Limited Companies

Description

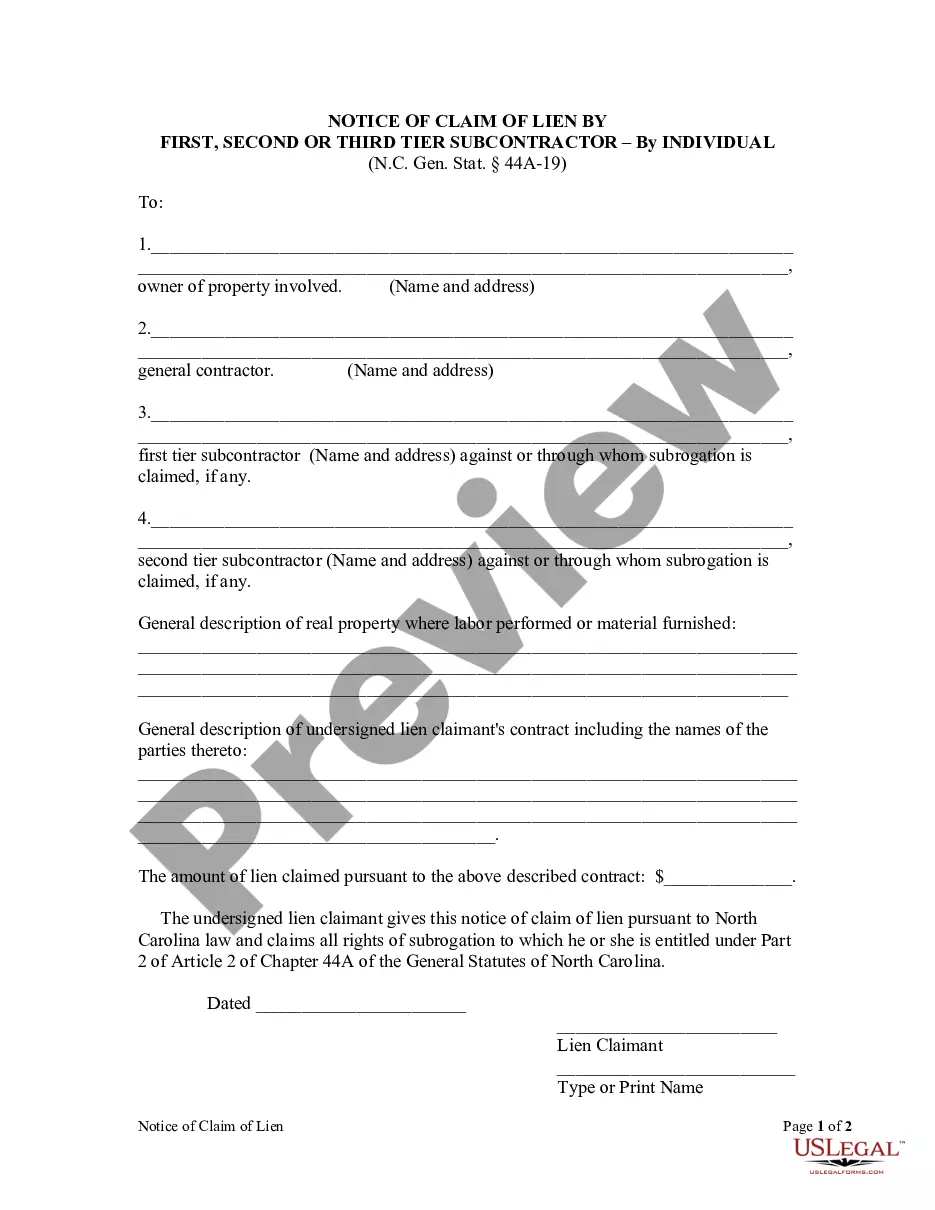

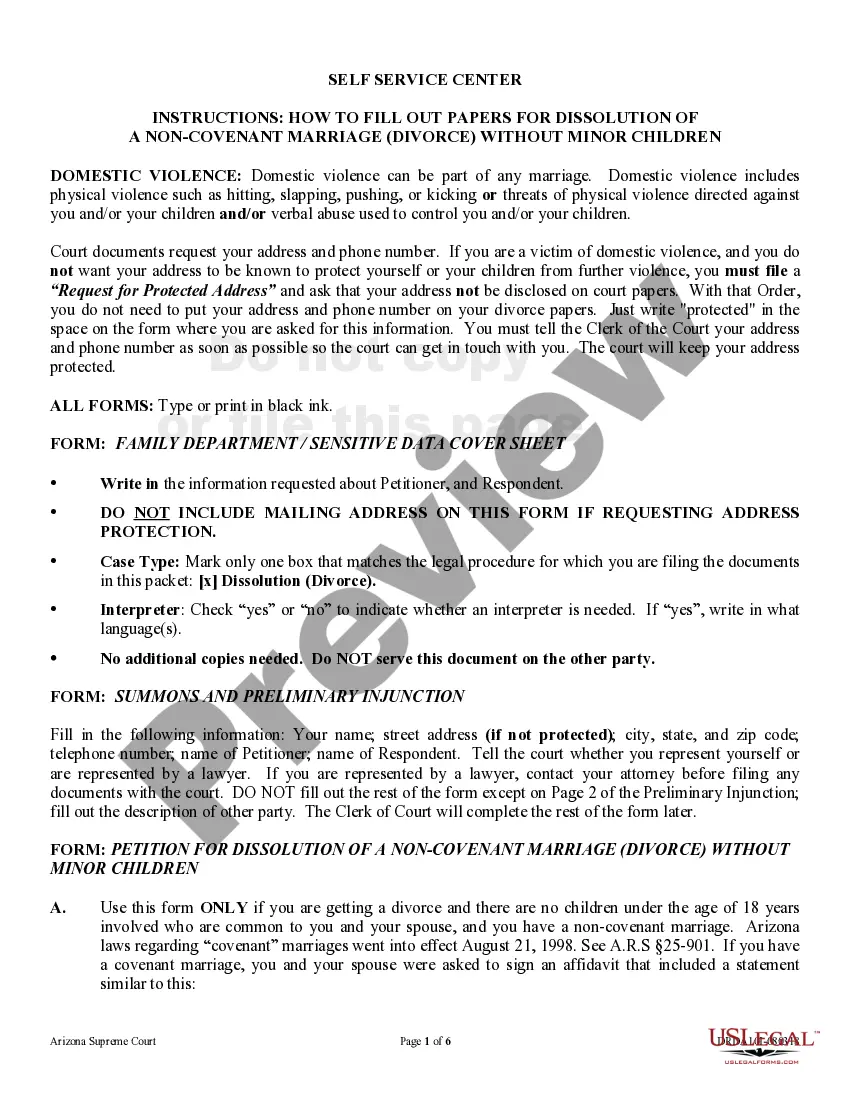

How to fill out North Carolina Notice Of Claim - More Remote Than 3rd Tier - Corporation?

