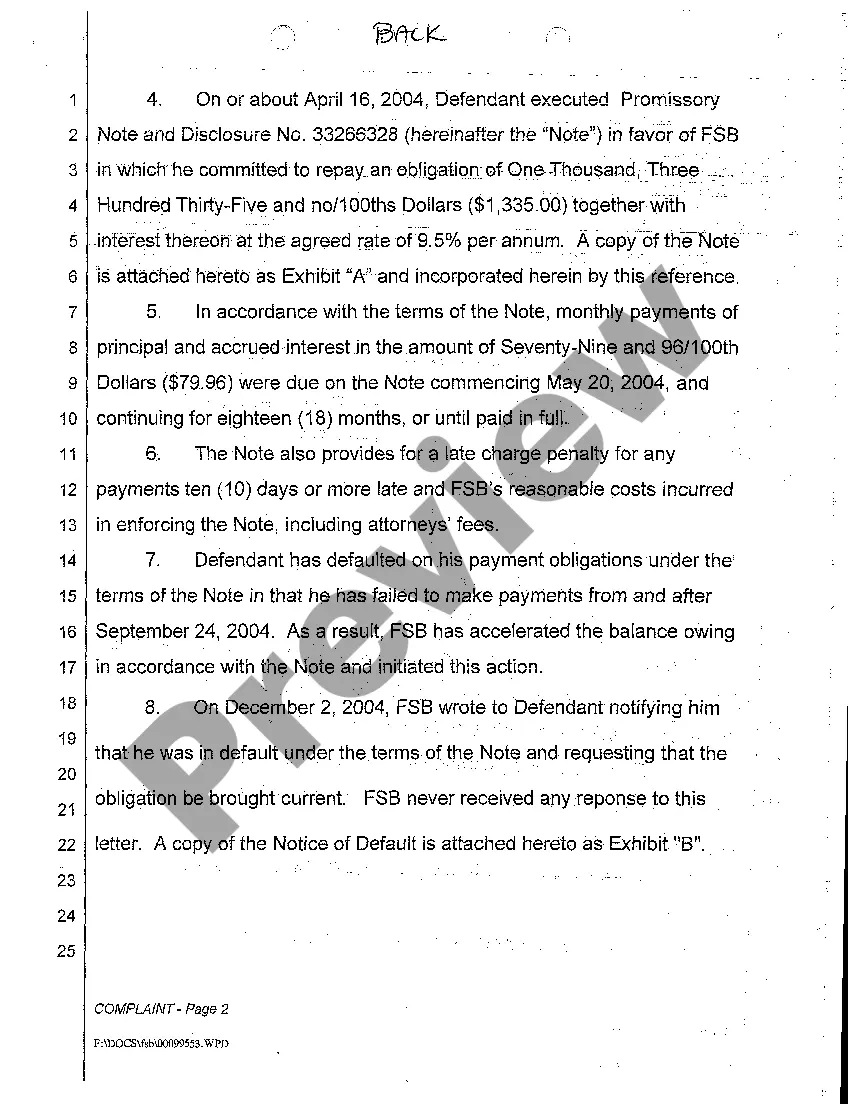

Breach Of Promissory Note With Details

Description

How to fill out Montana Complaint For Breach Of Promissory Note?

Individuals commonly link legal documentation with something intricate that only an expert can manage.

In a certain respect, this is accurate, as composing Breach Of Promissory Note With Details demands a comprehensive comprehension of subject matter criteria, encompassing state and local regulations.

However, with US Legal Forms, everything has become more straightforward: readily available legal templates for any life and business circumstance specific to state laws are compiled in a single online repository and are now accessible to everyone.

All templates in our collection are reusable: once acquired, they remain saved in your profile. You can access them anytime needed through the My documents tab. Discover all the benefits of using the US Legal Forms platform. Subscribe now!

- Verify the page content carefully to ensure it fulfills your needs.

- Examine the form description or confirm it via the Preview option.

- If the previous sample doesn’t meet your requirements, search for another one using the Search field above.

- When you find the appropriate Breach Of Promissory Note With Details, click Buy Now.

- Select the pricing plan that suits your needs and budget.

- Create an account or Log In to continue to the payment page.

- Purchase your subscription using PayPal or with your credit card.

- Choose the format for your sample and click Download.

