Mississippi Repossession With Intent To Distribute

Description

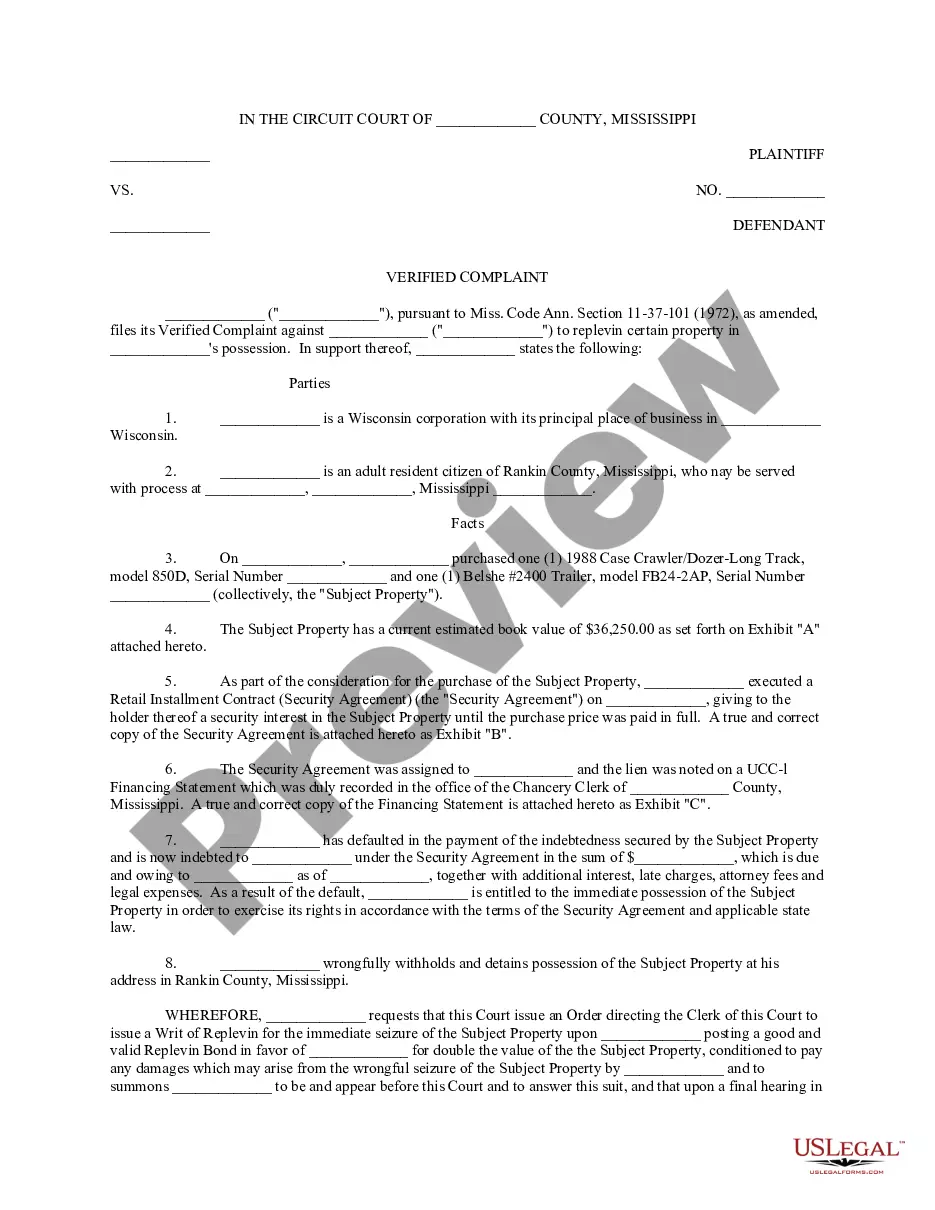

How to fill out Mississippi Complaint For Replevin Or Repossession Of Dozer?

The Mississippi Repossession With Intent To Distribute you see on this page is a reusable legal template drafted by professional lawyers in line with federal and regional laws. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Mississippi Repossession With Intent To Distribute will take you only a few simple steps:

- Look for the document you need and check it. Look through the sample you searched and preview it or review the form description to confirm it suits your requirements. If it does not, utilize the search option to find the right one. Click Buy Now when you have found the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Pick the format you want for your Mississippi Repossession With Intent To Distribute (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your paperwork again. Utilize the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Mississippi law allows the borrower to redeem the vehicle prior to any sale. The redemption of a vehicle is possible once you've repaid your balance in full, which includes late payment charges, court costs, collection costs, and other repossession charges like repair fees, storage costs, and tow charges.

With involuntary repossession, agents take the car without your permission. In Michigan, they may not use violence, nor may they enter your home uninvited.

What happens after my property is repossessed? Under Mississippi law, the creditor must notify you in writing that the property will be sold to pay off the indebtedness. This notice also gives you the opportunity to "redeem" the property. This means that you have the chance to get the property back.

Repossession agents can confiscate a vehicle parked on private property. However, they must follow a legal process and do it in a commercially reasonable manner. During a repossession, a repo agent cannot use force or the threat of force, ing to Mississippi law.

Mississippi allows a lender to repossess a car without a court order. This is referred to as a self-help repossession. A repo agent can tow your car from your driveway, a public street, a public parking lot, and a public garage.