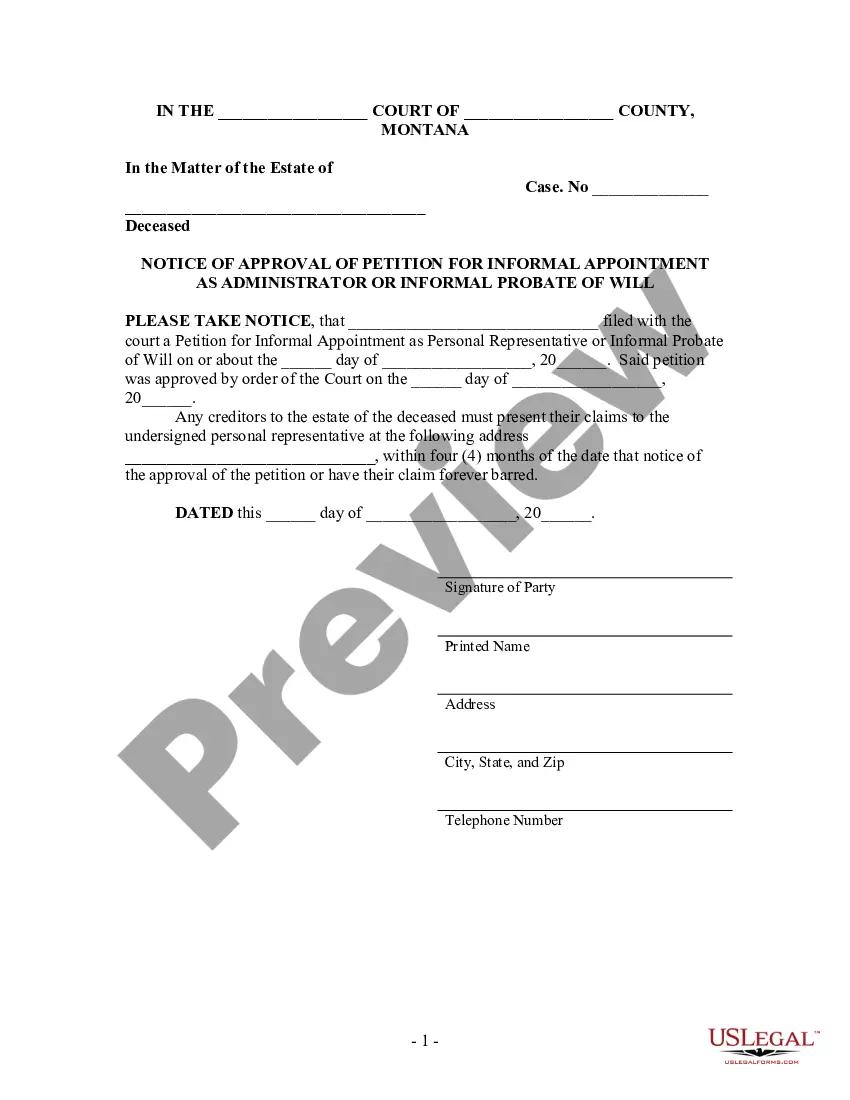

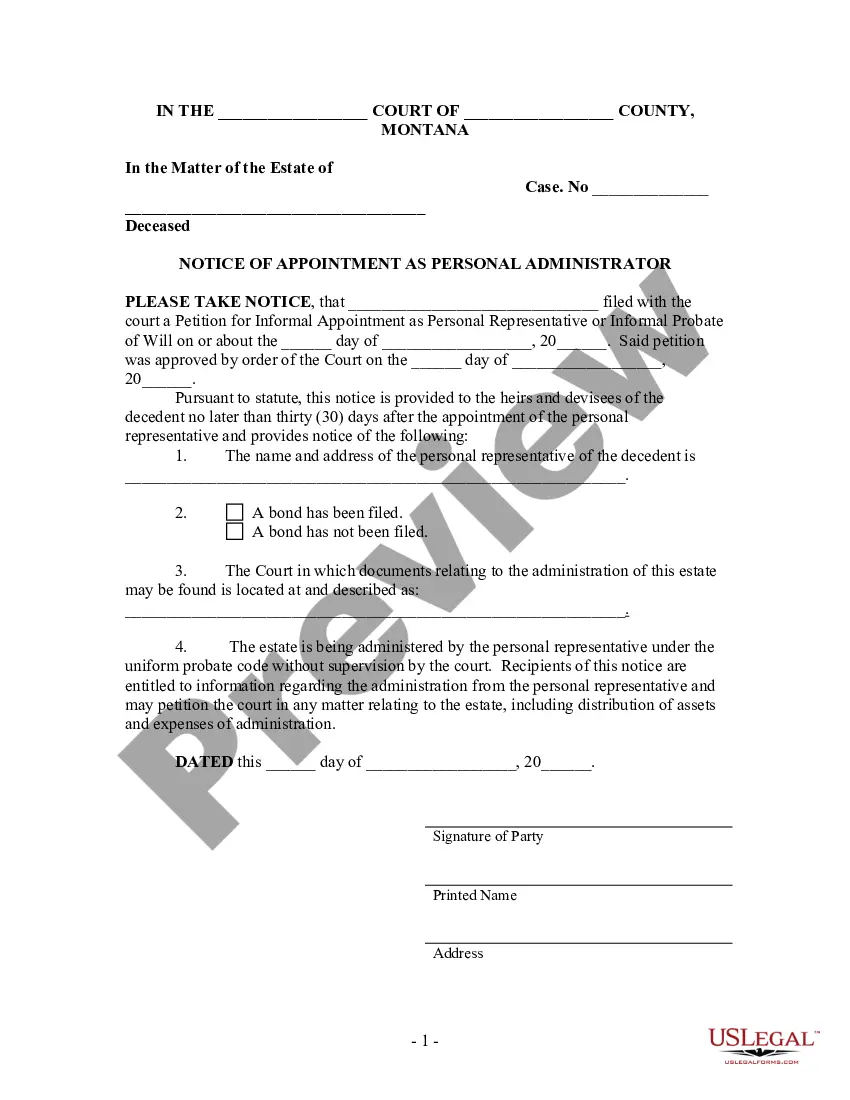

Small Estates Form

Description

How to fill out Small Estates Form?

What is the most reliable service to obtain the Small Estates Form and other current versions of legal documents? US Legal Forms is the answer! It boasts the largest array of legal templates for various scenarios. Each template is professionally crafted and verified for adherence to federal and local laws and regulations.

Files are organized by region and state of application, making it straightforward to find the one you require.

Alternative form search. If any discrepancies arise, use the search bar at the top of the page to locate a different template. Click Buy Now to select the appropriate one. Account creation and subscription payment. Choose the most fitting pricing option, Log In or set up your account, and settle for your subscription through PayPal or credit card. Form retrieval. Choose the format you wish to save the Small Estates Form (PDF or DOCX) and click Download to obtain it. US Legal Forms is an excellent option for anyone needing to handle legal documentation. Premium members enjoy further benefits as they can complete and electronically sign previously saved documents anytime within the built-in PDF editing feature. Give it a try today!

- Experienced users just need to Log In to the platform, ensure their subscription is active, and click the Download button next to the Small Estates Form to acquire it.

- After downloading, the template will be accessible for future use in the My documents section of your account.

- If you do not yet have an account with us, here's what you need to do.

- Form compliance verification. Prior to obtaining any template, ensure it aligns with your specific requirements and the regulations of your state or county. Review the form description and utilize the Preview option if available.

Form popularity

FAQ

To fill out an IL small estate affidavit, start by gathering the decedent's information, assets, and debts. Then, complete the affidavit form by detailing the heirs and their respective shares of the estate. Using a small estates form tailored for Illinois can streamline this process, ensuring it meets state requirements for quick and efficient estate administration.

An estate can simplify the transition of assets after death, especially for smaller estates. Unlike a will, which must go through probate, a small estate can often be transferred directly with less legal complication. Therefore, using small estates forms can save time and resources, making it a preferred option for many.

In Indiana, the small estate limit is currently set at $50,000 for estates that do not include real estate. This means that if your estate falls under this amount, you can use a small estates form to expedite the process and avoid full probate. It's an ideal solution for those looking to quickly settle modest estates.

Income for an estate generally includes interest, dividends, and rental income generated from the estate’s assets. Any income earned after a person's death should be reported on the estate's income tax return. By correctly classifying and reporting this income, you can better manage estate obligations while utilizing small estates forms for efficient processing.

The 3-year rule refers to the time frame in which certain estate taxes can be claimed after a person's death. Typically, this rule allows estate executors to file necessary documents and make claims within three years of the deceased's passing. Being aware of this rule can help you navigate the estate process, especially when using small estates forms to expedite small estate settlements.

