Subordination Agreement Form For Second Lien Holders

Description

How to fill out Montana Lease Subordination Agreement?

Regardless of whether you handle documentation frequently or occasionally need to file a legal report, it is crucial to obtain a resource where all examples are relevant and current.

The initial step you must take with a Subordination Agreement Form For Second Lien Holders is to confirm that it is indeed the latest version, as it determines its eligibility for submission.

If you wish to streamline your search for the most recent document examples, look for them on US Legal Forms.

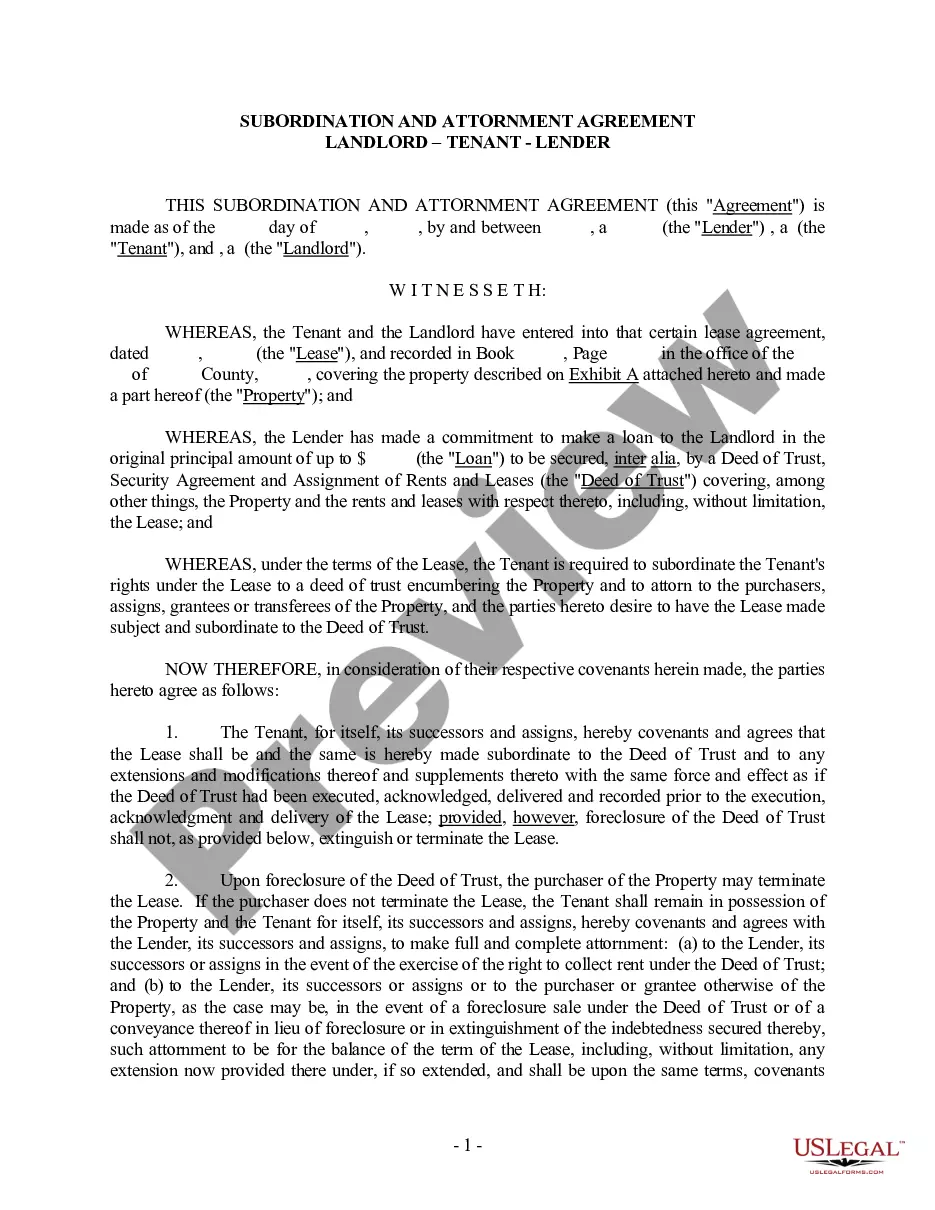

Utilize the search menu to locate the form you need. View the Subordination Agreement Form For Second Lien Holders preview and outline to make sure it is precisely what you're seeking. After verifying the form, just click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Use your credit card information or PayPal account to finalize the purchase. Choose the document format for download and confirm it. Eliminate the confusion associated with legal documentation. All your templates will be neatly organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents housing virtually any document template you may need.