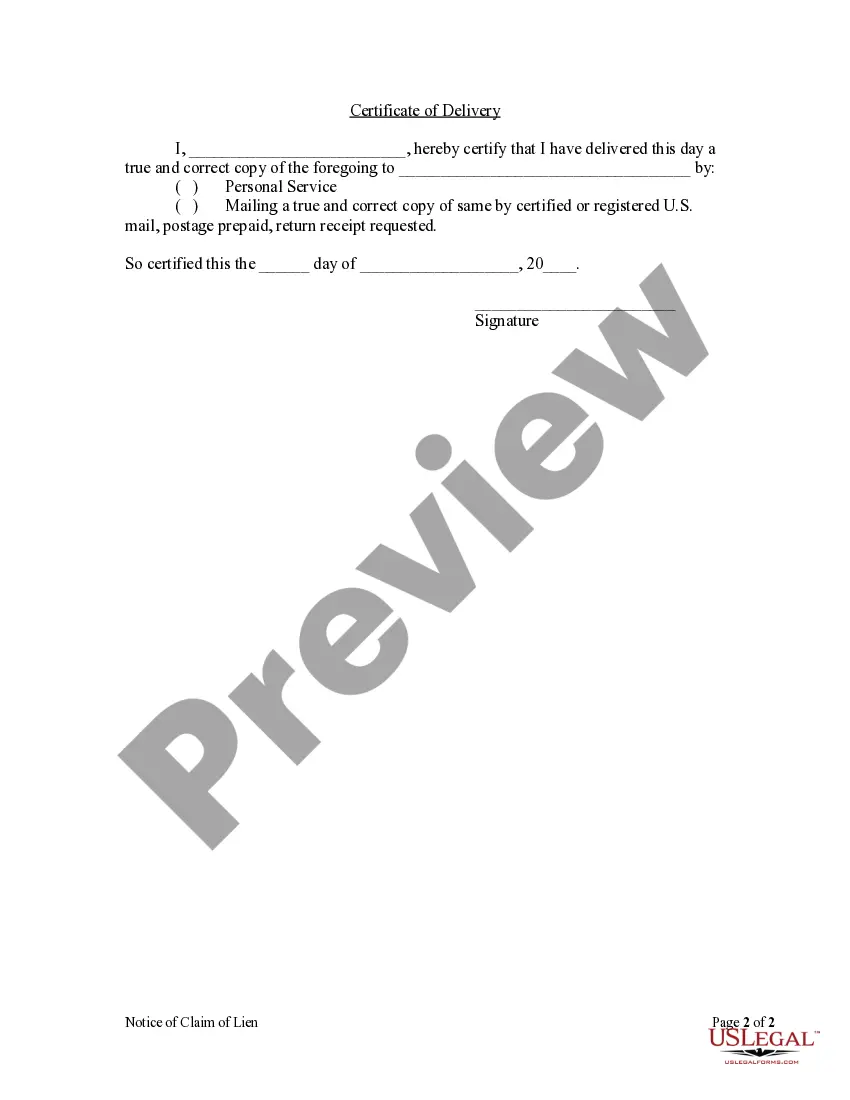

- If you're a returning user, log in to your account and select the required form template. Ensure your subscription is active. Renew your plan if necessary.

- For first-time users, start by checking the Preview mode. Browse through the form descriptions to confirm that you have selected a template that meets your legal needs.

- Utilize the Search tab at the top to find additional templates if needed. If you identify any discrepancies, ensure that you find the right form for your jurisdiction.

- Purchase the needed document by clicking the Buy Now button. Select a subscription plan that suits you, then create an account to unlock the full resource library.

- Process your payment by entering your credit card information or using your PayPal account to secure the subscription.

- Download your selected form to your device and access it later from the My Forms section in your profile.

In conclusion, US Legal Forms offers an expansive collection of over 85,000 editable legal forms, making it an invaluable resource for limited companies. With expert help available, you can ensure your documents are both precise and legally compliant.

Start your journey today and explore the comprehensive resources provided by US Legal Forms.

Form popularity

FAQ

The primary difference between a limited company and an LLC lies in how they are structured and taxed. An LLC offers flexibility in management and is often favored by smaller businesses due to its simpler tax treatment. In contrast, a limited company can take many forms and includes specific regulations that might be imposing for some. Understanding these differences can assist you in selecting the right model that aligns best with your business goals.

If a business is a limited company, it signifies that owners' financial risk is confined to their investment in the company. This means that personal assets are safeguarded against business liabilities, fostering security and peace of mind. Limited companies must comply with specific legal obligations, enhancing credibility in the marketplace. This structure can also facilitate investment and growth opportunities as potential investors view limited companies more favorably.

An LLC, or Limited Liability Company, is a specific type of limited company that offers unique benefits, such as pass-through taxation. In contrast, a limited company can refer to various company structures, including private and public limited companies. While both provide liability protection, understanding their differences is essential for your business strategy. Choosing the right structure affects taxation, management, and operations.

Being a limited company means that the business is a separate legal entity from its owners. This separation protects personal assets from business debts, providing a layer of security. Limited companies must adhere to specific regulations and reporting requirements, ensuring accountability. As a result, they often project a more professional image to clients and collaborators.

Yes, Apple Inc. is a limited company. As a public limited company, it trades its shares on the stock market, allowing the public to invest in it. The limited company structure provides Apple with the ability to raise substantial capital while offering its shareholders limited liability. For those interested in similar business structures, uslegalforms can assist you in setting up a limited company effectively.

An example of a limited company is Microsoft Corporation. As a well-known limited company, Microsoft has shareholders whose financial responsibility is limited to their investment in the company. This structure allows the company's operations to expand while protecting individual shareholders' personal assets. Understanding how limited companies operate can guide your decision-making on business structures.

A limited company is a type of business structure that combines the benefits of a corporation with those of a partnership. It allows for shared ownership, meaning multiple individuals can invest in and run the business. This structure provides the added security of limited liability for its owners. If you're looking to establish a business with these benefits, consider forming a limited company through reliable services like uslegalforms.

Limited companies include various types such as private limited companies (Ltd) and public limited companies (PLC). They are structured to limit the personal liability of their owners, which is one of the main reasons for their popularity. These companies are registered with specific legal protections and obligations under federal and state laws. If you’re considering forming a limited company, platforms like uslegalforms can make the process simpler.

life example of a limited liability company is Tesla, Inc. This company operates as a limited company, which means its owners enjoy liability protection. In the event of financial difficulties, the personal assets of the owners are typically shielded from creditors. Therefore, limited liability companies are popular for entrepreneurs looking to minimize risks while conducting business.

Whether forming a limited company is a good idea often depends on your business goals and structure. Many entrepreneurs favor limited companies because they provide liability protection and creditworthiness. However, it's essential to weigh the benefits against potential regulatory burdens and seek advice on platforms like UsLegalForms to ensure the decision aligns with your business needs.