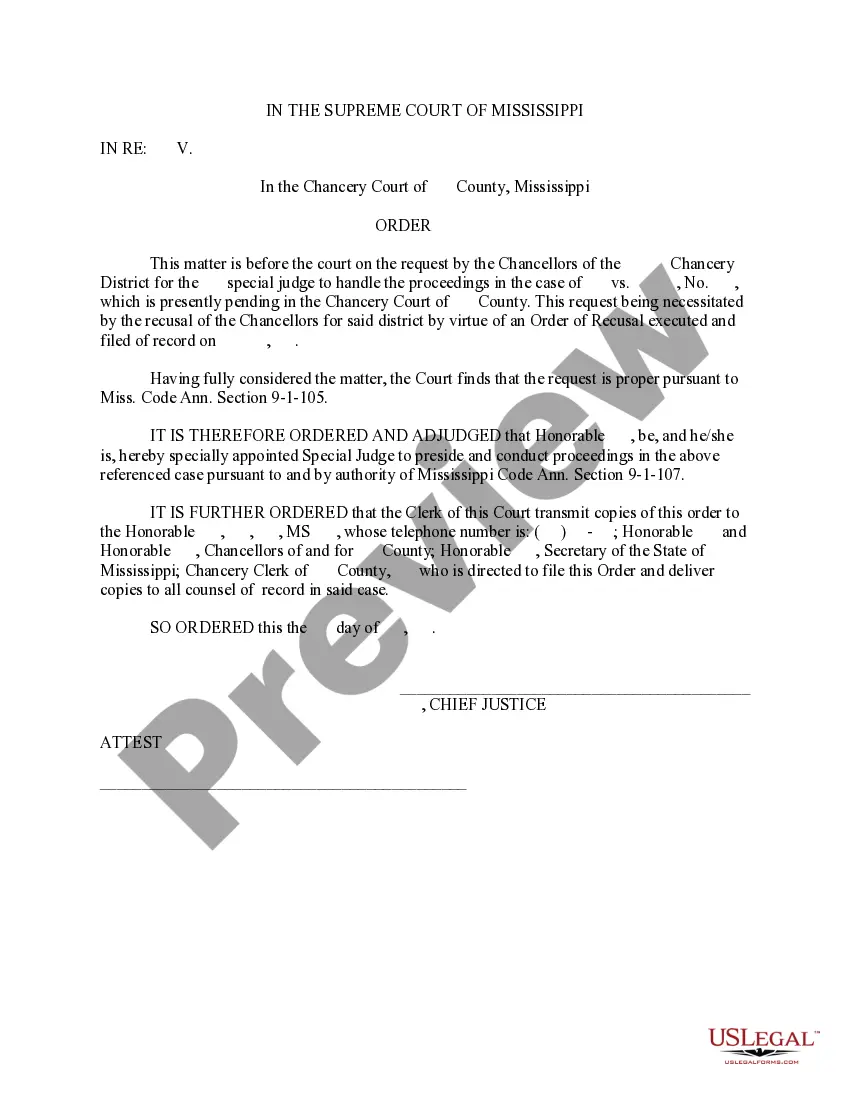

Mississippi Official Form With Example

Description

How to fill out Mississippi Order?

Managing legal documents can be overwhelming, even for the most experienced professionals.

When you're looking for a Mississippi Official Form With Example and can't dedicate time to find the correct and current version, the process can be stressful.

Access legal and business forms specific to your state or county. US Legal Forms accommodates any requirements you may have, ranging from personal to commercial documents, all in one place.

Utilize advanced tools to complete and manage your Mississippi Official Form With Example.

Here are the steps to follow after downloading the form you need: Verify that this is the correct form by previewing it and reviewing its details. Ensure that the sample is valid in your state or county. Click Buy Now when you are ready. Choose a subscription plan. Select the format you require, then Download, complete, sign, print, and submit your documents. Take advantage of the US Legal Forms online library, backed by 25 years of expertise and trustworthiness. Improve your daily document management with a simple and user-friendly process today.

- Tap into a valuable resource library of articles, guides, and materials related to your situation and needs.

- Save time and effort searching for the documents you require, and use US Legal Forms’ sophisticated search and Preview feature to locate Mississippi Official Form With Example and download it.

- If you have a membership, Log In to your US Legal Forms account, find the form, and download it.

- Visit the My documents section to view the documents you have previously saved and manage your folders as needed.

- If this is your first time using US Legal Forms, create a free account and gain unlimited access to all the platform's advantages.

- A comprehensive web form library could revolutionize the way anyone handles these matters effectively.

- US Legal Forms is a leading provider of online legal documents, boasting over 85,000 state-specific forms accessible at any moment.

- With US Legal Forms, you can.

Form popularity

FAQ

FILING REQUIREMENTS Single resident taxpayers ? you have gross income in excess of $8,300 plus $1,500 for each dependent. Married resident taxpayers ? you and your spouse have gross income in excess of $16,600 plus $1,500 for each dependent.

If you live in a state that requires you to pay income taxes, there may be a state-based standard deduction that you can claim on your state tax return. There is an IRS tool that you can use to calculate your own standard deduction.

Income Tax Brackets The standard deduction in Mississippi is $2,300 for single filers and married individuals filing separately, $4,600 for married individuals filing jointly and $3,400 for heads of household. If itemized deductions are less than the standard deduction, taxpayers receive the standard deduction.

All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. The tax is based on gross proceeds of sales or gross income, depending on the type of business.

You would not be required to file a tax return. But you might want to file a return, because even though you are not required to pay taxes on your Social Security, you may be able to get a refund of any money withheld from your paycheck for taxes.