Child Support Withholding For Independent Contractors

Description

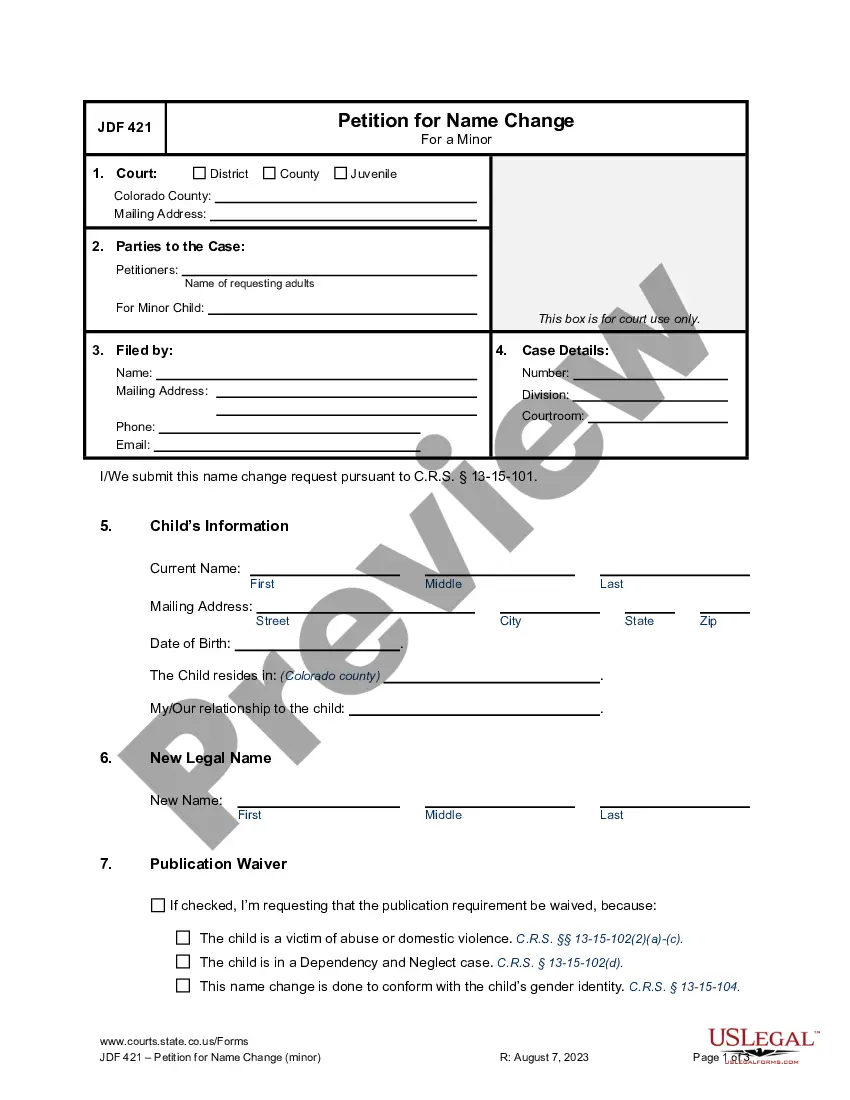

How to fill out Mississippi Motion For Emergency Hearing In Child Support Regarding Health Insurance?

Creating legal documents from the ground up can frequently be somewhat daunting.

Certain situations may require extensive research and substantial financial investment.

If you're seeking a simpler and more economical method for preparing Child Support Withholding For Independent Contractors or any other paperwork without unnecessary complications, US Legal Forms is always available to you.

Our online collection of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal affairs.

However, before proceeding to download Child Support Withholding For Independent Contractors, keep these suggestions in mind: Review the document preview and descriptions to ensure you're selecting the correct form. Confirm that the template you choose meets your state and county's criteria. Select the appropriate subscription option to obtain the Child Support Withholding For Independent Contractors. Download the document, then complete, sign, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us today and transform document handling into a straightforward and efficient process!

- With just a few clicks, you can conveniently access state- and county-specific templates meticulously prepared for you by our legal experts.

- Utilize our platform whenever you require a dependable and trustworthy service to swiftly locate and download the Child Support Withholding For Independent Contractors.

- If you're a returning user and have already created an account, simply Log In to your account, select the form, and download it immediately or access it later in the My documents section.

- Not signed up yet? No worries. Registration takes just a few minutes, allowing you to browse through the catalog.

Form popularity

FAQ

Independent contractors and child support The OCSE leaves no room for interpretation as to whether these orders apply to independent contractors. Per the OCSE: "If you receive an IWO for a nonemployee, and you make payments to that person, you must withhold child support from those payments."

When calculating child support under California guidelines, the court uses both parents' ?net disposable income?. This is the parent's net income after paying state and federal taxes, social security, health care, and mandatory union dues.

The withholding limits set by the federal CCPA are: 50 percent - Supports a second family with no arrearage or less than 12 weeks in arrears. 55 percent - Supports a second family and more than 12 weeks in arrears. 60 percent - Single with no arrearage or less than 12 weeks in arrears.

The income of independent contractors is a viable source of financial stability for many children and families. Employers/income withholders are responsible for withholding support from payments made to independent contractors pursuant to the Income Withholding Order/Notice for Support (IWO).

The new Guidelines appear to include substantial increases in child support for families with multiple children in Massachusetts, eliminate a controversial 15% ?cap? on parental cost sharing for childcare (but not medical insurance costs), and reallocates the balance between alimony and child support by increasing ...