Notice Of Supplemental Discovery Form W-4

Description

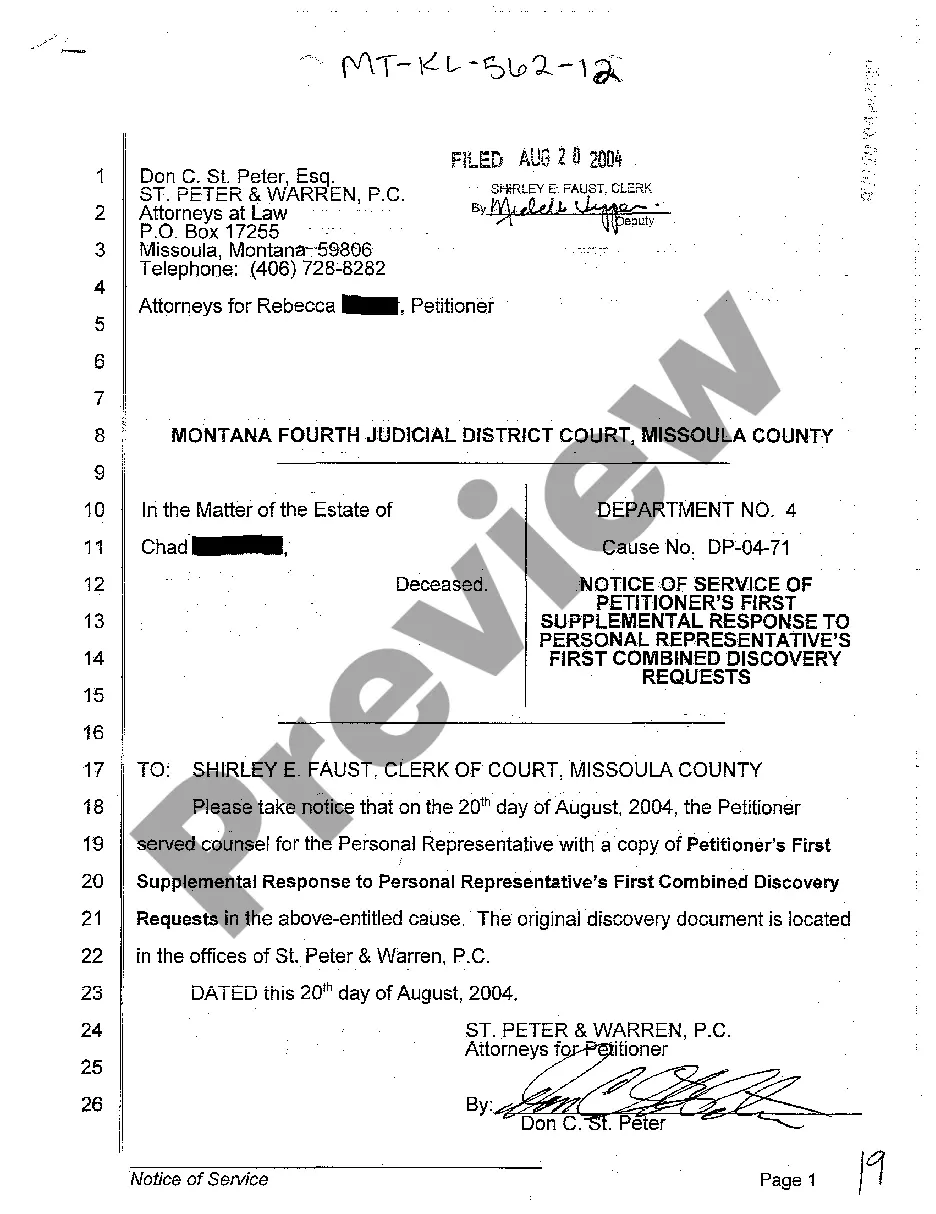

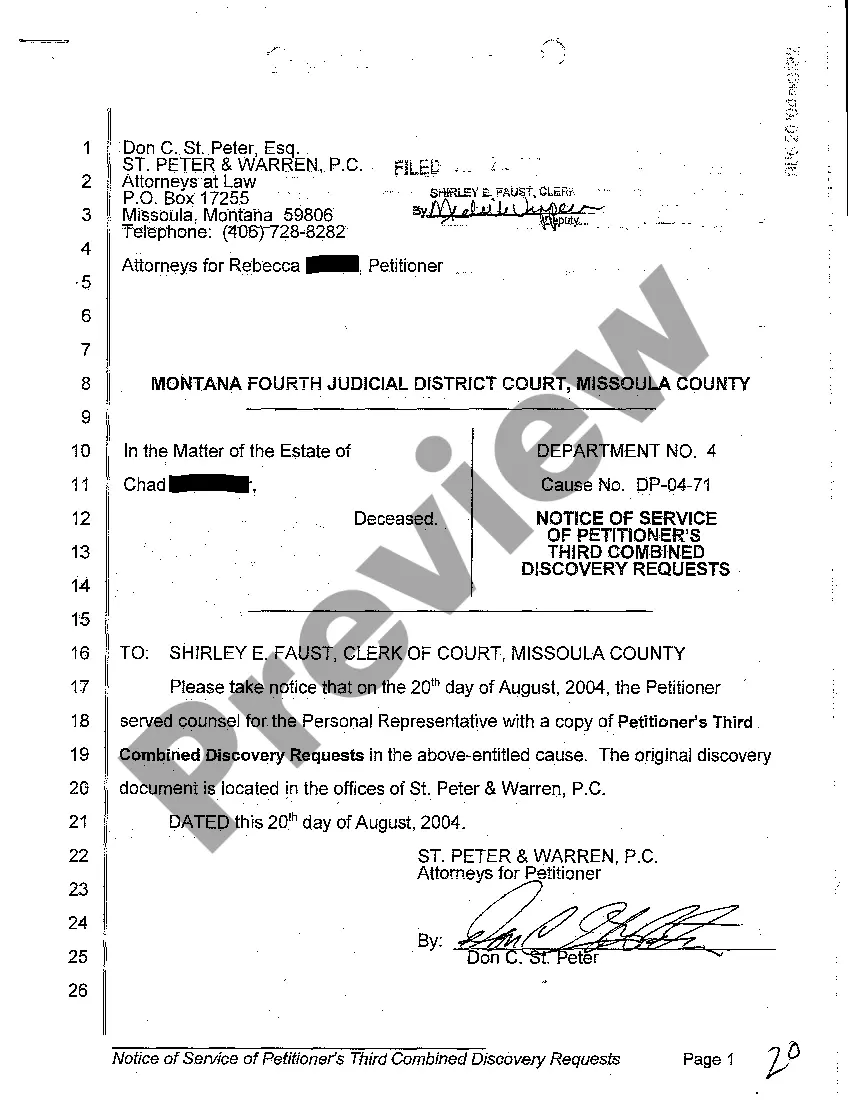

How to fill out Montana Notice Of Service Of Petitioners First Supplemental Response To Personal Representative's First Combined Discovery Requests?

Well-prepared official documents are a key assurance for preventing issues and legal disputes, though acquiring them without an attorney's assistance may require some time.

If you need to swiftly locate a current Notice Of Supplemental Discovery Form W-4 or any other paperwork for employment, family, or commercial purposes, US Legal Forms is always available to assist.

The process is even simpler for current users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and hit the Download button next to the selected file. Furthermore, you can retrieve the Notice Of Supplemental Discovery Form W-4 at any time later, as all the documents previously obtained on the site are accessible through the My documents section of your profile. Conserve time and expenses on drafting official documents. Explore US Legal Forms today!

- Verify that the form fits your situation and location by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar located in the header of the page.

- Select Buy Now once you find the right template.

- Choose the pricing option, sign in to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Opt for PDF or DOCX format for your Notice Of Supplemental Discovery Form W-4.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

The best number of deductions to claim on your W-4 depends on your financial situation, including your expected income and expenses. Typically, you may want to claim more deductions if you have dependents or own a home. Conversely, fewer deductions can lead to a larger tax refund. The Notice of supplemental discovery form W-4 serves as a valuable tool, guiding you to make informed decisions about the number of deductions you should claim.

To accurately fill out your W-4, start by entering your personal information at the top of the form. Next, determine your filing status and follow the form’s sections to calculate your allowances. Consider your financial situation, including dependents and potential deductions, to ensure your withholding reflects your needs. Using the Notice of supplemental discovery form W-4 can enhance your understanding and effectiveness in completing the form.

You are not required to fill out Step 4b on the W-4 form unless you have additional income, such as interest or dividends, not subject to withholding. This step focuses on ensuring the right amount of tax is withheld by adding any extra amount you might want deducted. It's vital to consider your specific financial situation when completing this part. If you're unsure, the Notice of supplemental discovery form W-4 offers essential insights into this process.

