Estate Executor Form

Description

How to fill out Mississippi Petition To Close Estate By Executor?

There's no longer a necessity to squander hours hunting for legal paperwork to comply with your local state regulations.

US Legal Forms has gathered all of them in a single location and enhanced their accessibility.

Our website offers over 85k templates for any business and personal legal matters categorized by state and area of application.

Prepare legal paperwork under federal and state regulations quickly and easily with our library. Explore US Legal Forms today to maintain your documentation in order!

- All forms are expertly drafted and verified for validity, ensuring you receive a current Estate Executor Form.

- If you are acquainted with our platform and already possess an account, you must verify that your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You may also revisit all previously acquired documents at any time by accessing the My documents tab in your profile.

- If this is your first encounter with our platform, the process will require a few additional steps to finish.

- Here’s how new users can locate the Estate Executor Form in our catalog.

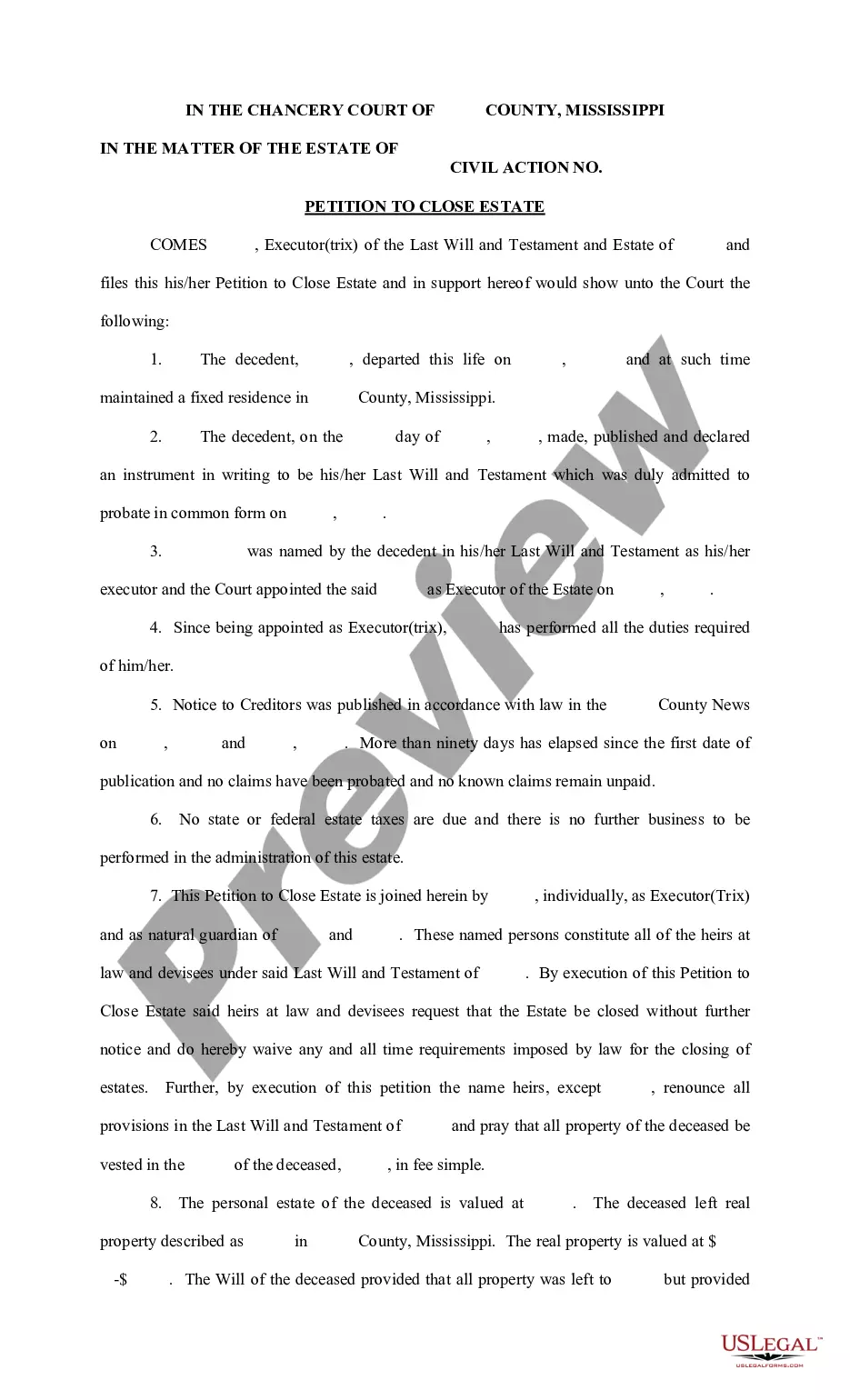

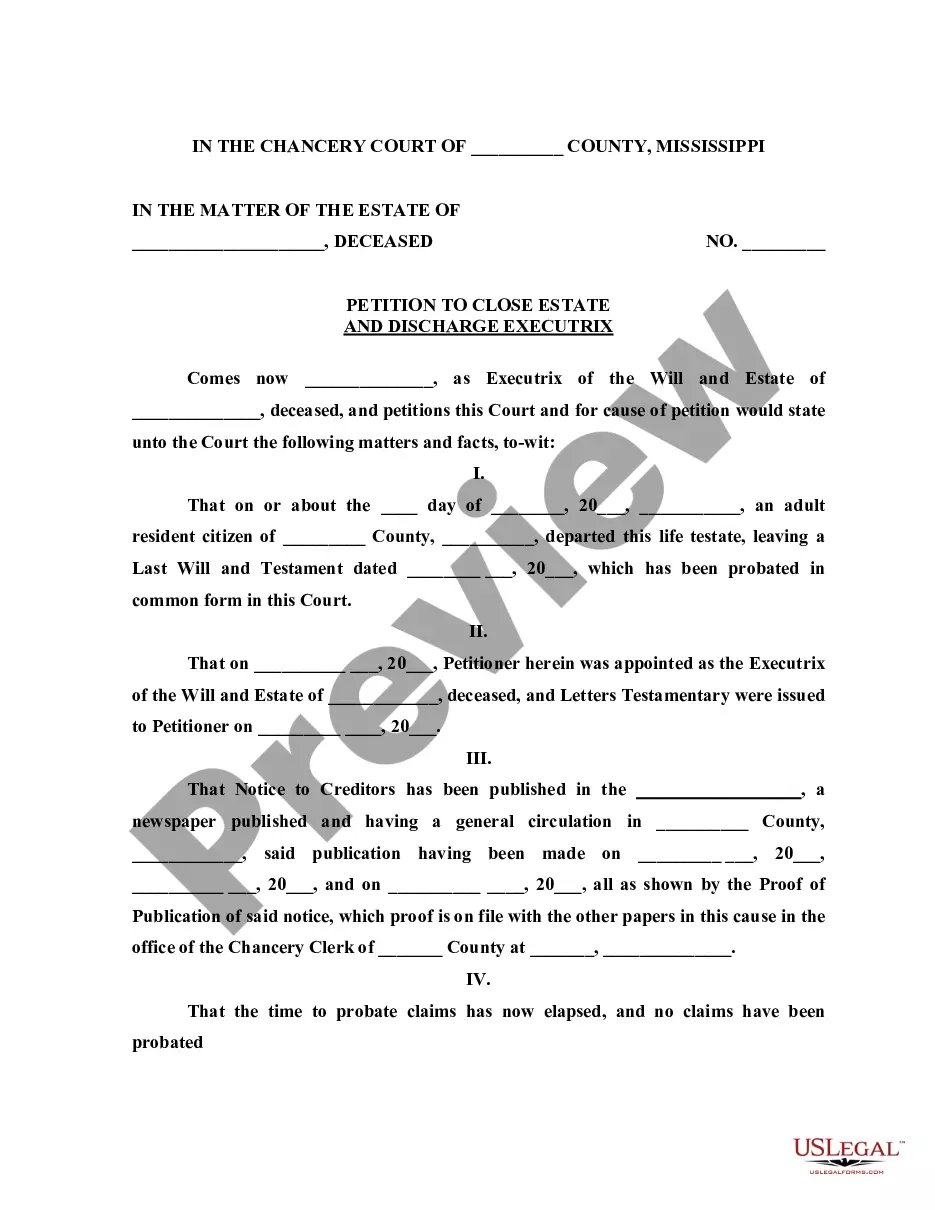

- Carefully read the page content to verify it contains the sample you need.

- Utilize the form description and preview options if available.

Form popularity

FAQ

As an executor, your first steps include locating the will and filing it with the probate court. Next, notify beneficiaries and creditors, and secure the estate’s assets. Additionally, assess debts and establish an inventory of property. Utilizing our Estate executor form can facilitate these initial steps and ensure that you fulfill your duties effectively.

You prove you are the executor of an estate by presenting the Letters Testamentary issued by the probate court. These letters serve as legal confirmation of your appointment and authority to handle the estate's affairs. Additionally, you may need to show the will that names you as executor. Our Estate executor form can help clarify the documentation needed for this process.

To file as the executor of an estate, you need the original will, a petition for probate, identification, and any necessary estate information. This may include asset details and debts owed by the deceased. Additionally, research your state’s specific requirements to ensure a complete submission. You can find useful templates, like the Estate executor form, to assist with gathering these documents.

