Lender Owner Commenced For 5 Years

Description

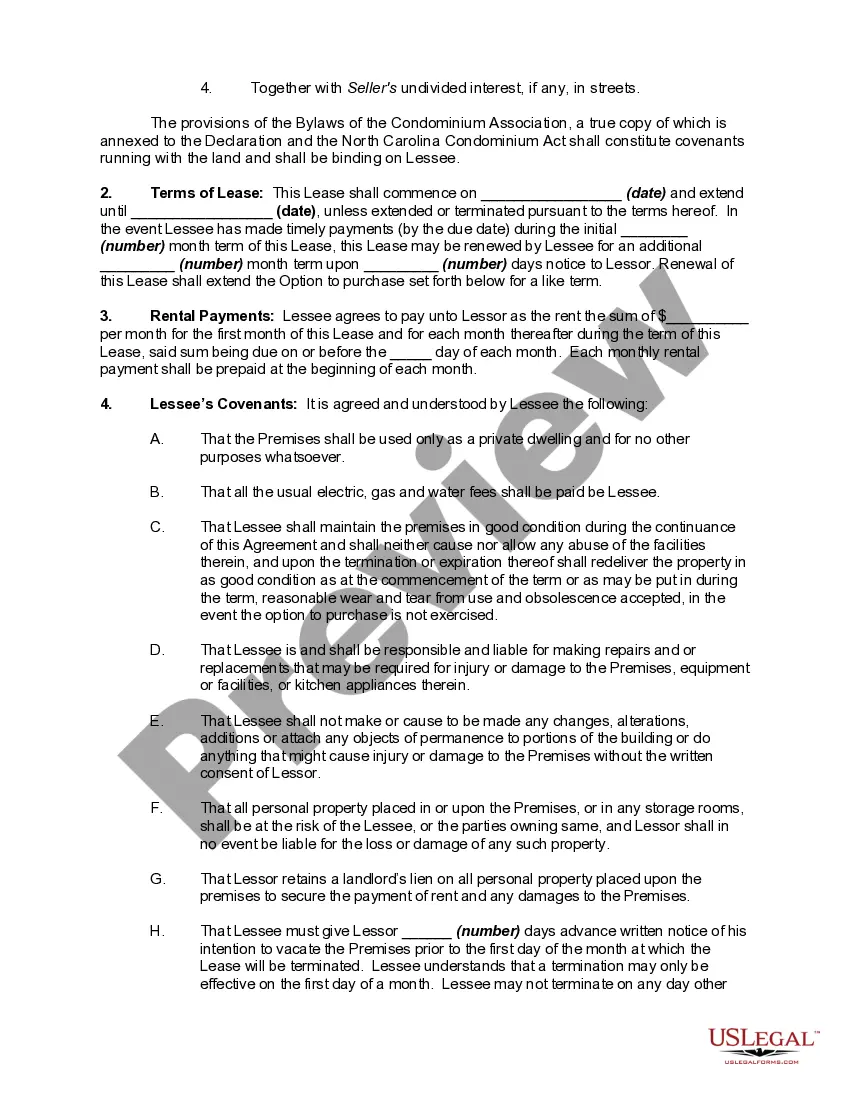

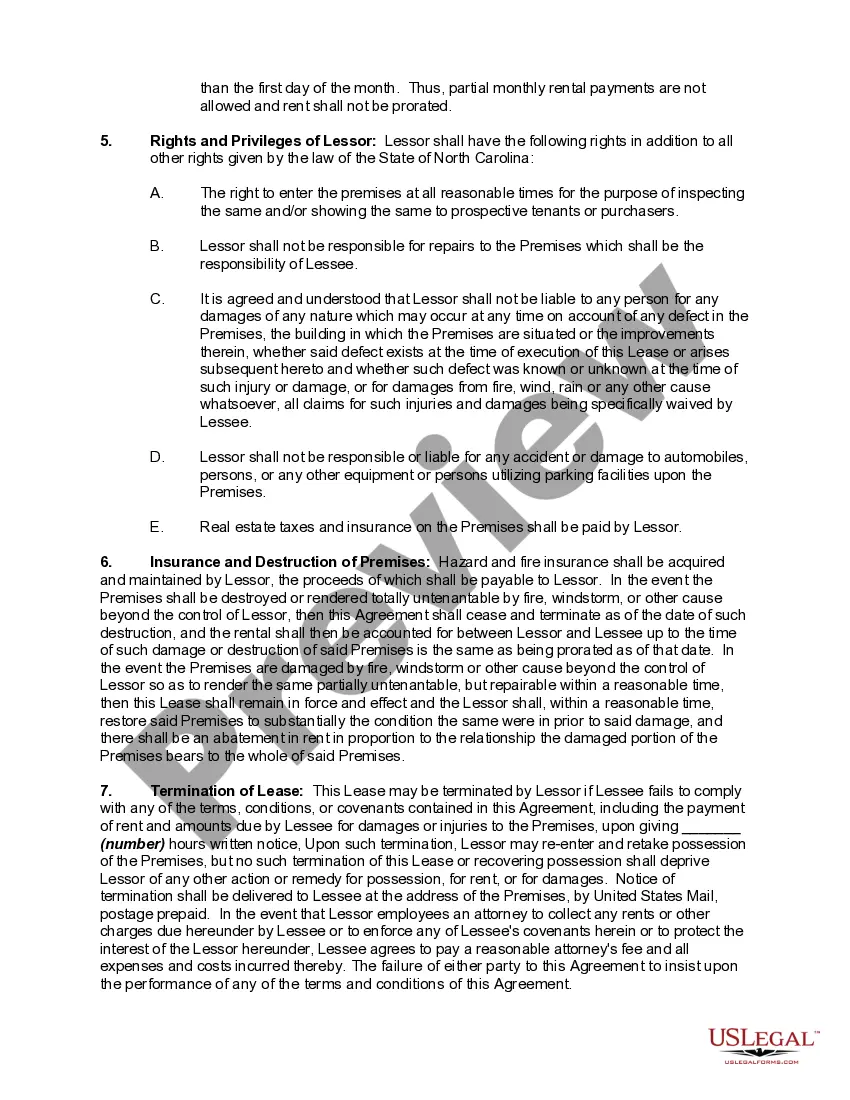

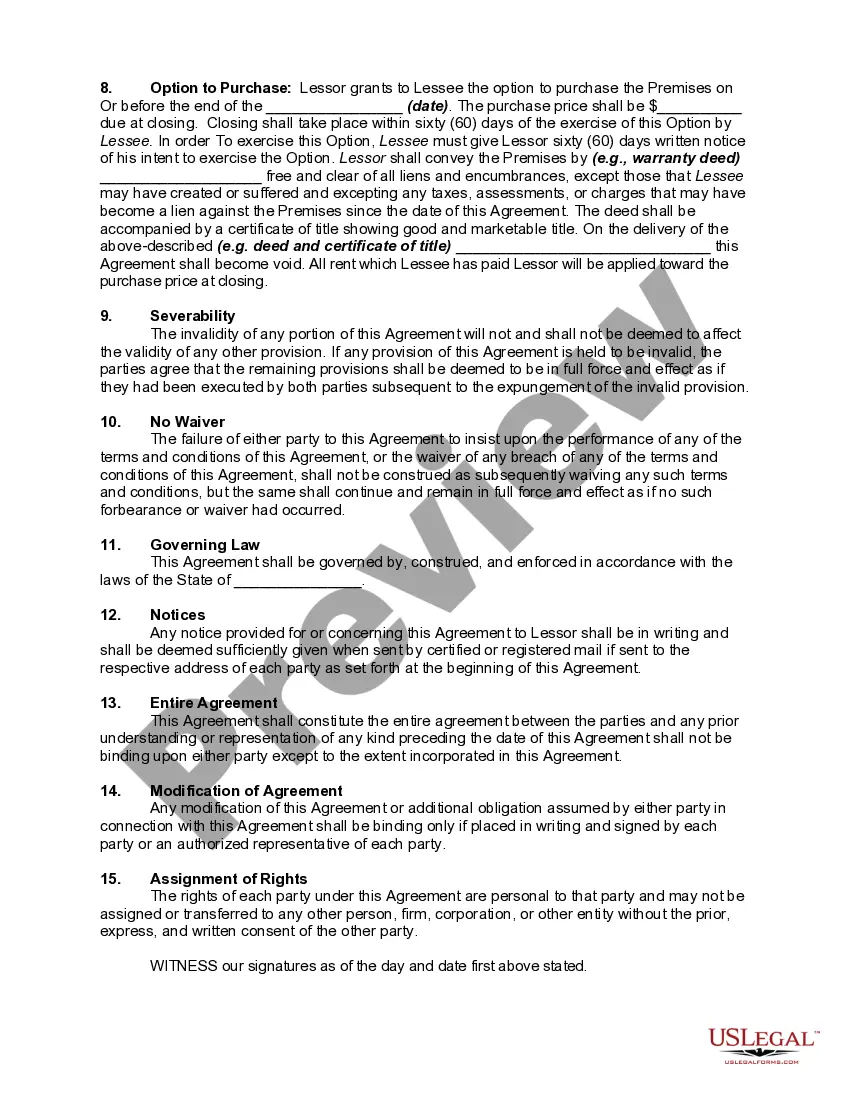

How to fill out North Carolina Condominium Lease Agreement With Option To Purchase And Rent Payments To Apply To Purchase Price - Rent To Own - Condo Rental?

- If you are a returning user, log in to your account and locate the desired form. Verify that your subscription is active; if it isn’t, renew it based on your payment plan.

- For first-time users, start by exploring the Preview mode and reading the form description carefully to ensure it meets your legal needs and jurisdiction.

- If the form doesn’t fit your requirements, use the Search tab above to find an alternative template relevant to your situation.

- Once you find the right form, click on the Buy Now button and select your preferred subscription plan. You will need to create an account to access the form library.

- Proceed to checkout by entering your credit card information or using your PayPal account to finalize your subscription purchase.

- After completing your purchase, download the form directly to your device. You can also retrieve it anytime through the My Forms menu in your profile.

US Legal Forms empowers you to create legal documents quickly and efficiently with its extensive library of over 85,000 customizable forms. Enjoy more options than competitors with the same investment.

Don't hesitate to take advantage of our premium expert support for assistance with form completion to ensure accuracy and compliance. Start your hassle-free legal document journey today!

Form popularity

FAQ

