Disburse Funds Adjudged With Interest

Description

How to fill out Mississippi Order To Disburse Funds On Motion Of The Plaintiffs?

- If you're a returning user, log into your account and select the required template by clicking the Download button. Ensure your subscription is active; if not, renew it accordingly.

- For first-time users, begin by reviewing the Preview mode and form descriptions. Confirm you've selected the appropriate template that satisfies your needs.

- If your chosen document doesn't meet your requirements, you can search for alternatives using the Search tab provided above.

- Once you find the correct document, click the Buy Now button to choose the subscription plan that suits you best, which will require you to create an account for access.

- Proceed to payment by entering your credit card details or opting for PayPal to complete your subscription.

- Finally, download your completed form. You can access the template anytime in the My Forms section of your account.

In conclusion, utilizing US Legal Forms not only simplifies your legal documentation process but also provides access to expert support for form completion. Experience the benefits of our extensive library today.

Visit our website to get started on your legal documents efficiently.

Form popularity

FAQ

The best interest disbursement for a Certificate of Deposit (CD) typically refers to the annual percentage yield offered by financial institutions. This interest is calculated on the principal amount you deposit, compounded over the CD's term. When disbursing funds adjudged with interest related to a CD, find institutions that offer competitive rates and favorable terms. Researching options can help you maximize your returns.

Receiving a disbursement check generally means you have been awarded funds in a legal case, perhaps with interest adjudged. This check represents your rightful compensation that has been processed following a court order. It's important to review the details associated with the check to ensure all amounts reflect the terms of your settlement. If you need assistance understanding the check, USLegalForms can provide valuable resources.

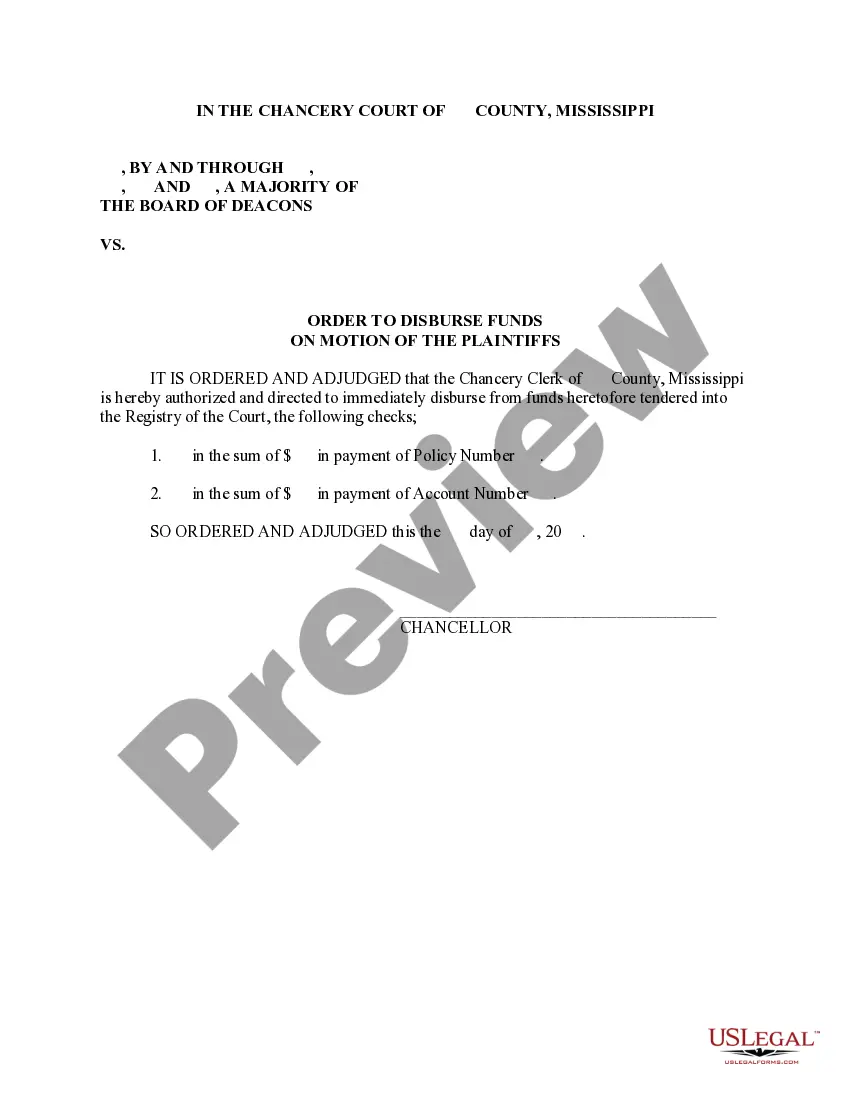

Interest disbursement is the allocation of interest earned on funds that have been awarded or adjudged by a court. When a legal dispute concludes, and funds are distributed, interest accruing during the litigation period may also be included. This ensures that you receive compensation for the time you had to wait for your funds. By learning about interest disbursement, you can better manage your financial planning.

The two main types of disbursement are direct disbursement and indirect disbursement. Direct disbursement involves transferring funds directly to the entitled party, such as in a settlement. Indirect disbursement involves third-party payments, where funds may go through intermediary accounts before reaching the final recipient. Knowing the types can aid you in navigating the legal landscape.

Interest disbursement refers to the process of distributing earned interest on funds adjudged in a legal matter. When a court awards funds, they may also determine an interest payment that accrues over time. This interest is then disbursed to the entitled party as part of the settlement. Understanding this can help you manage your financial expectations effectively.

The disbursement period is the time frame within which funds are released to recipients after an agreement or obligation is made. This period can vary based on the nature of the transaction, such as loans, grants, or real estate deals, and is essential for maintaining financial clarity. When it comes to disbursing funds adjudged with interest, understanding this period is vital for all parties involved, as it ensures proper timing for investments and repayments. Using platforms like USLegalForms can simplify the process of managing disbursements effectively.

Schools usually have a specific timeframe to disburse financial aid, often dictated by federal regulations and institutional policies. Generally, they must complete this disbursement before the end of the academic term or semester for which the aid is granted. When schools disburse funds adjudged with interest, they should communicate clearly with students about when they can expect to receive financial assistance. This proactive communication helps students plan their finances more effectively.

The disbursement date in real estate refers to the specific day funds are distributed to the involved parties after a property sale concludes. This date is crucial for ensuring that all parties receive their due amounts, especially when it involves disburse funds adjudged with interest. Typically, real estate transactions set this date to align with the closing date or shortly thereafter. Understanding this timing helps buyers and sellers manage their financial expectations effectively.

Once your financial aid is disbursed, your school first applies the funds to your tuition and fees. Any remaining balance typically results in a refund, which you may receive in a few days to weeks. Schools have their own policies regarding how they disburse funds adjudged with interest, so it is beneficial to review your school's guidelines. You can also explore resources like US Legal Forms for assistance with related legal documents and questions.

To expedite your financial aid refund, ensure that all necessary paperwork is submitted on time and that your school's financial aid office has your correct banking information. Additionally, you can inquire about options like direct deposit, which often speeds up the process. Remember, schools may disburse funds adjudged with interest in various ways, so understanding their system can help you navigate it more efficiently.