Sample Subpoena To Accountant For Tax Return

Description

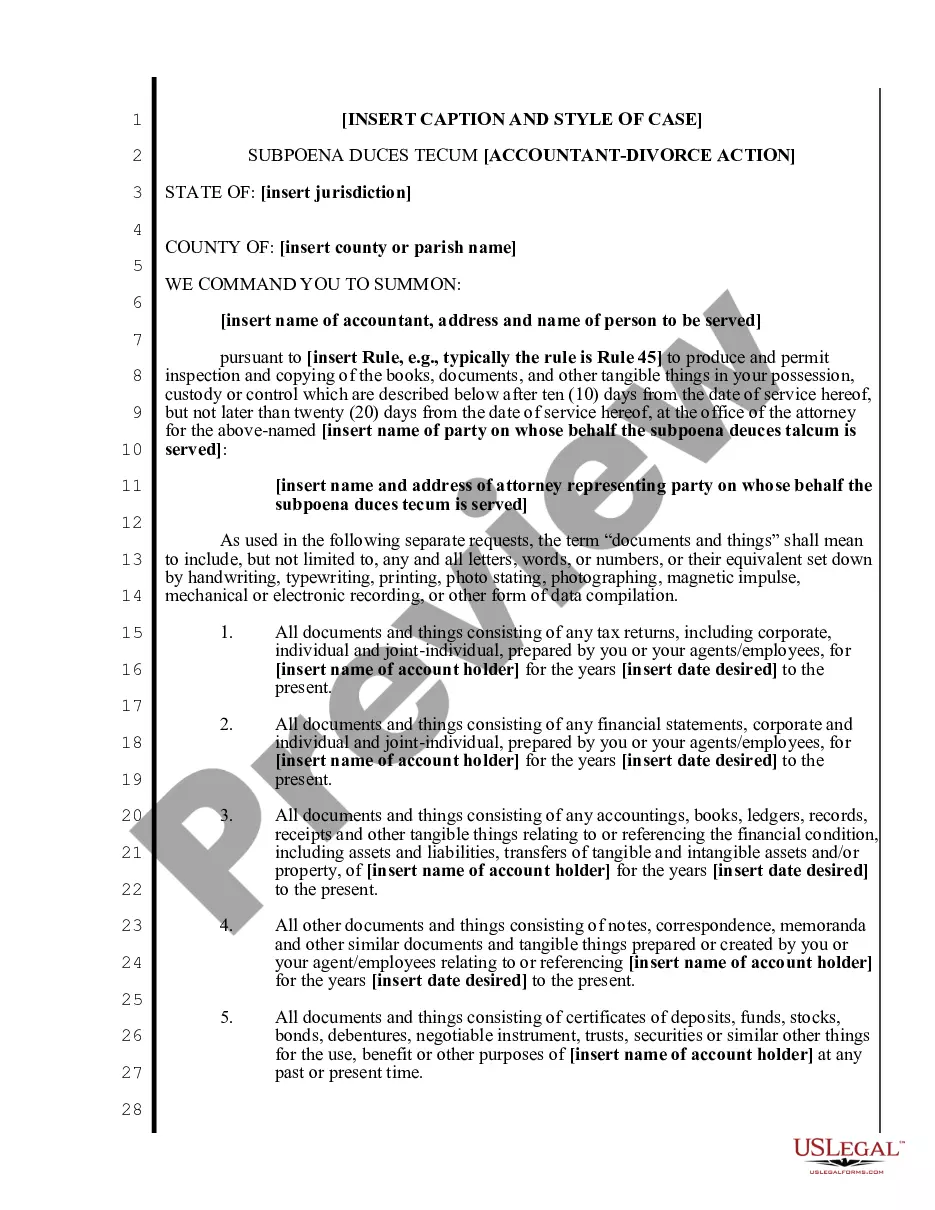

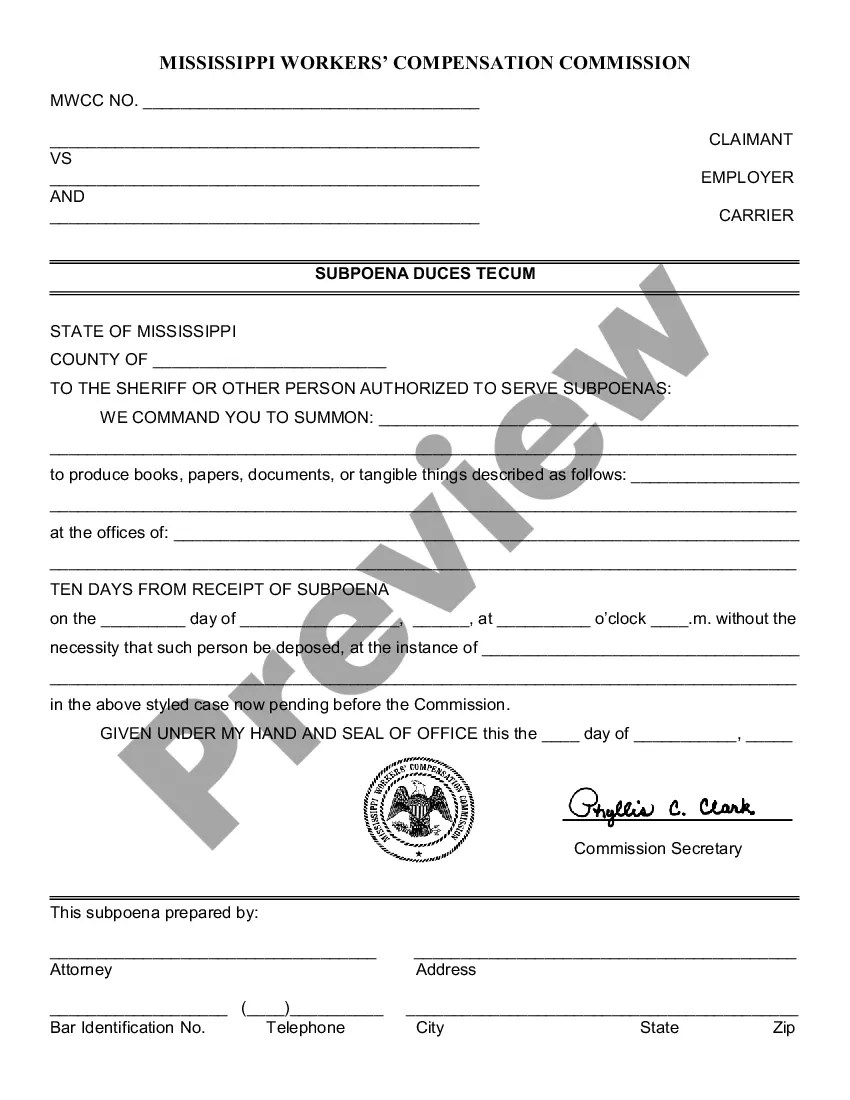

How to fill out Mississippi Subpoena Duces Tecum - Accountant - Divorce Action?

Utilizing legal document samples that adhere to national and local regulations is essential, and the internet provides a variety of choices to select from.

However, what’s the use of spending time searching for the appropriately drafted Sample Subpoena To Accountant For Tax Return sample online when the US Legal Forms online library already compiles such templates in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable templates created by lawyers for any personal and business circumstance.

