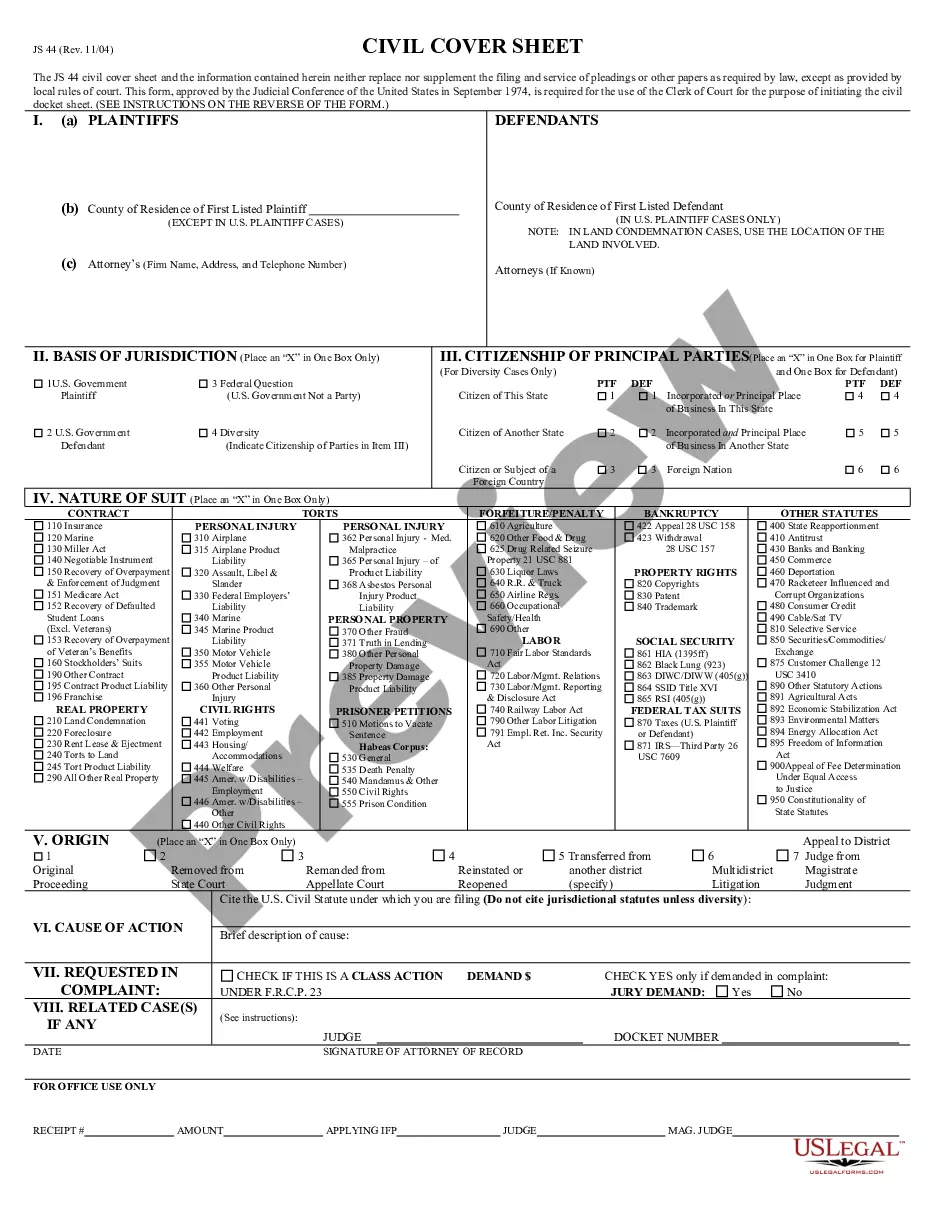

Civil Cover Sheet Mississippi Format

Description

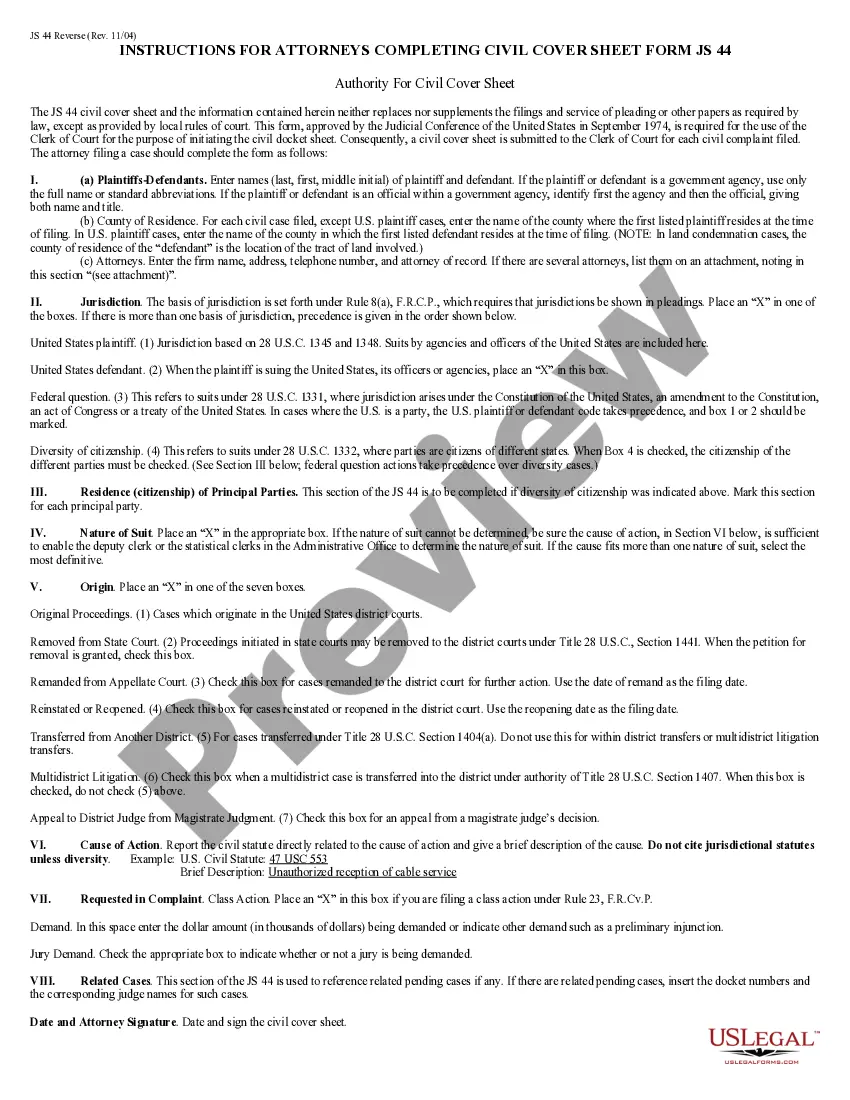

How to fill out Mississippi JS-44 Civil Cover Sheet - Federal District Court?

Managing legal documents can be daunting, even for the most skilled professionals.

When you're in search of a Civil Cover Sheet Mississippi Format and lack the time to dedicate to finding the correct and current version, the process can become overwhelming.

Access a valuable resource hub of articles, tutorials, and guides pertinent to your situation and needs.

Save time and effort in locating the forms you require, using US Legal Forms' sophisticated search and Review tool to find and download the Civil Cover Sheet Mississippi Format.

Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Transform your document management into a seamless and user-friendly experience today.

- If you are a subscriber, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to view previously saved documents and manage your folders as desired.

- If you are new to US Legal Forms, create a free account to gain unlimited access to all library benefits.

- Follow the steps to access the desired form: Preview it to ensure it meets your needs and is recognized in your state or county.

- Click Buy Now when you're ready to proceed, choose a subscription plan, select your desired file format, and Download, complete, sign, print, and submit your documents.

- Access state- or county-specific legal and business documents.

- US Legal Forms caters to any requirements you may have, from personal to corporate paperwork, all in one location.

- Use advanced tools to fill out and manage your Civil Cover Sheet Mississippi Format.

Form popularity

FAQ

Rule 65 governs injunctions and restraining orders in Mississippi civil procedures. This rule allows plaintiffs to seek immediate relief from a court when they face imminent harm. Proper documentation, including a civil cover sheet Mississippi format, is essential when filing for such orders. You can find reliable templates and guidance for these filings on US Legal Forms.

