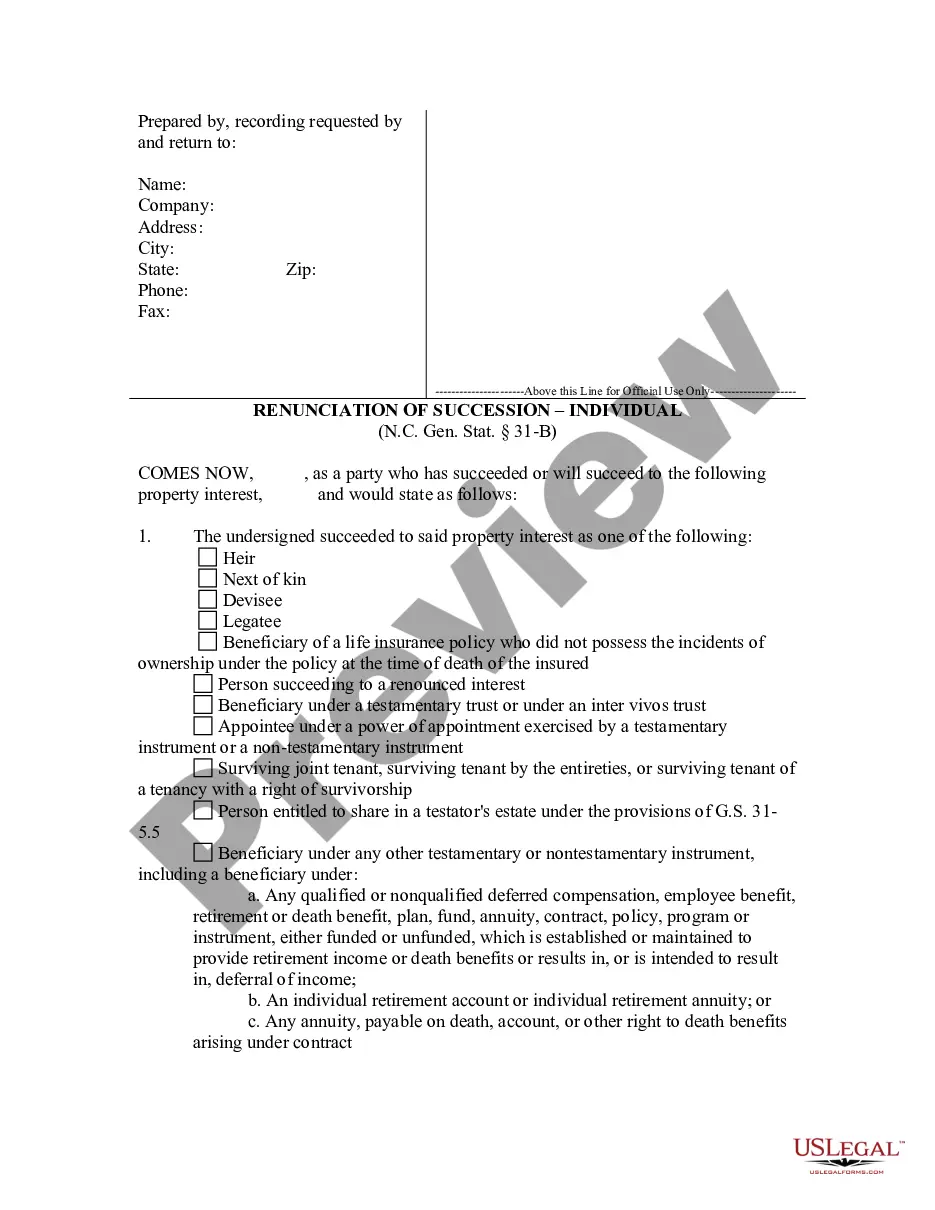

Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Disclaimer of Property

Interest-North Carolina

North Carolina General Statutes

Chapter 31B Renunciation of Property and Renunciation of Fiduciary

Powers Act.

Right to renounce succession.

