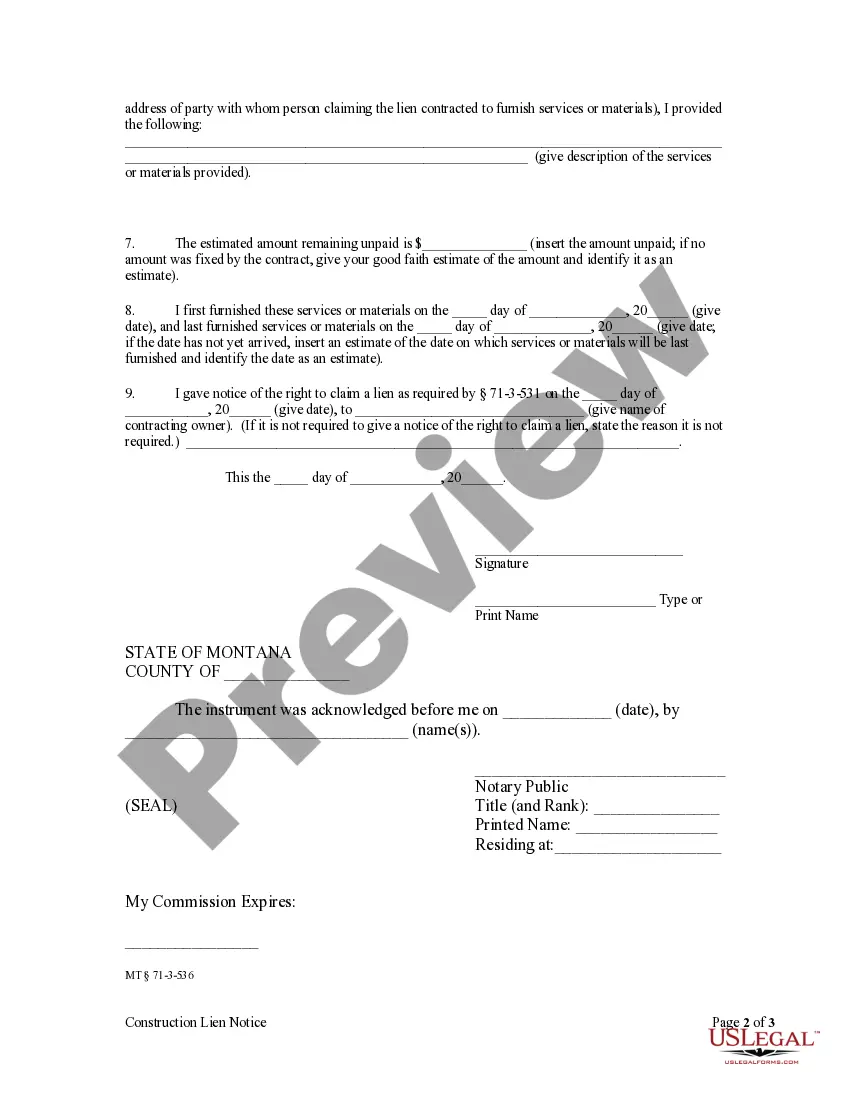

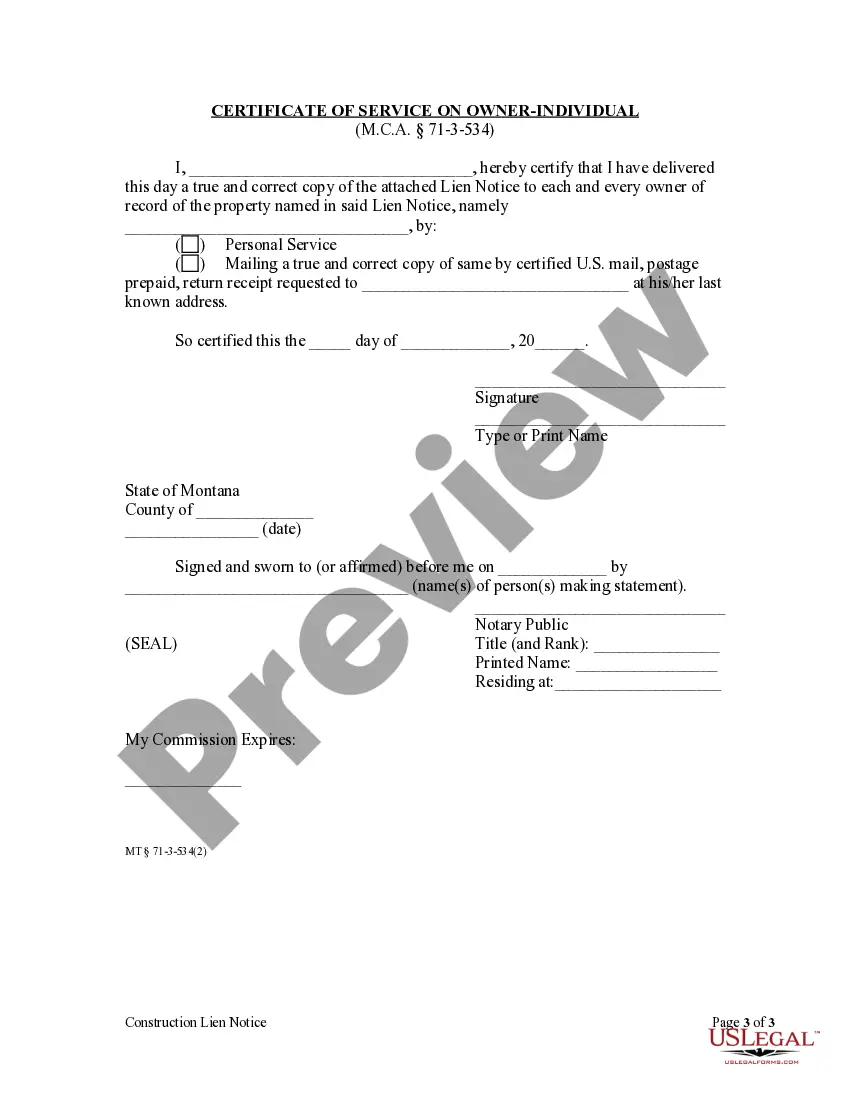

Montana law sets out the form for the filing of a Construction Lien. The Lien Notice form supplies all of the needed information to put all parties in interest on Notice of the lien claimant's lien. It must be filed within ninety (90) days of the final furnishing of services or materials or within ninety (90) days of the filing of a Notice of Completion.

Montana Lien Law Withholding Tax

Description

How to fill out Montana Construction Lien Notice - Individual?

Legal managing may be overwhelming, even for skilled specialists. When you are interested in a Montana Lien Law Withholding Tax and do not have the a chance to spend in search of the right and up-to-date version, the operations might be nerve-racking. A robust online form catalogue might be a gamechanger for anyone who wants to handle these situations effectively. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms available to you anytime.

With US Legal Forms, you can:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any requirements you might have, from personal to enterprise papers, all-in-one spot.

- Employ innovative tools to finish and control your Montana Lien Law Withholding Tax

- Access a resource base of articles, instructions and handbooks and materials connected to your situation and needs

