Llc Ltd

Description

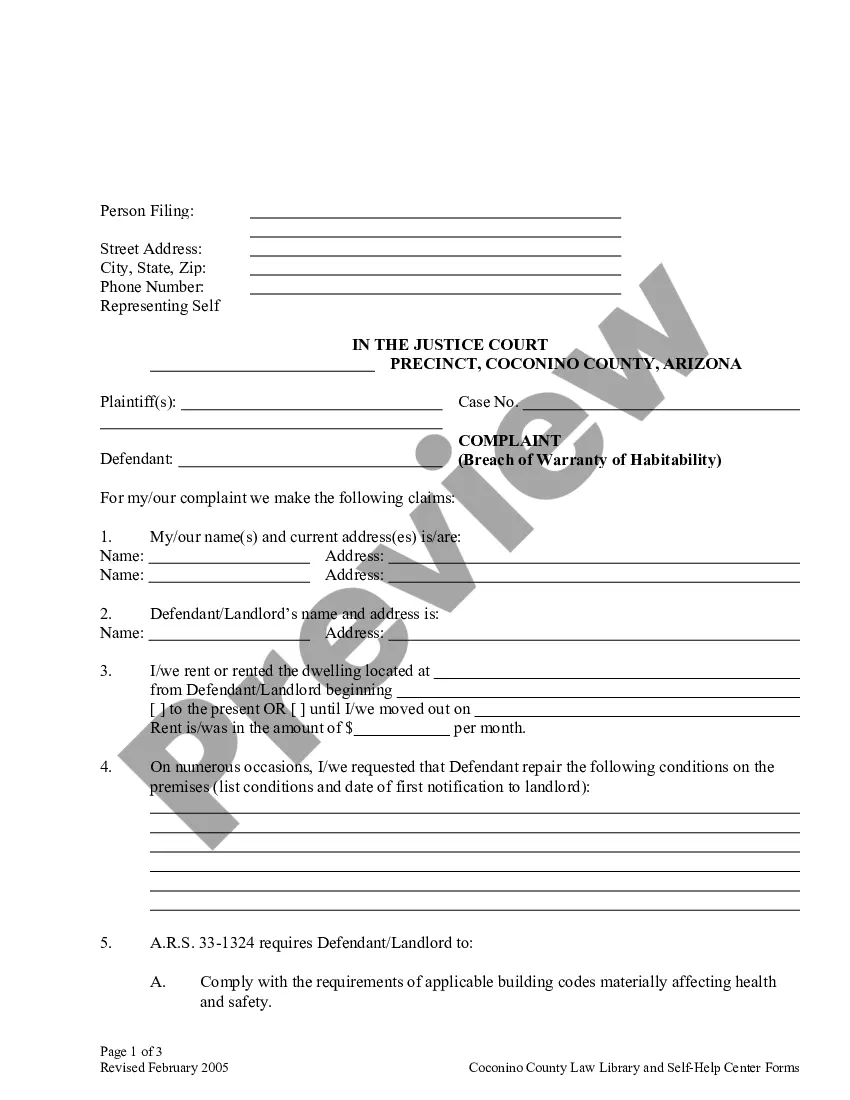

How to fill out North Carolina Limited Liability Company LLC Operating Agreement?

- If you're a returning user, log in to your account to download your desired form by clicking the Download button. Ensure your subscription remains active and renew it if necessary.

- For first-time users, start by previewing the available forms. Review the description and ensure the chosen document meets your requirements and complies with local jurisdiction.

- If additional templates are needed, utilize the Search tab to locate alternative documents. If you find a form that is a better fit, proceed to the next step.

- To acquire your selected document, click the Buy Now button and select an appropriate subscription plan. You’ll need to create an account to access the complete library.

- Complete your purchase by entering your credit card information or opting to use your PayPal account.

- Finally, download your form and save it on your device. Access it anytime in the My documents section of your profile.

In conclusion, US Legal Forms provides a robust selection of legal documentation tools, making it easier for users to manage their LLC LTD paperwork. With personalized assistance from experts, you can ensure all your legal documents are accurate and compliant.

Start your journey with US Legal Forms today and simplify your legal documentation process!

Form popularity

FAQ

You can file your LLC separately from other businesses, especially if you have multiple entities. Each LLC has its own distinct legal status, which allows for separate tax filings and liabilities. This can provide clarity and protect your personal assets. Consider using US Legal Forms to simplify the filing process for any LLC you operate.

Failing to file taxes for your LLC can lead to serious consequences, including penalties and interest on unpaid taxes. The IRS may also classify your LLC as inactive or suspended, which can affect your legal protections. It is essential to stay compliant, even if your LLC is not generating income. Utilizing platforms like US Legal Forms can help you stay informed about your tax responsibilities and deadlines.

A single owner LLC is treated as a pass-through entity for tax purposes, meaning the income is reported on your personal tax return. You will file a Schedule C along with your Form 1040 to report business income and expenses. This streamlined process simplifies your tax obligations while allowing you to benefit from the protections an LLC offers. Consulting with a tax professional can help you navigate any specific questions about your LLC taxes.

Yes, you can establish an LLC and choose not to engage in any active business operations. However, you still have to maintain your legal obligations, such as filing annual reports and paying applicable fees. Ignoring these requirements could result in the dissolution of your LLC, despite it being inactive. Consider using US Legal Forms to ensure you manage these aspects properly.

You cannot use Ltd instead of LLC, as they serve different legal purposes. An LLC stands for Limited Liability Company and provides certain protections to its owners. On the other hand, Ltd, which stands for Limited Company, generally indicates a different structure, mostly used in the UK. It's important to choose the correct designation, as using the wrong one can lead to legal confusion.

An Ltd does need an EIN if it plans to have employees or if it elects to be taxed as a corporation. The EIN serves as a unique identifier for the business, facilitating its compliance with federal tax regulations. Even for small businesses, having an EIN is beneficial for managing finances and ensuring a structured approach to operations. If you're considering forming an Ltd, obtaining an EIN should be part of your planning process.

Yes, an irrevocable trust must obtain an EIN, as it is treated as a separate entity for tax purposes. Unlike a revocable trust, once established, an irrevocable trust does not allow the grantor to retain control, necessitating an EIN for its tax matters. This ensures compliance with IRS regulations and keeps the trust's assets distinct from personal assets. If you're navigating this process, uslegalforms can offer supportive resources to guide you.

An Ltd may need to issue a 1099 form if it pays independent contractors or freelancers $600 or more in a given tax year. This requirement applies similarly to LLCs as well. The 1099 form serves as a record of payments and is necessary for tax compliance. Therefore, if you're operating an Ltd and expect to hire freelancers, consider preparing to manage 1099 filings accurately.

While it is technically possible to operate an LLC without an EIN, doing so can limit your business’s functionality. Without an EIN, you may face challenges in opening a bank account, hiring employees, or filing taxes properly. Moreover, obtaining an EIN is generally advisable for tax identification and to maintain the limited liability feature of your LLC ltd. Thus, it is often best to secure an EIN right from the start.

When naming your Limited Liability Company, include 'LLC' or 'Limited Liability Company' in the title. This designation indicates that your business structure limits personal liability, which is a crucial aspect of forming an LLC ltd. Make sure to check state requirements, as they might have specific instructions regarding naming conventions. For assistance, uslegalforms can provide the necessary templates to ensure compliance and save you time.