To file as an executor, start by submitting the original will to the probate court along with a petition to be officially appointed. You may need to provide identification and possibly bond, depending on state requirements. Once approved, you receive Letters Testamentary, allowing you to act on behalf of the estate. Our Estate executor form can guide you through filing and documentation.

To apply for the role of the executor, you typically need to file the will and a petition with the probate court. This process involves submitting necessary documents and possibly attending a court hearing. Generally, the court assesses your qualifications and may grant you the title based on your suitability. Using our Estate executor form can simplify the application process.

Yes, executor fees are considered taxable income and must be reported to the IRS. As the executor, you will receive compensation for your work, which is subject to income tax. It is crucial to keep records of all fees earned and report them properly on your tax return. For proper documentation, you can utilize our Estate executor form for clarity.

As an executor, you need to file taxes for the estate using IRS Form 1041, the estate income tax return, if the estate generates income. You will report income, deductions, and credits of the estate on this form. Additionally, beneficiaries need to receive Schedule K-1 forms to report their shares of estate income on their personal tax returns. Use our Estate executor form to ensure compliance with tax responsibilities.

To get executor paperwork, contact the probate court in the jurisdiction where the estate will be administered. You can also find relevant forms, including the Estate executor form, online on the court's website. Ensure you have all required information handy when requesting these documents. This proactive step will help facilitate your role as executor and ensure compliance with legal requirements.

You can obtain executor of estate paperwork by visiting your local probate court or accessing their website. Many courts provide downloadable forms, including the Estate executor form you will need for official tasks. Make sure to gather any additional information necessary for your situation. Always verify that you have the most current forms to avoid delays in the estate administration process.

To start acting as an executor, first, ensure you have been officially appointed through a will or probate court. Next, gather the necessary documents, including the death certificate and will. Completing the Estate executor form is a crucial step in formalizing your role. Additionally, familiarize yourself with your responsibilities and the estate’s financial status to effectively manage the process.