Sales Tax With Texas

Description

How to fill out Mississippi Complaint?

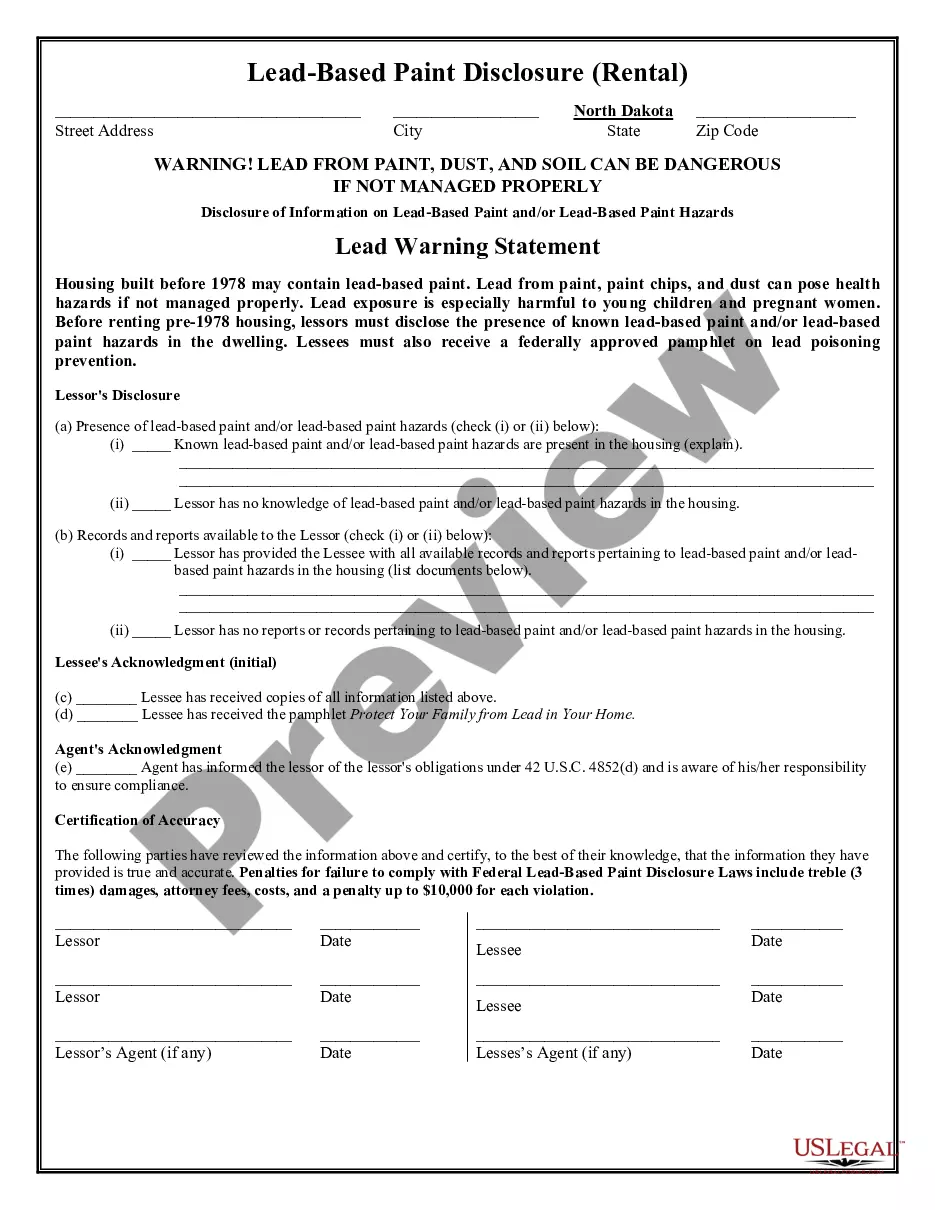

The Sales Tax With Texas displayed on this page is a versatile formal template created by expert attorneys following federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 validated, state-specific documents for any business and personal needs. It’s the fastest, simplest, and most reliable method to acquire the paperwork you require, as the service assures the highest level of data protection and anti-malware security.

Enroll in US Legal Forms to access verified legal templates for every life situation at your fingertips.

- Browse for the form you require and review it.

- Sign up and Log In.

- Obtain the editable template.

- Complete and sign the document.

- Download your files one more time.

Form popularity

FAQ

The Texas state sales and use tax rate is 6.25 percent, but local taxing jurisdictions (cities, counties, special-purpose districts and transit authorities) also may impose sales and use tax up to 2 percent for a total maximum combined rate of 8.25 percent.

How to Calculate Sales Tax Find list price and tax percentage. Divide tax percentage by 100 to get tax rate as a decimal. Multiply list price by decimal tax rate to get tax amount. Add tax amount to list price to get total price.

Texas does not have an individual income tax. Texas does not have a corporate income tax but does levy a gross receipts tax. Texas has a 6.25 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 8.20 percent.

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.

The minimum combined 2023 sales tax rate for Price, Texas is 8.25%. This is the total of state, county and city sales tax rates. The Texas sales tax rate is currently 6.25%. The County sales tax rate is 0%.