North Carolina Judgement Laws

Description

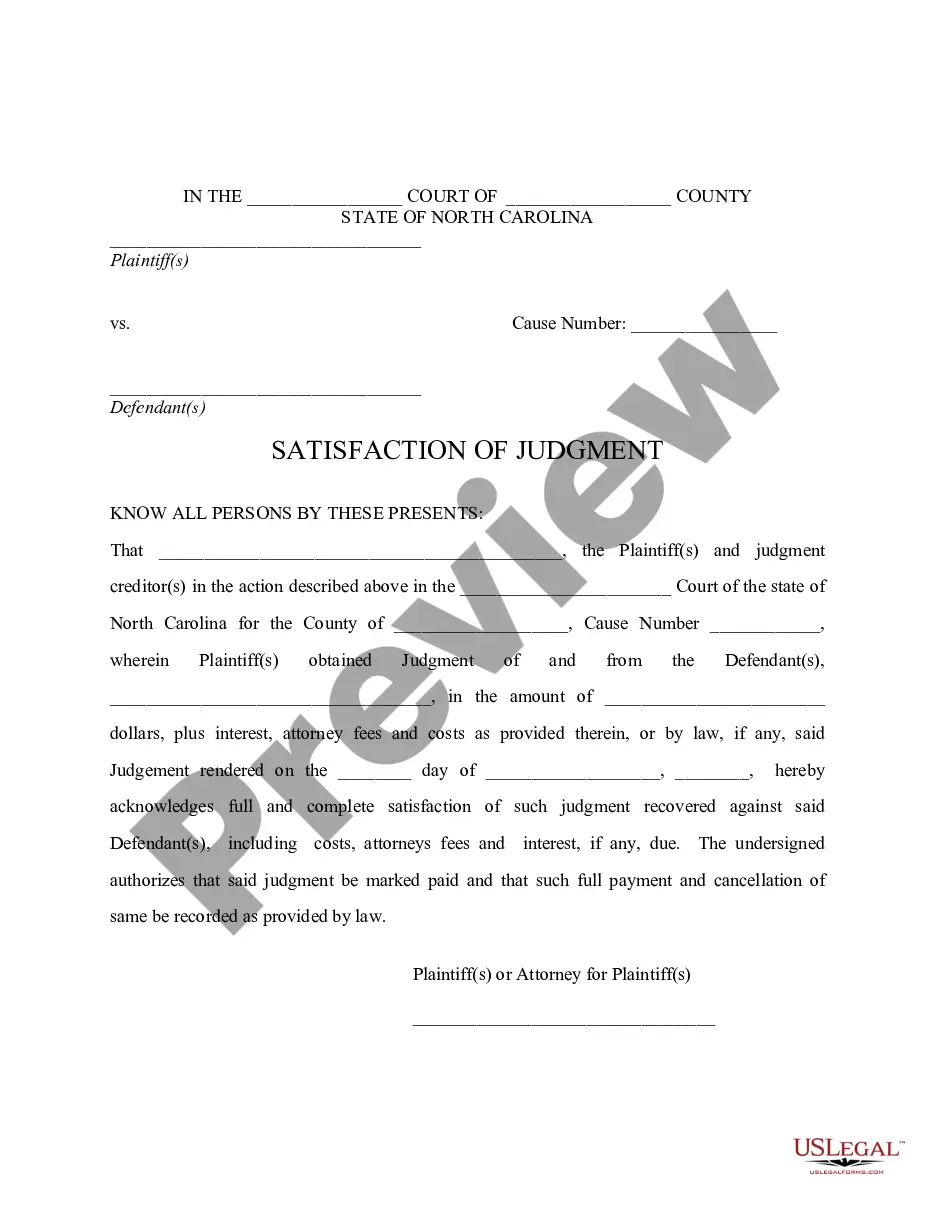

How to fill out North Carolina Satisfaction Of Judgment?

Managing legal paperwork can be overwhelming, even for the most seasoned experts.

If you're interested in North Carolina Judgment Laws but lack the time to search for the appropriate and updated version, the tasks may be challenging.

US Legal Forms caters to all your requirements, from personal to business paperwork, all in one location.

Utilize advanced tools to complete and oversee your North Carolina Judgment Laws.

Here are the steps to follow after accessing the form you need.

- Access a valuable repository of articles, tutorials, and guides pertinent to your situation and needs.

- Save time and effort searching for the documents you require and make use of US Legal Forms' advanced search and Preview tool to obtain North Carolina Judgment Laws.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and acquire it.

- Visit the My documents tab to review the documents you previously saved and manage your folders according to your preferences.

- If this is your first experience with US Legal Forms, create an account for unrestricted access to the entire library.

- A comprehensive online form library could transform the way individuals handle these matters efficiently.

- US Legal Forms is a pioneer in online legal documentation, offering more than 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

A judgment lien is created automatically on any property owned by the debtor in the North Carolina county where the judgment is entered. For any debtor property found outside the county, the creditor must file the judgment with the county clerk for the county where the property is located.

In order to get to judgment execution, the initial ingredient in the post-judgment collections formula, the judgment creditor must first (1) wait for the time to file a notice of appeal has expired, which is thirty (30) days from entry of judgment (tip: be sure to serve all parties with copies of the entered judgment ...

If a judgment debtor does not voluntarily pay the judgment, the judgment creditor can try to collect the money from the judgment debtor involuntarily. This is called ?executing? the judgment. A judgment creditor can execute upon a judgment debtor's wages, real property, bank account, or cash box.

In North Carolina a judgment accrues 8% interest from the time it is entered. Judgment can be enforced by execution/through Court process. A creditor with a judgment can attempt to use some of your property to pay the judgment. However, the creditor MUST use the Court system before getting access to your property.

Many people reach an agreement about the terms of payment after the court decides how much money one party must pay the other. If there is no agreement, the winning party can begin the collections process. The clerk of superior court will record the judgment, and interest will begin to accrue if it is not paid.