Subcontractors more than three tiers removed from the contractor are required to use this form to claim a lien in North Carolina.

North Carolina Corporation Company Withholding

Description

How to fill out North Carolina Corporation Company Withholding?

When you are required to complete North Carolina Corporation Company Withholding in accordance with your local state's statutes, there can be numerous options to select from.

There's no need to inspect every document to confirm it satisfies all the legal specifications if you are a US Legal Forms member.

It is a dependable service that can assist you in obtaining a reusable and current template on any subject.

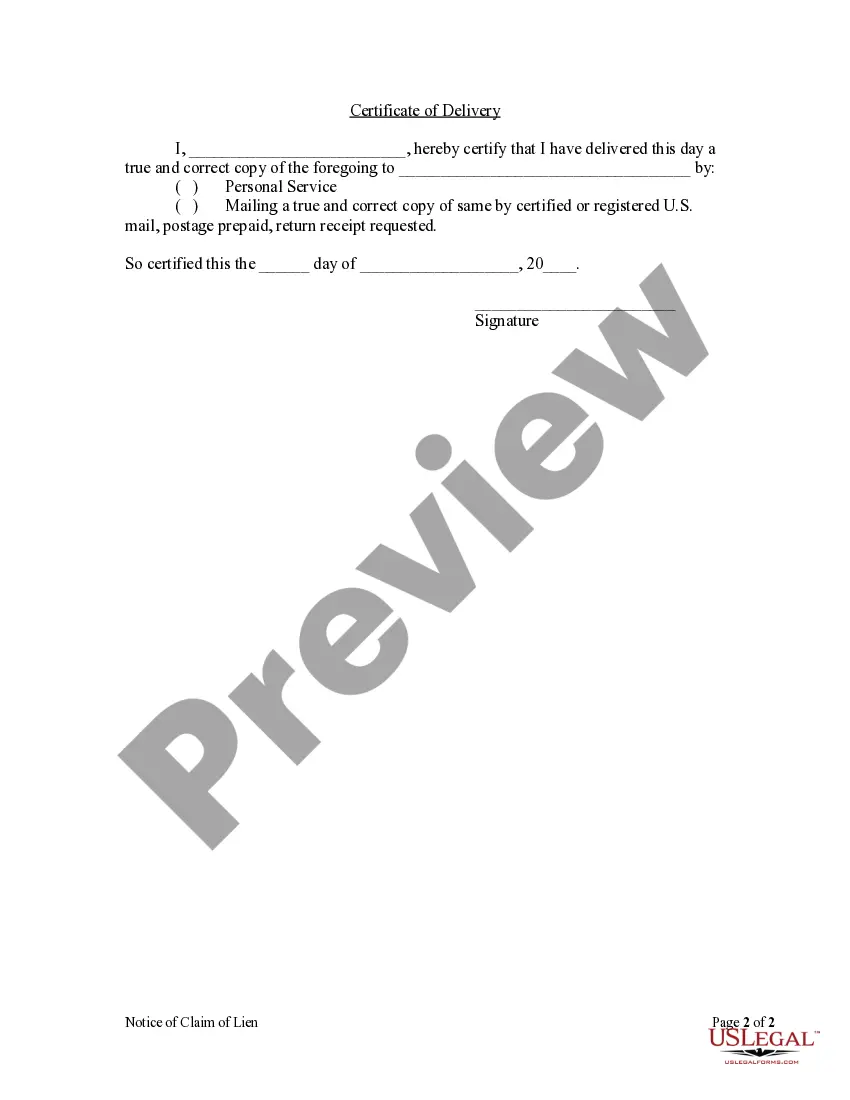

Utilize the Preview mode and peruse the form description if available.

- US Legal Forms is the largest online repository with a compilation of over 85,000 ready-to-use documents for business and personal legal matters.

- All templates are authenticated to comply with each state's regulations.

- Consequently, when downloading North Carolina Corporation Company Withholding from our site, you can be confident that you possess a legitimate and up-to-date document.

- Acquiring the necessary sample from our platform is remarkably simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the selected file.

- Later, you can access the My documents tab in your profile and retrieve the North Carolina Corporation Company Withholding at any time.

- If it's your first time using our site, please follow the instructions below.

- Review the recommended page and verify it for alignment with your requirements.

Form popularity

FAQ

Yes, North Carolina offers an AW-4 form. This form allows employees to specify their withholding allowances. It plays a critical role in managing your North Carolina corporation company withholding, ensuring that the correct amount is withheld from your paycheck.

Yes, you can electronically file an amended return for North Carolina. This option is beneficial since it speeds up the process of correcting any discrepancies related to your North Carolina corporation company withholding. Utilizing an online platform for amendments enhances accuracy and ensures compliance with state regulations.

Yes, North Carolina allows taxpayers to file their state taxes electronically. This method simplifies the process and helps avoid common mistakes associated with paper filing. By filing your state taxes electronically, you can efficiently manage your North Carolina corporation company withholding.

No, the NC-3 does not have to be filed electronically, but electronic filing is encouraged. Filing electronically often results in fewer errors and a quicker processing time for your North Carolina corporation company withholding. Consider using an online solution to ensure you meet all requirements efficiently.

Absolutely, you can file the NC-BR form online. This online filing option is designed for business registration, which includes various components related to North Carolina corporation company withholding. By utilizing this platform, you save time and can easily navigate through the filing process.

Yes, you can file for an LLC online in North Carolina. The process is simple and can be completed through the North Carolina Secretary of State's website. This online option streamlines the creation of your North Carolina corporation company withholding, making it efficient and quick.

Filling out a withholding form requires you to provide personal information, such as your name, social security number, and the number of allowances you are claiming. Follow the instructions provided on the form closely to ensure you complete it correctly. Uslegalforms can assist with templates and guidance for accurate completion, making it easier for you to manage your North Carolina corporation company withholding.

Filing NC withholding tax involves completing the appropriate forms and submitting them to the North Carolina Department of Revenue. Ensure that you have accurate records of your withholdings throughout the year. For assistance, uslegalforms offers resources and tools to simplify the filing process and ensure compliance with North Carolina corporation company withholding regulations.

To choose your withholdings effectively, start by evaluating your income, deductions, and credits. Utilize the IRS withholding calculator or worksheets to guide you in determining the right number of allowances for your North Carolina corporation company withholding. Regularly reviewing your earnings and adjusting withholdings as necessary can help you avoid tax surprises.

Your withholding allowance should reflect your personal circumstances, such as marital status and number of dependents. If you're unsure, you can use the IRS Form W-4 to make informed decisions about your allowances. Reviewing your financial situation regularly will help you adjust and optimize your North Carolina corporation company withholding.