- Search for the templates you need, evaluate their relevance immediately, and learn more about how to use them.

- With US Legal Forms, you have access to over 85,000 document templates across a diverse range of industries.

- Locate the Subordination Agreement Form For Second Lien Holders samples in just a few clicks and save them anytime in your account.

- A US Legal Forms account provides you with easier access to all the samples you need with added convenience and less hassle.

- You merely need to click Log In in the site header and navigate to the My documents section where you can have all the forms you need at your fingertips, so you won't have to spend time searching for the correct template or assessing its relevance.

- To acquire a form without an account, adhere to these steps.

Form popularity

FAQ

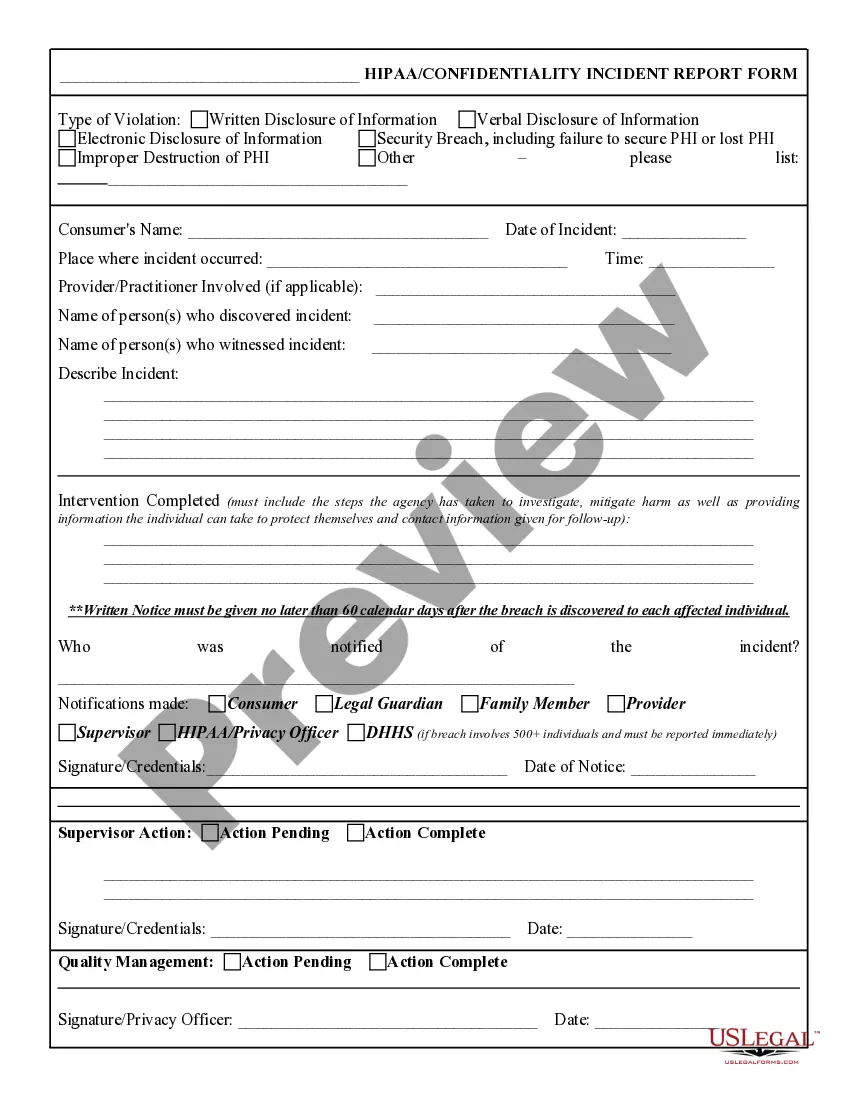

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

A subordinate loan agreement is a legal document that establishes the order in which creditors are paid. If a borrower is behind in payments on multiple debts, they may be able to use a subordinated loan agreement to help lenders collect on those debts.

