Appeals Court For The Circuit

Description

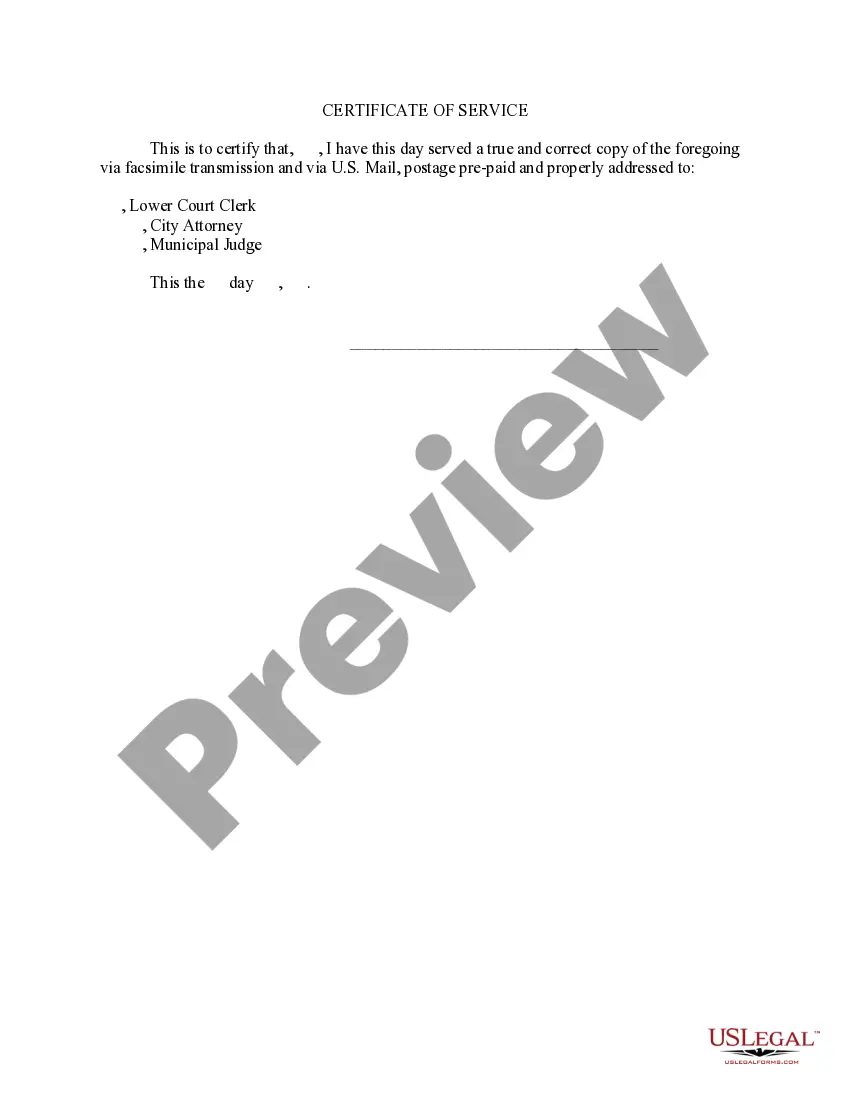

How to fill out Mississippi Notice Of Appeal From Municipal Court To County Court?

Managing legal documents can be perplexing, even for the most adept specialists.

If you are looking into an Appeals Court For The Circuit and lack the opportunity to seek out the accurate and current version, the procedures can be overwhelming.

Benefit from a valuable repository of articles, guides, and reference materials related to your circumstances and requirements.

Save time and energy searching for the forms you need, and take advantage of US Legal Forms' advanced search and Review tool to obtain Appeals Court For The Circuit and download it.

Ensure that the template is valid in your state or county. Click Buy Now when you are prepared. Choose a monthly subscription plan. Select the format you need and Download, fill it out, eSign, print, and send your documents. Leverage the US Legal Forms online library, supported by 25 years of experience and reliability. Streamline your daily document management into a straightforward and user-friendly process today.

- If you possess a membership, Log In to your US Legal Forms account, locate the form, and download it.

- Check your My documents tab to see the documents you have previously saved and to manage your folders as you wish.

- If this is your first experience with US Legal Forms, create a free account and enjoy unlimited access to all the platform's features.

- Here are the steps to follow after acquiring the form you desire.

- Verify that this is the correct form by previewing it and reviewing its details.

- Access state- or county-specific legal and business forms.

- US Legal Forms accommodates any requirements you might have, from personal to corporate documents, all in a single location.

- Utilize advanced tools to complete and manage your Appeals Court For The Circuit.

Form popularity

FAQ

The Division has transitioned from the RI-7004 to the Form BUS-EXT. Details are contained in ADV 2022-38. For Tax Year 2022, if an extension is being filed for the RI- 1065, RI-1120S, RI-1120C, RI-PTE or RI-1120POL, the extension must be filed using the Form BUS-EXT.

The fee typically charged will vary by state between $800 and $1,000. Some states, like Nevada, don't charge a franchise tax fee, making them an alluring place to do business. Miscellaneous government filing fees: Government filing fees may vary from $50 to $200 depending on the state and the type of business.

To have a California S corporation, you'll need to create either a limited liability company (LLC) or a C corporation (the default form of corporation) if you haven't already done so. Then, you'll file an election form with the Internal Revenue Service (IRS).

All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format. Most forms are provided in a format allowing you to fill in the form and save it. To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.

Follow these five steps to start a Rhode Island LLC and elect Rhode Island S corp designation: Name Your Business. Choose a Resident Agent. File the Rhode Island Articles of Organization. Create an Operating Agreement. File Form 2553 to Elect Rhode Island S Corp Tax Designation.

S Corporations: A small business corporation having an election in effect under subchapter S of the Internal Revenue Code is required to file an annual tax return using Form RI-1120S and is subject to the income tax (minimum $400.00).

S Corporations: A small business corporation having an election in effect under subchapter S of the Internal Revenue Code is required to file an annual tax return using Form RI-1120S and is subject to the income tax (minimum $400.00).

To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors.