Mississippi Trust Sample With No Experience

Description

Form popularity

FAQ

While many assets can be held in a trust, a Mississippi trust sample with no experience should exclude certain items. Typically, personal items like your primary residence or vehicles may have better management outside of trust structures. Likewise, some retirement accounts cannot be directly transferred into a trust. To avoid pitfalls, review the guidelines available on US Legal Forms for comprehensive understanding.

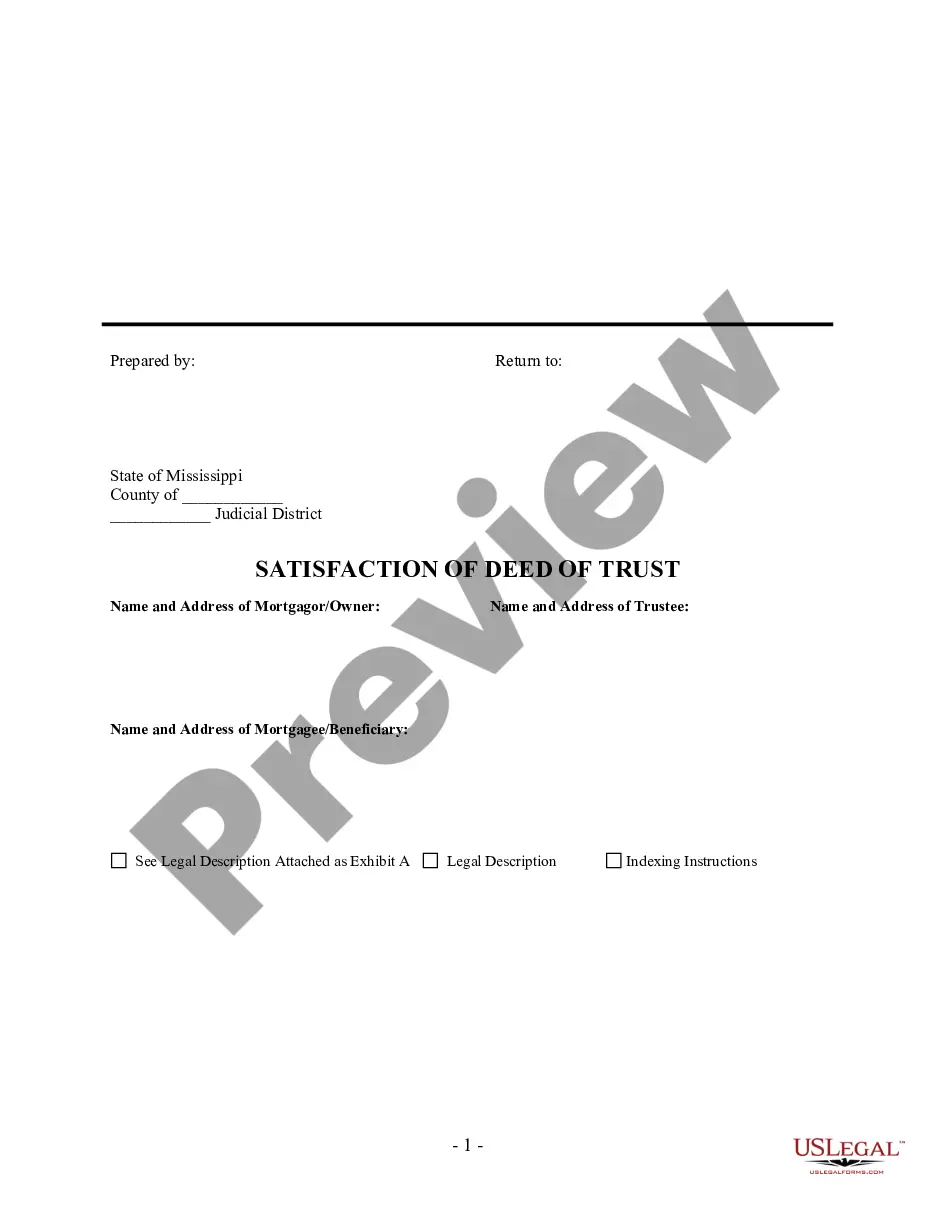

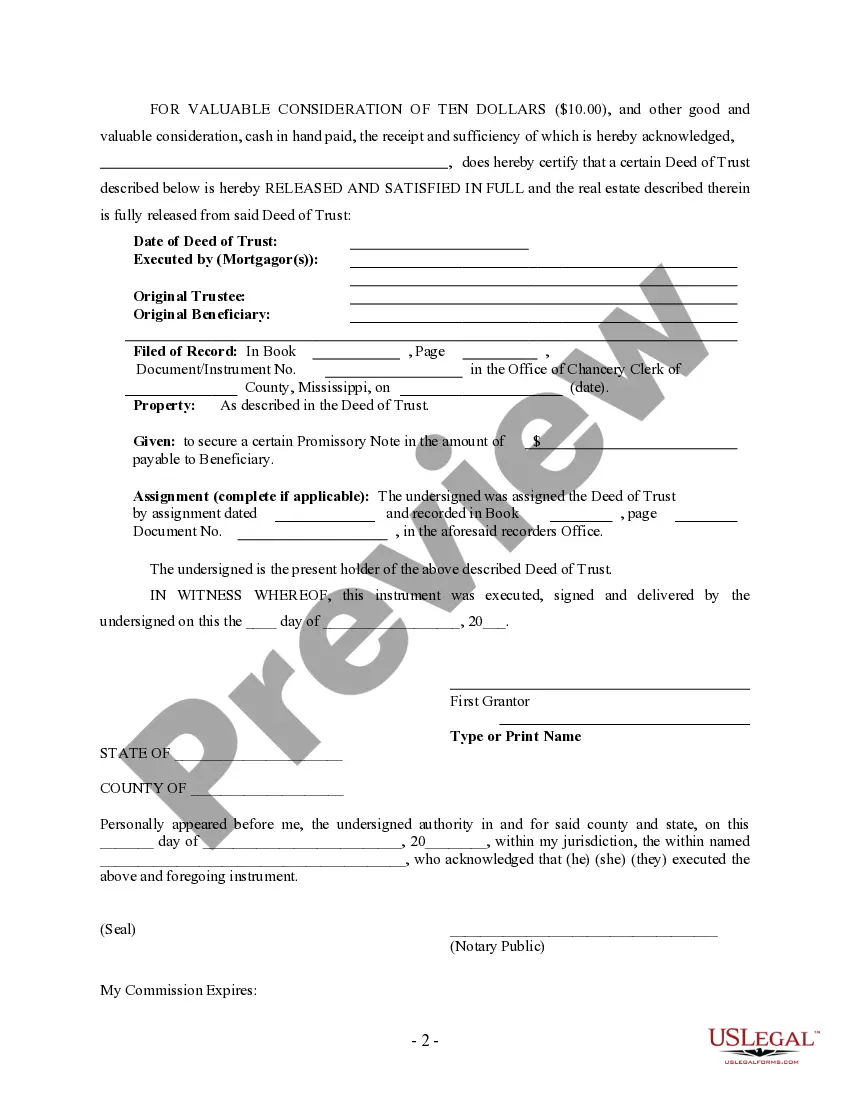

Writing a simple trust does not have to be complicated, especially with a Mississippi trust sample with no experience. Start by outlining the grantor, trustee, and beneficiaries along with their respective roles. Then, specify the assets held within the trust and how they will be distributed. US Legal Forms offers easy-to-follow templates that can simplify this process for you.

Certain assets may not be ideal for a Mississippi trust sample with no experience. For instance, retirement accounts typically require specific beneficiary designations instead of being held in a trust. Additionally, personal belongings that are hard to transfer should be managed outside of a trust. Consulting resources through US Legal Forms can provide clarity on managing these assets.

Creating a Mississippi trust sample with no experience can present risks. If established incorrectly, beneficiaries may not receive the intended benefits. Additionally, maintaining a trust requires ongoing management, which can be burdensome for some individuals. To mitigate these risks, consider using professional services like US Legal Forms to guide you in setting up your trust accurately.

The 5 year rule for trusts typically relates to the look-back period for Medicaid asset transfers. If you place assets in a trust and then apply for Medicaid, any transfer made within five years may be scrutinized. Understanding this rule is key for anyone using a Mississippi trust sample with no experience, and uslegalforms can provide straightforward templates that clarify these rules for easier compliance.

The payout rule for trusts refers to how and when distributions are made to beneficiaries. In many cases, a trustee can choose to distribute income or principal according to the trust document's terms. If you are looking for a Mississippi trust sample with no experience, uslegalforms offers templates that clearly define payout rules, making the process easier for you.

Trusts may need to file tax returns annually, depending on their income and structure. If the trust generates taxable income, it must file Form 1041, U.S. Income Tax Return for Estates and Trusts. For individuals seeking a Mississippi trust sample with no experience, understanding tax obligations is vital, and uslegalforms can provide the necessary forms and instructions to ensure compliance.

Yes, the 5 year rule can apply to certain trusts, particularly in the context of Medicaid eligibility. If you transfer assets to a trust within five years of applying for Medicaid, those assets may still affect your eligibility. For a Mississippi trust sample with no experience, it's crucial to understand these implications, and uslegalforms offers valuable resources to help you navigate this complex area.

To establish a trust in Mississippi, you need to create a legal document outlining the terms of the trust. This document should specify the trust's beneficiaries, the trustee, and the assets involved. For those seeking a Mississippi trust sample with no experience, using platforms like uslegalforms can simplify the process. They provide templates and guidance, making it easy to set up a trust that meets your specific needs.

Writing a simple trust begins with defining the trust's purpose and identifying the beneficiaries. Next, detail the assets included in the trust and how they will be managed. Utilizing a Mississippi trust sample with no experience can provide essential guidance on wording and structure. Always ensure that your trust is legally compliant to protect your assets and your loved ones.