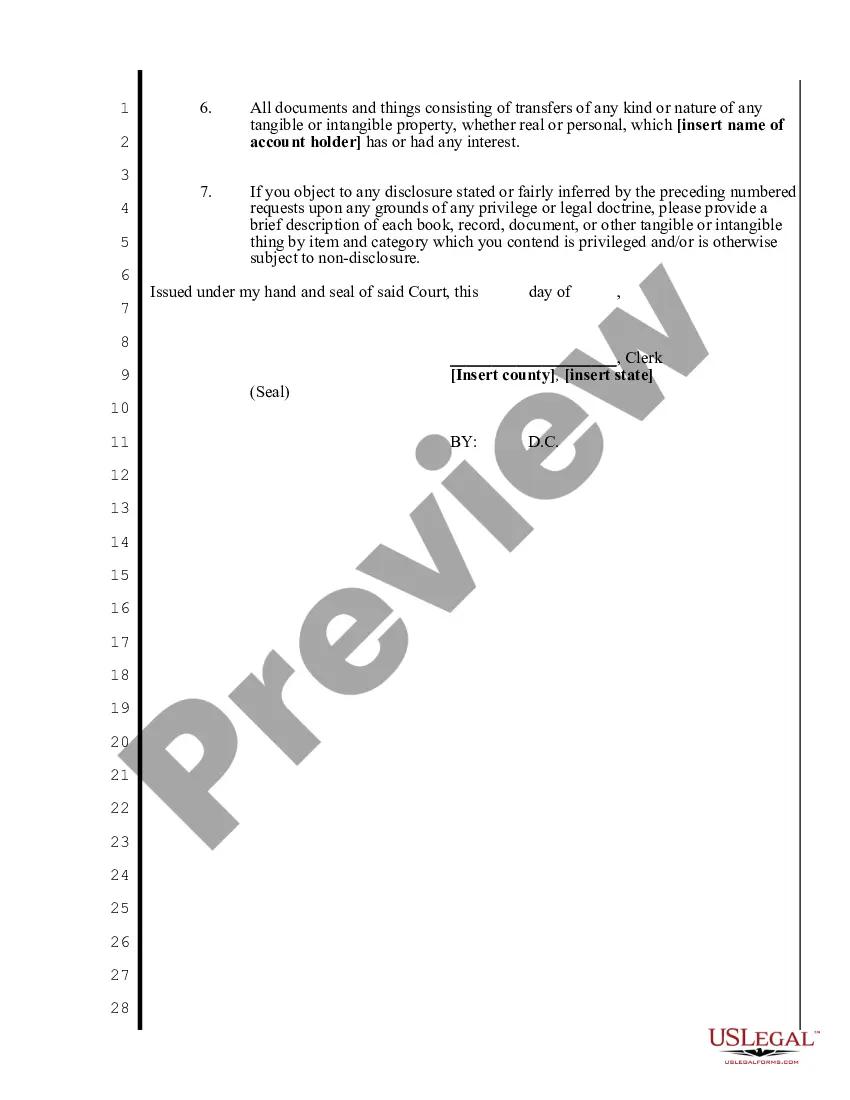

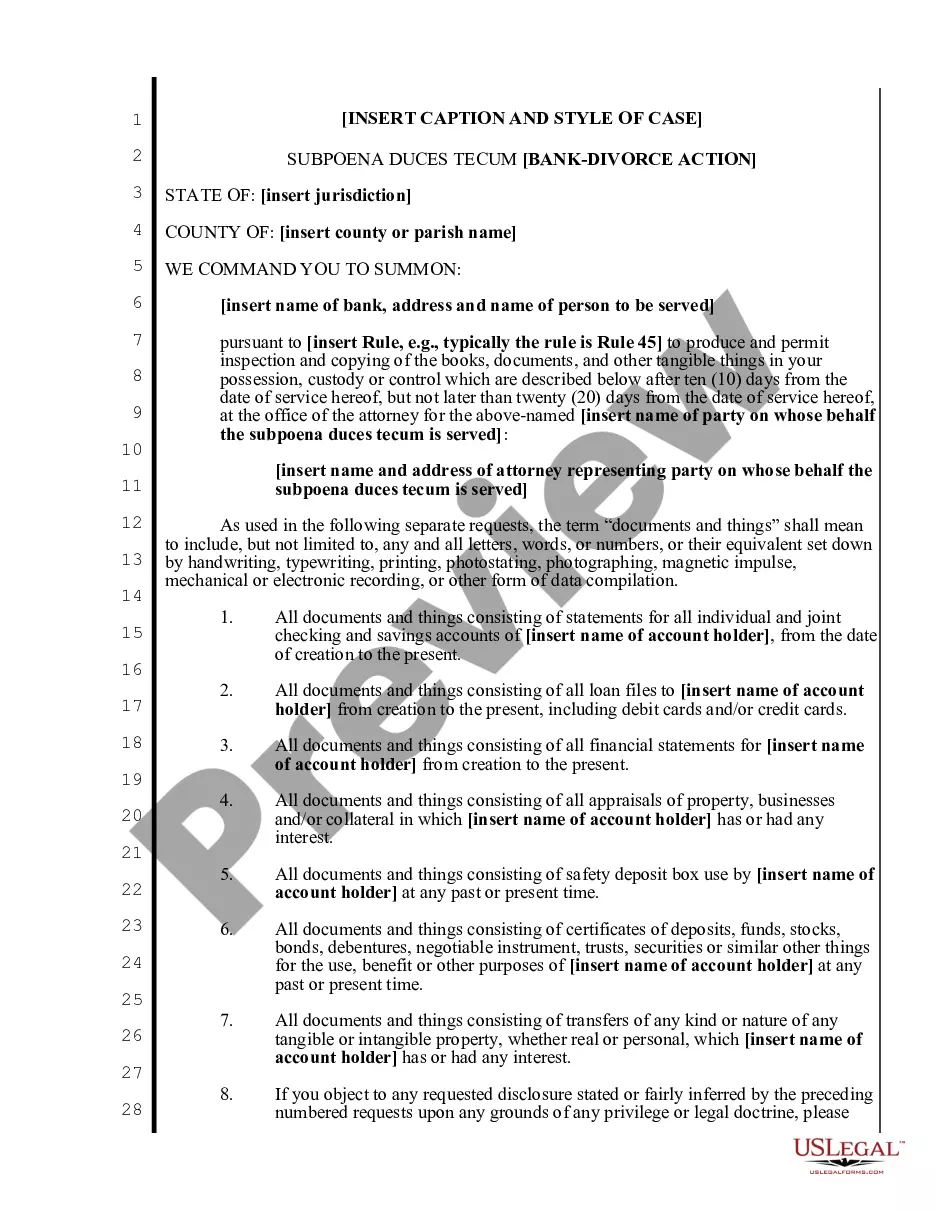

Evaluate the template using the Preview option or through the text description to confirm it satisfies your needs.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts stay updated with legislative changes, ensuring your paperwork is current and compliant when acquiring a Sample Subpoena To Accountant For Tax Return from our site.

- Retrieving a Sample Subpoena To Accountant For Tax Return is swift and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you need in the appropriate format.

- If you are new to our website, follow the steps outlined below.

Form popularity

FAQ

A subpoena for financial records is a legal document that compels an individual or organization to provide specific financial information. This can include bank statements, tax returns, and other relevant documents. When dealing with such requests, using a sample subpoena to accountant for tax return can simplify the process and ensure all necessary details are included.

Yes, you can subpoena the IRS for tax returns, but it involves specific legal processes and conditions. The IRS typically protects taxpayer information, so you must demonstrate a compelling need for those documents. A sample subpoena to accountant for tax return can aid in framing your request appropriately.

To stop a subpoena for bank records, you may file a motion to quash it in court. This legal action challenges the validity of the subpoena, often on the grounds of relevance or overreach. Seeking guidance from legal experts who understand the sample subpoena to accountant for tax return could strengthen your case.

Responding to a subpoena for records requires careful consideration. You should review the document to understand what is requested and the deadline for compliance. If you need assistance, utilizing a sample subpoena to accountant for tax return can provide clarity on how to prepare the required documents properly.

