Mississippi Deed Trust Without Consideration

Description

How to fill out Mississippi Deed Trust Without Consideration?

Navigating through the red tape of official documents and forms can be challenging, particularly when one does not engage in that field professionally.

Finding the appropriate template for the Mississippi Deed Trust Without Consideration will be labor-intensive, as it must be accurate down to the last digit.

However, you will need to invest significantly less time obtaining a suitable template from a reliable source.

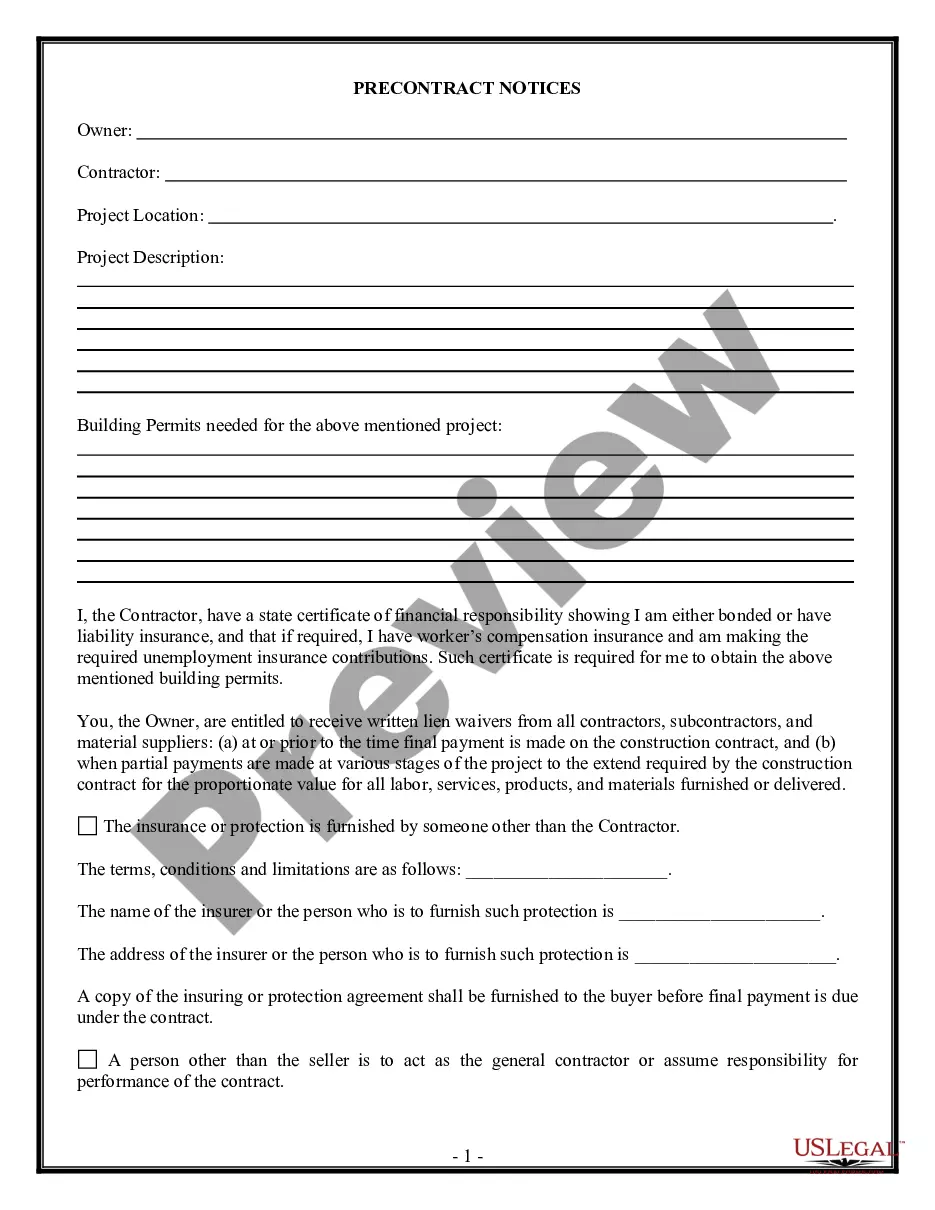