(a) A person who succeeds to a property interest as:

(5) Beneficiary of a life insurance policy who did not possess

the incidents of ownership under the policy at the time of death of the

insured, or

(6) Person succeeding to a renounced interest, or

(7) Beneficiary under a testamentary trust or under an inter vivos

trust, or

(8) Appointee under a power of appointment exercised by a testamentary

instrument or a nontestamentary instrument, or

(9) Repealed by Session Laws 1989, c. 684, s. 2.

(9a) Surviving joint tenant, surviving tenant by the entireties,

or surviving tenant of a tenancy with a right of survivorship, or

(9b) Person entitled to share in a testator's estate under the

provisions of G.S. 31-5.5, or

(9c) Beneficiary under any other testamentary or nontestamentary

instrument, including a beneficiary under:

a. Any qualified or nonqualified deferred compensation,

employee benefit, retirement or death benefit, plan, fund, annuity, contract,

policy, program or instrument, either funded or unfunded, which is established

or maintained to provide retirement income or death benefits or results

in, or is intended to result in, deferral of income;

c. Any annuity, payable on death, account, or other right to death

benefits arising under contract; or

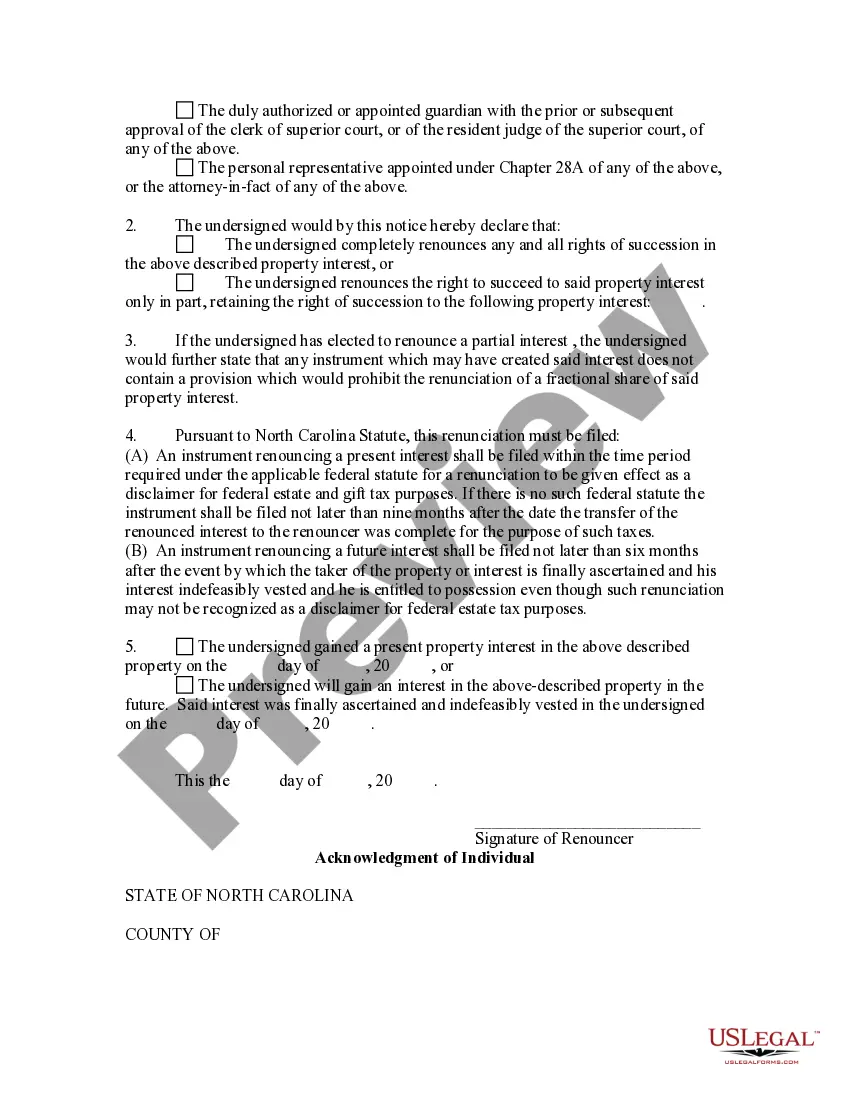

(9d) The duly authorized or appointed guardian with the prior or subsequent

approval of the clerk of superior court, or of the resident judge of the

superior court, of any of the above.