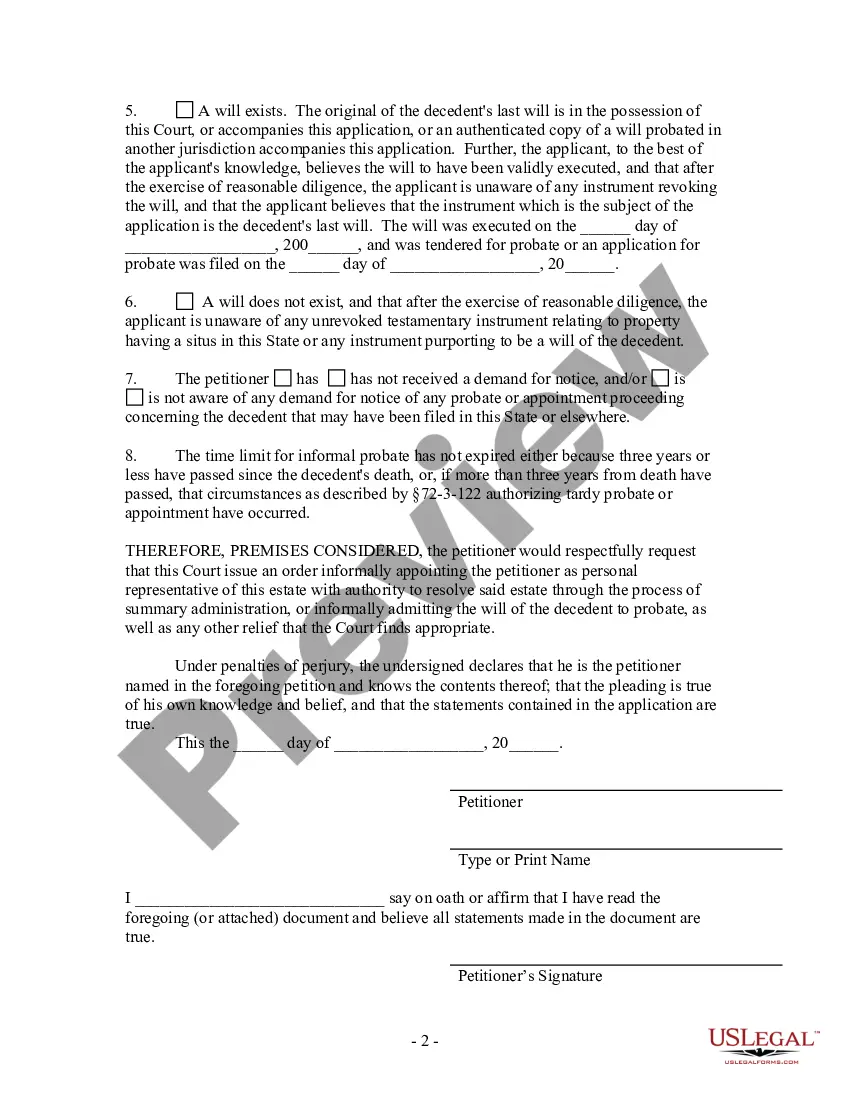

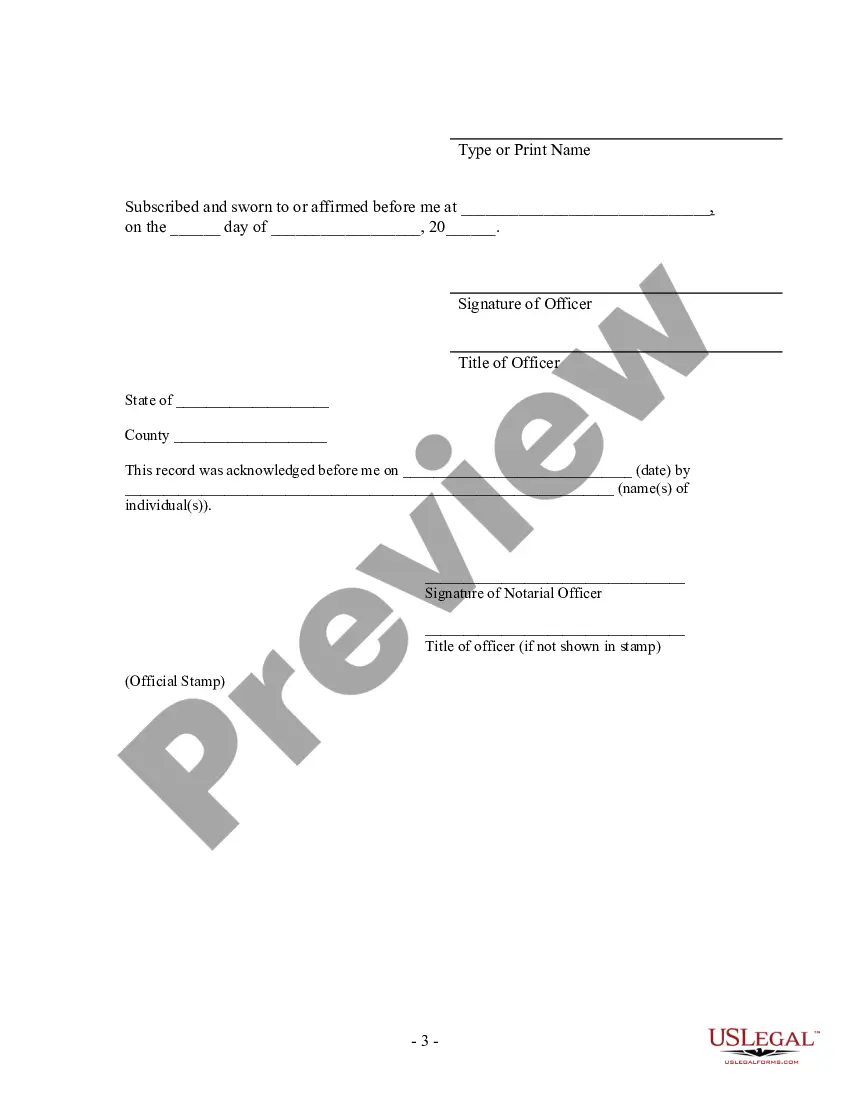

Filling out an estate document requires careful attention to detail. First, gather all necessary information about the decedent's assets and debts. Then, use a small estates form that outlines the distribution of the estate to heirs. Make sure to follow the instructions provided with the form to ensure it is completed correctly.

Certain assets, like life insurance policies with named beneficiaries, retirement accounts, and jointly owned property, do not go through probate. This means that if you want to avoid the lengthy probate process, it's beneficial to understand these exceptions. By utilizing small estates forms, you can simplify the transfer of these assets without additional legal hurdles.

In New York, any estate valued at more than $50,000 must typically go through probate. This process ensures that debts are settled and assets are distributed according to the will or state law, if no will exists. Estates below this threshold may qualify for the small estates form, allowing for a quicker settlement. Knowing this information can help families plan their estate management more effectively.

