Limited Liabiluty

Description

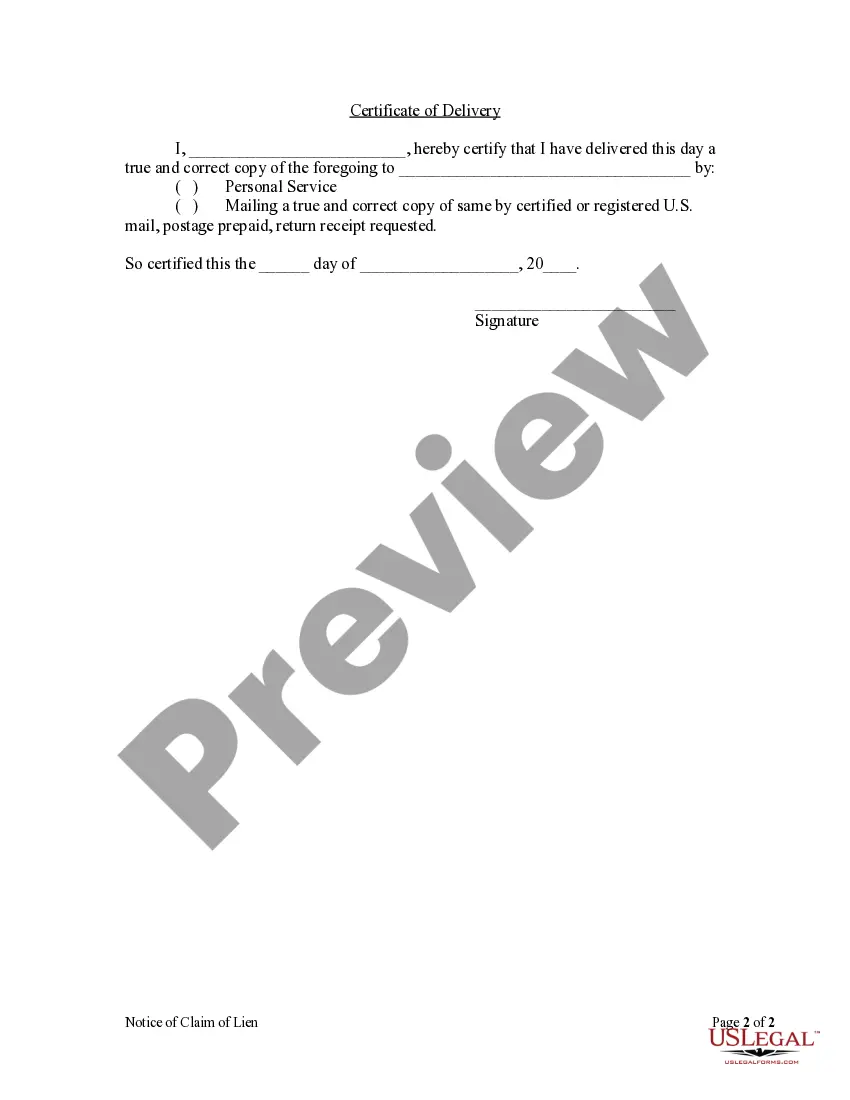

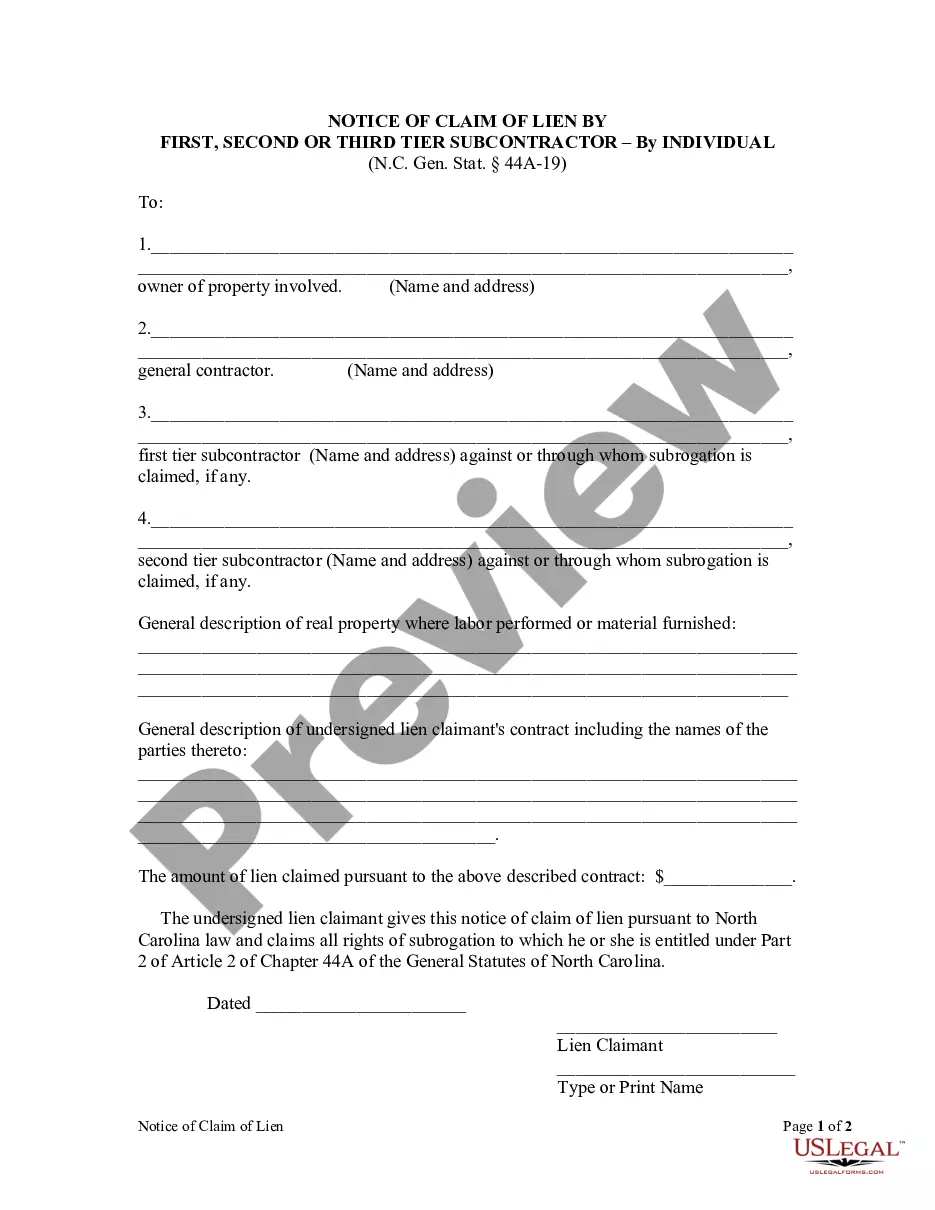

How to fill out North Carolina Notice Of Claim - More Remote Than 3rd Tier - Corporation?

- Login to your existing account on US Legal Forms. Make sure your subscription remains active to access available documents.

- If you're a first-time user, start by browsing the extensive library. Use the Preview mode and form descriptions to choose the right document that fits your specific jurisdiction and needs.

- If the form you need isn't suitable, utilize the Search feature to find alternative templates that meet your criteria.

- Select your desired document by clicking the 'Buy Now' button, and opt for a subscription plan that aligns with your requirements.

- Complete the payment process by entering your credit card information or using PayPal for a secure transaction.

- Once the purchase is confirmed, download your form directly to your device, and find it later in the 'My Forms' section of your account.

By following these steps, you can conveniently access the necessary legal documents to establish limited liability. US Legal Forms not only provides a robust collection of over 85,000 legal forms but also connects you with expert assistance when needed.

Start leveraging the benefits of US Legal Forms today to create legally sound documents with ease!

Form popularity

FAQ

An example of a limited liability company is a small family-run bakery that operates under an LLC structure, protecting the owner's personal assets from business debts. This limited liabiluty allows the owners to invest in their business with reduced personal risk. Many types of businesses, from online retailers to service professionals, can benefit from this structure, demonstrating its versatility for entrepreneurs. Utilizing platforms like US Legal Forms makes establishing your LLC easier and more efficient.

In most cases, the owner of an LLC can’t be sued personally due to the protections offered by limited liabiluty. However, exceptions exist, such as if an owner personally guarantees loans or engages in illegal activities. It's crucial to follow the proper procedures to maintain the limited liability status, as failing to do so could expose personal assets. Consulting a legal expert can help clarify your specific circumstances.

To write a limited liability company, begin with the Articles of Organization, which must include the LLC's name, purpose, duration, and registered agent. Next, draft an Operating Agreement that specifies the management structure and the responsibilities of its members. You can find valuable resources and templates through US Legal Forms to assist you in crafting a compliant limited liabiluty document.