(10) The personal representative appointed under Chapter 28A of

any of the above, or the attorney-in-fact of any of the above may renounce

in whole or in part the right of succession to any property or interest

therein, including a future interest, by filing a written instrument under

the provisions of this Chapter. A renunciation may be of a fractional share

or any limited interest or estate. Provided, however, there shall be no

right of partial renunciation if the decedent or donee of the power expressly

so provided in the instrument creating the interest.

(b) This Chapter shall apply to all renunciations of present and future

interests, whether qualified or nonqualified for federal and State inheritance,

estate, and gift tax purposes, unless expressly provided otherwise in the

instrument creating the interest.

(c) The instrument shall (i) describe the property or interest renounced,

(ii) declare the renunciation and extent thereof, (iii) be signed and acknowledged

by the person authorized to renounce.

Chap. 31B, § 31B-1.

(1975, c. 371, s. 1; 1983, c. 66, s. 1; 1989, c. 684, s. 2; 1998-148,

s. 1.)

Right to renounce fiduciary powers.

(a) Except as otherwise provided in the testamentary or

nontestamentary instrument, a fiduciary under a testamentary or nontestamentary

instrument may renounce, in whole or in part, fiduciary rights, privileges,

powers, and immunities by executing and by delivering, filing, or recording

a written renunciation pursuant to the provisions of G.S. 31B-2.

A fiduciary may not renounce the rights of beneficiaries unless the instrument

creating the fiduciary relationship authorizes such a renunciation.

(b) The instrument of renunciation shall (i) describe any fiduciary

right, power, privilege, or immunity renounced, (ii) declare the renunciation

and the extent thereof, and (iii) be signed and acknowledged by the fiduciary

authorized to renounce.

Chap. 31B, §31B-1A.

(1989, c. 684, s. 3.)

Time and place of filing renunciation.

(a) To be a qualified disclaimer for federal and State inheritance,

estate, and gift tax purposes, an instrument renouncing a present interest

shall be filed within the time period required under the applicable federal

statute for a renunciation to be given effect as a disclaimer for federal

estate and gift tax purposes. If there is no such federal statute the instrument

shall be filed not later than nine months after the date the transfer of

the renounced interest to the renouncer was complete for the purpose of

such taxes.

(b) An instrument renouncing a future interest shall be filed not

later than six months after the event by which the taker of the property

or interest is finally ascertained and his interest indefeasibly vested

and he is entitled to possession even though such renunciation may not

be recognized as a disclaimer for federal estate tax purposes.

