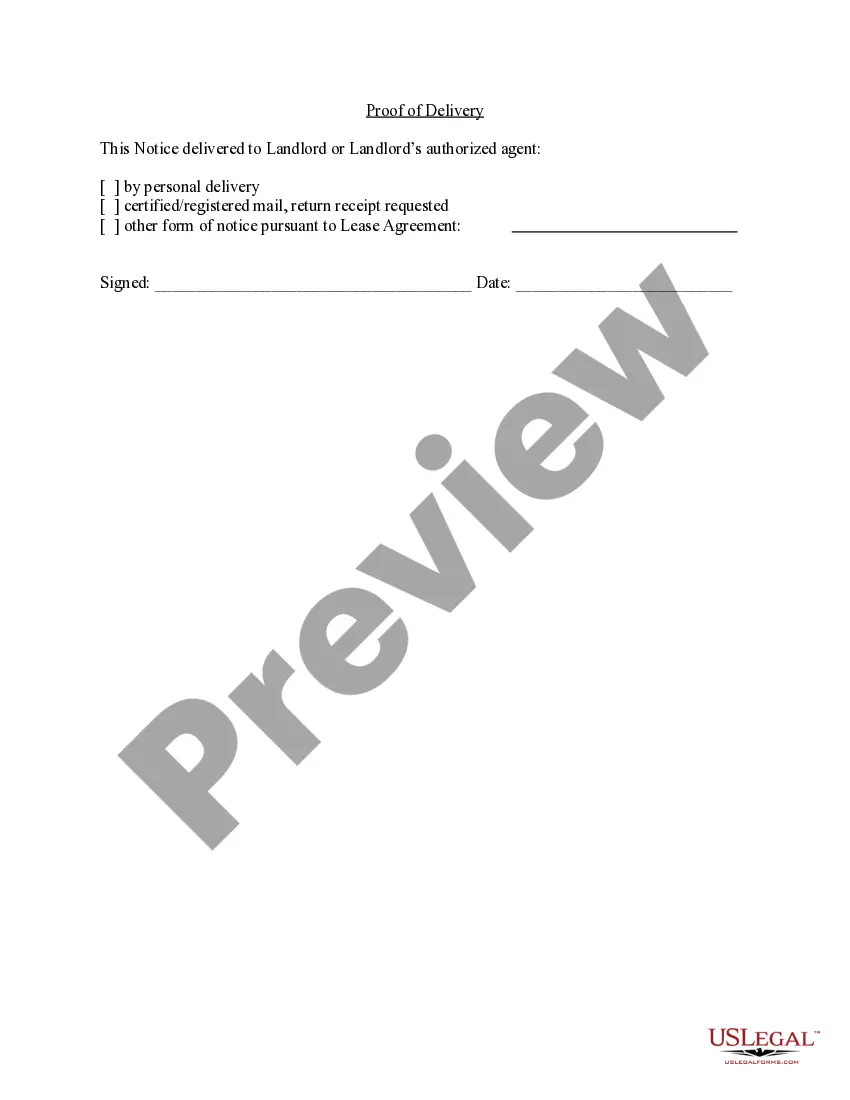

Examine the form preview and descriptions to confirm you have located the document you need.

- Utilize our platform whenever you require a dependable and trustworthy service through which you can effortlessly find and download the 30 Day Notice To Quit Form California.

- If you’re already familiar with our website and have set up an account with us previously, just Log In to your account, choose the form, and download it or access it again later in the My documents section.

- No account yet? No worries. It only takes a few minutes to register and browse through the catalog.

- However, before proceeding directly to downloading the 30 Day Notice To Quit Form California, kindly follow these guidelines.

Form popularity

FAQ

How do you write a pour-over will? Set up a living trust. Before you can make a pour-over will, you first need to create a living trust. ... Name your trustee as the beneficiary in your pour-over will. ... Name a will executor. ... Consider your other estate-planning needs.

over will transfers assets into your trust while a testamentary trust is set up by your will. Both accomplish the result of transferring assets into a trust, but a pourover will moves your assets into an already existing trust.

Signature: The will must be signed by the testator or by someone else in the testator's name in his presence, by his direction. Witnesses: A Massachusetts will must be signed by at least two witnesses, who should not also be beneficiaries in the will. Writing: A Massachusetts will must be in writing.

You Can Avoid Probate If You Have A Funded Revocable Living Trust.

Because trusts avoid probate, many believe a pour-over will also not enter probate. However, a pour-over will is still a type of will and must go through probate before your personal representative (the person who follows the instructions in your will) can add the assets to your trust.

The main downside to pour-over wills is that (like all wills), the property that passes through them must go through probate. That means that any property headed toward a living trust may get hung up in probate before it can be distributed by the trust.

Do I Need to Have My Will Notarized? No, in Massachusetts, it is not necessary to notarize your will to make it legal. Massachusetts does, however, allow you to make your will "self-proving." A self-proving will speeds up probate because the court can accept the will without contacting the witnesses who signed it.

The benefits of using a living trust are many. Pairing it with a pour-over will can help wrangle any loose assets that you purposely (or inadvertently) didn't transfer to the living trust.