Limited liabilities of an LLC protect owners from personal responsibility for business debts and liabilities. This means that if the LLC incurs debt or is sued, your personal assets are generally shielded. This feature of limited liabiluty allows entrepreneurs to take reasonable risks without exposing their personal wealth. It’s essential to create and maintain the proper legal structure to enjoy these protections.

The biggest disadvantage of an LLC often involves higher initial costs and ongoing fees compared to sole proprietorships or partnerships. Additionally, some states impose a franchise tax on LLCs, which can increase operating expenses. Understanding these limitations is crucial, especially when setting up your limited liabiluty. Consulting legal resources can clarify these points and help you make informed decisions.

To fill for an LLC, start by choosing a unique name that complies with your state’s rules. Next, prepare and file Articles of Organization with the Secretary of State. You should also create an Operating Agreement, which outlines the LLC’s structure and operation. US Legal Forms can provide templates and guidance for each step to ensure your limited liabiluty formation process is smooth.

Limited liability for all owners means that every member or shareholder in the business enjoys protection from personal asset loss due to business liabilities. Each owner’s exposure is restricted to the extent of their investment in the business structure. This principle is fundamental to encouraging collaboration and investment in businesses, providing peace of mind for all involved.

Limited liability means that business owners are offered protection from being personally liable for the debts and legal obligations of their business. This core concept enables individuals to manage and run businesses without the fear of losing personal property due to business misfortunes. Limited liability fosters a secure environment for business operations and investment.

Limited liability refers to the legal protection that ensures owners are not personally responsible for business debts beyond what they invested. In contrast, unlimited liability means that owners are fully responsible for all debts, risking their personal assets. Understanding the difference is crucial for choosing the right business structure that will safeguard your finances.

Limited liability for owners means that their financial responsibility is limited to the amount they have invested in the business. This protects personal assets, such as homes or savings accounts, from business debts. Owners can confidently operate their businesses knowing that their financial risk is minimized through the structure of limited liability.