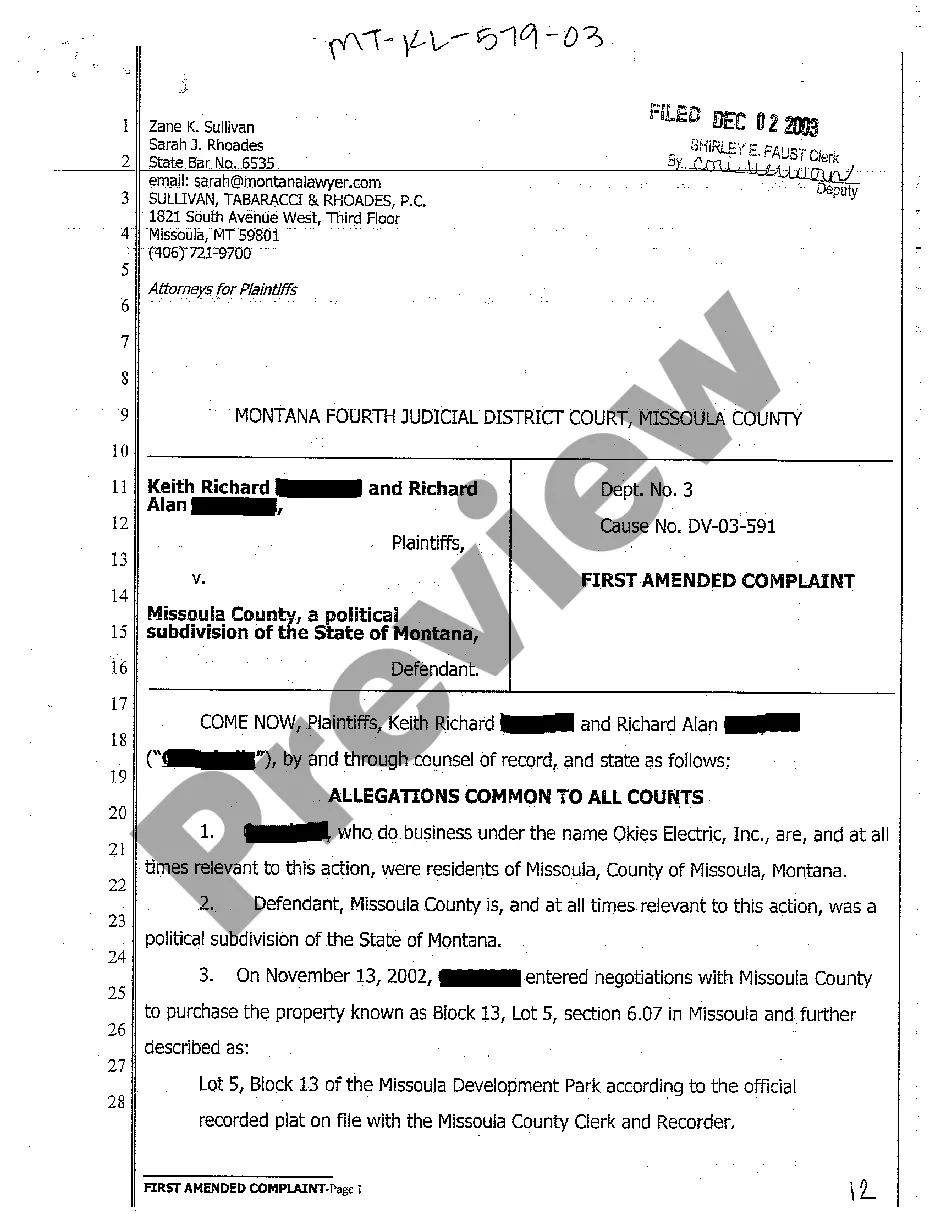

Sample Of Amended Complaint In Montana Withholding

Description

How to fill out Montana First Amended Complaint?

There's no longer a need to spend hours searching for legal documents to fulfill your state's requirements.

