Garnishment For Independent Contractor

Description

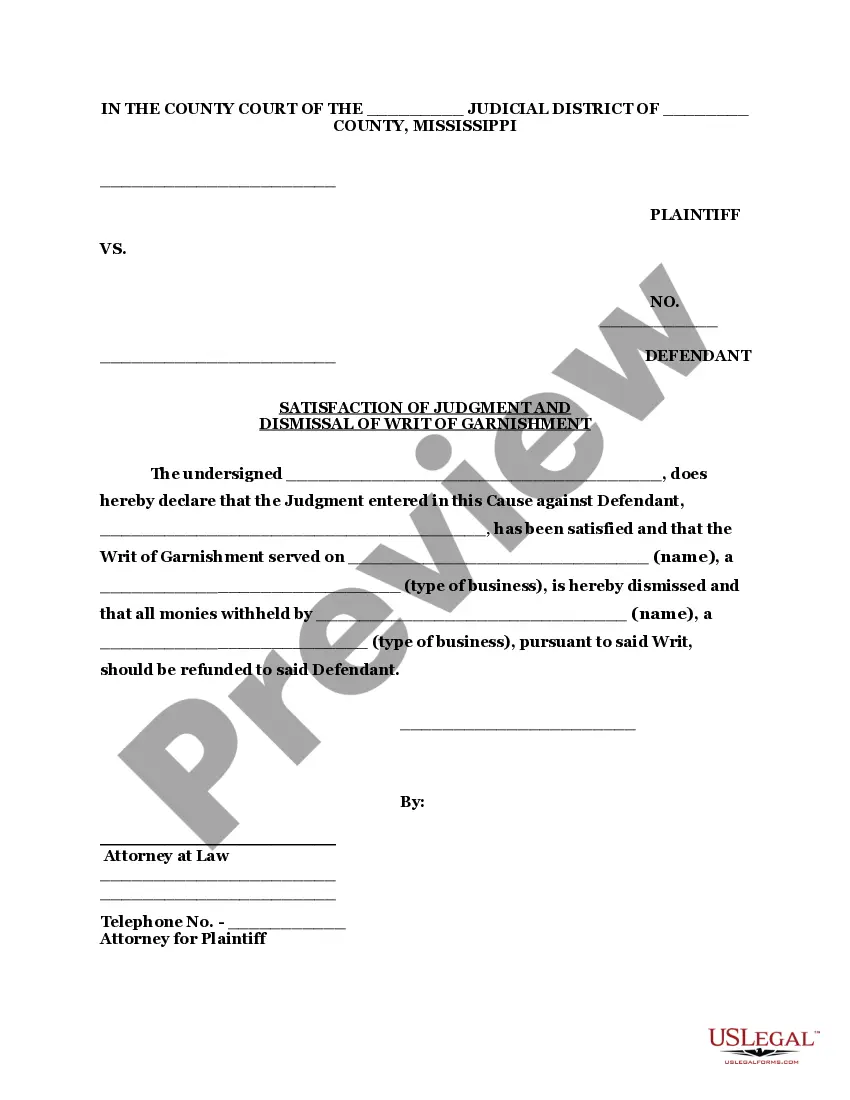

How to fill out Mississippi Satisfaction Of Judgment And Dismissal Of Garnishment?

Bureaucracy requires exactness and correctness.

If you do not engage with filling documents such as Garnishment For Independent Contractor regularly, it may result in certain misconceptions.

Selecting the appropriate template from the outset will ensure that your document submission proceeds smoothly and avoid any inconveniences of resubmitting a file or starting the entire process anew.

If you are not a subscribed member, finding the necessary template may take a few additional steps: Find the template using the search function. Ensure the Garnishment For Independent Contractor you've found is pertinent to your state or jurisdiction. View the preview or check the description that outlines the details on using the template. When the result aligns with your search, click the Buy Now button. Choose the appropriate option among the available subscription plans. Log In to your account or sign up for a new one. Complete the transaction using a credit card or PayPal account. Download the file in your preferred format. Acquiring the correct and updated templates for your documentation takes just a few minutes with an account at US Legal Forms. Sidestep bureaucratic issues and streamline your paperwork process.

- You can always acquire the suitable template for your paperwork in US Legal Forms.

- US Legal Forms is the largest online forms repository that houses over 85 thousand templates for various topics.

- You can obtain the most recent and relevant iteration of the Garnishment For Independent Contractor by simply searching it on the website.

- Find, save, and download templates in your account or review the description to ensure you have the correct one available.

- With an account at US Legal Forms, you can effortlessly gather, store in one place, and navigate the templates you've saved for quick access.

- When on the webpage, click the Log In button to authenticate.

- Then, go to the My documents page, where your document history is stored.

- Review the description of the forms and download the ones you require at any time.

Form popularity

FAQ

Technically, the IRS (or other creditors) cannot garnish the wages of independent contractors and freelancers, because wages are earnings paid to an employee by an employer. However, if you are self-employed, this is not cause to relax.

Yes! IRS 1099 Non-Wage Garnishment works similarly to W2 Wage Garnishment but no employer is involved. Because of that, there are some key differences. If you owe taxes to the IRS from a prior tax year, you should be aware that the agency has the power to collect it from your earnings.

There are two different types of garnishments, garnishments under federal law and garnishments court-ordered by state laws. Federal garnishments consist of bankruptcies, creditor garnishments, federal tax levies, federal administrative garnishments, and federal student loans.

Yes, the IRS can take your paycheck. It's called a wage levy/garnishment. But if the IRS is going to do this, it won't be a surprise. The IRS can only take your paycheck if you have an overdue tax balance and the IRS has sent you a series of notices asking you to pay.

The IRS can garnish your earnings just as easily as it can with any employee. However, the IRS can only take what is owed to you at the moment your earnings are garnished. So, if you have not been paid yet for a two-week assignment, that money is safe from the IRS.