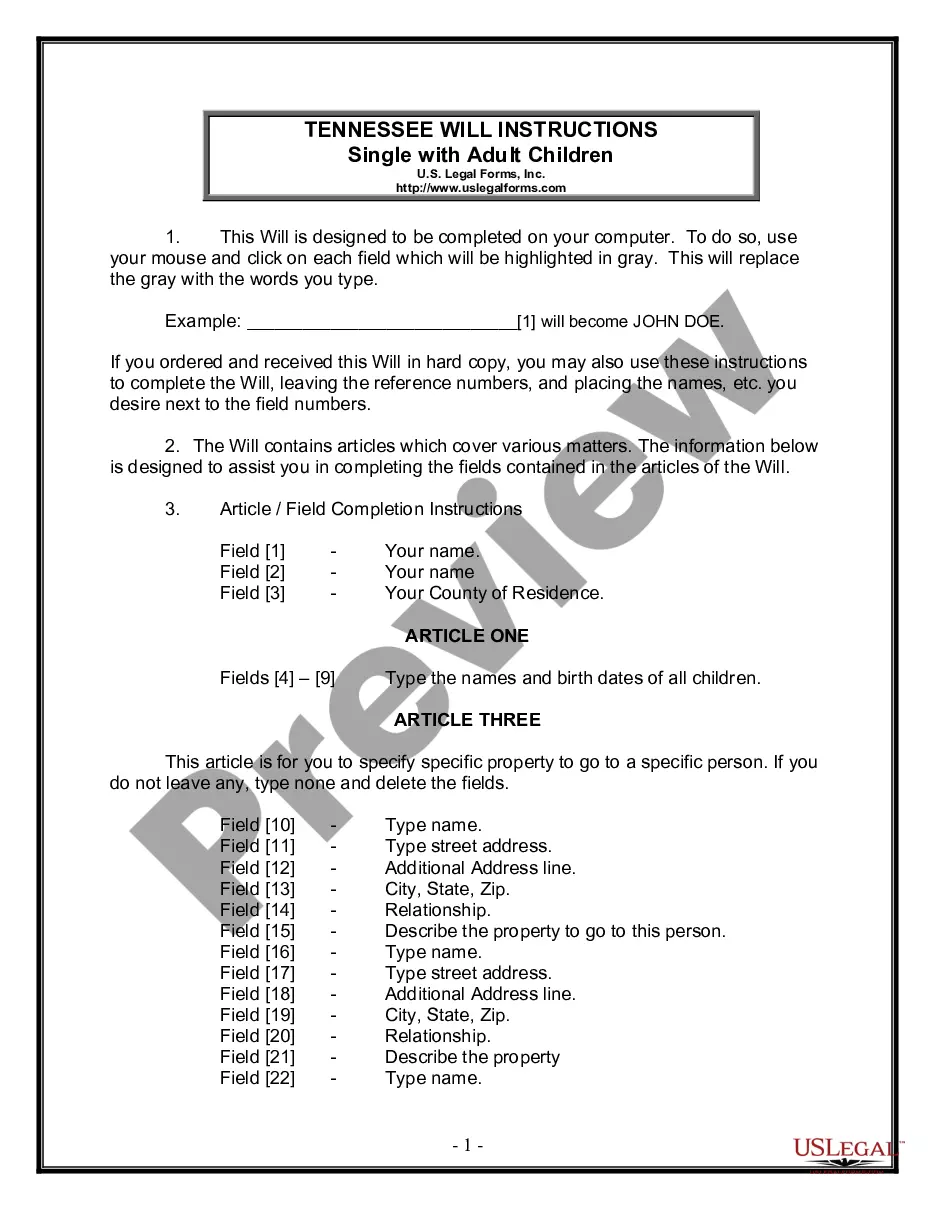

Acquire the correct form in a few easy steps: Enter the document title in the search box, locate the appropriate Mississippi Deed Trust Without Consideration from the results, review the sample description or view its preview, click Buy Now when the template meets your specifications, select your subscription plan, register an account with your email and create a security password, choose a credit card or PayPal payment method, and download the template document to your device in your preferred format.