US Legal Forms has gathered all of them in one location and made them easier to access.

Our platform provides over 85,000 templates for various business and individual legal matters categorized by state and purpose. All forms are professionally created and verified for accuracy, so you can be confident in obtaining an up-to-date Sample Of Amended Complaint In Montana Withholding.

Select the most suitable pricing plan and either register for an account or Log In. Complete payment for your subscription using a card or PayPal to proceed. Choose the file format for your Sample Of Amended Complaint In Montana Withholding and download it to your device. Print your form to fill it out by hand or upload the sample if you prefer to use an online editor. Preparing legal documentation under federal and state laws and regulations is quick and straightforward with our library. Experience US Legal Forms today to keep your paperwork organized!

- If you are acquainted with our service and have an account, ensure your subscription is active before acquiring any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all downloaded documents anytime by accessing the My documents section in your profile.

- If you are new to our service, the process will require a few additional steps.

- Here’s how new users can locate the Sample Of Amended Complaint In Montana Withholding in our library.

- Carefully read the page details to verify it includes the sample you need.

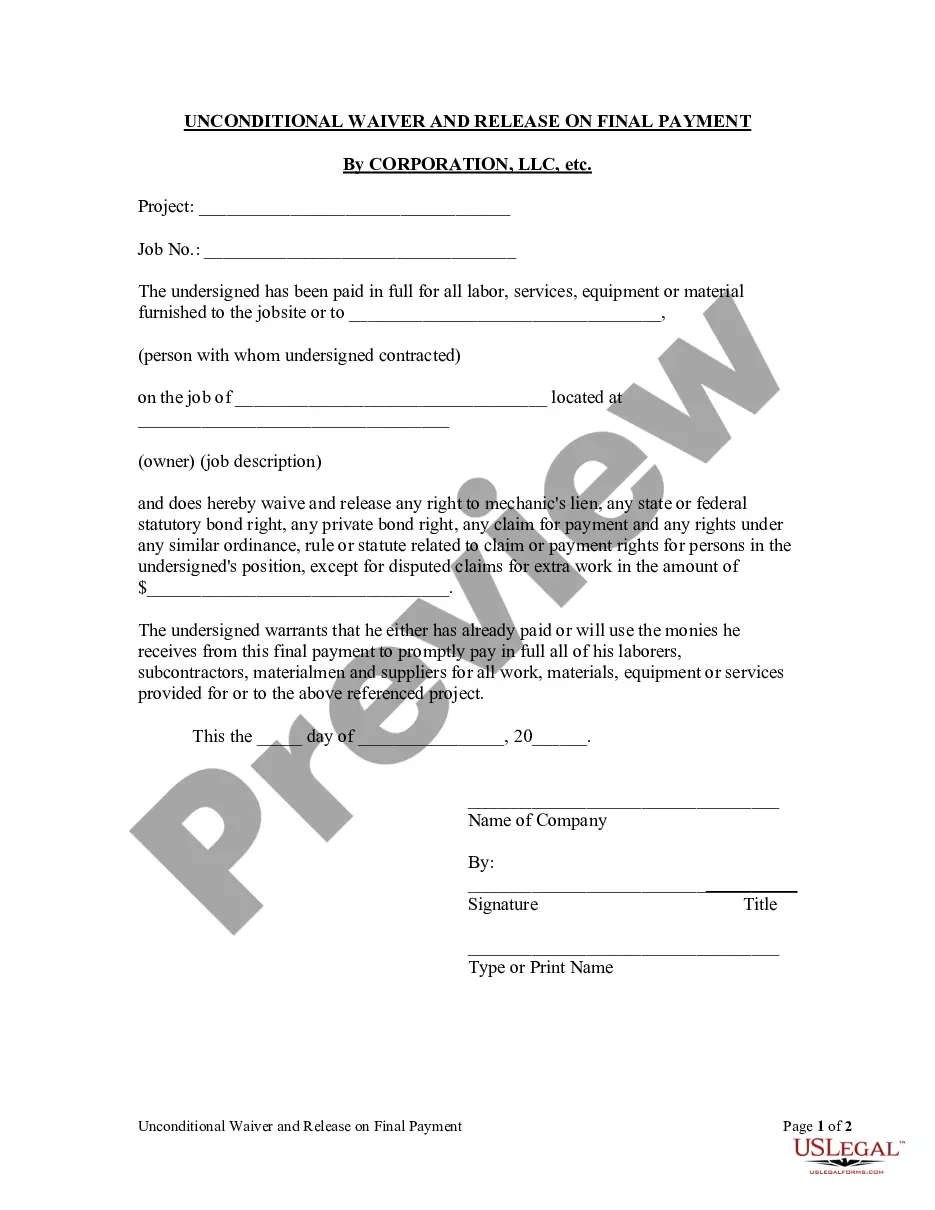

- Utilize the form description and preview options if available.

- Use the search bar above to look for another template if the one provided doesn't meet your needs.

- Press Buy Now next to the template title when you find the right one.

Form popularity

FAQ

Yes, you can remove a case to federal court after filing an amended complaint, but specific criteria must be met. The removal is typically permissible if the amended complaint introduces federal jurisdiction or if the parties are from different states. Preparing a thorough sample of amended complaint in Montana withholding can assist you in evaluating whether federal court is an appropriate venue for your case.

Rule 5 of the Montana Rules of Civil Procedure outlines the requirements for serving papers and documents in legal actions. It ensures that all parties receive notice of the proceedings and can respond accordingly. When preparing your sample of amended complaint in Montana withholding, understanding Rule 5 helps ensure compliance with service of process requirements.

Certainly, you can file a motion to dismiss an amended complaint. The same legal principles that apply to the original complaint also apply to any amendments. Therefore, it is crucial to analyze your amended complaint carefully, and a sample of amended complaint in Montana withholding can provide clarity on how to structure your arguments effectively.

