Sell Real Estate

Description

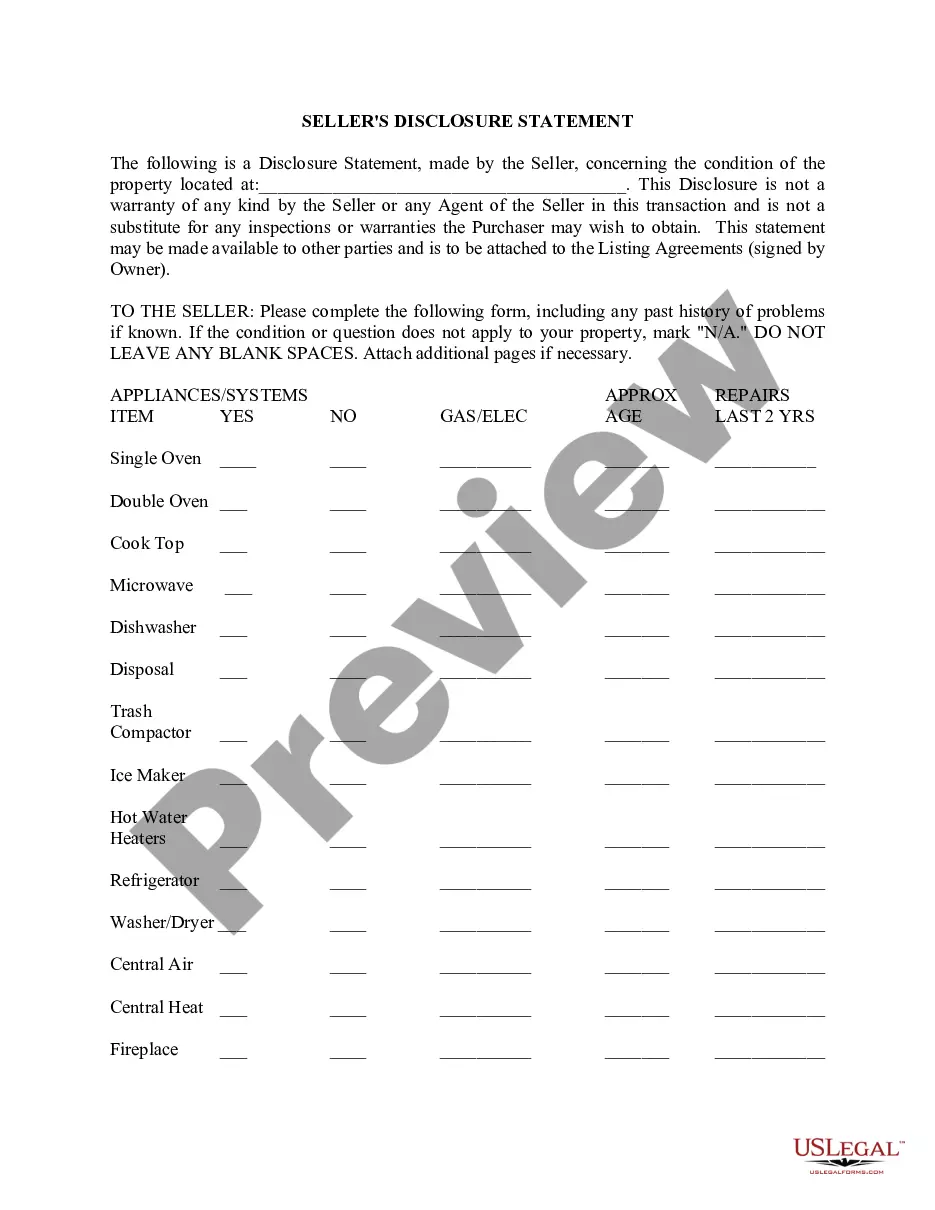

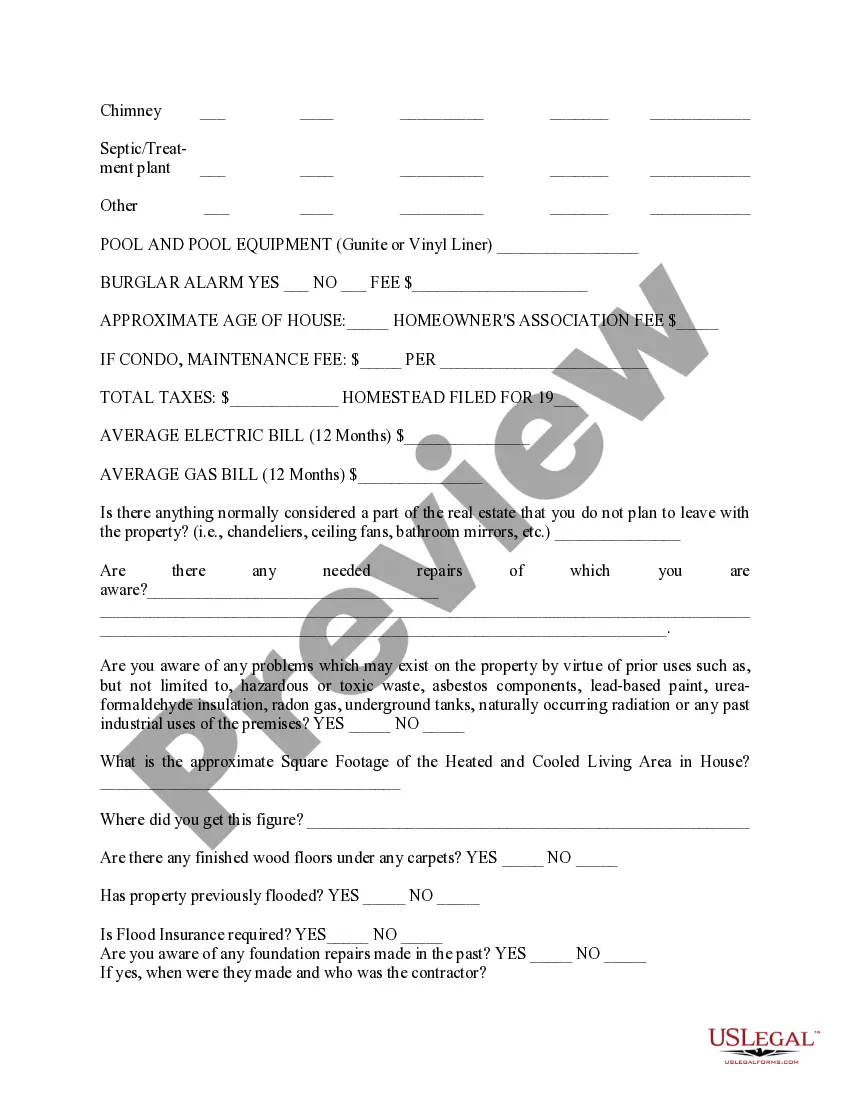

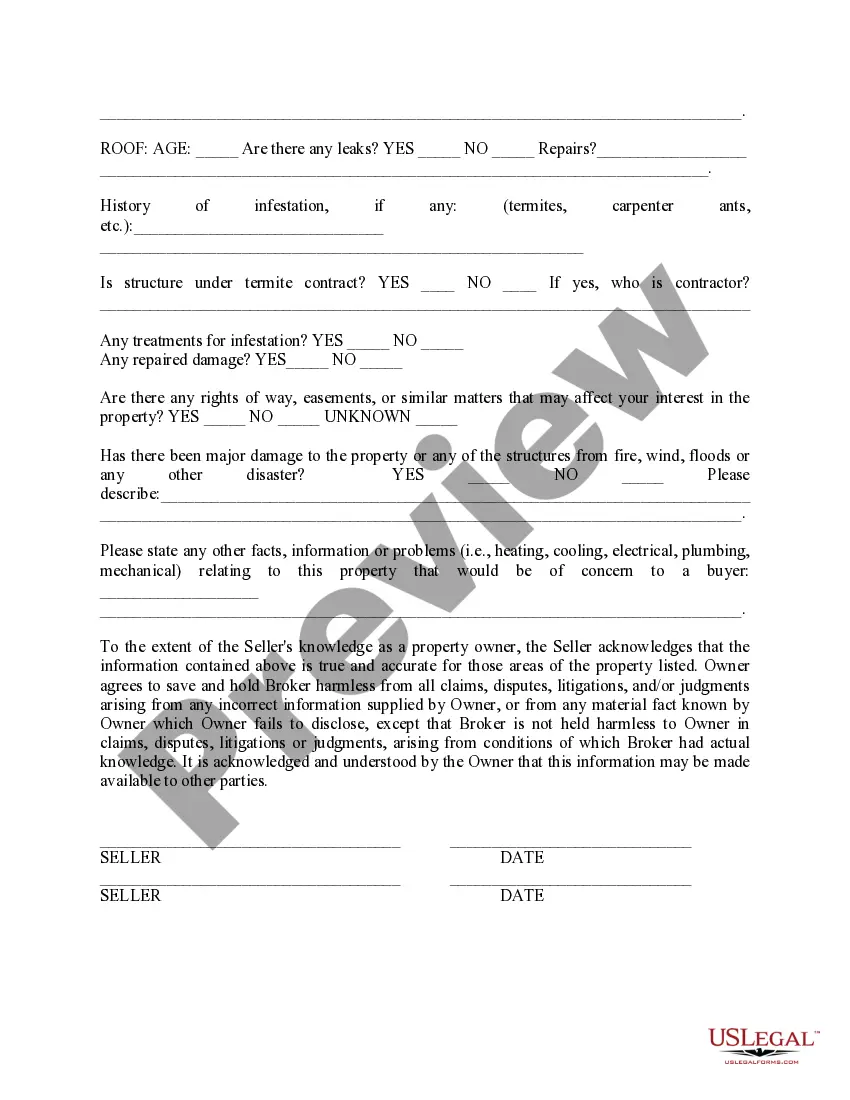

How to fill out Mississippi Seller's Residential Real Estate Disclosure Statement?

- Log in to your account if you are a returning user and verify your subscription status before proceeding.

- Explore the Preview mode to review form descriptions. Select the legal document that fits your needs best, ensuring compliance with your local regulations.

- If necessary, utilize the Search feature to find an alternative template that suits your requirements.

- Proceed to purchase your selected document by clicking the 'Buy Now' button and choose your desired subscription plan. An account creation is required for access.

- Complete your purchase by entering your payment details, either through a credit card or PayPal.

- Once the transaction is finalized, download the required form to your device. Access it later in the 'My Forms' section of your profile at any time.

In conclusion, US Legal Forms provides a user-friendly platform for obtaining vital legal documents. With over 85,000 forms available and access to expert assistance, you can confidently navigate the selling process.

Get started today and streamline your selling experience!

Form popularity

FAQ

Most realtors make between $30,000 to $50,000 in their first year, but figures can vary widely depending on efforts and market conditions. Consistent networking, learning from successful agents, and leveraging marketing tools can help increase your earnings. Many successful agents focus on building connections and utilizing services like US Legal Forms to streamline their business.