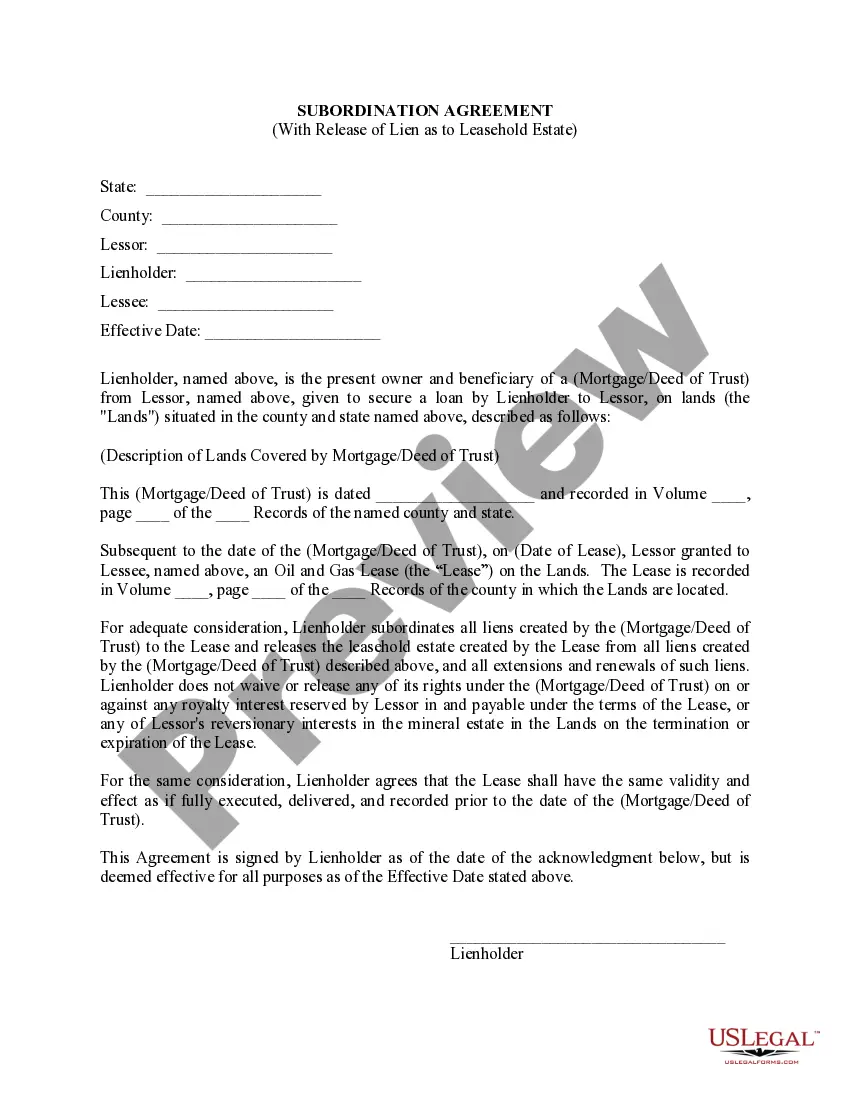

Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance. When you have a home equity line of credit, for example, you actually have two loans your mortgage and HELOC. Both are secured by the collateral in your home at the same time.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

Getting A Second MortgageA second mortgage will become a subordinate loan. If you repay the primary loan within the term of the second mortgage, then the second mortgage can take its place as the primary loan. As a second mortgage, the lender will be taking on more risk.