Sample Subpoena To Accountant For Tax Preparation

Description

Form popularity

FAQ

When visiting a new accountant, bring all relevant financial documents, including past tax returns, bank statements, and receipts. This information will help your accountant understand your financial situation. Additionally, if you have received a sample subpoena to accountant for tax preparation, be sure to include those documents as well, as they can be crucial for your new accountant's assessment.

A notice of subpoena informs you that a subpoena has been issued that requires your attendance or documents. This notice serves as a formal warning, outlining what is required from you. If it relates to financial matters, utilizing a sample subpoena to accountant for tax preparation can provide clarity on how to respond appropriately.

Yes, it is possible to subpoena the IRS for your tax returns under certain circumstances, particularly in legal disputes. However, the process can be complex. By requesting a sample subpoena to accountant for tax preparation, you will better understand how to formulate your request and what information to include.

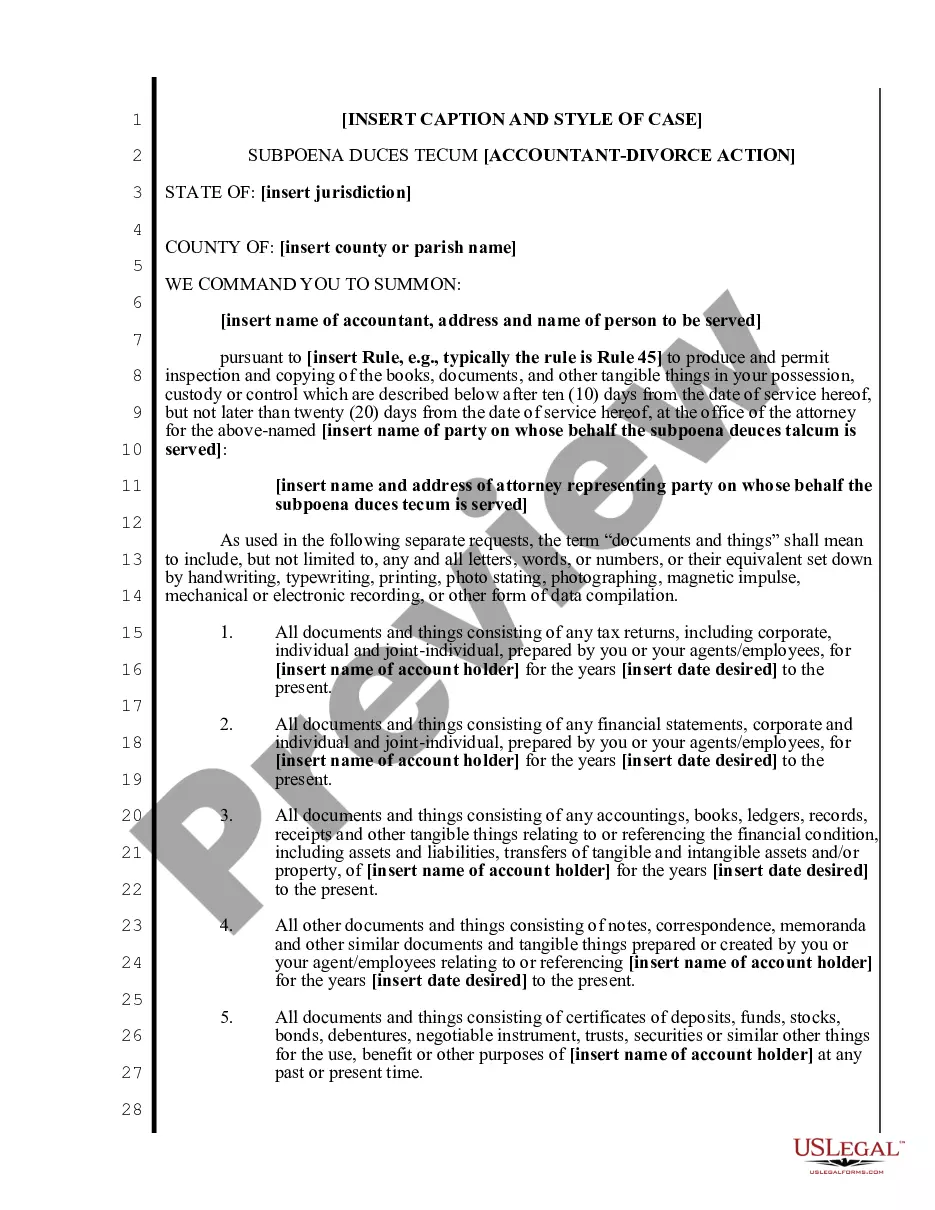

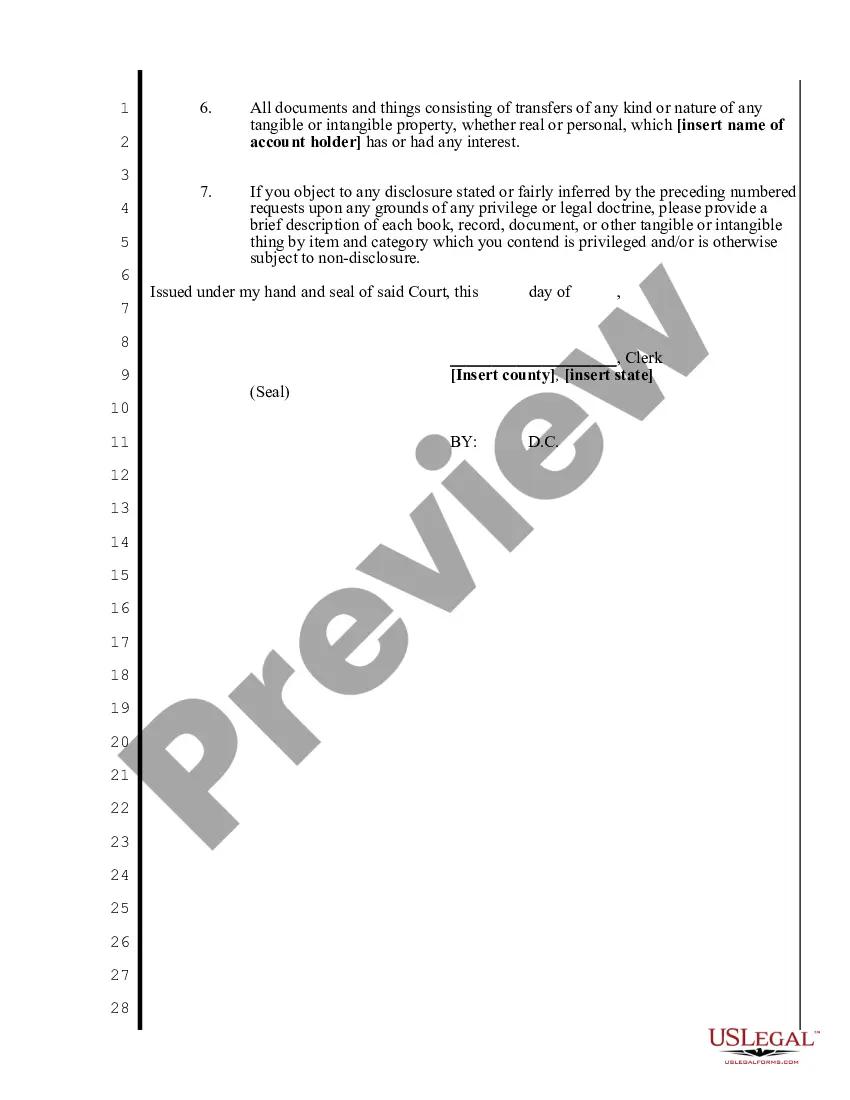

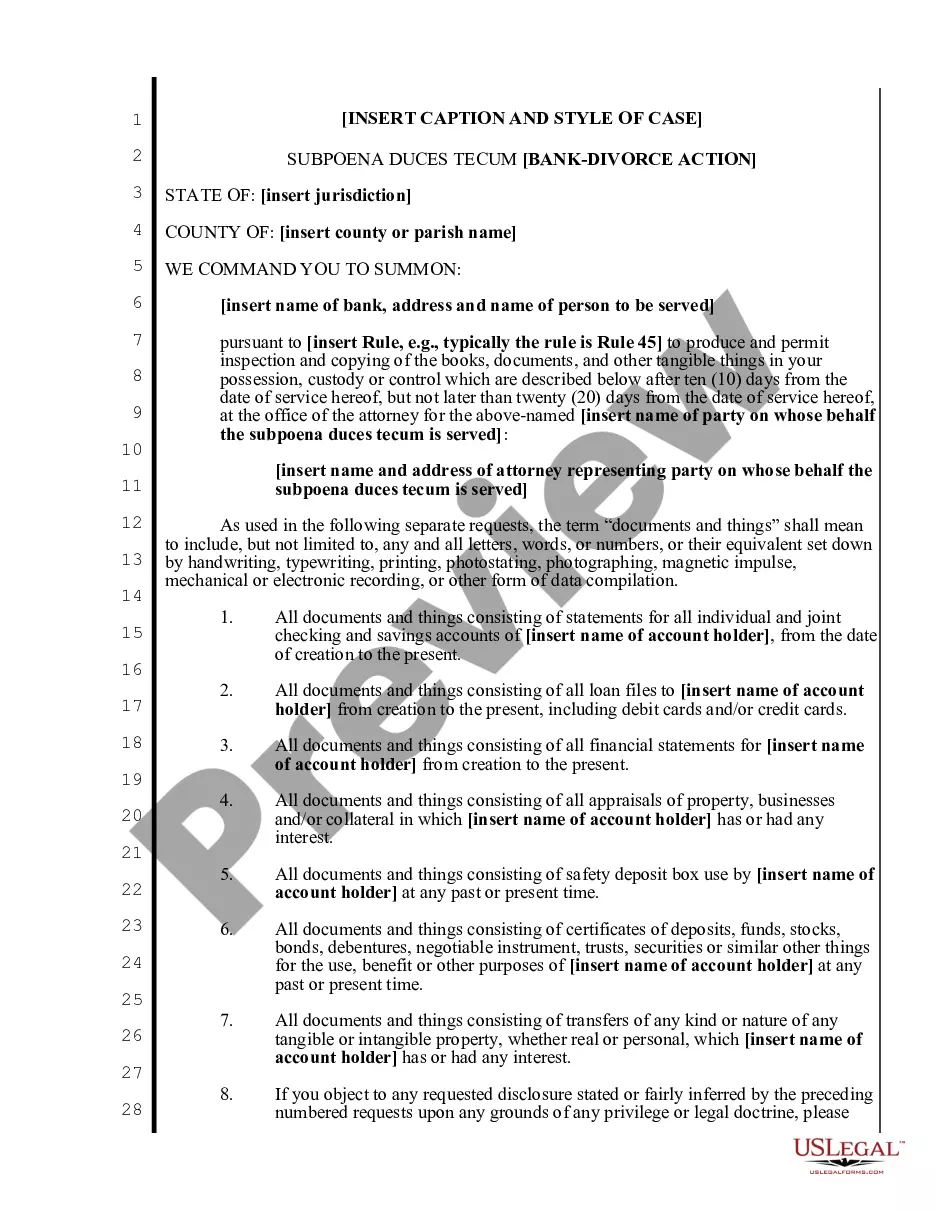

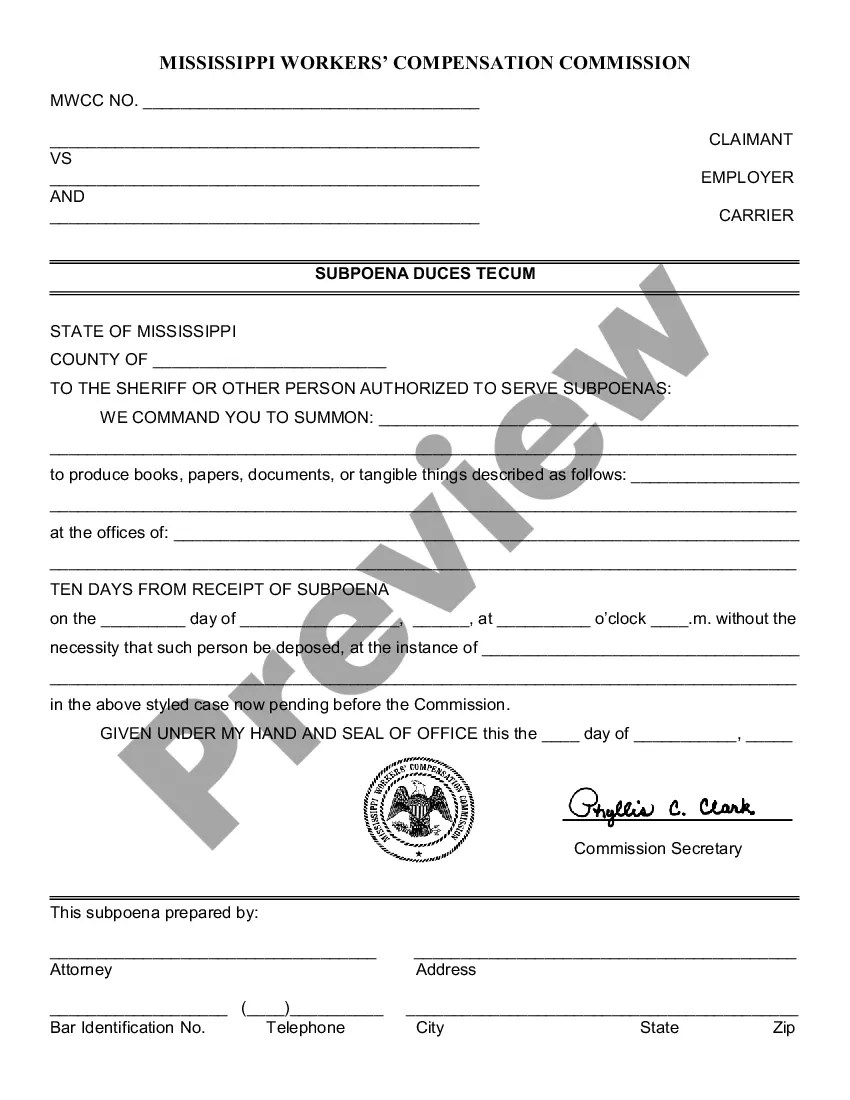

A subpoena for financial records is a legal document that requires an individual or organization to provide financial documents, like tax returns or account statements, to a court or legal entity. When you need to prepare your taxes, utilizing a sample subpoena to accountant for tax preparation can help ensure that you gather all necessary records efficiently. Always consult with a legal professional if you are unsure how to proceed.

You may receive a subpoena because a court or legal authority needs information relevant to a case. This document demands your presence or the production of specific documents, like financial records, which could include a sample subpoena to accountant for tax preparation. It’s important to respond in a timely manner to avoid potential legal consequences.