A lawyer may subpoena bank records to gather crucial financial information in a legal case. These records can help verify claims, uncover assets, or provide evidence against a party. By using a sample subpoena to accountant for tax return, the lawyer ensures compliance and obtains the necessary documents efficiently.

Accessing someone else's tax return typically requires their consent or a legal basis, such as a court order. If you believe you have a valid reason for accessing this information, you may need to initiate legal proceedings. In this case, issuing a sample subpoena to accountant for tax return could be a necessary step.

No, IRS tax returns are generally not considered public records. Information on your tax returns is kept confidential and only shared with specific parties related to legal proceedings. However, obtaining a sample subpoena to accountant for tax return can facilitate access to the records necessary for legal matters.

Yes, accountants can be held accountable for their actions, particularly if they violate professional standards or laws. If you suspect wrongdoing, it’s important to document your concerns and seek legal advice. Under certain circumstances, a sample subpoena to accountant for tax return can play a key role in gathering evidence.

It is advisable to consult a lawyer before speaking to the IRS to protect your rights. A lawyer can guide you through the process and help prepare your statements. In certain scenarios, a sample subpoena to accountant for tax return can clarify necessary points if your accountant needs to testify.

Yes, accountants are generally required to maintain confidentiality regarding your financial information. This duty ensures trust in the accountant-client relationship. However, in cases of a subpoena, such as a sample subpoena to accountant for tax return, they may need to disclose specific information as ordered by a court.