The number of houses you need to sell to reach 100k depends on the average commission per sale. If you earn a 3% commission on homes priced at $300,000, you would need to sell about 11 houses in a year. Analyzing your local market and setting realistic sales goals can help you determine the number of transactions necessary to reach that income.

Making 100k as a realtor can be challenging, especially for new agents. It depends on several factors such as your market, sale prices, and the effort you put into building relationships. Persistence, a strong work ethic, and utilizing resources like US Legal Forms to streamline transactions can significantly improve your chances of achieving this goal.

Yes, making 100k your first year in real estate is achievable, but it requires hard work and dedication. Success depends on your networking skills, market knowledge, and ability to connect with clients. Many agents focusing on high-demand areas have hit this mark early on, especially when they effectively utilize marketing tools and platforms that enhance visibility.

To effectively sell real estate, start by crafting a clear and engaging property description. Highlight key features such as location, size, amenities, and unique selling points. Use descriptive language that draws potential buyers in while ensuring all information is accurate. Good visuals, like quality photographs, can complement your listing and engage more viewers.

Yes, you generally need to report the sale of your home to the IRS, especially if you do not qualify for the exclusion of capital gains. Reporting is crucial to avoid unforeseen tax liabilities. If you are unsure how to proceed, resources like US Legal Forms can assist you in managing tax reporting requirements effectively when you sell real estate.

When selling your house, you usually need Form 8949 for detailing capital gains and losses, and possibly Schedule D to summarize your investment results. If your property was used for business purposes, you may also require Form 4797. Consulting guides on platforms such as US Legal Forms can help ensure you have all necessary documents ready when you sell real estate.

You should use Form 4797 to report the sale of business property, including real estate used in a trade or business. On the other hand, Form 8949 is specifically for reporting capital gains and losses from the sale of capital assets, like personal real estate. Understanding which form to use allows you to accurately report your transactions when you sell real estate.

When you sell real estate, the primary IRS form you may need is Form 8949, which is used to report capital gains and losses. Depending on your specific situation, you might also require Schedule D to summarize your gains and losses. Using the correct forms is crucial for an accurate tax return when you decide to sell real estate.

To file for real estate, begin by gathering all necessary documents related to your property. You will need to complete the appropriate local and state forms, which may vary based on your area. After filling out the forms, submit them to your local real estate office. For guidance, platforms like US Legal Forms can provide the templates you need to ensure a smooth filing process.