Typically, you have a window of about 30 to 60 days to shop for lenders without impacting your credit score significantly. During this time, ensure you consider multiple lenders to find the best rates and terms for a lender owner commenced for 5 years. It's beneficial to compare various offers and ask questions to clarify your options. The more informed you are, the better your final decision will be.

Yes, it is very much possible to secure a 5-year mortgage. This option suits those looking to invest in property without long-term financial commitments. Many lenders offer tailored solutions that can fit your unique needs. With a strong understanding of a lender owner commenced for 5 years, you can navigate your financing options with confidence.

Absolutely, obtaining a mortgage for five years is a feasible goal. Many lenders cater to this need, making it accessible for those who are looking for flexibility in their housing finance. A lender owner commenced for 5 years can work well for buyers who anticipate moving or refinancing in the near future. Start by comparing your options to find the best fit for your financial situation.

Choosing a 5-year fixed mortgage can be a smart move for many borrowers. This option provides stability in payments, allowing you to budget effectively without worrying about interest rate fluctuations. Moreover, if you expect to sell your home or refinance within five years, this type of mortgage aligns perfectly with your plans. Thus, lenders often see a steady demand for a lender owner commenced for 5 years.

Lenders use self-employment income to determine your eligibility for a mortgage by calculating your net income based on tax returns, bank statements, and other documentation. They evaluate income stability and trends over the last few years. For someone with a status as a 'lender owner commenced for 5 years', consistent income can significantly boost your chances of approval.

To prove income when self-employed, compile your tax returns for the past two years, along with profit and loss statements and bank statements. These documents provide a clear picture of your income and expenses. For self-employed individuals, particularly those who have been a 'lender owner commenced for 5 years', showcasing a solid financial history can greatly enhance your mortgage application.

Proof of income for a self-employed mortgage usually includes two years of personal and business tax returns, along with recent bank statements and profit and loss statements. This information allows lenders to assess the sustainability of your income. If you identify as a 'lender owner commenced for 5 years', these documents can emphasize your financial stability.

The closing timeline varies but typically a lender needs anywhere from 30 to 45 days after receiving a complete application. If you are self-employed, it may take a little longer due to the additional documentation required. However, being transparent about your situation as a 'lender owner commenced for 5 years' can help smooth the process.

Lenders evaluate self-employed income by analyzing your net income from your tax returns, often focusing on the last two years. They may also consider the stability and consistency of your income, particularly if you have been a 'lender owner commenced for 5 years'. This perspective allows them to assess your financial reliability.

To provide proof of income as a self-employed individual, you typically need to submit tax returns for the past two years. Additionally, including profit and loss statements and bank statements can strengthen your case. This documentation helps lenders understand your financial status, especially if you are a 'lender owner commenced for 5 years'.