North Carolina Life Estate Deed Form For Florida

Description

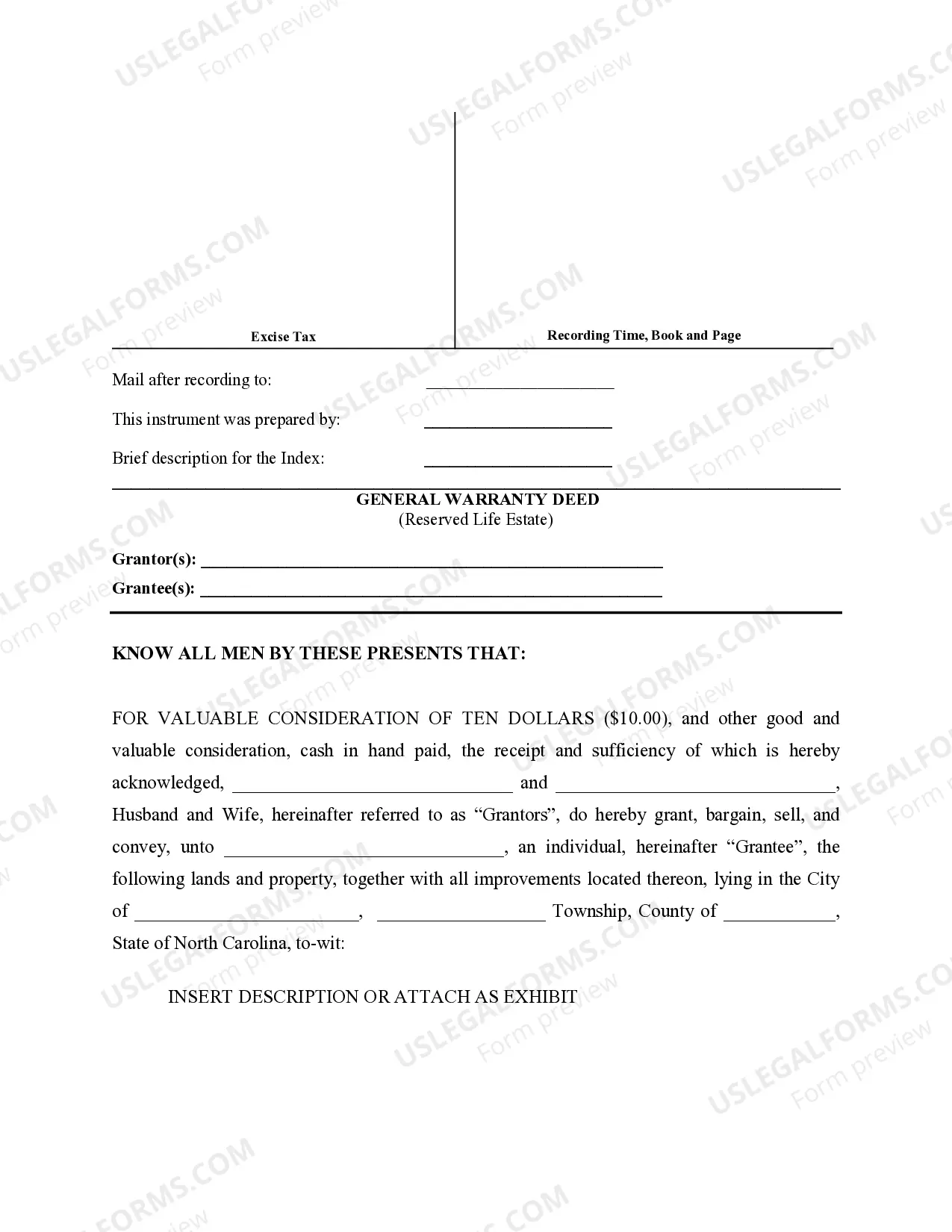

How to fill out North Carolina Warranty Deed To Child Reserving A Life Estate In The Parents - Husband And Wife Grantors?

The North Carolina Life Estate Deed Form For Florida you see on this page is a reusable legal template drafted by professional lawyers in compliance with federal and state laws and regulations. For more than 25 years, US Legal Forms has provided individuals, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the quickest, simplest and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this North Carolina Life Estate Deed Form For Florida will take you just a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or check the form description to verify it fits your requirements. If it does not, make use of the search bar to get the correct one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Pick the format you want for your North Carolina Life Estate Deed Form For Florida (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Utilize the same document again whenever needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

A life estate is a right to live in the property until your death. When you pass away, the real property passes to your beneficiaries designated in the lady bird deed, called the remaindermen.

Life estate interests can be created by deed, by conveyance through last will and testament or as we commonly see as the default distribution of homestead to a spouse who is not on title and choses not to elect to take a one-half ownership interest in Property within six months from the date of death of their spouse.

The person holding the life estate ? the life tenant ? possesses the property during his or her life. The other owner ? the remainderman ? has a current ownership interest but cannot take possession until the death of the life estate holder.

A Florida Enhanced Life Estate Deed can help avoid probate, speed up the transfer of a property upon death, maintain the ability to use the fair market value of the property at the time of death as a cost basis (lowers income taxes upon sale), and maintain Medicaid eligibility.

Life Estate Deed to Avoid MERP in North Carolina You can work with an estate planning attorney to set life estate deeds up and avoid paying MERP by conveying 1% of the home to an adult child. However, this deed must include the owner designation JTWROS or ?joint tenants with a right of survivorship.?