Notice Of Intent Mississippi Withdrawal Form

Description

How to fill out Notice Of Intent Mississippi Withdrawal Form?

There’s no additional justification to squander hours hunting for legal documents to fulfill your local state criteria.

US Legal Forms has gathered all of them in one location and streamlined their availability.

Our platform offers over 85k templates for any business and personal legal matters organized by state and area of application. All forms are properly drafted and validated for authenticity, so you can trust in receiving a current Notice Of Intent Mississippi Withdrawal Form.

Select the preferred subscription plan and create an account or Log In. Make the payment for your subscription using a card or via PayPal to proceed. Choose the file format for your Notice Of Intent Mississippi Withdrawal Form and download it to your device. Print your form to complete it by hand or upload the sample if you choose to use an online editor. Creating legal documents under federal and state regulations is quick and easy with our library. Try US Legal Forms today to keep your paperwork organized!

- If you are acquainted with our platform and already hold an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all saved documents anytime needed by accessing the My documents tab in your profile.

- If you haven’t used our platform before, the process will require a few more steps to finalize.

- Here’s how new users can locate the Notice Of Intent Mississippi Withdrawal Form in our library.

- Examine the page content thoroughly to ensure it includes the example you seek.

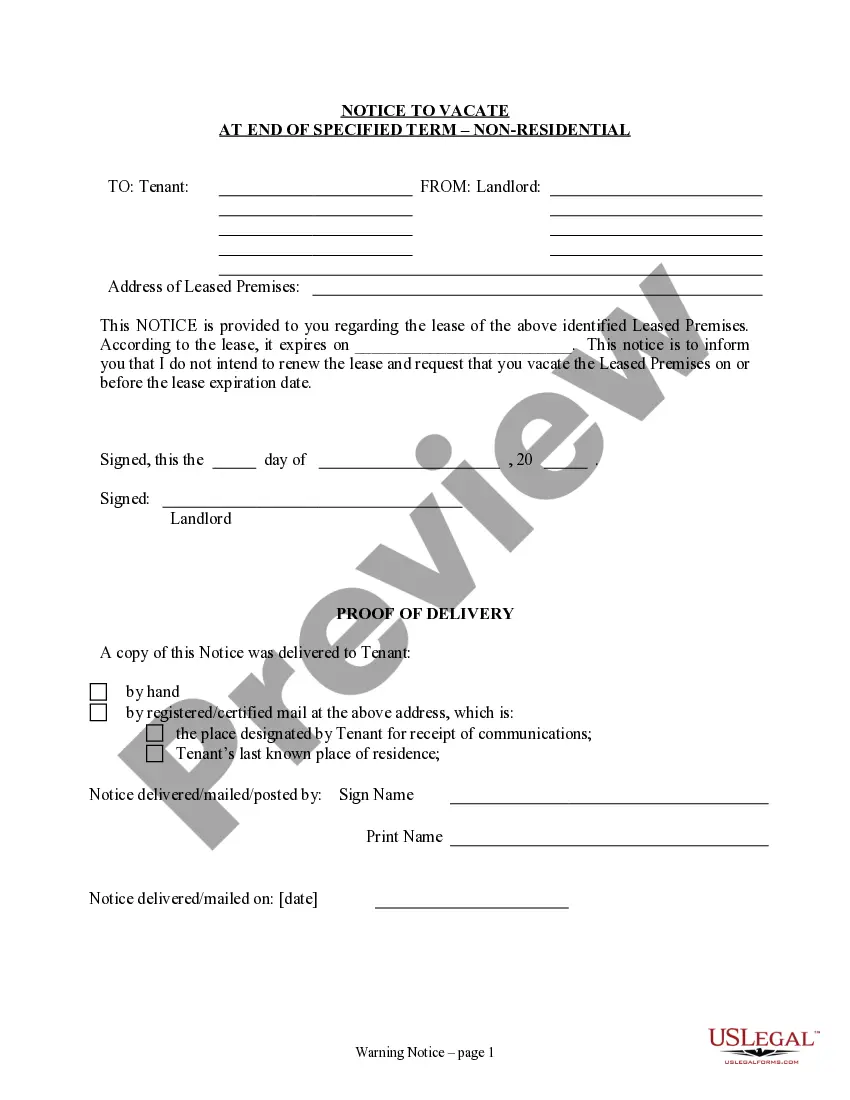

- To do this, utilize the form description and preview options if available.

