Mississippi Exemption Application For Title

Description

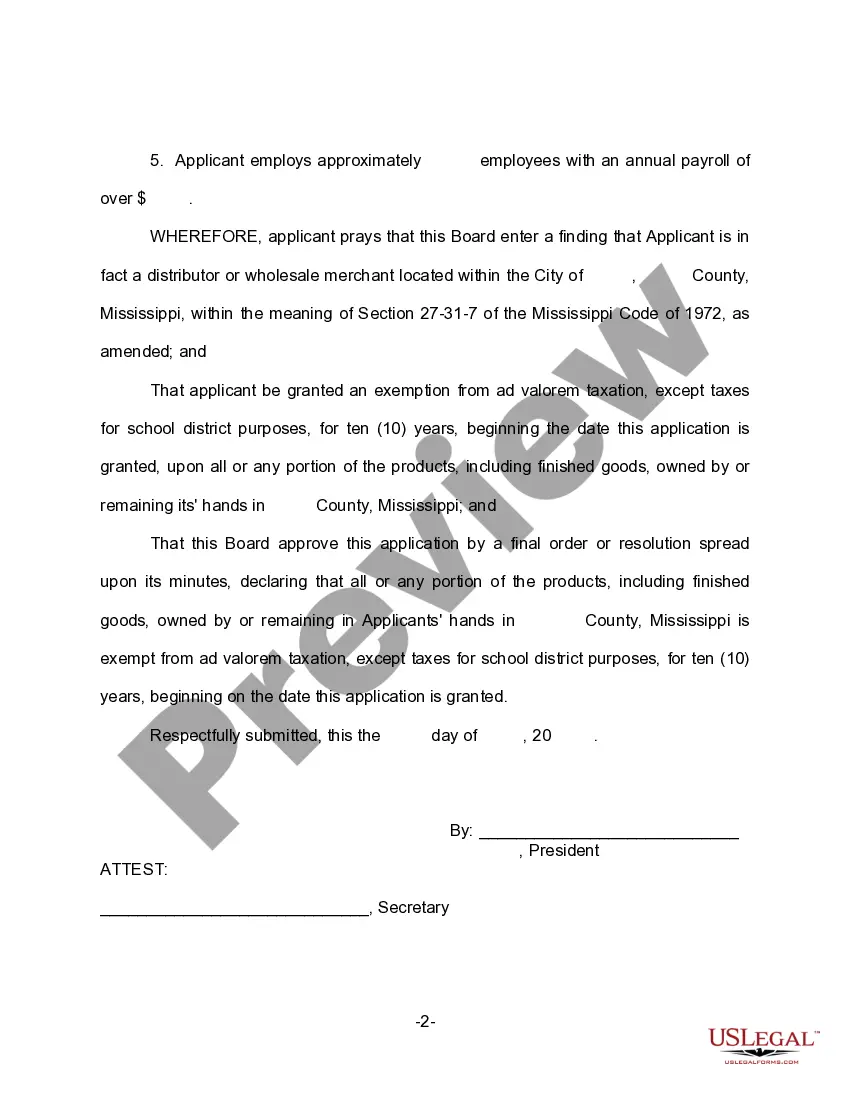

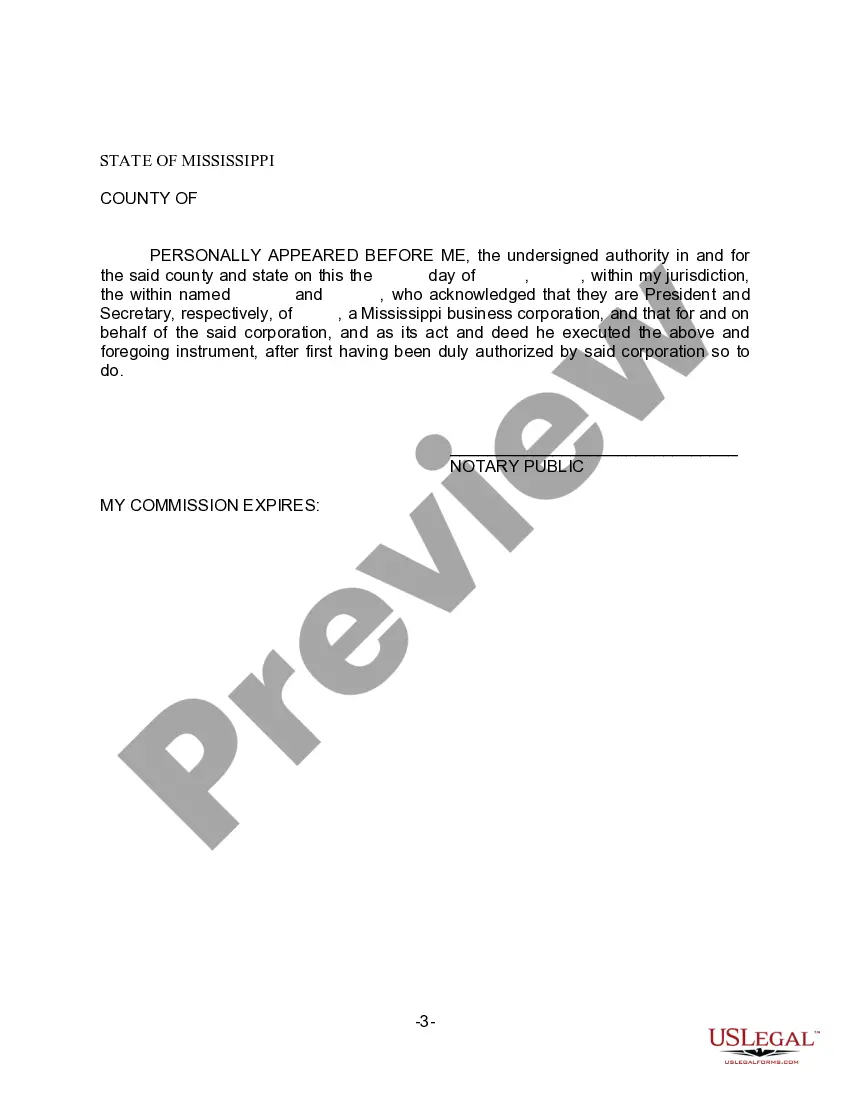

How to fill out Mississippi Application For Exemption From Ad Valorem Taxes For Certain Manufactured Products Held For Sale Or Shipment To Other Than Final Consumer For A Period Of 10 Years?

It’s well-known that you cannot become a legal authority instantly, nor can you quickly understand how to draft the Mississippi Exemption Application For Title without a specialized background. Compiling legal documents is a lengthy endeavor requiring specific training and expertise. So why not entrust the development of the Mississippi Exemption Application For Title to the professionals.

With US Legal Forms, one of the most extensive legal template collections, you can find anything from court documents to templates for internal business communication. We recognize how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all templates are location-specific and current.

Here’s how you can initiate your journey on our website and obtain the document you need in just a few minutes.

You can regain access to your documents from the My documents tab at any time. If you’re an existing client, you can simply Log In, and find and download the template from the same tab.

Regardless of the purpose of your documents—whether they are financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- Locate the document you require by utilizing the search bar at the top of the page.