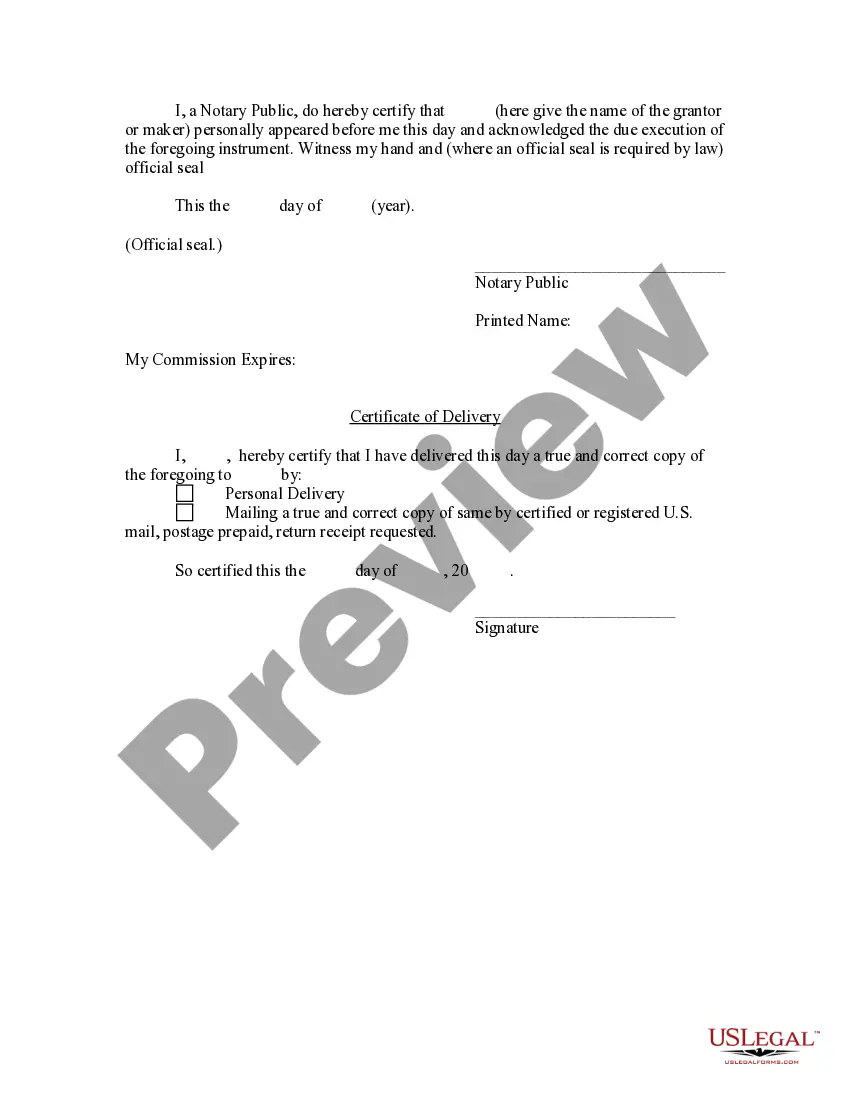

(c) The renunciation shall be filed with the clerk of court of the

county in which proceedings have been commenced for the administration

of the estate of the deceased owner or deceased donee of the power or,

if they have not been commenced, in which they could be commenced. A copy

of the renunciation shall be delivered in person or mailed by registered

or certified mail to any personal representative, or other fiduciary of

the decedent or donee of the power. If the property interest renounced

includes any proceeds of a life insurance policy being renounced pursuant

to G.S. 31B-1(a)(5) the person renouncing shall mail, by registered or

certified mail, a copy of the renunciation to the insurance company issuing

the policy. If the property or property interest renounced is created by

nontestamentary instrument, a copy of the renunciation shall be delivered

in person, or mailed by registered or certified mail, to the trustee or

other person who has legal title to, or possession of, the property or

property interest renounced.

(d) If real property or an interest therein is renounced, a copy

of the renunciation shall also be filed for recording in the office of

the register of deeds of all counties wherein any part of the interest

renounced is situated. The renunciation shall be indexed in the grantor's

index under (i) the name of the deceased owner or donee of the power, and

(ii) the name of the person renouncing. The renunciation of an interest,

or a part thereof, in real property shall not be effective to renounce

such interest until a copy of the renunciation is filed for recording in

the office of the register of deeds in the county wherein such interest

or part thereof is situated. A spouse of a person renouncing real property

or an interest in real property shall have no statutory dower, inchoate

marital rights, or any other interest in the real property or real property

interest renounced.

Chap. 31B, §31B-2.

(1975, c. 371, s. 1; 1979, c. 525, s. 7; 1983, c. 66, s. 2; 1989,

c. 684, s. 4; 1991, c. 744, s. 1; 1998-148, s. 2.)

Effect of renunciation.

(a) Unless the decedent, donee of a power of appointment,

or creator of an interest under an inter vivos instrument has otherwise

provided in the instrument creating the interest, the property or interest

renounced devolves as follows:

(1) If the renunciation is filed within the time period

described in G.S. 31B-2(a), the property or interest renounced devolves

as if the renouncer had predeceased the date the transfer of the renounced

interest to the renouncer was complete for federal and State inheritance,

estate, and gift tax purposes, or, in the case of the renunciation of a

fiduciary right, power, privilege, or immunity, the property or interest

subject to the power devolves as if the fiduciary right, power, privilege,

or immunity never existed. Any such renunciation relates back for all purposes

to the date the transfer of the renounced interest to the renouncer was

complete for the purpose of those taxes.

(2) If the renunciation is not filed within the time period described

in G.S. 31B-2(a), the property or interest devolves as if the renouncer

had died on the date the renunciation is filed, or, in the case of the

renunciation of a fiduciary right, power, privilege, or immunity, the property

or interest subject to the power devolves as if the fiduciary right, power,

privilege, or immunity ceased to exist as of the date the renunciation

is filed.

(3) Any future interest that takes effect in possession or enjoyment

after the termination of the estate or interest renounced takes effect

as if the renouncer had died on the date determined under subdivision (1)

or (2) of this subsection, and upon the filing of the renunciation the

persons in being as of the time the renouncer is deemed to have died will

immediately become entitled to possession or enjoyment of any such future

interest.

(b) In the event that the property or interest renounced was created

by testamentary disposition, the devolution of the property or interest

renounced shall be governed by G.S. 31-42(a) notwithstanding that in fact

the renouncer has not actually died before the testator.

(c) In the event that the decedent dies intestate, or the ownership

or succession to property or to an interest is to be determined as though

a decedent had died intestate, and the renouncer has living issue who would

have been entitled to an interest in the property or interest if the renouncer

had predeceased the decedent, then the property or interest renounced shall

be distributed to such issue, per stirpes. If the renouncer does not have

such issue, then the property or interest shall be distributed as though

the renouncer had predeceased the decedent.

Chap. 31B, §31B-3.

(1975, c. 371, s. 1; 1979, c. 525, s. 6; 1989, c. 684, s. 5; 1993,

c. 308, ss. 1, 2; 1998-148, s. 3.)

Waiver and bar.

(a) The right to renounce property or an interest therein

is barred by:

(1) An assignment, conveyance, encumbrance, pledge, or

transfer of the property or interest, or a contract therefor by the person

authorized to renounce,

(2) A written waiver of the right to renounce, or

(3) Repealed by Session Laws 1998-148, s. 4.

(4) A sale of the property or interest under judicial sale made

before the renunciation is effected.

(b) The renunciation or the written waiver of the right to renounce

is binding upon the renouncer or person waiving and all persons claiming

through or under him.

(c) A fiduciary's application for appointment or assumption of duties

as fiduciary does not waive or bar the fiduciary's right to renounce a

right, power, privilege, or immunity.

(d) No person shall be liable for distributing or disposing of property

in reliance upon the terms of a renunciation that is invalid for the reason

that the right of renunciation has been waived or barred, if the distribution

or disposition is otherwise proper, and the person has no actual knowledge

of the facts that constitute a waiver or bar to the right of renunciation.

(e) The right to renounce property or an interest in property pursuant

to this Chapter is not barred by an acceptance of the property, interest,

or benefit thereunder; provided, however, an acceptance of the property,

interest, or benefit thereunder may preclude such renunciation from being

a qualified renunciation for federal and State inheritance, estate, and

gift tax purposes.

Chap. 31B, §31B-4.

(1975, c. 371, s. 1; 1989, c. 684, s. 6; 1998-148, ss. 4, 5; 2000-140,

s. 8.)

Exclusiveness of remedy.

This Chapter does not exclude or abridge any

other rights or procedures existing under any other statute or otherwise

provided by law to waive, release, refuse to accept, disclaim or renounce

property or an interest therein, or any fiduciary right, power, privilege,

or immunity.

Chap. 31B, §31B-5.

(1975, c. 371, s. 1; 1989, c. 684, s. 7.)

Application of Chapter.

A present interest in property existing on October

1, 1975, as to which the time for filing a renunciation under this Chapter

has not expired may be renounced within six months after October 1, 1975.

A future interest in property existing on October 1, 1975, as to which

the time for filing a renunciation under this Chapter has not expired

may be renounced within six months after October 1, 1975, or within six

months after the future interest has become indefeasibly vested and the

taker is entitled to possession, whichever is later.

Chap. 31B, §31B-6.

(1975, c. 371, s. 1.)

Short title.

This Chapter may be cited as the Renunciation

of Property and Renunciation of Fiduciary Powers Act.

Chap. 31B, §31B-7.

(1975, c. 371, s. 1; 1989 (Reg. Sess., 1990), c. 1024, s. 11.)