- Use the Search field above to look for another example if the previous one did not fit your needs.

- Click Buy Now next to the template title once you identify the correct one.

Form popularity

FAQ

Dissolving a corporation in Mississippi involves multiple steps, beginning with the approval of the board of directors and shareholders. After obtaining consent, you must file a Notice of Intent Mississippi Withdrawal Form with the Secretary of State to officially begin the dissolution process. This form serves as your official notice and outlines your intentions, ensuring that all legal obligations are satisfied.

Yes, you can reinstate a dissolved corporation in Mississippi under certain conditions. You will typically need to file for reinstatement and meet specific requirements set forth by the Secretary of State. It's important to have the correct documents, such as a Notice of Intent Mississippi Withdrawal Form if relevant, to streamline the process and protect your business interests.

Yes, if you plan to conduct business in Mississippi, you must register your out-of-state business with the Secretary of State. This includes filing necessary documents and could require a Notice of Intent Mississippi Withdrawal Form if you decide to cease operations in the state. Ensuring proper registration not only complies with state laws but also offers legal protection for your business activities.

A corporation can be dissolved through several methods including voluntary dissolution by the shareholders, administrative dissolution by the state due to non-compliance, or judicial dissolution through a court order. If you choose to voluntarily dissolve your corporation, you will need to submit a Notice of Intent Mississippi Withdrawal Form to the state to initiate the process. This form notifies the state of your decision and ensures that all legal requirements are met.

The penalty for withdrawing from PERS in Mississippi can include a reduction in benefits, depending on your age and years of service. Specifically, if you withdraw before reaching retirement age, you may incur a penalty that affects your retirement benefits. To fully understand the implications, consider referencing the guidelines in the Notice of Intent Mississippi withdrawal form. For comprehensive advice, USLegalForms can provide necessary documentation and expert insights into your circumstances.

Withdrawing from Mississippi PERS involves submitting a Notice of Intent Mississippi withdrawal form to express your intention formally. It’s crucial to provide complete and accurate information to avoid delays in processing. After submission, the state will review your request, which may take several weeks. For assistance in navigating this process, USLegalForms offers templates and resources to ease your withdrawal.

In Mississippi, opting out of PERS is generally not allowed for most employees. However, there are specific exceptions based on your employment status and certain positions. If you’re considering your options, completing the Notice of Intent Mississippi withdrawal form is essential for clarifying your status. To better understand your situation, refer to USLegalForms to find helpful resources and guidance.

To close a business in Mississippi, you must follow a series of steps to ensure a smooth transition. First, settle any outstanding debts and obligations. Next, submit your formal dissolution documents, which can often be facilitated by a Notice of Intent Mississippi withdrawal form. For detailed instructions and state-specific requirements, visit USLegalForms for easy access to necessary documents.

If you submit your Notice of Intent Mississippi withdrawal form, you can expect your PERS refund to be processed within 60 to 90 days. The timeline may vary based on several factors, including the volume of requests and the accuracy of your submitted information. To ensure a smooth process, make sure to follow all instructions carefully when completing your form. For further assistance, consider using platforms like USLegalForms to access reliable templates and guidance.

A request for tax clearance is a formal application to verify that all tax obligations have been met. This document is often required for business transactions, property sales, or other legal purposes. Using the Notice of Intent Mississippi Withdrawal Form can facilitate your request, ensuring all necessary information is included to avoid delays.