Mississippi Articles Of Incorporation Form For Nonprofit

Description

Form popularity

FAQ

The easiest nonprofit to start is typically a social club or charitable organization. These types of nonprofits have fewer regulatory hurdles than others. When starting, consider using the Mississippi articles of incorporation form for nonprofit to simplify the incorporation process. Utilizing uslegalforms can also guide you through the required steps efficiently.

While various states offer advantages, Wyoming is viewed as the best state to set up a private foundation. The state provides low fees, privacy protection, and flexible laws. If you decide to incorporate in Mississippi, make sure you have the proper documents, including the Mississippi articles of incorporation form for nonprofit. This ensures your foundation meets state guidelines.

Delaware is often considered one of the easiest states to start a nonprofit organization. The process is straightforward, and the state offers favorable regulations. However, if you are focusing on Mississippi, ensure you fill out the Mississippi articles of incorporation form for nonprofit correctly. This form is essential to establish your nonprofit in the state.

Yes, a foreigner can start a nonprofit organization in the US. They must adhere to specific regulations and may need to designate a registered agent. When filing, ensure you complete the Mississippi articles of incorporation form for nonprofit to meet state requirements. This form helps establish your nonprofit's legal status in Mississippi.

Mississippi law requires a minimum of three directors for your nonprofit board. These individuals must not be related to maintain proper governance. This structure ensures diverse perspectives and effective decision-making. By completing the Mississippi articles of incorporation form for nonprofit, you can specify your board's makeup, creating a strong foundation for your entity's success.

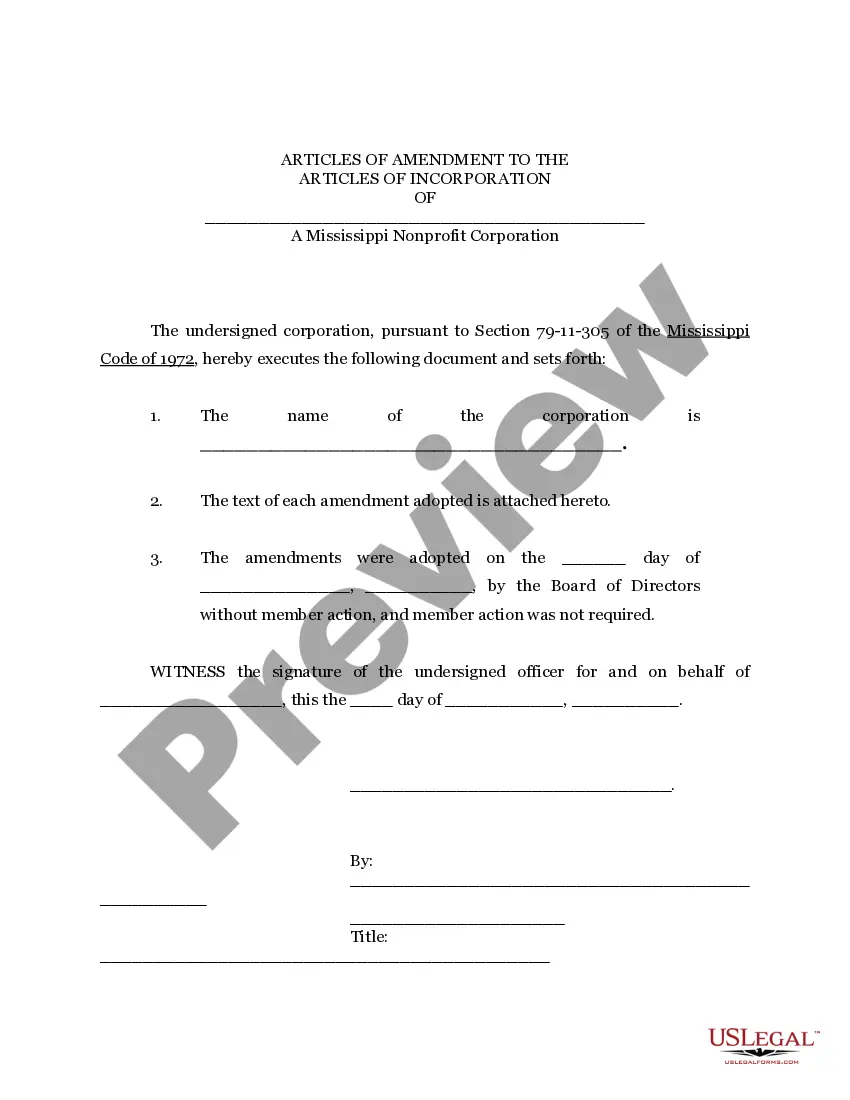

In Mississippi, you need to file articles of incorporation to establish your nonprofit organization. This official document serves as your business's foundation, outlining its purpose and structure. By completing the Mississippi articles of incorporation form for nonprofit, you ensure your organization complies with state laws. Using a reliable platform like USLegalForms can simplify this process for you, providing guidance and templates.

Mississippi State University operates as a public institution, which means it is not classified as a non-profit in the same way as private 501(c)(3) organizations. However, many programs and entities associated with the university may operate under non-profit status. Understanding the structure of public universities can help clarify the distinction between them and traditional non-profits. For those wishing to start a non-profit, the Mississippi articles of incorporation form for nonprofit is essential to initiate your venture.

The easiest state to register a non-profit organization typically varies by individual needs, but many find Delaware appealing due to its straightforward laws. However, Mississippi also has a simple process, particularly with the Mississippi articles of incorporation form for nonprofit. The key is to ensure that you meet all local requirements to streamline registration. Choosing the right state should align with your organization's goals.

To register a non-profit in Mississippi, you need to file the Mississippi articles of incorporation form for nonprofit with the Secretary of State. This form requires basic information about your organization, such as its name, purpose, and address. After completing the form, submit it along with the required fees. Once approved, you can start operation and apply for tax-exempt status.

To form a nonprofit in Mississippi, start by drafting your organization’s mission and structure. Then, complete the Mississippi articles of incorporation form for nonprofit and file it with the Secretary of State. After incorporation, obtain your Employer Identification Number (EIN) from the IRS, and consider applying for federal tax-exempt status to benefit from various advantages.