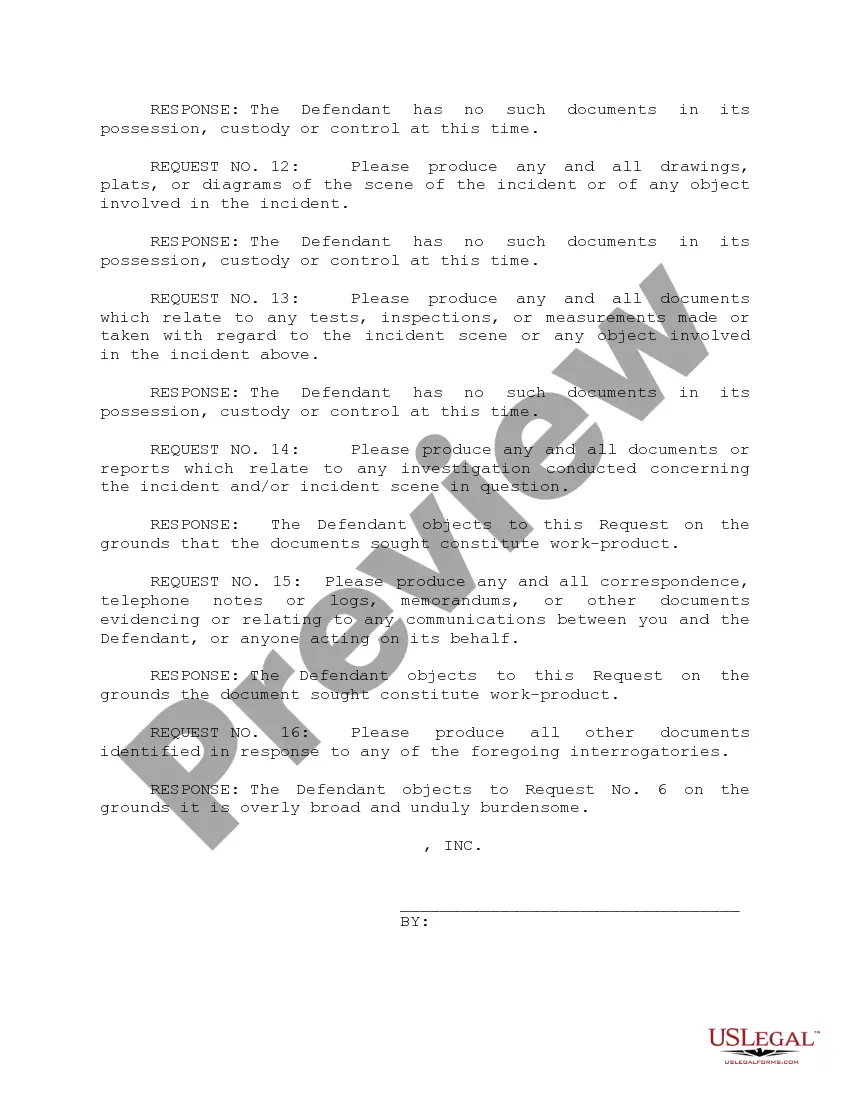

Sample Response To Form Interrogatory 15.1

Description

How to fill out Mississippi Defendant's Answers To Plaintiff's First Set Of Interrogatories And Requests For Production Of Documents?

Regardless of whether for commercial intents or personal issues, everyone must confront legal matters at some point in their lives.

Filling out legal documents demands meticulous attention, beginning with choosing the appropriate form template.

Once it is downloaded, you can complete the form using editing software or print it and finish it manually.

- For instance, if you select an incorrect version of a Sample Response To Form Interrogatory 15.1, it will be rejected once submitted.

- Thus, it is crucial to find a trustworthy source of legal documentation such as US Legal Forms.

- To obtain a Sample Response To Form Interrogatory 15.1 template, follow these straightforward steps.

- 1. Locate the sample you require by using the search bar or browsing the catalog.

- 2. Review the form’s description to ensure it aligns with your case, jurisdiction, and state.

- 3. Click on the preview of the form to examine it.

- 4. If it’s the wrong document, return to the search feature to find the Sample Response To Form Interrogatory 15.1 template you need.

- 5. Download the template when it fits your requirements.

- 6. If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- 7. If you have not yet created an account, you can download the document by clicking Buy now.

- 8. Select the appropriate pricing option.

- 9. Fill out the profile registration form.

- 10. Choose your payment method: use a credit card or PayPal account.

- 11. Select the file format you need and download the Sample Response To Form Interrogatory 15.1.

Form popularity

FAQ

Preparing to answer interrogatories begins with understanding their purpose and requirements. Utilizing a sample response to form interrogatory 15.1 can provide insights into structuring your answers. Additionally, legal support from platforms like US Legal Forms can help streamline the process and enhance your responses.

When facing a question you do not know the answer to, clarify your uncertainty in your response. For example, you might state, 'I do not have sufficient information to answer this question.' This honesty is essential in legal settings. A sample response to form interrogatory 15.1 may guide you in crafting an appropriate reply in these situations.

Steps to Getting Your Arkansas Business License A business name. An EIN (Employer Identification Number) or SSN (if you're a sole proprietor) A business entity type (LLC, partnership, corporation, etc.) A business address and phone number. A business plan that includes anticipated revenue and expenses.

10 steps to start your business Conduct market research. ... Write your business plan. ... Fund your business. ... Pick your business location. ... Choose a business structure. ... Choose your business name. ... Register your business. ... Get federal and state tax IDs.

Arkansas LLC Cost. Arkansas charges a $45 state fee to form an LLC ($50 by mail). You'll also need to pay $150 every year to file a franchise tax report, and you may have to pay for additional services for your LLC?such as filing a DBA or hiring a professional registered agent.

In Arkansas, you can establish a sole proprietorship without filing any legal documents with the Arkansas state government.

Starting an Arkansas LLC requires a $45 fee to file the Arkansas Certificate of Organization with the Secretary of State. Filing this certificate legally creates your LLC. You can file online, or with a paper copy by mail or in person for an additional $5.

Ready to Start a Business in Arkansas? Pick a Business Structure. Name Your Business. File Formation Paperwork. Draft Internal Records. Get Arkansas Business Licenses. Get Business Insurance. Build Your Business Website. File Arkansas Franchise Tax.

Persons desiring to organize a business entity such as a corporation or partnership in Arkansas must apply to the Arkansas Secretary of State for authority to conduct business or other activities.

But good news: Arkansas doesn't require a general license to do business in the state. Meaning, your Arkansas LLC doesn't need a general state business license. But depending on what type of business you run, your LLC might need an occupational license.