Mississippi Child Support Withholding Limits

Description

How to fill out Mississippi Child Support Withholding Limits?

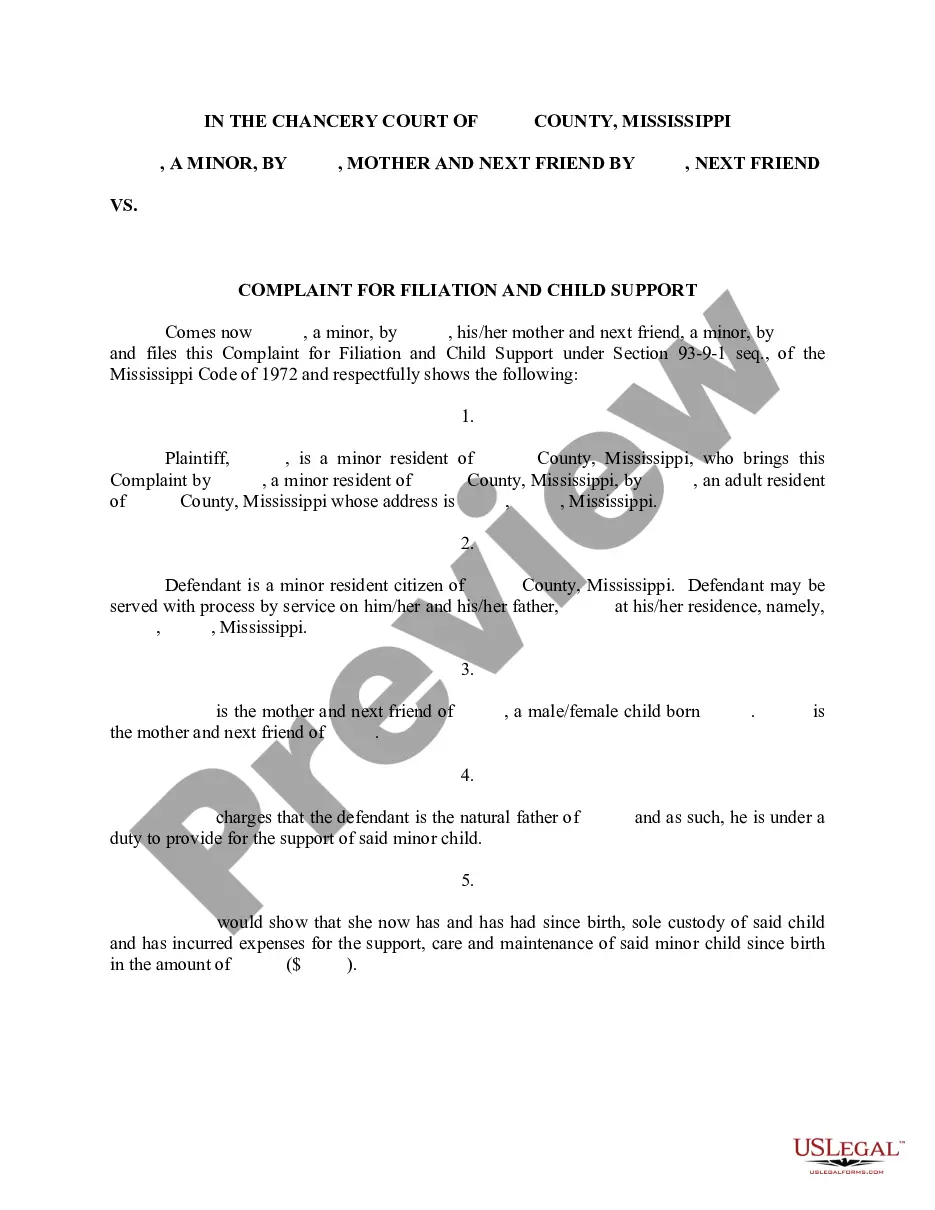

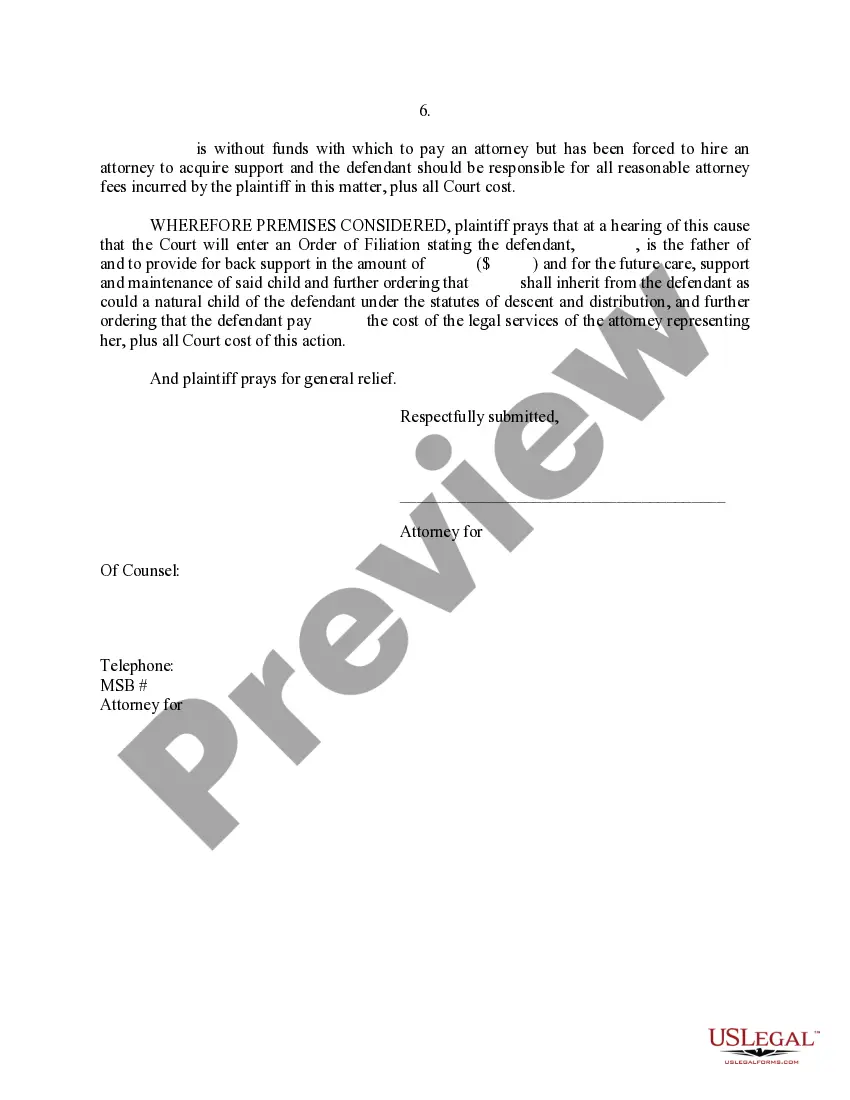

When you are required to submit Mississippi Child Support Withholding Limitations that adhere to your local state regulations, there can be numerous options to select from.

There's no necessity to review every document to ensure it meets all the legal requirements if you are a US Legal Forms subscriber.

It is a dependable service that can assist you in obtaining a reusable and current template on any topic.

Navigating through the suggested page and checking it for alignment with your needs is essential.

- US Legal Forms is the most extensive online repository with a collection of over 85k ready-to-use documents for business and personal legal situations.

- All templates are certified to conform to each state's laws.

- Therefore, when downloading Mississippi Child Support Withholding Limits from our site, you can feel confident that you possess a valid and current document.

- Obtaining the necessary sample from our platform is exceptionally easy.

- If you already have an account, simply Log In to the system, ensure your subscription is valid, and save the chosen file.

- Later, you can open the My documents tab in your profile and access the Mississippi Child Support Withholding Limits at any time.

- If this is your first time using our library, please follow the instructions below.

Form popularity

FAQ

In Mississippi for one child the non-custodial parent pays 14% of their adjusted gross income. For two children the non-custodial parent pays 20% of their adjusted gross income. For three children the non-custodial parent pays 22% of their adjusted gross income.

The guideline formula for determining the amount of child support is 14% of noncustodial parent's income for one child, 20% for two children, 22% for three children, 24% for four children and 26% for five or more children.

The formula is keyed to the payor's adjusted gross income, which generally means the same thing as after-tax income. So if the absent parent's monthly after-tax income is $1,000, and there is one child, the child support will be 14 percent of $1,000 $140/month.

In Mississippi for one child the non-custodial parent pays 14% of their adjusted gross income. For two children the non-custodial parent pays 20% of their adjusted gross income. For three children the non-custodial parent pays 22% of their adjusted gross income.

Determine the limit federal/state law places on withholding. If the employee is single, the maximum withholding amount is 60% of the employee's disposable income.