Montana Law For Final Paycheck

Description

How to fill out Montana Paternity Law And Procedure Handbook?

The Montana Statute Regarding Final Paychecks you find on this page is a reusable official template created by experienced attorneys in alignment with federal and regional regulations.

For over 25 years, US Legal Forms has offered individuals, companies, and legal practitioners more than 85,000 authenticated, state-specific documents for any business and personal event. It’s the fastest, easiest, and most reliable method to acquire the paperwork you require, as the service guarantees bank-grade data protection and anti-malware measures.

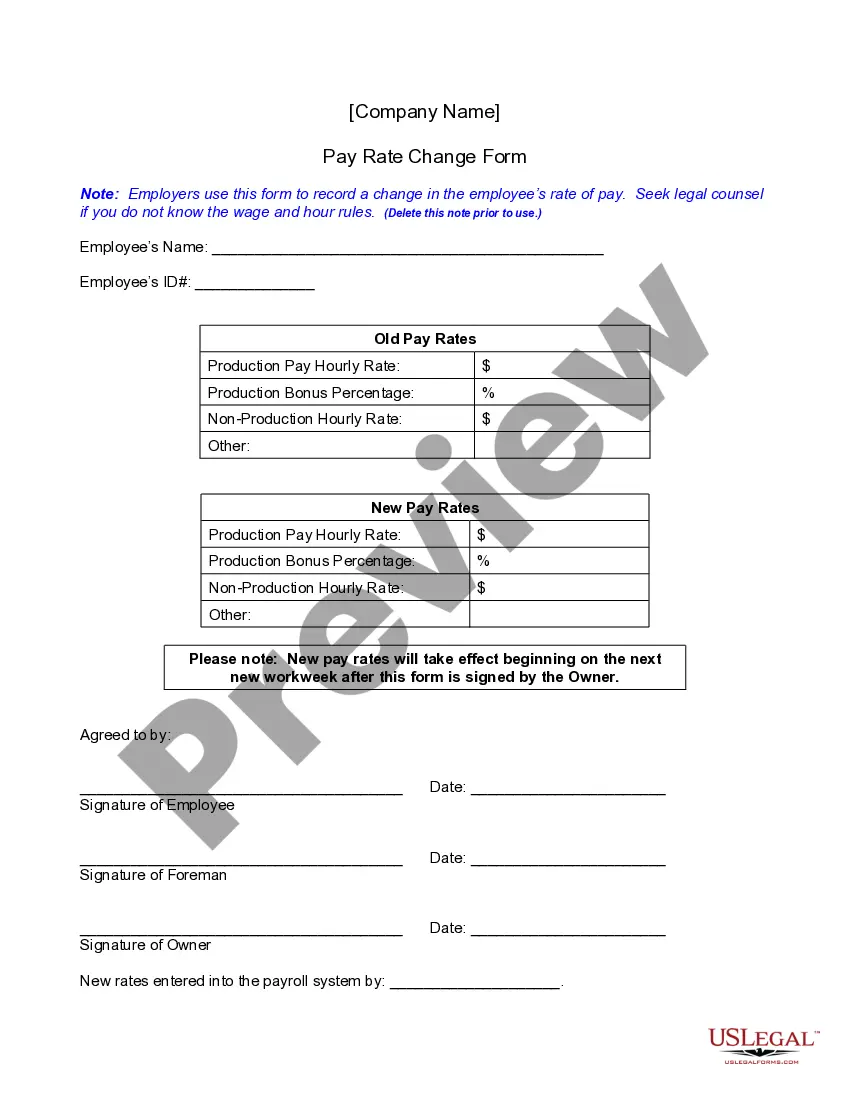

Pick the format you desire for your Montana Statute Regarding Final Paycheck (PDF, Word, RTF) and download the document onto your device. Fill in and sign the document. Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your form with an eSignature. Re-download your documents when needed. Use the same document again whenever necessary. Visit the My documents tab in your profile to re-download any forms you have bought previously. Register for US Legal Forms to access authenticated legal templates for all of life's situations at your fingertips.

- Select the document you need and examine it.

- Review the sample you searched for and preview it or consult the form description to ensure it meets your needs. If it doesn’t, use the search bar to find the right one. Click Buy Now once you have found the template you require.

- Register and Log In.

- Pick the pricing plan that fits you and create an account. Utilize PayPal or a credit card for quick payment. If you already own an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

If an employee is laid off, or discharged, all wages are due immediately unless the employer has a pre-existing, written personnel policy that extends the time for payment. The wages cannot be delayed beyond the next pay day for the period in which the separation occurred, or 15 days, whichever occurs first.

Private sector employers are not required to pay out severance pay, sick leave, or paid time off (PTO). These are considered benefits and may be paid based on the employer's policies. There is no requirement in state law to provide these benefits.

Three U.S. states (California, Colorado, and Montana) prohibit use-it-or-lose-it policies for vacation time, which means that unused vacation time must carry over from year to year. Or, employers can choose to cash out unused vacation pay at the end of the year.

Final paychecks in Montana If an employee is terminated or laid off, they must be paid all final wages immediately upon separation unless there is a written policy that extends the payment to the next regular payday or within 15 days, whichever comes first.

Montana prohibits use-it-or-lose-it for vacation time. Together, Montana statute and case law mean that use-it-or-lose-it policies are not allowed for vacation time. This includes use-it-or-lose-it by a particular date, and use-it-or-lose-it at employment separation. Montana allows use-it-or-lose-it for sick leave.