- Preview it (if this feature is available) and review the supporting description to ascertain if the Mississippi Exemption Application For Title is what you need.

- Restart your search if you require any other form.

- Sign up for a free account and select a subscription plan to acquire the template.

- Select Buy now. Once the transaction is completed, you can obtain the Mississippi Exemption Application For Title, complete it, print it, and send or mail it to the necessary individuals or organizations.

Form popularity

FAQ

You should go to your local county Tax Collector's office and complete a title application, form 78-002.

Claiming personal exemptions: (a) Single Individuals enter $6,000 on Line 1. (b) Married individuals are allowed a joint exemption of $12,000. If the spouse is not employed, enter $12,000 on Line 2(a).

Claiming personal exemptions: (a) Single Individuals enter $6,000 on Line 1. (b) Married individuals are allowed a joint exemption of $12,000. If the spouse is not employed, enter $12,000 on Line 2(a).

How To Fill Out The MS Transfer Of Title Form Turn to the back of DMV title transfer form. Under the ?Assignment of title by registered owner? words, print your name (buyer) and full address on the correct lines. Write in the car's current mileage on the next line.

MS Code Ann. § 27-65-103(f): Agriculture Exemptions. 1. Vendors selling home grown Mississippi produce (grown by the vendor) or Mississippi home processed foods (made by the vendor), from a MDAC certified market, are exempt from the collection of sales tax.