Save effort and time in search of the papers you need, and utilize US Legal Forms’ advanced search and Preview feature to get Montana Lien Law Withholding Tax and download it. In case you have a monthly subscription, log in to the US Legal Forms profile, search for the form, and download it. Review your My Forms tab to find out the papers you previously saved and to control your folders as you can see fit.

Should it be your first time with US Legal Forms, make a free account and have limitless access to all benefits of the platform. Listed below are the steps to consider after getting the form you need:

- Confirm it is the right form by previewing it and looking at its description.

- Ensure that the sample is acknowledged in your state or county.

- Select Buy Now when you are ready.

- Choose a subscription plan.

- Pick the formatting you need, and Download, complete, sign, print and deliver your papers.

Benefit from the US Legal Forms online catalogue, supported with 25 years of expertise and trustworthiness. Change your everyday papers managing in to a smooth and user-friendly process today.

Form popularity

FAQ

You have 3 years after a tax lien is placed on your property to pay all past due taxes, plus interest, penalties, and other costs, before you could lose your property through a public auction.

The taxpayer has 36 months to redeem their property. This process will repeat itself the following two years if no taxes are paid.

You must file your lien within ninety (90) days of your last work and/or materials supplied. You must send the Owner a copy of the lien that you file. You must file suit to enforce your lien within two (2) years of the date that it was filed.