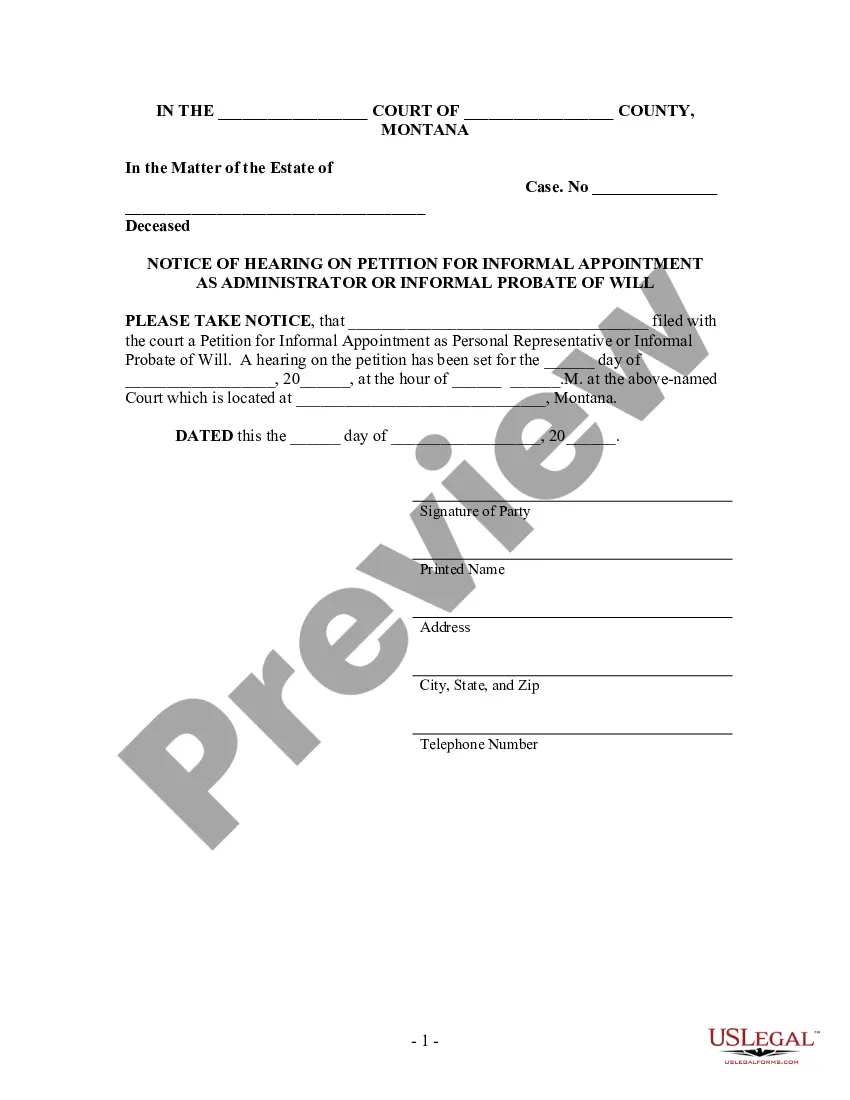

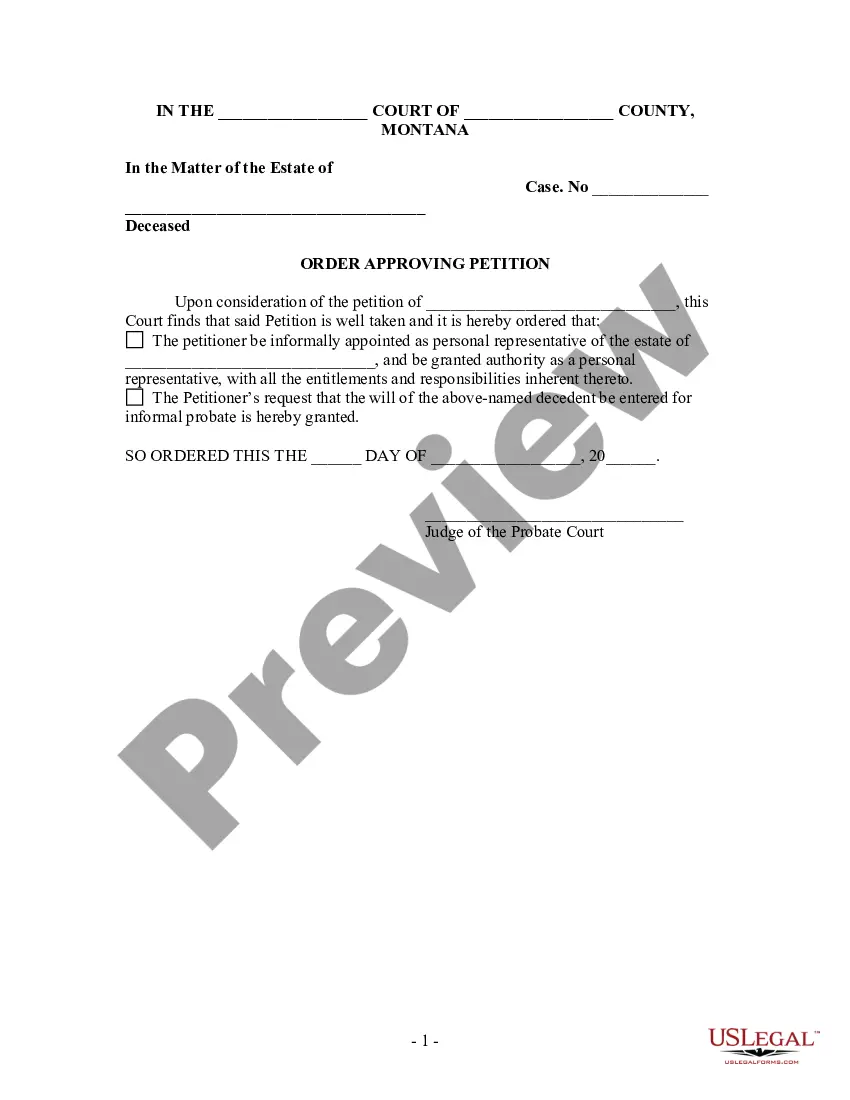

The approval time for a small estate affidavit can vary, but it typically takes a few days to a few weeks, depending on the county's workload and processing efficiency. After submitting the small estates form, the court will review the documentation to ensure it meets legal requirements. This expedited process is advantageous for heirs who need quick access to the decedent's assets. Using a reliable resource can help you understand the requirements and streamline this process.

In New York, there is no set minimum probate amount for filing a will. However, all estates valued above $50,000 generally require the probate process to distribute the assets legally. If the estate is under this threshold, heirs may use the small estates form to expedite asset transfer. Understanding these thresholds can help you make informed decisions regarding estate planning and management.