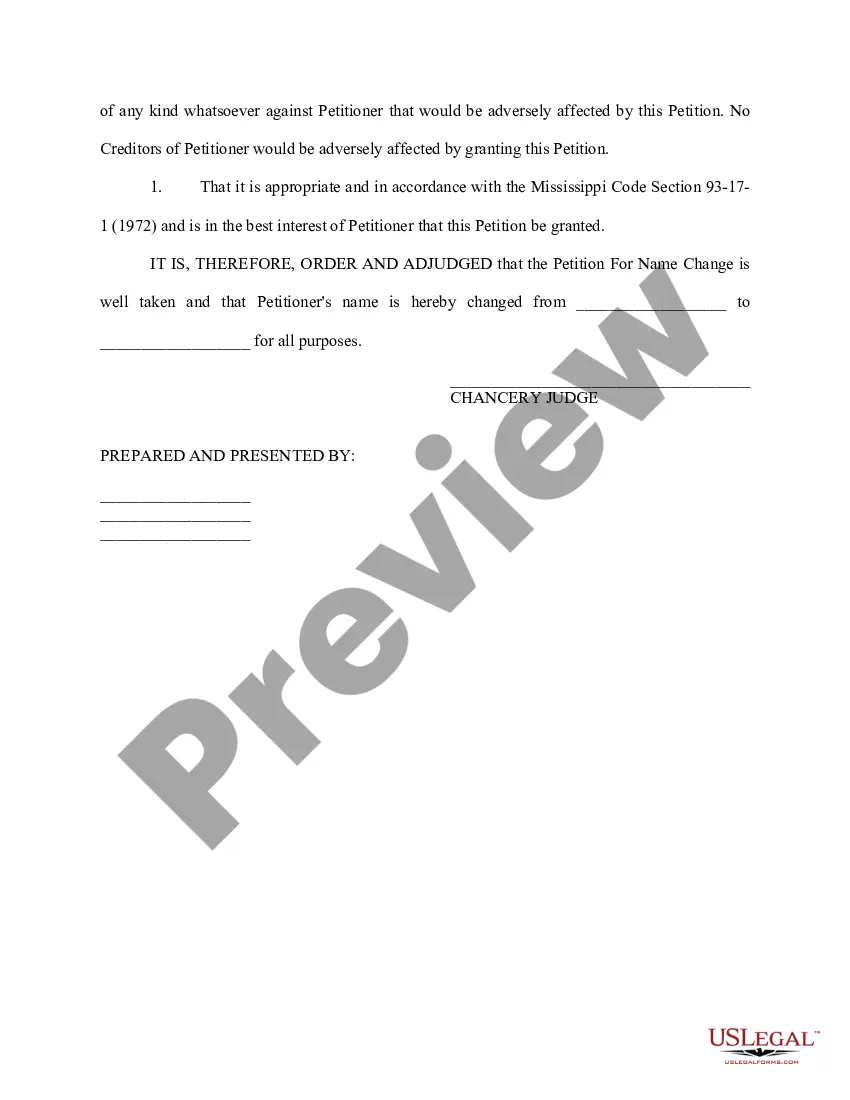

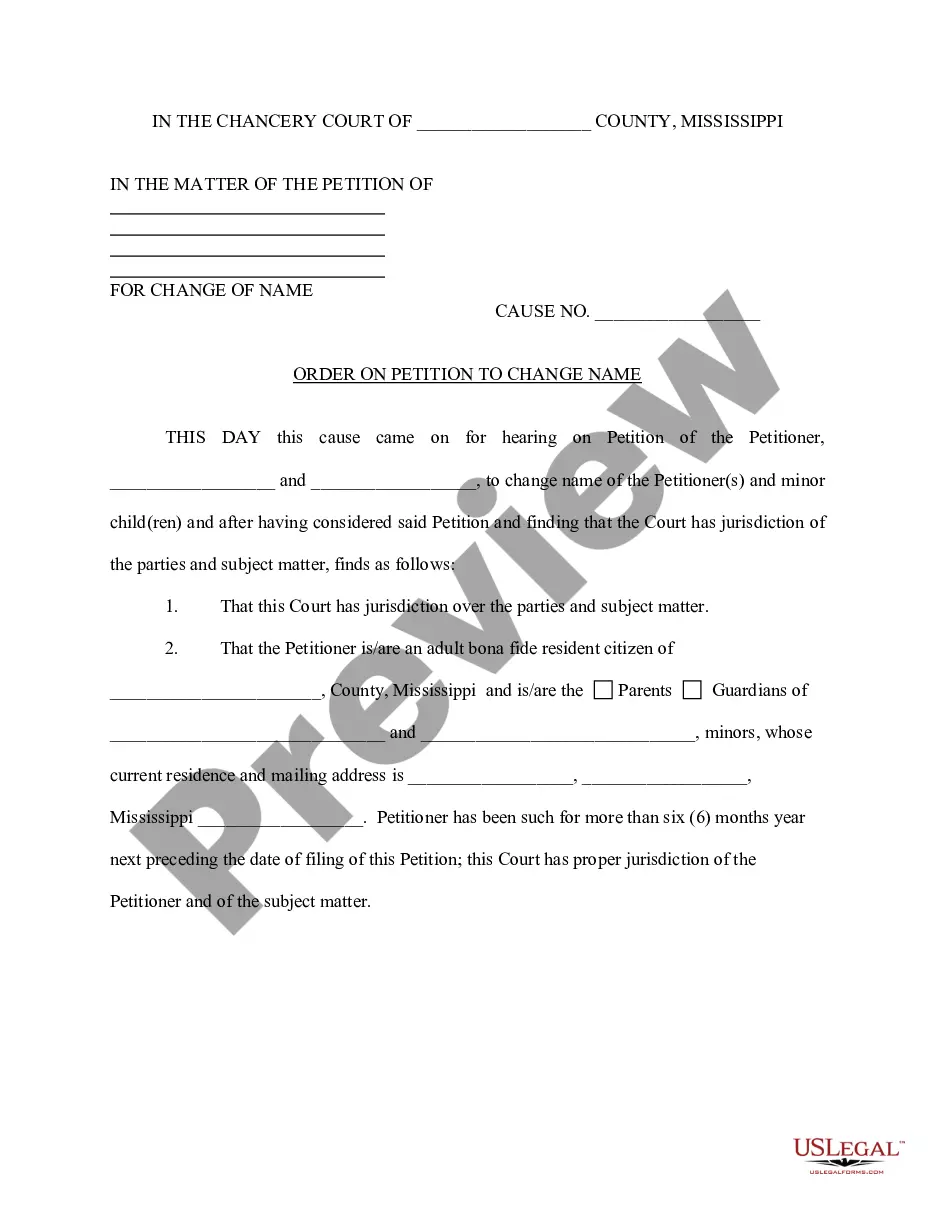

Order Of Name Change Form For Irs

Description

Form popularity

FAQ

Editing a PDF tax form can be done using various software tools specifically designed for PDF editing. Look for options that allow you to make text changes, and remember to save your updated document. If you're changing your name for IRS records, make sure to complete the order of name change form for IRS to reflect this change properly. After editing the PDF, check for any additional requirements before submission.

To amend your tax form, you'll need to file a Form 1040-X with the IRS. This form allows you to make corrections, including those related to your name. If you’ve changed your name recently, remember to file the order of name change form for IRS simultaneously to update your records seamlessly. This process ensures your amendments will be processed smoothly.

While you cannot completely delete a filed tax return, you can file an amended return to correct any mistakes. This approach allows you to present accurate information to the IRS. If you've changed your name, using the order of name change form for IRS will help update your records. Always ensure your documents align with your current legal name to avoid issues.

To edit your tax documents, start by accessing the file on your computer. You can often make changes directly if it’s a digital document. If you need to update your name for IRS purposes, consider using the order of name change form for IRS to ensure proper documentation. Once you've made your changes, save the file again to keep your updated information.