To write a good subpoena, clarity and specificity are key. Ensure that you articulate exactly what documents or testimony you need, especially when formulating a sample subpoena to accountant for tax preparation. Additionally, confirm that it complies with local laws and court rules for the best chance of enforcement. Utilizing platforms like uslegalforms can guide you in crafting a well-structured subpoena.

To write your own subpoena, start by clearly identifying the court and case details at the top of the document. Next, include a detailed description of the information or documents you wish to gather; this step is crucial when creating a sample subpoena to accountant for tax preparation. You should also include a compliance deadline and provide instructions on how the recipient can respond.

A valid subpoena typically includes the name of the court, the case number, and clear instructions on what is required from the recipient. It also usually specifies a deadline for compliance, ensuring timely response. If you're drafting a sample subpoena to accountant for tax preparation, make sure these elements are evident to avoid confusion or legal challenges.

Consulting with a lawyer before speaking to the IRS is usually advisable. A lawyer can help clarify your rights and obligations, especially in complex situations involving taxes. If you are unsure, preparing a sample subpoena to accountant for tax preparation may be a step to consider, emphasizing the importance of having legal guidance.

Subpoenaing the IRS for tax returns involves a formal process that may include filing specific forms or motions with the court. It's essential to present a valid legal reason for the request. Engaging a legal professional can guide you in drafting a sample subpoena to accountant for tax preparation and ensuring compliance with IRS rules.