Agreement Form Montana Withholding Registration

Description

How to fill out Montana Premarital Agreements Package?

Precisely composed official paperwork is one of the essential assurances for preventing complications and legal disputes, but obtaining it without an attorney's assistance might require time.

Whether you need to swiftly locate an up-to-date Agreement Form Montana Withholding Registration or any other templates for employment, family, or business circumstances, US Legal Forms is always available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and press the Download button next to the chosen document. Moreover, you can retrieve the Agreement Form Montana Withholding Registration at any time, as all documentation previously acquired on the platform remains accessible within the My documents tab of your profile. Save time and resources on preparing official documents. Experience US Legal Forms today!

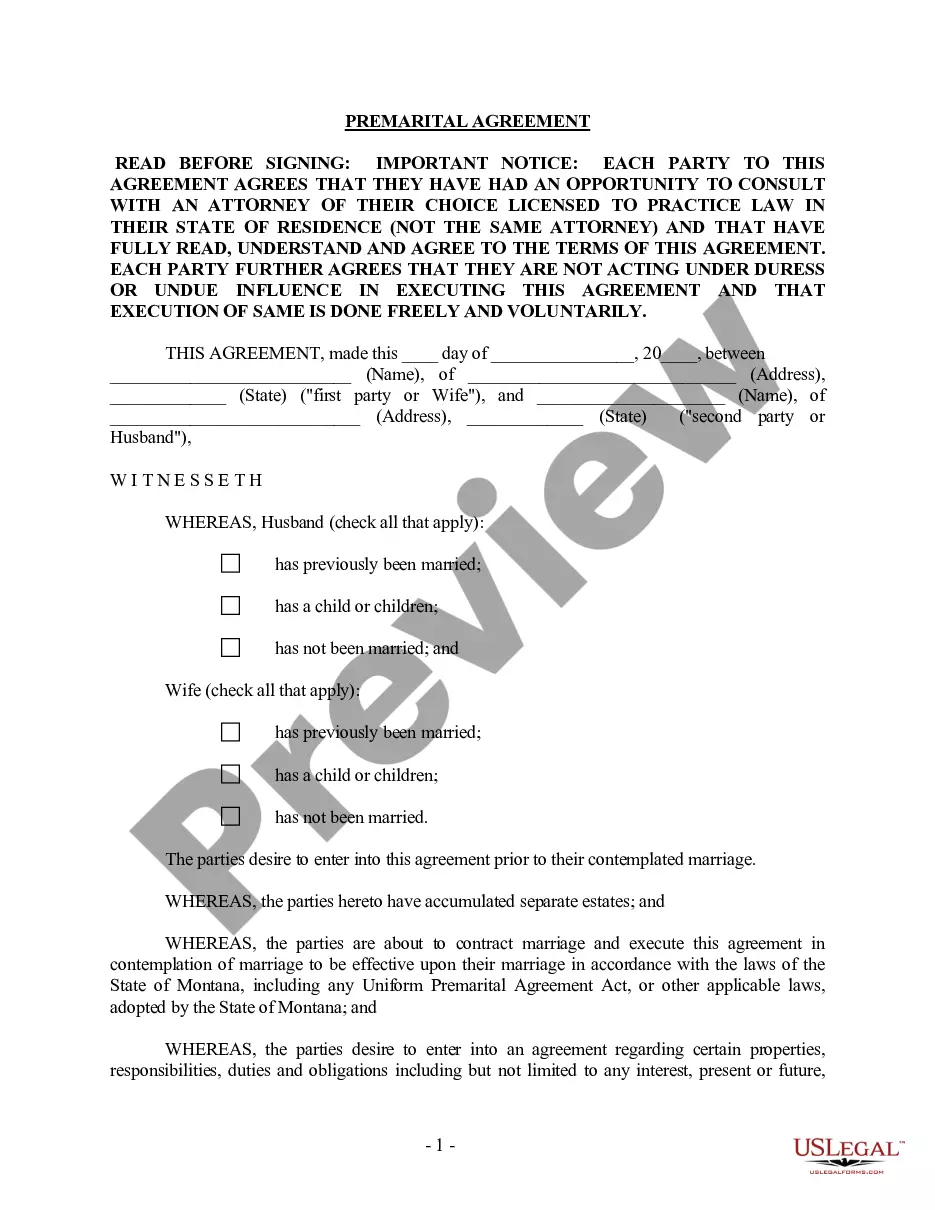

- Confirm that the form is appropriate for your situation and location by reviewing the description and preview.

- Search for an additional sample (if necessary) using the Search bar in the page header.

- Hit Buy Now once you find the relevant template.

- Choose the pricing plan, Log In to your account, or create a new one.

- Select your preferred payment method to acquire the subscription plan (via credit card or PayPal).

- Pick PDF or DOCX file format for your Agreement Form Montana Withholding Registration.

- Click Download, then print the sample to complete it or upload it to an online editor.

Form popularity

FAQ

Companies who pay employees in Montana must register with the MT Department of Revenue (DOR) for a Withholding Account Number and the MT Department of Labor and Industry (DLI) for a Unemployment Insurance (UI) Account Number. Apply online at the DOR's to receive the number within 2 days.

The 2022 tax rates range from 1% to 6.75%. Employees who make more than $18,400 will hit the highest tax bracket. Montana doesn't have any local taxes, so you only have to withhold for state taxes.

Change Your WithholdingComplete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer.Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.Make an additional or estimated tax payment to the IRS before the end of the year.

If you are a new business, register online with the Montana Department of Labor and Industry. You can also register via phone at 1-800-550-1513. If you already have a Montana UI Account Number, you can look this up online or by contacting the agency at 406-444-3834.

Montana Employee's Withholding Allowance and Exemption Certificate (Form MW-4) A completed Form MW-4 is used by employers to determine the amount of Montana income tax to withhold from wages paid. This form allows each employee to claim allowances or an exemption to Montana wage withholding when applicable.