Yes, you can file a motion to dismiss against an amended complaint. The amended complaint must still adhere to the same legal standards as the original. Therefore, utilizing a well-crafted sample of amended complaint in Montana withholding can help ensure your arguments are clear and well-founded, increasing your chances of a successful motion.

Rule 15 allows a party to amend their pleadings, including complaints, under certain conditions. Generally, this rule encourages amendments to ensure cases are decided based on their merits rather than on technical mistakes. Utilizing a sample of amended complaint in Montana withholding can help you navigate this process effectively and ensure your amendments meet all necessary legal standards.

A complaint is the initial legal document that outlines the basis of your claims against the defendant. In contrast, an amended complaint modifies the original document to correct errors, expand on claims, or add new parties. Understanding these differences is crucial when preparing your sample of amended complaint in Montana withholding, as each document serves a unique purpose in your legal strategy.

In Montana, a motion to dismiss can be based on various grounds, including lack of jurisdiction, failure to state a claim upon which relief can be granted, or failure to comply with the court's procedural rules. It's essential to provide solid reasoning for your motion, as the court will examine the merits of your arguments. A well-prepared sample of amended complaint in Montana withholding can strengthen your case and clarify your position.

Yes, in many cases, you can electronically file an amended tax return using specified tax software. This method simplifies the process, allowing for quicker submissions and confirmations. However, ensure that your software is approved for amending returns. If you need more information, a sample of amended complaint in Montana withholding can provide relevant details.

To amend your tax return after filing, you need to fill out the amended return form and clearly outline the changes made. Gather all relevant documents that support your amendments and submit them to ensure compliance with tax laws. Additionally, you might want to look at a sample of amended complaint in Montana withholding for specific guidelines on making these changes.

When you file an amended tax return, you might face penalties if you're liable for additional taxes owed. However, if you are simply correcting a mistake, there typically aren’t severe penalties. Instead, it’s important to file as soon as you discover the error to minimize any potential penalties. You can review a sample of amended complaint in Montana withholding to better understand your responsibilities.