To correct an IRS form, you need to file the appropriate amended return, usually using Form 1040X. First, check your original form for errors and prepare to correct them. Also, if you changed your name, make sure to order the name change form for IRS to ensure that all records are updated accordingly.

If you mistakenly amend your tax return, don't panic. You can file another amended return to correct the change. Make sure you order the name change form for IRS if the amendment relates to a name update, and ensure that the new amended return reflects the correct information.

As of now, you cannot file Form 1040X electronically for every tax year. Some tax software providers do offer this option for recent years. When you need to correct your name with the IRS, make sure you order the name change form for IRS, as this might be necessary before submitting your amended return.

Typically, there is no penalty for filing an amended return if you are correcting an error. However, if the amended return results in additional taxes owed, you may incur interest and penalties on that amount. To avoid complications, properly order the name change form for IRS if applicable, ensuring your amended return is submitted on time.

Changing your tax form involves filling out an amended return, often Form 1040X. Begin by gathering your original tax information and then order the name change form for IRS if your name has changed. Ensure your amended form reflects any new changes accurately before submission.

To amend your IRS records, you will need to complete the correct form that corresponds to your tax year. For changes related to your name, first ensure you order the name change form for IRS through uslegalforms. After obtaining the form, fill it out completely and mail it to the appropriate IRS address as directed.