You must send the Owner notice of your right to claim a lien within twenty (20) days of first work performed and/or materials supplied. You must file this notice of your right to claim a lien with the county recorder where the property is located within five (5) days of sending the notice to the Owner.

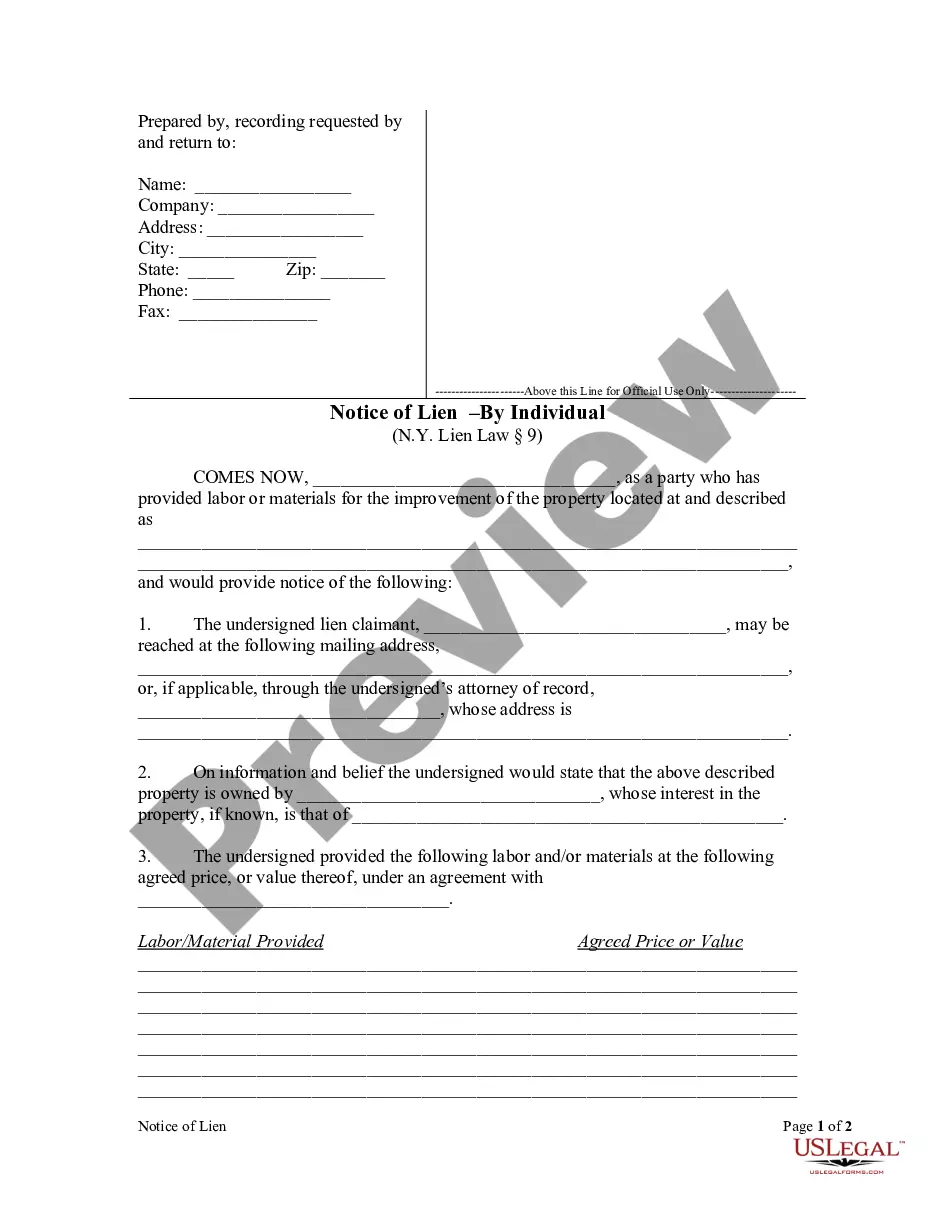

How to File a Montana Mechanics Lien | A Step-by-Step Guide to Get You Paid Properly identify yourself. Identify the property owner(s) Describe the labor or materials provided. Identify the hiring party. State the amount of the lien claim. Provide the first and last dates when labor or materials were provided.