Form popularity

FAQ

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

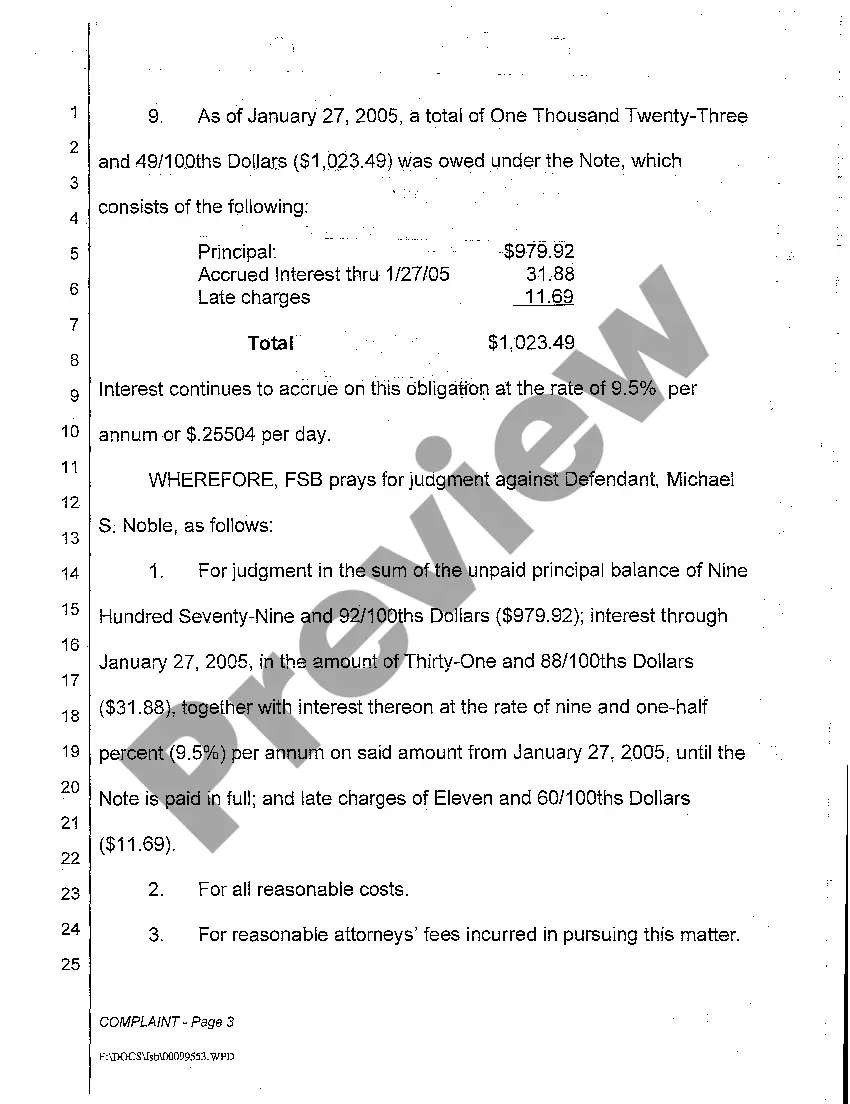

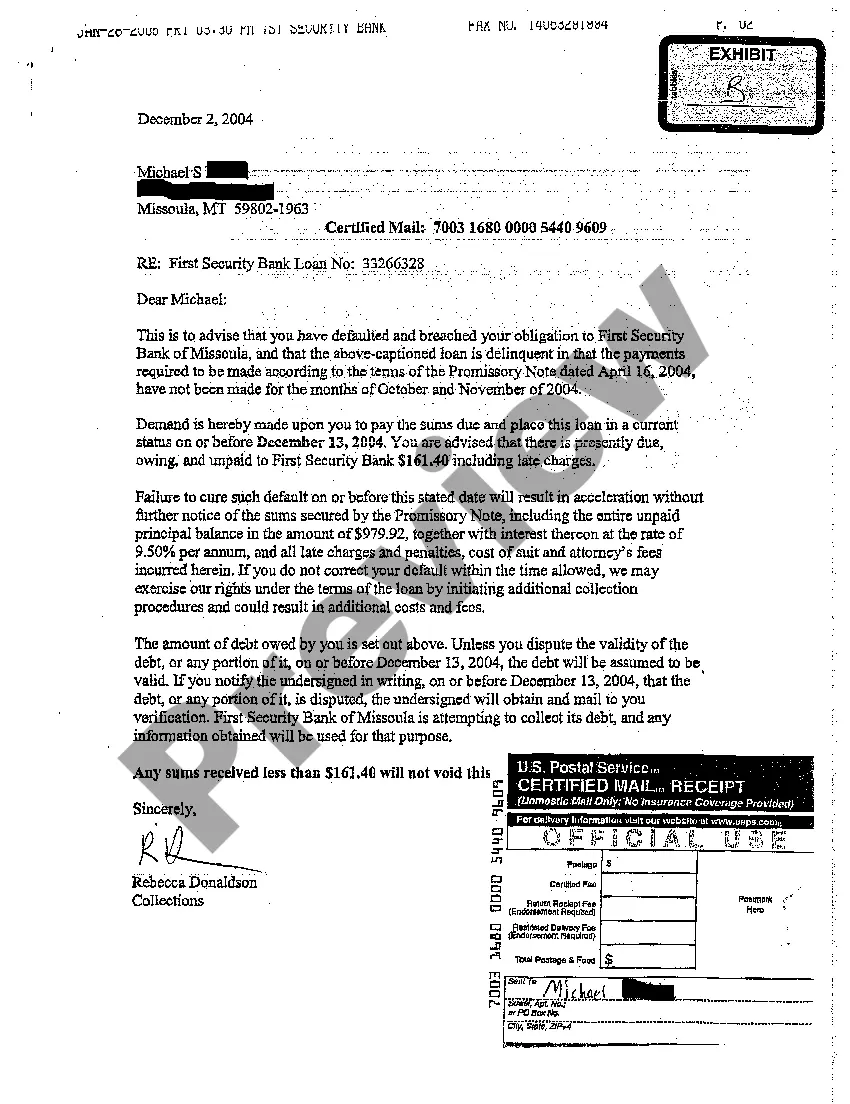

A promissory note is breached when payment due, or properly demanded as per the terms of the note, is not received. If you want to enforce a breached promissory note, you must follow the terms agreed upon when making demands for payment.