- US Legal Forms is a platform that streamlines the process of locating the right forms online.

- US Legal Forms is the sole destination you need to acquire the latest document samples, learn of their usage, and download these samples for completion.

- It is a repository with over 85K forms applicable in various sectors.

- If you are searching for a Mississippi Deed Trust Without Consideration, you can be confident in its validity as all forms are authenticated.

- Having an account with US Legal Forms will ensure that all necessary samples are readily accessible.

- You can store them in your history or add them to the My documents directory.

- Access your saved forms from any device by clicking Log In on the library website.

- If you do not yet have an account, you can always conduct a new search for the template you need.

Form popularity

FAQ

The strongest type of deed is the warranty deed, which provides the highest level of protection to the buyer. This deed guarantees that the seller holds clear title to the property and has the right to sell it. In a Mississippi deed trust without consideration, this type of deed can add extra security for the buyer by ensuring that they inherit all rights to the property without any hidden claims. Always consult legal resources to understand the full implications of the deed type you choose.

A deed outlines the legal transfer of property ownership. In the context of a Mississippi deed trust without consideration, it’s important to note that various elements, like the grantor, grantee, and legal description of the property, must be clear. The deed must be executed properly, reflecting the intentions of both parties involved. Moreover, it should be recorded in the county where the property is located to provide public notice.

In Mississippi, a trustee on a deed of trust can be an individual or an institution, provided they are legally competent and willing to accept the responsibilities involved. It is important that the trustee understands their duties, especially when dealing with a Mississippi deed trust without consideration, as this involves significant fiduciary responsibilities. If you need assistance selecting a trustee or navigating the legal nuances, the US Legal Forms platform can offer valuable resources.

To transfer property title to a family member in Mississippi, you typically need to draft a deed that specifies the property and the parties involved. A Mississippi deed trust without consideration is a common strategy to facilitate this transfer without monetary exchange. Make sure to comply with recording requirements to maintain clear title and consult the US Legal Forms platform for templates to simplify the process.

An irrevocable trust in Mississippi generally cannot be altered once established. However, certain circumstances may allow for modifications if they are in the best interest of the beneficiaries. When considering an irrevocable trust, it is essential to think about long-term goals, especially if you are using a Mississippi deed trust without consideration for property transfer. For specific legal advice, exploring resources on the US Legal Forms platform can help deepen your understanding of your options.

To establish a trust in Mississippi, you will need to draft a trust document that defines the terms and conditions of the trust. This document should list the assets and identify the trustee, who will manage the trust. Utilizing a Mississippi deed trust without consideration can be particularly effective, as it allows you to transfer property into the trust without the need for payment. Consider consulting the US Legal Forms platform for templates and legal guidance to ensure compliance with state laws.

To create a Mississippi deed trust without consideration, certain requirements must be met. First, the deed must be in writing and clearly state the trust terms. Additionally, the parties involved must be competent to contract, and the deed must be properly executed and notarized. Understanding these requirements will ensure that your document is valid and enforceable.

The fastest way to transfer a deed in Mississippi is to file a properly executed deed with the appropriate county clerk's office. If you are transferring a property through a Mississippi deed trust without consideration, make sure all legal requirements are met to avoid delays. Engaging with platforms like US Legal Forms can streamline this process by offering tools to prepare and submit the necessary forms quickly.

To obtain the deed to your house in Mississippi, you typically need to request it from the local county land records office. If you are dealing with a Mississippi deed trust without consideration, ensure that the paperwork reflects the correct title and ownership. Additionally, utilizing resources from US Legal Forms can help facilitate obtaining or creating the required documentation.

In Mississippi, anyone can technically prepare a deed, but it is often advisable to have a qualified individual, such as an attorney or title company, handle the preparation. This ensures that the deed complies with state requirements and addresses any specific legal considerations, especially for a Mississippi deed trust without consideration.