To fill out a W-4 withholding form, start by providing your name, address, and Social Security number. Next, indicate your filing status, like single or married, and follow the steps for personal allowances or deductions. It is important to ensure accuracy to avoid overpaying or underpaying taxes. Finally, the Notice of supplemental discovery form W-4 will provide guidance on adjustments based on your unique financial situation.

Withholding an additional amount on your W-4 may be beneficial if you have other income sources or significant deductions that might not be reflected in standard withholding. This extra amount helps cushion your tax responsibilities, potentially preventing unexpected tax bills. Ensure you assess your financial situation and consult the Notice of supplemental discovery form w-4 for personalized advice.

Your employer requires you to fill out a W-4 tax form to determine the correct amount of federal income tax to withhold from your paycheck. This withholding ensures compliance with tax regulations and helps you avoid underpayment penalties. Completing this form accurately is vital for managing your tax obligations. You can refer to the Notice of supplemental discovery form w-4 for assistance in understanding the intricacies involved.

Extra withholding on your W-4 can be a strategic choice if you anticipate owing taxes at the end of the year. This approach might help you avoid a tax bill and potentially secure a larger refund. However, it's crucial to evaluate your current and expected financial situation to make an informed decision. Utilizing tools like the Notice of supplemental discovery form w-4 can streamline your decision-making.

To fill out a W-4 form, you will need your personal information, including your name, address, Social Security number, and filing status. You should also gather information about your expected income, deductions, and any additional adjustments you wish to make. All this information helps ensure accurate withholding throughout the year. The Notice of supplemental discovery form w-4 can be a helpful reference for your completion process.

When deciding whether to file 0 or 1 on your W-4, consider your tax obligations and financial goals. Filing 0 typically results in higher tax withholding, which may be beneficial if you expect to owe taxes. Conversely, filing 1 might be more suitable for those expecting a refund; utilize the notice of supplemental discovery form W-4 as a reference to help you choose wisely.

Choosing your filing status on W-4 is important, as it directly affects your tax withholdings. Generally, if you’re single and not married, you should choose single. However, if you’re married or have dependents, consider your options carefully; the notice of supplemental discovery form W-4 provides clarity on which might be the best choice for your circumstances.