Your domicile depends on many things, including where you live, where you vote, where you register your vehicles and where you own or rent property. The department may ask you to fill out a Legal Residence (Domicile) ?Questionnaire? to determine your domicile.

The state where you spend the majority of your time is your tax domicile. If you spend less than half your time in multiple states, you have a more complicated issue. However, if you can establish that you spend 183 days/year in Florida, you can make Florida your domicile and other states places you visit.

A resident is any individual who meets any of the following: ? Present in California for other than a temporary or transitory purpose. Domiciled in California, but outside California for a temporary or transitory purpose. See Section L, Meaning of Domicile. A nonresident is any individual who is not a resident.

You can be a resident of two states at the same time, usually by maintaining a domicile in one state and spending 183 days or more in another. It is not advisable, as you will be liable to file income taxes in both states, rather than in only one.

Yes, you can live anywhere you choose in the USA and even own a home in each state of the union. Yes. State law is subservient to federal law. Each citizen has freedom of movement within the states.

Residency is where one chooses to live. Domicile is more permanent and is essentially somebody's home base. Once you move into a home and take steps to establish your domicile in one state, that state becomes your tax home.

If you are a nonresident or part-year resident of Wisconsin and your Wisconsin gross income (or the combined gross income of you and your spouse) is $2,000 or more, you must file a Form 1NPR, Nonresident and Part-Year Resident Income Tax Return.

Your physical presence in a state plays an important role in determining your residency status. Usually, spending over half a year, or more than 183 days, in a particular state will render you a statutory resident and could make you liable for taxes in that state.